Industrial Brakes and Clutches Market Size, Share, Trends, Growth and Forecast 2034

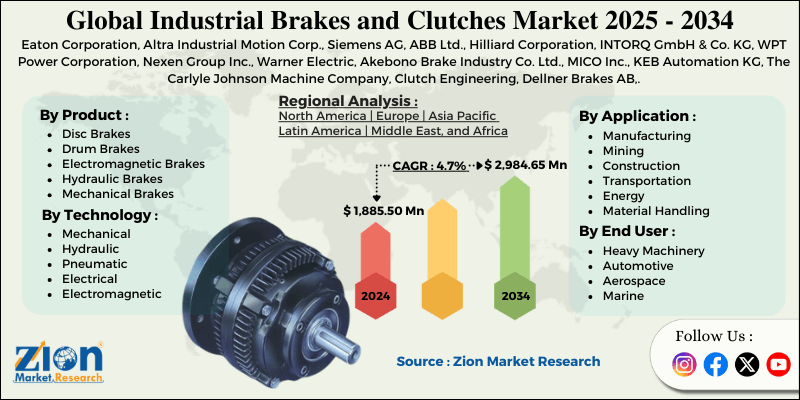

Industrial Brakes and Clutches Market By Product Type (Disc Brakes, Drum Brakes, Electromagnetic Brakes, Hydraulic Brakes), By Application (Manufacturing, Mining, Construction, Transportation, Energy, Material Handling), By End-User (Heavy Machinery, Automotive, Aerospace, Marine, Power Generation), By Technology (Mechanical, Hydraulic, Pneumatic, Electrical), By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

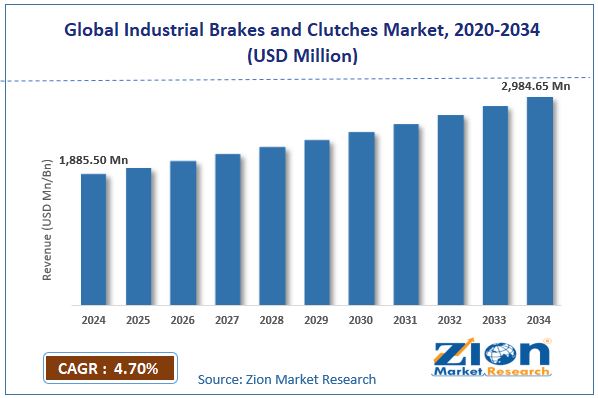

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,885.50 Million | USD 2,984.65 Million | 4.70% | 2024 |

Industrial Brakes and Clutches Industry Prospective:

The global industrial brakes and clutches market was valued at approximately USD 1,885.50 million in 2024 and is expected to reach around USD 2,984.65 million by 2034, growing at a compound annual growth rate (CAGR) of roughly 4.70% between 2025 and 2034.

Industrial Brakes and Clutches Market: Overview

Industrial brakes and clutches are mechanical components designed for controlling motion, transmitting power, and ensuring operational safety in industrial machinery. Brakes are used to slow down or stop motion, while clutches engage and disengage power transmission between components. These systems provide precise stopping, holding, and power transfer capabilities in complex machinery spanning multiple sectors, including manufacturing, transportation, energy, and heavy industrial operations.

Advances in friction materials and electronic control integration have enhanced performance, durability, and efficiency in modern braking and clutch systems. The growing adoption of automation and innovative manufacturing technologies drives demand for high-performance braking solutions with real-time monitoring capabilities.

Additionally, stringent safety regulations and industry standards are accelerating the development of fail-safe and energy-efficient braking systems in the industrial brakes and clutches industry.

Key Insights:

- As per the analysis shared by our research analyst, the global industrial brakes and clutches market is estimated to grow annually at a CAGR of around 4.70% over the forecast period (2025-2034)

- In terms of revenue, the global industrial brakes and clutches market size was valued at around USD 1,885.50 million in 2024 and is projected to reach USD 2,984.65 million by 2034.

- The industrial brakes and clutches market is projected to grow significantly due to manufacturing, heavy machinery, and technological advancements in the electrical and electromagnetic brake systems sectors, driving market growth.

- Based on the product type, disc brakes lead the segment and will continue to dominate the global market.

- Based on the application, manufacturing is anticipated to command the largest market share.

- Based on the end users, heavy machinery will lead the segment and continue dominating the global market.

- Based on technology, hydraulic braking systems are expected to lead the market during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Industrial Brakes and Clutches Market: Growth Drivers

Industrial Automation and Technological Innovation

The rapid advancement of industrial automation is fundamentally transforming the industrial brakes and clutches market. Innovative manufacturing processes demand increasingly sophisticated motion control systems with enhanced precision, reliability, and energy efficiency.

Advanced sensors, predictive maintenance technologies, and integrated control systems are revolutionizing traditional mechanical brake and clutch designs. Emerging technologies like IoT-enabled condition monitoring, artificial intelligence-driven predictive maintenance, and smart diagnostic systems are creating new value propositions.

Global Manufacturing and Infrastructure Development

Sustained growth in global manufacturing sectors, particularly in emerging economies, is driving substantial demand in the industrial brakes and clutches industry. Infrastructure development projects, expansion of manufacturing capabilities, and increasing investments in industrial machinery create significant market opportunities.

Developing regions are witnessing rapid industrialization, with investments in manufacturing, construction, and transportation infrastructure. This trend generates unprecedented demand for high-performance, durable brake and clutch systems capable of operating in challenging industrial environments.

Industrial Brakes and Clutches Market: Restraints

Economic Volatility and Supply Chain Complexities

Global economic uncertainties and persistent supply chain disruptions pose significant challenges to market growth. Raw material price fluctuations, semiconductor shortages, and geopolitical tensions create operational challenges for manufacturers. The industrial brakes and clutches market must maintain competitive pricing and technological innovation.

Manufacturers increasingly focus on diversifying their supplier base and adopting localized production strategies to mitigate risks. The rising logistics costs and trade restrictions add to the pressure, compelling companies to streamline operations and enhance supply chain resilience.

Industrial Brakes and Clutches Market: Opportunities

Sustainable and Energy-Efficient Technologies

The transition towards sustainable industrial solutions presents remarkable growth opportunities in the industrial brakes and clutches market. Manufacturers are developing eco-friendly brake and clutch systems that reduce environmental impact, boost energy efficiency, and improve lifecycle.

Electrical and electromagnetic technologies replace traditional hydraulic and mechanical systems, offering superior performance and lower maintenance requirements.

As emerging markets increasingly prioritize energy-efficient industrial technologies, opportunities for smart brake and clutch solutions are created. Integrating advanced materials, lightweight designs, and smart control systems drives market evolution.

Additionally, the growing emphasis on Industry 4.0 and automation fuels demand for intelligent braking systems that enhance operational efficiency and predictive maintenance capabilities.

Industrial Brakes and Clutches Market: Challenges

Technological Complexity and Skills Gap

The increasing advancement in the industrial brake and clutch industry necessitates specialized engineering expertise. The skills gap in understanding and implementing advanced motion control systems is a significant challenge for technology adoption.

Manufacturers must invest in training programs and develop user-friendly technological solutions. Collaborations with technical institutions and workforce development initiatives are essential to bridging the skills gap and ensuring a skilled labor pool.

Additionally, integrating digital interfaces and automated diagnostics can simplify system operation and maintenance for end users. As industrial systems become more complex, continuous education and upskilling will play a crucial role in maximizing the efficiency and reliability of advanced brake and clutch technologies.

Industrial Brakes and Clutches Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Brakes and Clutches Market |

| Market Size in 2024 | USD 1,885.50 Million |

| Market Forecast in 2034 | USD 2,984.65 Million |

| Growth Rate | CAGR of 4.70% |

| Number of Pages | 215 |

| Key Companies Covered | Eaton Corporation, Altra Industrial Motion Corp., Siemens AG, ABB Ltd., Hilliard Corporation, INTORQ GmbH & Co. KG, WPT Power Corporation, Nexen Group Inc., Warner Electric, Akebono Brake Industry Co. Ltd., MICO Inc., KEB Automation KG, The Carlyle Johnson Machine Company, Clutch Engineering, Dellner Brakes AB, Ogura Industrial Corp., Sibre Siegerland Bremsen GmbH, and others. |

| Segments Covered | By Product Type, By Application, By End User, By Technology, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Brakes and Clutches Market: Segmentation

The global industrial brakes and clutches market is segmented into product type, application, end-user, technology, and region.

Based on the product type, the market is segregated into disc, drum, electromagnetic, hydraulic, and mechanical brakes. Disc brakes lead the market due to their superior stopping power, heat dissipation, and durability, making them ideal for high-performance industrial applications.

Based on the application, the industrial brakes and clutches industry is classified into manufacturing, mining, construction, transportation, energy, material handling, and aerospace. Of these, the manufacturing sector dominates the market due to the extensive use of automated machinery and conveyor systems that require precise motion control and braking solutions.

Based on the end-users, the market is categorized into heavy machinery, automotive, aerospace, marine, power generation, and industrial equipment. Heavy machinery is expected to lead during the forecast period as industrial brakes and clutches are essential for mining, construction, and material handling equipment, where safety and operational efficiency are paramount.

Based on technology, the brakes and clutches industry is divided into mechanical, hydraulic, pneumatic, electrical, and electromagnetic. Hydraulic braking systems are the most widely adopted due to their ability to handle high loads, provide smooth operation, and ensure reliable performance in heavy-duty applications.

Industrial Brakes and Clutches Market: Regional Analysis

North America to Lead the Market

North America leads the global industrial brakes and clutches market, which is driven by advanced manufacturing capabilities, high industrial automation adoption, and infrastructure development. The region's established automotive, aerospace, and heavy machinery industries need high-performance braking and clutch solutions, driving the market demand.

The U.S. has a significant global market share due to strict workplace safety regulations and the increasing adoption of smart motion control systems. Investments in renewable energy and power generation also contribute to the growth as industrial brakes play a crucial role in wind turbines, hydroelectric plants, and other clean energy applications.

Transportation and logistics companies adopt advanced braking technologies for better efficiency and safety. North America's market also benefits from a focus on predictive maintenance solutions, IoT-enabled monitoring, and AI-driven automation, enhancing the performance and life of industrial braking systems.

Asia-Pacific to Witness Significant Growth

Asia-Pacific is the fastest-growing region in the industrial brakes and clutches industry. It rapidly increases due to industrialization, infrastructure growth, and automation adoption in key countries like China, India, Japan, and South Korea. The region's manufacturing sector and mining and construction activities drive demand for high-performance braking and clutch systems.

China, a global manufacturing hub, plays a significant role in the market's growth with heavy investments in industrial automation, robotics, and material handling equipment.

Similarly, India's growing automotive and infrastructure industry creates enormous opportunities for brake and clutch manufacturers. The shift towards sustainable and energy-efficient industrial solutions is gaining momentum, and companies are adopting advanced braking technologies.

The increasing adoption of IoT-enabled condition monitoring and AI-driven predictive maintenance solutions is transforming the region’s industrial brakes and clutches landscape, solidifying its position as the global leader in this market.

Recent Market Developments:

- In January 2025, Altra Industrial Motion introduced an advanced electromagnetic brake system with integrated predictive maintenance capabilities.

- In February 2025, Siemens launched next-generation intelligent clutch technology for industrial automation.

- In March 2025, Federal-Mogul developed high-performance brake solutions utilizing advanced composite materials.

Industrial Brakes and Clutches Market: Competitive Analysis

The global industrial brakes and clutches market is driven by key players such as:

- Eaton Corporation

- Altra Industrial Motion Corp.

- Siemens AG

- ABB Ltd.

- Hilliard Corporation

- INTORQ GmbH & Co. KG

- WPT Power Corporation

- Nexen Group Inc.

- Warner Electric

- Akebono Brake Industry Co. Ltd.

- MICO Inc.

- KEB Automation KG

- The Carlyle Johnson Machine Company

- Clutch Engineering

- Dellner Brakes AB

- Ogura Industrial Corp.

- Sibre Siegerland Bremsen GmbH

The global industrial brakes and clutches market is segmented as follows:

By Product Type

- Disc Brakes

- Drum Brakes

- Electromagnetic Brakes

- Hydraulic Brakes

- Mechanical Brakes

By Application

- Manufacturing

- Mining

- Construction

- Transportation

- Energy

- Material Handling

- Aerospace

By End User

- Heavy Machinery

- Automotive

- Aerospace

- Marine

- Power Generation

- Industrial Equipment

By Technology

- Mechanical

- Hydraulic

- Pneumatic

- Electrical

- Electromagnetic

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial brakes and clutches are mechanical components designed for controlling motion, transmitting power, and ensuring operational safety in industrial machinery. Brakes are used to slow down or stop motion, while clutches engage and disengage power transmission between components.

The industrial brakes and clutches market is expected to be driven by rising industrial automation, increasing demand for high-performance motion control systems, advancements in smart braking technologies, expansion of the manufacturing and transportation sectors, and growing emphasis on energy-efficient and sustainable braking solutions.

According to our study, the global industrial brakes and clutches market was worth around USD 1,885.50 million in 2024 and is predicted to grow to around USD 2,984.65 million by 2034.

The CAGR value of the industrial brakes and clutches market is expected to be around 4.70% during 2025-2034.

The global industrial brakes and clutches market will register the highest growth in North America during the forecast period.

Key players in the industrial brakes and clutches market include Eaton Corporation, Altra Industrial Motion Corp., Siemens AG, ABB Ltd., Hilliard Corporation, INTORQ GmbH & Co. KG, WPT Power Corporation, Nexen Group Inc., Warner Electric, Akebono Brake Industry Co., Ltd., MICO, Inc., KEB Automation KG, The Carlyle Johnson Machine Company, Clutch Engineering, Dellner Brakes AB, Ogura Industrial Corp., and Sibre Siegerland Bremsen GmbH.

The report comprehensively analyzes the industrial brakes and clutches market, covering key market drivers, challenges, emerging trends, and regional growth dynamics. It delves into technological advancements, including smart braking systems, IoT-enabled monitoring, and predictive maintenance solutions, shaping the industry's future.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed