India Smartphone Market Size, Share, Trends, Growth and Forecast 2030

India Smartphone Market By Cost of Smartphones (Luxury and Affordable), By Demographic (Working Professionals, Students, Senior Citizens, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

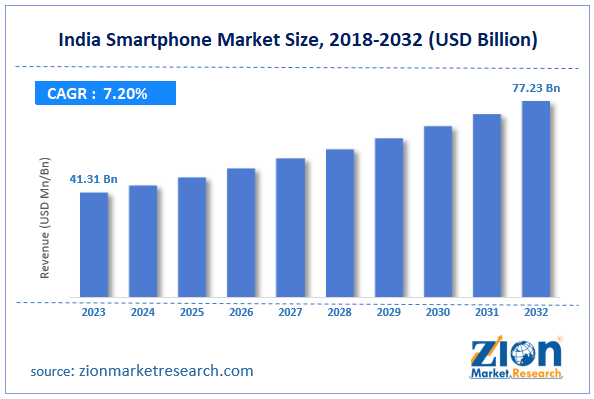

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 41.31 Billion | USD 77.23 Billion | 7.20% | 2023 |

India Smartphone Industry Prospective:

The India smartphone market size was worth around USD 41.31 billion in 2023 and is predicted to grow to around USD 77.23 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.20% between 2024 and 2032.

India Smartphone Market: Overview

The Indian smartphone industry is one of the world’s most lucrative sectors for smartphone makers across the globe. The regional market deals with the production, import-export, distribution, and consumption of smartphones. As per definition, an intelligent smartphone is defined as a mobile device that can perform functions similar to computers. Most smartphones are equipped with a touchscreen that replaces the traditional keypad. Additionally, all smartphones have access to the Internet and some may offer connection to the latest 5G systems. The operating system in the smartphone allows users to download and run several applications of their choice. The Indian smartphone industry is highly dynamic. The region has a high demand for affordable smartphones with low maintenance, but it is also one of the prominent markets for luxury smartphone sellers such as Apple and Samsung. The penetration of the regional e-commerce industry has been pivotal in driving the sales of smartphones in the last few years. The changing consumer preferences, increasing number of working professionals, and availability of a large number of smartphone options in the country are driving the regional market revenue. However, the industry is at the risk of becoming oversaturated which may impact the market growth trends during the projection period.

Key Insights:

- As per the analysis shared by our research analyst, the India smartphone market is estimated to grow annually at a CAGR of around 7.20% over the forecast period (2024-2032)

- In terms of revenue, the India smartphone market size was valued at around USD 41.31 billion in 2023 and is projected to reach USD 77.23 billion, by 2032.

- The India smartphone market is projected to grow at a significant rate due to the growing trend of consumers moving to higher-value products

- Based on the cost of smartphones, the affordable segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the demographic, the working professionals segment is anticipated to command the largest market share

- Based on region, Northern and North Eastern states are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

India Smartphone Market: Growth Drivers

Growing trend of consumers moving to higher-value products will drive the market growth rate

The India smartphone market is expected to grow during the projection period due to consumers moving to products with higher value. Research indicates that average Indian buyers tend to upgrade their products when re-purchasing an item such as a smartphone. The trend can be witnessed across price tiers including affordable and high-end phones. In addition to this, as companies continue to launch new products in the market with higher performance value, consumers get interested in trying the new technology. A recent official survey indicates that more than 30 million people in Delhi city are willing to spend more on buying 5G phones.

Large consumer base of the country works in favor of the industry

India has a large consumer base. The regional population is over 1.3 billion and it is expected to grow during the projection period. Along with the growing population density, the country is also witnessing a shift in the purchasing power of buyers. The standard of living in major cities has improved with a rise in earning opportunities. Increased foreign direct investment (FDA), the surge in investment in the manufacturing sector, and the emergence of several new start-ups have helped general buyers change their lifestyles. Around 660 million people in India own smartphones. Around 61.5% of smartphone users in India tend to change their phones every 2 years thus creating growth scope for industry players.

India Smartphone Market: Restraints

Stiff competition and higher initial investments will limit the industry’s growth rate

The India smartphone market is expected to be restricted due to the stiff competition the businesses face in the regional sector. The industry for smartphones in India is filled with several brands and their extensive range of products. The vast array of available products has led to the regional sector becoming oversaturated. Since almost all smartphones offer similar features, the availability of multiple options can impact the overall buying experience of the customers. In addition to this, developing a smartphone developing and producing business in India can be cost-intensive with procuring components acting as the major expense. Moreover, setting up factory and labor costs add to the total expenditure required for a successful smartphone-developing business in the country.

India Smartphone Market: Opportunities

Surge in official initiatives to promote the domestic production of smartphones holds exceptional growth possibilities

The India smartphone industry is anticipated to deliver exceptional growth possibilities during the forecast period. The Indian government has taken several steps in recent times to promote domestic production of smartphones encouraging international companies as well as domestic firms. For instance, as per the July 2024 union budget announced by Indian officials, basic customs duty on chargers, mobile phones, and printed circuit boards (PCBs) will be reduced from 20% to 15%. Additionally, duties on critical minerals will also be exempted. The advantage will also extend to raw materials and inputs required for manufacturing smartphones. Simplified tariffs and reduced duty fees were necessary to promote domestic production of smartphones as the country aims to compete with existing manufacturing giants such as China and Vietnam.

Introduction of a 5G network in India may generate demand for 5 G-compatible phones

India is steadily transitioning in terms of network technologies. The India smartphone market can benefit from the changes in the country’s network systems. In June 2024, Nokia, a leading telecommunications company, announced its plan to expedite the monetization process for 5G in India for its regional customers Bharti Airtel and Reliance Jio. In October 2023, Vodafone India announced that it will make significant investments in the country’s 5G sector in the coming years thus generating substantial growth opportunities for smartphone companies operating in India.

India Smartphone Market: Challenges

Rising cases of phone scams in the country could challenge market expansion rate

The industry for smartphones in India faces challenges due to the rising cases of phone-related scams in the country. According to official reports, the country recorded around 80 million phishing scams in 2023. Smartphones are vulnerable to cyberattacks causing users to encounter financial fraud and compromise data privacy. These factors could impact the industry’s growth rate during the projection period.

India Smartphone Market: Segmentation

The India smartphone market is segmented based on the cost of smartphones, demographics, and region.

Based on the cost of smartphones, the India smartphone industry is divided into luxury and affordable. In 2023, the highest growth was witnessed in the affordable category. Most Indian buyers belong to low or middle-income groups. The affordable smartphone section offers smartphones starting at low prices such as INR 10,000 and above. For instance, the POCO C61 is currently priced at INR 6,649. However, luxury phones, especially iPhones have become widely popular in the country. Apple sold more than 90 lakh iPhones in 2023.

Based on the demographic, the regional market divisions are working professionals, students, senior citizens, and others. In 2023, the highest demand was observed in the working professionals segment. Employed people tend to have extensive use of smartphones. Additionally, they are more financially capable of purchasing expensive smartphones. The rise in the number of working professionals in the country along with the growing premiumization trend will fuel the segmental demand. Premiumization has been attributed as the leading reason for India achieving milestone revenue of USD 10 billion in the second quarter of 2024.

India Smartphone Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Smartphone Market |

| Market Size in 2023 | 41.31 Bn |

| Market Forecast in 2032 | 77.23 Bn |

| Growth Rate | CAGR of 7.20% |

| Number of Pages | 220 |

| Key Companies Covered | Motorola, Samsung, Micromax, Oppo, Vivo, Asus, Xiaomi, Poco, Realme, Tecno, iQOO, OnePlus, Lava, Apple, Infinix., and others. |

| Segments Covered | By Cost of Smartphones, By Demographic, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Smartphone Market: Regional Analysis

Northern and North Eastern states of the country to deliver optimal results during the projection period

The India smartphone market will be led by the Northern states of the country during the projection period. States such as Gujarat, Maharashtra, Himachal Pradesh, and Punjab are some of the leading contributors to India’s smartphone sector. Rural penetration of intelligent mobile phones is exceptionally high in these regions. For instance, over 96.01% of the rural population in Gujarat is equipped with smartphones. The same statistics for Punjab currently stand at over 91%. The most popular smartphones in India are owned by Samsung followed by Oppo and Vivo. These companies produce some of the most functionally-rich smartphones at reasonable prices thus meeting the needs of the regional population. Samsung held control over 18.01% of the total market share in 2023. In March 2023, reports emerged suggesting that Korean electronics giant Samsung was planning to invest in developing a smart manufacturing functionality at its mobile phone plant currently located in the Noida region. In July 2024, Vivo announced that it would soon commence the production of smartphones at its recently built facility worth INR 3500 in Greater Noida.

India Smartphone Market: Competitive Analysis

The India smartphone market is led by players like:

- Motorola

- Samsung

- Micromax

- Oppo

- Vivo

- Asus

- Xiaomi

- Poco

- Realme

- Tecno

- iQOO

- OnePlus

- Lava

- Apple

- Infinix.

The India smartphone market is segmented as follows:

By Cost of Smartphones

- Luxury

- Affordable

By Demographic

- Working Professionals

- Students

- Senior Citizens

- Others

By Region

- India

Table Of Content

Methodology

FrequentlyAsked Questions

The Indian smartphone industry is one of the world’s most lucrative sectors for smartphone makers across the globe.

The India smartphone market is expected to grow during the projection period due to consumers moving to products with higher value.

According to study, the India smartphone market size was worth around USD 41.31 billion in 2023 and is predicted to grow to around USD 77.23 billion by 2032.

The CAGR value of India smartphone market is expected to be around 7.20% during 2024-2032.

The India smartphone market will be led by the Northern states of the country during the projection period.

The India smartphone market is led by players like Motorola, Samsung, Micromax, Oppo, Vivo, Asus, Xiaomi, Poco, Realme, Tecno, iQOO, OnePlus, Lava, Apple, and Infinix.

The report explores crucial aspects of the India smartphone market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed