India Foodservice Market Trend, Share, Growth, Size, Analysis and Forecast 2032

India Foodservice Market By Foodservice Type (Cafes & Bars, Cloud Kitchen, Full Service Restaurants, and Quick Service Restaurants), By Outlet (Chained Outlets and Independent Outlets), By Location (Leisure, Lodging, Retail, Standalone, and Travel), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

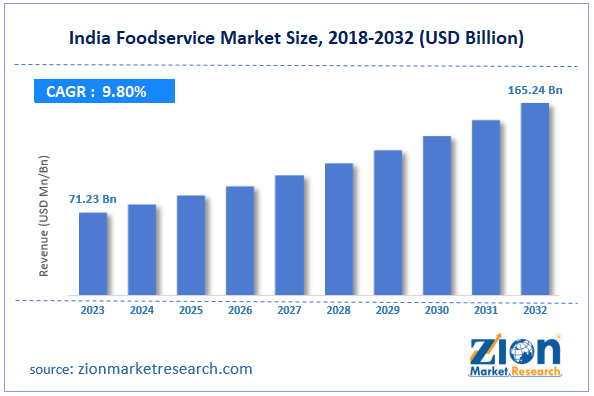

| USD 71.23 billion | USD 165.24 billion | 9.8% | 2023 |

India Foodservice Industry Prospective:

India foodservice market size was worth around USD 71.23 billion in 2023 and is predicted to grow to around USD 165.24 billion by 2032 with a compound annual growth rate (CAGR) of roughly 9.8% between 2024 and 2032.

India Foodservice Market: Overview

Foodservices are the catering services that the food and beverage (F&B) industries offer. These services involve the preparation of meals outside of the home for consumption, takeout, and delivery. They provide efficient time management, the delivery of high-quality meals via supply chains, convenience, improved customer satisfaction, and effective revenue generation. They are used in full-service, fast-food, specialty, and limited-service restaurants due to their attributes. Food service establishments are currently generally divided into commercial and institutional service categories. Commercial food services include a range of fine-dining venues, such as fast-food restaurants, pubs, nightclubs, and hotels; institutional food services include organizations that serve food at hospitals, universities, and military bases.

Key Insights

- As per the analysis shared by our research analyst, the India foodservice market is estimated to grow annually at a CAGR of around 9.8% over the forecast period (2024-2032).

- In terms of revenue, the India foodservice market size was valued at around USD 71.23 billion in 2023 and is projected to reach USD 165.24 billion, by 2032.

- The growing food sector is expected to propel the India foodservice market growth over the projected period.

- Based on the foodservice type, the quick service restaurants segment is expected to dominate the market over the forecast period.

- Based on the outlet, the chained outlets segment is expected to capture the largest market share over the forecast period.

- Based on the location, the retail segment is expected to garner a significant revenue share over the forecast period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Foodservice Market: Growth Drivers

An increase in people's willingness to try out new foods and dining experiences drives market growth

The populace of India is diverse and increasingly receptive to trying out new dishes and eating experiences. The country boasts a rich culinary heritage. As such, there has been an increase in specialty restaurants offering unique and imaginative dining experiences. Leading Indian cuisines are Lebanese, Chinese, and Japanese, in addition to Indian. Sushi orders increased by fifty percent in 2019 compared to 2021. Owing to factors including evolving lifestyles, increased urbanization, and the growing appeal of dining out, the foodservice business in India is developing. One study conducted in 2021 found that 45 million Indians enjoyed dining out. Thus, the aforementioned facts are expected to propel the India foodservice market growth during the forecast period.

India Foodservice Market: Restraints

Labor shortage in the foodservice industry impedes market growth

One of the main issues impeding the food service industry's expansion in India is the lack of workers. There is a labor deficit in the market, which includes breakfast, lunch, and supper alternatives in both fine dining businesses and informal dining places. Additionally, jobs in this industry, such as those in restaurants serving pizza, burgers, and chicken, are sometimes low-paying and don't offer many prospects for career progression. As a result, fewer people are applying for these jobs. Job insecurity and restricted access to benefits like health insurance and sick leave are factors negatively influencing this trend.

India Foodservice Market: Opportunities

Rising investment by market players offers an attractive opportunity for market growth

The increasing investment by the key market players is expected to propel the India foodservice market growth during the forecast period. For instance, in March 2023, to expand McDonald's restaurants in India, MMG, a multibillion-dollar corporation, committed between Rs. 400 and 600 crore. Three years ago, the MMG group—which operates in the northern and eastern parts of India—owned McDonald's. The "No Onion, No Garlic" campaign is one of the company's initiatives; it encourages clients along the Vaishno Devi Shrine trail in Katra and Tarakot to eat vegetarian food. Their objective is to open 40 new locations by 2023, generating at least 1500 new jobs. In addition to expanding in Delhi, Punjab, and Uttar Pradesh, which are their main current markets, they intend to open their first-ever stores in Ranchi, Jamshedpur, Siliguri, and Gorakhpur.

India Foodservice Market: Challenges

Seasonal variability and high operational cost pose a major challenge to market expansion

Demand swings throughout the year, especially around festivals and holidays, can cause irregular income trends and operational difficulties for foodservice businesses. Furthermore, growing labor, ingredient, rent, and utility costs add to the high overhead costs faced by the foodservice industry, which has an impact on pricing and profitability.

India Foodservice Market: Segmentation

India foodservice industry is segmented based on foodservice type, outlet, location, and region.

Based on the foodservice type, the India foodservice market is bifurcated into cafes & bars, cloud kitchens, full service restaurants, and quick service restaurants. The quick service restaurants segment is expected to dominate the market over the forecast period. The market is driven by a young demographic inflow. Young individuals (18 to 35 years old) spend a large portion of their income on eating out and fast food, which they find to be delicious. Teens from wealthy homes spend twenty-four percent of their money on food. This age group represents the prime clientele for QSR restaurants, which emphasizes the importance of this market's expansion. In India, the age distribution is as follows: over 50% of the population is under 25, and over 65% is under 35. Benefiting from a younger demographic, quick service franchises like McDonald's, Burger King, and Domino's expand their presence in India's smaller cities.

Based on the outlet, the India foodservice industry is segmented into chained outlets and independent outlets. The chained outlets segment is expected to capture the largest market share over the forecast period. Chained outlets gain from well-known brands and consumer confidence, which draw in loyal customers looking for uniform standards of quality and care everywhere. Additionally, these establishments frequently use technology to improve consumer engagement and operational efficiency. Examples of this include online ordering, loyalty programs, and operational management systems. Thereby, driving the segment growth.

Based on the location, the India foodservice market is segmented into leisure, lodging, retail, standalone, and travel. The retail segment is expected to garner a significant revenue share over the forecast period. The biggest cities in India often have food courts that cater to both locals and visitors, offering a variety of dining alternatives. These food courts, which offer a wide range of cuisines and dining alternatives, are a significant revenue generator for the retail industry. In response to the growth of e-commerce platforms, retail chains are also venturing into online food shopping and delivery services. Customers may now easily purchase food along with groceries and home goods. Thus, drives the market growth.

India Foodservice Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Foodservice Market |

| Market Size in 2023 | USD 71.23 Billion |

| Market Forecast in 2032 | USD 165.24 Billion |

| Growth Rate | CAGR of 9.8% |

| Number of Pages | 217 |

| Key Companies Covered | Coffee Day Enterprises Limited, Barbeque Nation Hospitality Ltd, Barista Coffee Company Limited, Doctor's Associate Inc., Graviss Foods Private Limited, Gujarat Cooperative Milk Marketing Federation, Haldiram Food Private Limited, Hotel Saravana Bhavan, Impresario Entertainment and Hospitality Pvt. Ltd., Jubilant FoodWorks Limited, McDonald's Corporation, Mountain Trail Foods Private Limited, Rebel Foods, Restaurant Brands Asia Limited, Tata Starbucks Private Limited, Wow! Momo Foods Private Limited, Yum! Brands Inc., and others. |

| Segments Covered | By Foodservice Type, By Outlet, By Location, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Foodservice Market: Region Analysis

North India is expected to dominate the market over the forecast period

North India is expected to dominate the India foodservice market over the forecast period. Meal delivery services are becoming more and more popular in North India, primarily because of the COVID-19 pandemic, hectic lifestyles, and convenience. Another reason boosting cloud kitchens in India is the rise of online food ordering and delivery businesses like Swiggy and Zomato. These platforms allow cloud cooks to quickly search and purchase from a range of products, as well as a simple way to reach a large consumer base without investing a lot of money in marketing and advertising. Moreover, the investment made by major players in the region will also propel the market growth during the forecast period.

India Foodservice Market: Competitive Analysis

India foodservice market is dominated by players like:

- Coffee Day Enterprises Limited

- Barbeque Nation Hospitality Ltd

- Barista Coffee Company Limited

- Doctor's Associate Inc.

- Graviss Foods Private Limited

- Gujarat Cooperative Milk Marketing Federation

- Haldiram Food Private Limited

- Hotel Saravana Bhavan

- Impresario Entertainment and Hospitality Pvt. Ltd.

- Jubilant FoodWorks Limited

- McDonald's Corporation

- Mountain Trail Foods Private Limited

- Rebel Foods

- Restaurant Brands Asia Limited

- Tata Starbucks Private Limited

- Wow! Momo Foods Private Limited

- Yum! Brands Inc.

India foodservice market is segmented as follows:

By Foodservice Type

- Cafes & Bars

- Cloud Kitchen

- Full Service Restaurants

- Quick Service Restaurants

By Outlet

- Chained Outlets

- Independent Outlets

By Location

- Leisure

- Lodging

- Retail

- Standalone

- Travel

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Foodservices are the catering services that the food and beverage (F&B) industries offer. These services involve the preparation of meals outside of the home for consumption, takeout, and delivery. They provide efficient time management, the delivery of high-quality meals via supply chains, convenience, improved customer satisfaction, and effective revenue generation.

The India foodservice market is being driven by several factors such as increasing disposable income, rising urbanization, changing demographics, increasing tourism and hospitality sector, increasing government initiatives, and others.

According to the report, India foodservice market size was worth around USD 71.23 billion in 2023 and is predicted to grow to around USD 165.24 billion by 2032.

India's foodservice market is expected to grow at a CAGR of 9.8% during the forecast period.

India foodservice market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the rising investment by the major players.

India foodservice market is dominated by players like Coffee Day Enterprises Limited, Barbeque Nation Hospitality Ltd, Barista Coffee Company Limited, Doctor's Associate, Inc., Graviss Foods Private Limited, Gujarat Cooperative Milk Marketing Federation, Haldiram Food Private Limited, Hotel Saravana Bhavan, Impresario Entertainment and Hospitality Pvt. Ltd., Jubilant FoodWorks Limited, McDonald's Corporation, Mountain Trail Foods Private Limited, Rebel Foods, Restaurant Brands Asia Limited, Tata Starbucks Private Limited, Wow! Momo Foods Private Limited and Yum! Brands, Inc. among others.

India foodservice Market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed