India Digital Health Market Size, Share, Analysis, Trends, Growth, 2032

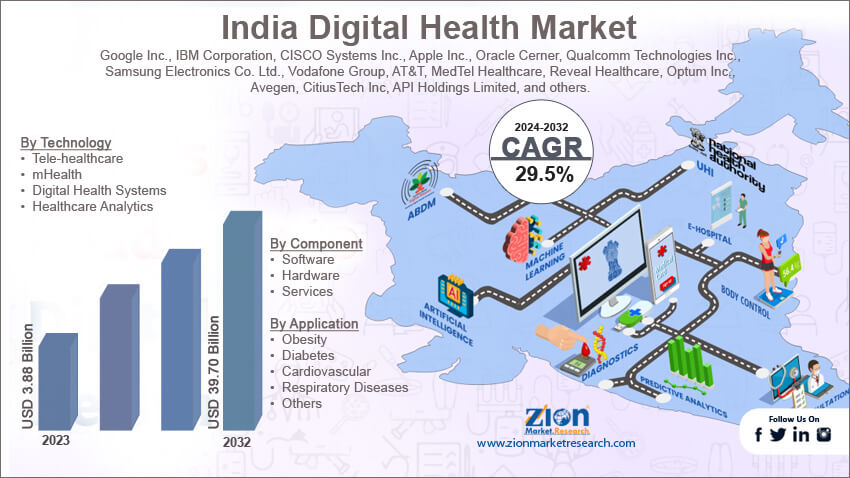

India Digital Health Market By Technology (Tele-healthcare, mHealth, Digital Health Systems, and Healthcare Analytics), By Component (Software, Hardware, and Services), By Application (Obesity, Diabetes, Cardiovascular, Respiratory Diseases, and Others), By End-use (Patients, Providers, Payers, and Others), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

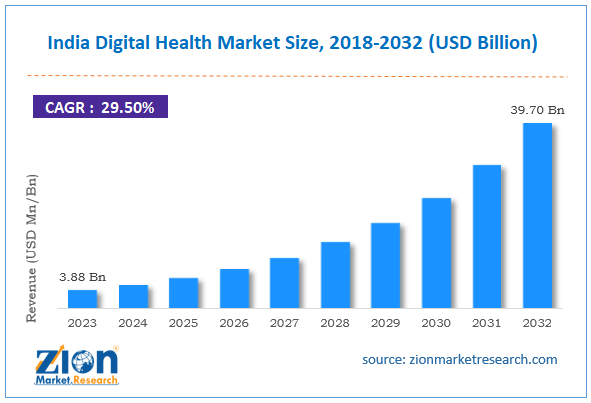

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.88 Billion | USD 39.70 Billion | 29.5% | 2023 |

India Digital Health Industry Prospective:

India digital health market size was worth around USD 3.88 billion in 2023 and is predicted to grow to around USD 39.70 billion by 2032 with a compound annual growth rate (CAGR) of roughly 29.5% between 2024 and 2032.

India Digital Health Market: Overview

The term "digital health" describes how technology, including wearables, cell phones, and electronic health records, is used to enhance patient participation, healthcare delivery, and health outcomes. Digital care programs are a subset of digital health, which is the fusion of digital technologies with living, health, and healthcare to improve healthcare delivery efficiency and enable more individualized & accurate medical treatment. As more hospitals and nursing homes use digital health platforms to give patients access to real-time healthcare services, including telehealth software, mobile health, and other wireless solutions, the term "digital health" has gained popularity.

Key Insights

- As per the analysis shared by our research analyst, the India digital health market is estimated to grow annually at a CAGR of around 29.5% over the forecast period (2024-2032).

- In terms of revenue, the India digital health market size was valued at around USD 3.88 billion in 2023 and is projected to reach USD 39.70 billion, by 2032.

- The growing prevalence of chronic disease is expected to propel India digital health market growth over the projected period.

- Based on the technology, the tele-healthcare segment is expected to dominate the market over the forecast period.

- Based on the component, the services segment is expected to capture the largest market share over the forecast period.

- Based on the application, the diabetes segment is expected to garner a significant revenue share over the forecast period.

- Based on the end-use, the patient segment is expected to capture a significant market share over the forecast period.

- Based on the state, Maharashtra is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Digital Health Market: Growth Drivers

The increasing prevalence of chronic disease drives market growth

Growing rates of chronic diseases such as diabetes, respiratory conditions, and cardiovascular diseases are putting pressure on the global healthcare system. In 2020, 19.3 million incident cases of cancer were reported worldwide, according to Global Cancer Observatory (GLOBOCAN) predictions. India placed third, behind China and the United States of America. As per the GLOBOCAN report, India is expected to see 2.08 million new cases of cancer diagnosis in 2040, a 57.5 percent rise from 2020. Given this significant rise in prevalence, there is an urgent need for digital healthcare solutions that aid in the prevention, management, and treatment of these illnesses. Chronic illness management is made possible by the technologies used in this sector, such as wearables, mobile health apps, and remote patient monitoring. In addition, these technologies empower patients with chronic illnesses by enabling them to monitor their health parameters and obtain personalized interventions from a distance.

India Digital Health Market: Restraints

The presence of open-source service providers impedes market growth

The open-source vendors provide a wide range of digital health solutions and have become oversupplied in the market. One can get almost all of the functionalities offered by proprietary on-premises and cloud-based digital health solution providers by mixing products from different open-source vendors. The benefits of open-source software include unconstrained creativity, increased legitimacy, and decentralized governance. Open-source alternatives therefore have a negative impact on the market share of proprietary businesses in the digital health space. Thus, impeding the India digital health market over the forecast period.

India Digital Health Market: Opportunities

Rising healthcare expenditure offers an attractive opportunity for market growth

Due to reasons including the aging population, rise in chronic diseases, and notable advancements in medical technology, healthcare costs are constantly rising, especially in developing countries. This is driving up revenue in the India digital health industry. The current health spending of India is around USD 64 billion, as reported by the Press Information Bureau. Through enhancing patient involvement, optimizing healthcare delivery, and reducing overuse of healthcare services, the technologies in this sector provide dependable answers to the growing cost of healthcare. Platforms for telemedicine, for instance, provide virtual consultations, doing away with the necessity for in-person visits and the associated costs of healthcare. Additionally, by detecting inefficiencies in the healthcare system, these digital health solutions might help provide a good outlook for the digital health market in India.

India Digital Health Market: Challenges

Infrastructure and security issue poses a major challenge to market expansion

The efficient implementation of digital health initiatives is hindered by inadequate healthcare infrastructure, which includes poor internet access and a dearth of digital equipment in rural locations. Furthermore, as digital health solutions become more widely used, worries regarding patient data security and privacy are becoming more prevalent. This can make people reluctant to employ these technologies. Thus, posing a major challenge to the India digital health market growth.

India Digital Health Market: Segmentation

India digital health industry is segmented based on technology, component, application, end-use, and region.

Based on the technology, the India digital health market is bifurcated into tele-healthcare, mHealth, digital health systems, and healthcare analytics. The tele-healthcare segment is expected to dominate the market over the forecast period. This growth rate is explained by improving internet connectivity, an increase in smartphone usage, increased technological readiness, a growing scarcity of healthcare professionals, rising medical costs, the accessibility of telehealth applications, and an increase in patient & physician adoption of these technologies. The ever-expanding telehealth applications and swift technical advancements contribute to the segment's growth. The main drivers of the segment's growth include increasing healthcare IT spending, government backing, and legislation encouraging healthcare digitization.

Based on the components, the India digital health industry is segmented into software, hardware, and services. The services segment is expected to capture the largest market share over the forecast period. Revenue has increased dramatically, especially since the COVID-19 epidemic has boosted the usage of telemedicine services. Partnerships between insurers and healthcare providers, telehealth platform subscription models, and more consultations are the main factors driving revenue development. Revenue has also increased thanks to electronic health records (EHRs), hospital management systems (HMS), and other health IT technologies. These technologies are being purchased by healthcare facilities to increase patient care, operational effectiveness, and regulatory compliance.

Based on the application, the India digital health market is segmented into obesity, diabetes, cardiovascular, respiratory diseases, and others. The diabetes segment is expected to garner a significant revenue share over the forecast period. Diabetes is the largest segment in the digital health space due to its prevalence and related problems. The requirements of people with diabetes can be creatively met by digital health technologies. Digital health tools allow patients to take an active role in controlling their diabetes. These tools range from smartphone applications for glucose testing to wearable gadgets that track physical activity and provide real-time health data. Additionally, these technologies enable remote patient monitoring, which in turn helps healthcare providers manage diabetes more effectively by enabling timely data delivery, educated decision-making, and prompt treatments.

Based on the end-use, the India digital health industry is segmented into patients, providers, payers, and others. The patient segment is expected to capture a significant market share over the forecast period because of the movement in healthcare toward patient-centered care and people's increased understanding of health management. By giving patients, the means to manage their care, access health records, and engage in remote monitoring, digital health technologies have completely changed the healthcare industry.

India Digital Health Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Digital Health Market |

| Market Size in 2023 | USD 3.88 Billion |

| Market Forecast in 2032 | USD 39.70 Billion |

| Growth Rate | CAGR of 29.5% |

| Number of Pages | 218 |

| Key Companies Covered | Google Inc., IBM Corporation, CISCO Systems Inc., Apple Inc., Oracle Cerner, Qualcomm Technologies Inc., Samsung Electronics Co. Ltd., Vodafone Group, AT&T, MedTel Healthcare, Reveal Healthcare, Optum Inc., Avegen, CitiusTech Inc, API Holdings Limited, and others. |

| Segments Covered | By Technology, By Component, By Application, By End-use, and By State |

| States Covered in India | Maharashtra, Tamil Nadu, Karnataka, Punjab,Rajasthan, and Uttar Pradesh |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Digital Health Market: State Analysis

Maharashtra is expected to dominate the market over the forecast period

Maharashtra is expected to dominate the India digital health market over the forecast period. Pune and Mumbai are two major centers for the uptake and development of digital health. The usage of telemedicine, mHealth apps, and online health services is made easier by the high level of smartphone accessibility and digital literacy among metropolitan populations. Moreover, Maharashtra has a far more developed healthcare infrastructure than other states, which facilitates the use of telemedicine platforms, hospitals, and electronic health records (EHRs). In addition, telemedicine has become more and more common in Maharashtra since it makes getting medical care easier and does not require physical travel to clinics or hospitals, as demonstrated by the COVID-19 epidemic. Thus, driving the market growth.

India Digital Health Market: Competitive Analysis

India digital health market is dominated by players like:

- Google Inc.

- IBM Corporation

- CISCO Systems Inc.

- Apple Inc.

- Oracle Cerner

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- Vodafone Group

- AT&T

- MedTel Healthcare

- Reveal Healthcare

- Optum Inc.

- Avegen

- CitiusTech Inc

- API Holdings Limited

India digital health market is segmented as follows:

By Technology

- Tele-healthcare

- mHealth

- Digital Health Systems

- Healthcare Analytics

By Component

- Software

- Hardware

- Services

By Application

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Others

By End-use

- Patients

- Providers

- Payers

- Others

By State

- Maharashtra

- Tamil Nadu

- Karnataka

- Punjab

- Rajasthan

- Uttar Pradesh

Table Of Content

Methodology

FrequentlyAsked Questions

The term "digital health" describes how technology, including wearables, cellphones, and electronic health records, is used to enhance patient participation, healthcare delivery, and health outcomes. Digital care programs are a subset of digital health, which is the fusion of digital technologies with living, health, and healthcare to improve healthcare delivery efficiency and enable more individualized and accurate medical treatment. As more hospitals and nursing homes use digital health platforms to give patients access to real-time healthcare services, including telehealth software, mobile health, and other wireless solutions, the term "digital health" has gained popularity.

The India digital health market is being driven by several factors such as increasing government initiatives like Digital India, growing health and wellness trends, increasing penetration of smartphones, and a growing number of startups.

According to the report, India digital health market size was worth around USD 3.88 billion in 2023 and is predicted to grow to around USD 39.70 billion by 2032.

India's digital health market is expected to grow at a CAGR of 29.5% during the forecast period.

India digital health market growth is driven by Maharashtra. It is currently the nation's highest revenue-generating market due to the rising investment.

India digital health market is dominated by players like Google, Inc., IBM Corporation, CISCO Systems, Inc., Apple Inc., Oracle Cerner, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Vodafone Group, AT&T, MedTel Healthcare, Reveal Healthcare, Optum Inc., Avegen, CitiusTech Inc and API Holdings Limited among others.

India digital health Market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed