India Automotive Market Size, Share, Trends, Growth and Forecast 2032

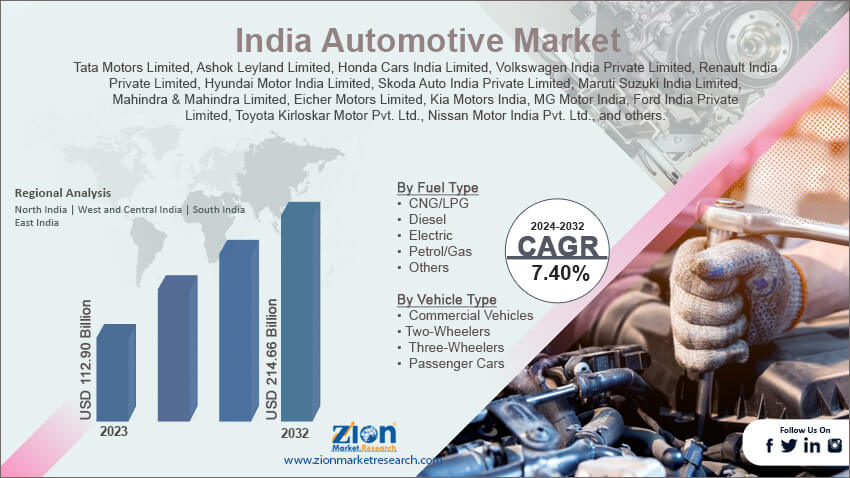

India Automotive Market By Fuel Type (CNG/LPG, Diesel, Electric, Petrol/Gas, and Others), By Vehicle Type (Commercial Vehicles, Two-Wheelers, Three-Wheelers, and Passenger Cars), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

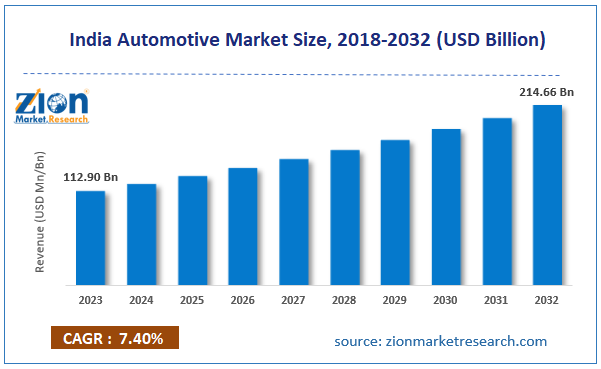

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 112.90 Billion | USD 214.66 Billion | 7.40% | 2023 |

India Automotive Industry Prospective:

The India automotive market size was worth around USD 112.90 billion in 2023 and is predicted to grow to around USD 214.66 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.40% between 2024 and 2032.

India Automotive Market: Overview

The India automotive industry, as per official records, is one of the main key drivers of the regional economy. The Indian automotive sector was liberalized in 1991 and initially began with 100% foreign direct investment (FDI). However, as of 2024, the country has become highly efficient in producing domestic automotives including affordable and luxury vehicles. Additionally, India is the world’s second-largest producer of two-wheelers. Recent statistics indicate that India is the largest producer of 3-wheelers. It ranks third in the global list of passenger car manufacturing. In recent times, the Indian automotive sector has shown a greater inclination toward electric vehicles as fuel prices remain unpredictable. Moreover, India is highly versatile in terms of producing auto parts driven by the presence of a well-formed manufacturing ecosystem. During the forecast period, the automotive sector of India is projected to generate massive returns in the agricultural segment. The surge in support from the Indian government to promote domestic production of automotives and their respective parts is likely to create excellent expansion opportunities for the industry players.

Key Insights:

- As per the analysis shared by our research analyst, the India automotive market is estimated to grow annually at a CAGR of around 7.40% over the forecast period (2024-2032)

- In terms of revenue, the India automotive market size was valued at around USD 112.90 billion in 2023 and is projected to reach USD 214.66 billion, by 2032.

- The India automotive market is projected to grow at a significant rate due to the surge in demand for electric vehicles (EVs) across commercial and passenger segments.

- Based on the fuel type, the diesel segment is growing at a high rate and will continue to dominate the regional market as per industry projections.

- Based on the vehicle type, the three-wheeler segment is anticipated to command the largest market share.

- Based on region, Northern states are projected to dominate the regional market during the forecast period.

Request Free Sample

Request Free Sample

India Automotive Market: Growth Drivers

Surge in demand for electric vehicles (EVs) across commercial and passenger segments will fuel the market revenue rate

The India automotive market is expected to grow during the projection period due to the surge in demand for electric vehicles. In the last 5 years, EVs in India have become widely popular. This trend is observed across commercial and passenger vehicle domains. India is actively working on reducing carbon emissions and controlling the emission of harmful gasses. The increasing use of two-wheelers, three-wheelers, and cars due to the increase in regional population has led to a high pollution rate. Higher adoption of electric vehicles across regions can help manage and reduce the growing pollution-induced problems in the country. In July 2024, River Mobility, a Bengaluru-based manufacturer of EVs, announced that it was undertaking discussions with several state governments for setting up an INR 1000 crore facility in India. The company aims to produce 5 lakh vehicles per year through the new site. Additionally, electric vehicles have generated interest among government officials and bodies. Thus, resulting in increased adoption of electric buses and other modes of electric public transport systems. In May 2023, GreenCell Mobility company NueGo, an electric vehicle producer, announced the commencement of electric inter-city buses to 5 South Indian states.

Agricultural automotive vehicles will receive huge demand during the projection period

The Indian agricultural sector is modernizing. The growing adoption of modern systems and technologies for agricultural purposes will create more demand for agricultural vehicles such as combine harvesters, tractors, seeders & planters, plows, and others. In a recent event, the Indian government announced the launch of the Pradhan Mantri Kisan Tractor Yojana 2022. Under the new scheme, Indian farmers are eligible for a 50% subsidy on buying agricultural tractors. In December 2023, Swaraj Tractors, a Mahindra & Mahindra division, launched the Swaraj 8200 Smart Harvester. The new product is the latest innovation presented by the company. It is specifically designed to meet the needs and expectations of Indian farmers. The Swaraj 8200 Smart Harvester performs exceptionally well for common harvesting crops such as soya bean and paddy. Indian companies and the government have been pushing to deploy more machines in the rural parts of the country’s agricultural sector. This trend could boost the India automotive market.

India Automotive Market: Restraints

Surging prices of vehicles to address rising financing costs will limit the market growth rate

The India automotive industry is expected to be limited due to the rising prices of vehicles. The production cost of automotives has been on the rising trend due to the limited supply of raw materials and changing regional regulations. For instance, the Indian government recently introduced new requirements for improved safety. The increased cost of integrating the changes such as driver bag security, anti-lock/integrated, rear brake sensors, speed warning siren, and warning & collision mode led to changes in the final road prices of the vehicles.

India Automotive Market: Opportunities

Strategic development measures undertaken by the Indian government will promote the industry’s expansion rate

The Indian automotive market is expected to be boosted further due to extensive support provided by the Indian government to promote the regional industry. In September 2021, the Government of India launched a new notification for a Production Linked Incentive (PLI) scheme for the automotive sector. The notification is worth USD 3.49 billion and is expected to bring total investments worth over USD 5.7 billion. In March 2024, the state government of Tamil Nadu signed a Memorandum of Understanding (MoU) with Tata Motors Group. The agreement is worth USD 1081 crore and will allow Tata Motors to explore opportunities for setting up new vehicle production facilities. In February 2024, the Indian government launched two new initiatives that are developed to support Micro, Small & Medium Enterprises (MSMEs) in the automotive space.

India Automotive Market: Challenges

Global economic slowdown and increasing competition could challenge the market expansion trends

The India automotive industry is projected to be challenged by the global economic slowdown. The international trade relationships are rapidly changing. Additionally, several political and geographical tensions such as the Russia-Ukraine war and other events have impacted the global economy. The impact of changes in the economic status of other countries directly impacts the Indian automotive industry. Moreover, increasing competition within the regional industry will further impact the addition of new players.

India Automotive Market: Segmentation

The India automotive market is segmented based on fuel type, vehicle type, and region.

Based on the fuel type, the regional market is divided into CNG/LPG, diesel, electric, petrol/gas, and others. In 2023, the highest growth was observed in the diesel segment. The growth rate was driven by higher demand for diesel-powered vehicles across public transport systems. Additionally, most large sports utility vehicles (SUVs) are powered by diesel. Petrol vehicles are generally priced at lower rates as compared to diesel counterparts. In 2023, Mahindra Thar priced between INR 11 lakh to INR 17.6 lakh was the most popular petrol car in the country.

Based on the vehicle type, the India automotive industry was divided into commercial vehicles, two-wheelers, three-wheelers, and passenger cars. In 2023, the highest growth was witnessed in the three-wheelers segment. India produced more than 855 thousand units of three-wheelers in 2023. The growing incorporation of electric three-wheelers for public transport will fuel the segmental demand during the projection period. The two-wheeler segment is driven by the higher demand for motorbikes in rural areas.

India Automotive Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Automotive Market |

| Market Size in 2023 | 112.90 Bn |

| Market Forecast in 2032 | 214.66 Bn |

| Growth Rate | CAGR of 7.40% |

| Number of Pages | 220 |

| Key Companies Covered | Tata Motors Limited, Ashok Leyland Limited, Honda Cars India Limited, Volkswagen India Private Limited, Renault India Private Limited, Hyundai Motor India Limited, Skoda Auto India Private Limited, Maruti Suzuki India Limited, Mahindra & Mahindra Limited, Eicher Motors Limited, Kia Motors India, MG Motor India, Ford India Private Limited, Toyota Kirloskar Motor Pvt. Ltd., Nissan Motor India Pvt. Ltd., and others. |

| Segments Covered | By Fuel Type, By Vehicle Type, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Automotive Market: Regional Analysis

Northern states of India to deliver the highest revenue during the projection period

The India automotive market will register the highest growth across the Northern states of the country. Regions such as Maharashtra, Gujarat, Uttar Pradesh, Haryana, and others are some of the leading producers of all forms of vehicles. These regions have expansive available landscapes. Additionally, a skilled labor force is easily available which further helps the region maintain dominance in the Indian automotive sector. Haryana is the country’s most important hub for automotive manufacturing. In July 2024, Maruti Suzuki announced the construction of the world’s largest passenger vehicle plant in the Sonepat region of Haryana state. The plant is expected to become operational in 2025 with a capacity of 10 lakh passenger vehicles annually. Southern states of India such as Tamil Nadu are also likely to generate more revenue in the coming years. In January 2024, VinFast, a Vietnamese electric vehicle manufacturer along with the Government of Tamil Nadu broke ground for its new EV plant in the state. The integrated EV plant is spread across 400 acres. It is projected to fuel the production of EVs in the country.

India Automotive Market: Competitive Analysis

The India automotive market is led by players like:

- Tata Motors Limited

- Ashok Leyland Limited

- Honda Cars India Limited

- Volkswagen India Private Limited

- Renault India Private Limited

- Hyundai Motor India Limited

- Skoda Auto India Private Limited

- Maruti Suzuki India Limited

- Mahindra & Mahindra Limited

- Eicher Motors Limited

- Kia Motors India

- MG Motor India

- Ford India Private Limited

- Toyota Kirloskar Motor Pvt. Ltd.

- Nissan Motor India Pvt. Ltd.

The India automotive market is segmented as follows:

By Fuel Type

- CNG/LPG

- Diesel

- Electric

- Petrol/Gas

- Others

By Vehicle Type

- Commercial Vehicles

- Two-Wheelers

- Three-Wheelers

- Passenger Cars

By Region

India

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

The India automotive industry, as per official records, is one of the main key drivers of the regional economy.

The India automotive market is expected to grow during the projection period due to the surge in demand for electric vehicles.

According to study, the India automotive market size was worth around USD 112.90 billion in 2023 and is predicted to grow to around USD 214.66 billion by 2032.

The CAGR value of India automotive market is expected to be around 7.40% during 2024-2032.

The India automotive market will register the highest growth across the Northern states of the country.

The India automotive market is led by players like Tata Motors Limited, Ashok Leyland Limited, Honda Cars India Limited, Volkswagen India Private Limited, Renault India Private Limited, Hyundai Motor India Limited, Skoda Auto India Private Limited, Maruti Suzuki India Limited, Mahindra & Mahindra Limited, Eicher Motors Limited, Kia Motors India, MG Motor India, Ford India Private Limited, Toyota Kirloskar Motor Pvt. Ltd. and Nissan Motor India Pvt. Ltd.

The report explores crucial aspects of the India automotive market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed