India ISO Tank Container Market Size, Share, Industry Analysis, Trends, Growth, 2032

India ISO Tank Container Market By Transportation Mode (Road, Marine, and Rail), By Container Type ( More than 30 Ft and Less than or Equal To 30 Ft), By Application (Food & Beverages, Petrochemicals, Pharmaceuticals, Chemicals, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

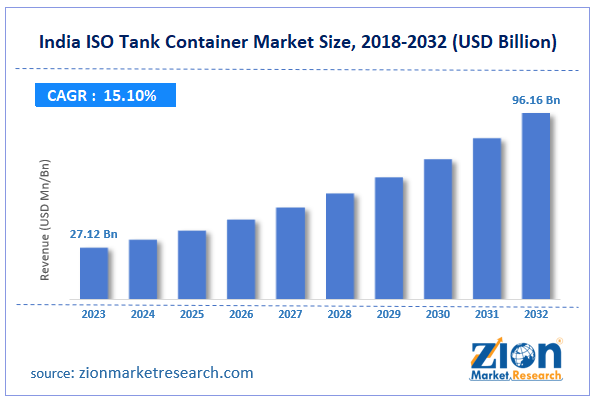

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 27.12 Billion | USD 96.16 Billion | 15.10% | 2023 |

India ISO Tank Container Industry Prospective:

The India ISO tank container market size was worth around USD 27.12 billion in 2023 and is predicted to grow to around USD 96.16 billion by 2032 with a compound annual growth rate (CAGR) of roughly 15.10% between 2024 and 2032.

India ISO Tank Container Market: Overview

The India International Organization for Standardization (ISO) tank container sector deals with the production, distribution, and consumption of ISO-marked tank containers across industries. An ISO-certified product is generally considered safe and trusted for further application since it meets international standard regulations. The primary function of tank containers deals with the storage and shipment of non-hazardous or hazardous substances such as powders, liquids, and gasses. ISO tank containers are built as per ISO regulations. Stainless steel is the basic raw material used for producing tank containers. They are made with an aluminum or polyurethane-based protective layer. These attributes provide comprehensive protection of the stored goods thus making ISO tank containers widely popular for transporting liquids and gasses. Some of the most commonly transported materials through ISO tank containers include alcohol, gasses, non-alcoholic liquids, chemicals, powders, and perishable or non-perishable food products. ISO certification guarantees product reliability and quality. However, the cost of buying or renting ISO tankers is high which limits the product’s adoption rate in the India ISO tank container industry.

Key Insights:

- As per the analysis shared by our research analyst, the India ISO tank container market is estimated to grow annually at a CAGR of around 15.10% over the forecast period (2024-2032)

- In terms of revenue, the India ISO tank container market size was valued at around USD 27.12 billion in 2023 and is projected to reach USD 96.16 billion, by 2032.

- The India ISO tank container market is projected to grow at a significant rate due to the rise in investments in the regional chemical & petrochemical industry.

- Based on the transportation mode, the marine segment is growing at a high rate and will continue to dominate the regional market as per industry projection.

- Based on the application, the food & beverages segment is anticipated to command the largest market share.

- Based on region, Western states of India are projected to dominate the regional market during the forecast period.

Request Free Sample

Request Free Sample

India ISO Tank Container Market: Growth Drivers

Rise in investments in the regional chemical & petrochemical industry will fuel the market demand rate

The India ISO tank container market is expected to be driven by rising investments in the chemical and petrochemical sectors. As per official data, the Indian chemical industry contributes to more than 12.01% of the regional gross domestic product (GDP). India’s thriving chemical and petrochemical sector is attributed to several reasons. For instance, India has a massive supply of skilled labor at reasonable prices. In addition to this, India is strategically surrounded by several other Southeast Asian countries that are critical contributors to the global chemical industry. In July 2024, Indian Chemical News, a leading online provider of information related to India’s chemical sector, announced the launch of a new panel discussion titled "Inviting investment to achieve US $2 Tn chemical economy by 2047”. The theme of the discussion was Transforming India into a Global Manufacturing Hub. India has an extensive demand for alkali chemicals. Over 69.9% of total chemical production in the country is related to the manufacturing of alkali chemicals. In addition to this, major players in the regional chemical sector are seeking solutions that can help reduce dependence on neighboring countries such as China for the production of essential chemicals and petrochemicals. The main areas of focus will be developing a more prominent and robust manufacturing hub for chemicals.

Regional alcohol sector will prove beneficial for the ISO tank container companies

ISO tank containers are used for the efficient transportation of alcohol across borders. They offer benefits such as cost-efficiency, safety, and higher reliability when transporting bulk quantities of alcohol. The internal and external structure of ISO tankers creates a favorable environment for long-route distances thus preserving alcohol quality during transporting. The Indian alcohol industry in 2023 was valued at over USD 55.01 billion. The growing consumption of alcohol across regions will promote the adoption of India ISO tank container market.

India ISO Tank Container Market: Restraints

High cost of the initial investment in developing an ISO tank container business is the industry’s most prominent growth barrier

The industry for India ISO tank containers is limited in terms of growth due to the high associated cost of initial investment. Setting up an ISO tank container business is expensive. ISO-certified tank containers are specially designed to meet the standards of the International Organization for Standardization. Thus, requiring the use of high-quality raw materials and design methodology. Additionally, the cost of obtaining ISO certification adds to the overall expenditure. An ISO tank container in India made of stainless steel and 20 ft in size may cost around INR 750,000.

India ISO Tank Container Market: Opportunities

Growth in the e-commerce sector to bolster new expansion possibilities over the forecast period

The India ISO tank container market players can expect greater growth momentum during the forecast period. India’s e-commerce industry is projected to become a key contributor over the growth period. India is home to one of the world's leading and high revenue-generating e-commerce sectors with a massive consumer base. As of March 2024, Amazon India has monthly visitors reaching over 294 million. As the e-commerce sector grows further the use of ISO tank containers will also increase due to higher demand for bulk orders. Moreover, the e-commerce industry promotes infrastructure and supply chain development. It facilitates the easy incorporation of ISO tank containers for transporting food & beverages and other items.

Rising focus on adopting sustainable solutions across industries will promote the use of ISO tank containers

India is fast pacing toward incorporating sustainable solutions especially products that are energy efficient. ISO tank containers are reusable and offer excellent energy-saving traits. ISO-marked tanks are used across transportation modes and thus have unlimited applications. Moreover, they eliminate the need for environmentally harmful single-use packaging.

India ISO Tank Container Market: Challenges

Several operational challenges with ISO tank containers will discourage further investments

ISO tank containers are regularly associated with several operational challenges. Some of the most commonly observed problems with the use of ISO tank containers include the risk of contamination from the previously stored materials, controlling optimal temperature, continuous repair & maintenance, and stringent regulations related to compliance or documentation. These concerns may discourage the entry of new players in the India ISO tank container industry.

India ISO Tank Container Market: Segmentation

The India ISO tank container market is segmented based on transportation mode, container type, application, and region.

Based on the transportation mode, the regional market segments are road, marine, and rail. In 2023, the highest growth was witnessed in the marine segment. Major ports in India are responsible for managing over 95% of India’s total foreign trade. Marine transportation is the backbone of international trade for India and its trading partners. The rail mode of transportation will be driven by the surging developments in India’s rail infrastructure to connect remote areas.

Based on container type, the India ISO tank container industry is divided into more than 30 ft and less than or equal to 30 ft.

Based on the application, the regional market divisions are food & beverages, petrochemicals, pharmaceuticals, chemicals, and others. In 2023, the highest demand was observed in the food & beverages (F&B) sector. One of the fastest-growing industries in India is the F&B industry. The high population density in the country is the essential promoter of demand for food & beverages. In 2023, the Indian F&B industry was valued at over USD 333 billion.

India ISO Tank Container Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India ISO Tank Container Market |

| Market Size in 2023 | 27.12 Bn |

| Market Forecast in 2032 | 96.16 Bn |

| Growth Rate | CAGR of 15.10% |

| Number of Pages | 223 |

| Key Companies Covered | Ritveyraaj Cargo Shipping Containers, Nathani Industrial Services, Boxtech Bangalore, Southern Containers, ISG Container, Savera Group, Shree Krishna Container Services, Tankwell Container Services, Duro Containers Pvt. Ltd., KPCL Industries Ltd., Ashish Interbuild Pvt. Ltd., IVRCL Ltd., Max Energy and Logistics, TRS Containers Pvt. Ltd., ACR Projects Pvt. Ltd., and others. |

| Segments Covered | By Transportation Mode, By Container Type, By Application, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India ISO Tank Container Market: Regional Analysis

Western states to continue delivering high revenue during the forecast period

The India ISO tank container market has been growing at a rapid rate during the projection period. The regional chemical industry is a key contributor to the higher adoption of ISO tank containers. In December 2023, Tokyo-based agrochemical producer, Sumitomo Chemical, announced the construction of a new chemical plant in the state of Gujarat. The endeavor will be completed on a land piece spread across 50 acres and a total initial capital of USD 35 million. In April 2024, the State Bank of India announced that it was preparing to lend around INR 17,000 crore to Adani Group. The funds will be allotted for the construction of a new petrochemical plant in the Mundra region. The loan represents around 60 to 70% of the total capital expenditure required for the plant. Similarly, other parts of the country are also registering growing investments. For instance, Haldia Petrochemicals Ltd (HPL) is expected to invest INR 3000 crore for new chemical plants to be set up in the West Bengal region. In May 2024, Fosroc India commenced operations at its new integrated Construction Chemicals Plant in the region of Hyderabad.

India ISO Tank Container Market: Competitive Analysis

The India ISO tank container market is led by players like:

- Ritveyraaj Cargo Shipping Containers

- Nathani Industrial Services

- Boxtech Bangalore

- Southern Containers

- ISG Container

- Savera Group

- Shree Krishna Container Services

- Tankwell Container Services

- Duro Containers Pvt. Ltd.

- KPCL Industries Ltd.

- Ashish Interbuild Pvt. Ltd.

- IVRCL Ltd.

- Max Energy and Logistics

- TRS Containers Pvt. Ltd.

- ACR Projects Pvt. Ltd.

The India ISO tank container market is segmented as follows:

By Transportation Mode

- Road

- Marine

- Rail

By Container Type

- More than 30 Ft

- Less than or Equal To 30 Ft

By Application

- Food & Beverages

- Petrochemicals

- Pharmaceuticals

- Chemicals

- Others

By Region

- India

Table Of Content

Methodology

FrequentlyAsked Questions

The India International Organization for Standardization (ISO) tank container sector deals with the production, distribution, and consumption of ISO-marked tank containers across industries.

The India ISO tank container market is expected to be driven by rising investments in the chemical and petrochemical sectors.

According to study, the India ISO tank container market size was worth around USD 27.12 billion in 2023 and is predicted to grow to around USD 96.16 billion by 2032.

The CAGR value of India ISO tank container market is expected to be around 15.10% during 2024-2032.

The western states of India industry is a key contributor to the higher adoption of ISO tank containers.

The India ISO tank container market is led by players like Ritveyraaj Cargo Shipping Containers, Nathani Industrial Services, Boxtech Bangalore, Southern Containers, ISG Container, Savera Group, Shree Krishna Container Services, Tankwell Container Services, Duro Containers Pvt. Ltd., KPCL Industries Ltd., Ashish Interbuild Pvt. Ltd., IVRCL Ltd., Max Energy and Logistics, TRS Containers Pvt. Ltd. and ACR Projects Pvt. Ltd.

The report explores crucial aspects of the India ISO tank container market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed