Industrial Vehicle Market Size, Share, Trends, Growth 2030

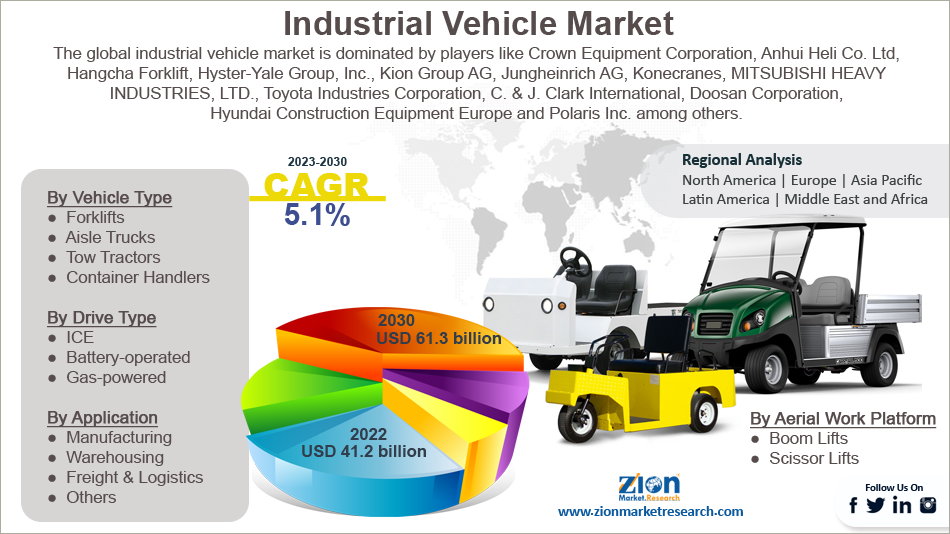

Industrial Vehicle Market By Vehicle Type (Forklifts, Aisle Trucks, Tow Tractors, and Container Handlers), By Drive Type (ICE, Battery-operated and Gas-powered), By Application (Manufacturing, Warehousing, Freight & Logistics, and Others), By Aerial Work Platform (Boom Lifts and Scissor Lifts) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 41.2 Billion | USD 61.3 Billion | 5.1% | 2022 |

Industrial Vehicle Industry Prospective:

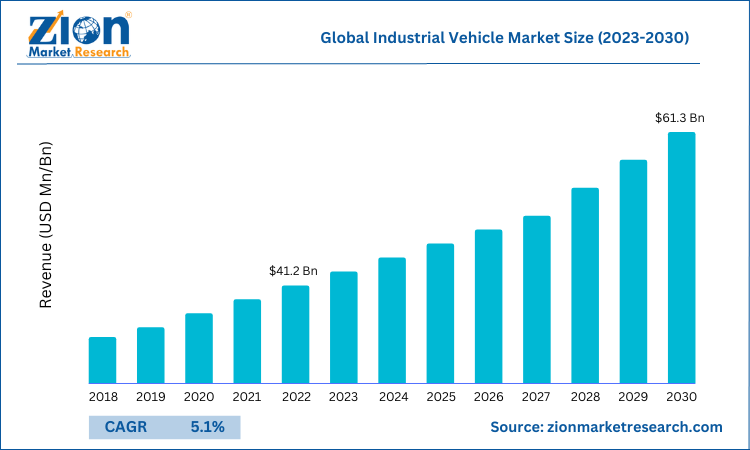

The global industrial vehicle market size was worth around USD 41.2 Billion in 2022 and is predicted to grow to around USD 61.3 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.1% between 2023 and 2030.

The report analyzes the global industrial vehicle market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the industrial vehicle market.

Industrial Vehicle Market: Overview

Industrial vehicles are simply automobiles that have been specifically created for the logistics of moving products between warehouse distribution hubs and retail locations with a finished inventory. Industrial vehicles come in a variety of sizes and are built to handle the weight of heavy loads. The loading and unloading of inventory from the warehouse, the storage of raw materials and completed goods, and the transportation of goods to the retail location all involve the use of industrial vehicles.

Key Insights

- As per the analysis shared by our research analyst, the global industrial vehicle market is estimated to grow annually at a CAGR of around 5.1% over the forecast period (2023-2030).

- In terms of revenue, the global industrial vehicle market size was valued at around USD 41.2 billion in 2022 and is projected to reach USD 61.3 billion, by 2030.

- Technological advancements and the increasing need for stacking boost the global industrial vehicle market growth.

- Based on the vehicle type, the aisle trucks segment is expected to dominate the market during the forecast period.

- Based on the drive type, the battery-operated segment accounted for the largest market share in 2022.

- Based on the application, the warehousing segment is growing at a rapid rate over the forecast period.

- Based on the aerial work platform, the boom lifts segment is expected to dominate the market over the forecast period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Industrial Vehicle Market: Growth Drivers

Growing e-commerce and warehouse facilities across the globe drive the market growth

The number of warehouses per region is increasing due to the growing demand for them to support hub and spoke models in several sectors, including e-commerce, the manufacturing of automotive components, consumer goods, and electronics. The storage and fulfillment sector is predicted to grow by twice the rate over the subsequent five years. From about 10% of all retail transactions in 2019 to over 15% in 2020, e-commerce was more widely used in the US. In addition, as of 2020, there were 19,194 facilities in the US, up from 15,255 in 2011, according to the US Bureau of Labor Statistics. Thus, growing e-commerce and warehouse facilities across the globe are expected to drive global industrial vehicle market expansion.

Industrial Vehicle Market: Restraints

Lack of R&D facilities hinders the market growth

The development of the industrial vehicle industry is constrained by a dearth of R&D facilities and stringent regulations. R&D and innovation are key requirements for industrial vehicles. OEMs must spend heavily on R&D to improve industrial vehicles' ability to lift heavy loads and increase productivity to shorten turnaround times. A top R&D facility is necessary to prevent forklifts from tipping over, sliding sideways, or dumping their cargo. To operate efficiently, industrial vehicles also require a lot of upkeep. As a consequence, industrial vehicle owners are required to perform routine inspections and preventative maintenance. A qualified maintenance worker should do this to keep industrial vehicles in a secure working atmosphere.

Industrial Vehicle Market: Opportunities

Growing demand for battery-operated industrial vehicles provides a lucrative opportunity

Battery-operated industrial vehicles use rechargeable batteries to power their respective vehicles. Industrial vehicles that run on batteries have gained a lot of momentum recently. Battery-operated engines' primary benefit is that they are environmentally sustainable. These engines are ideal eco-friendly equipment for warehouse and industrial tasks because they emit lower carbon dioxide emissions. As a result, the increasing adoption of integrating smart factories and battery-operated vehicles into the material handling industries will lead to digitalization and modularization, which will further boost the industrial vehicle market growth and present enormous opportunities for the market in the coming year.

Industrial Vehicle Market: Challenges

Stringent government regulations pose a major challenge

Industrial vehicle safety and pollution regulations have become stricter and more intricate over the past few years. According to the Occupational Safety and Health Administration (OSHA), forklift accidents are thought to be the cause of 1 in 6 workplace deaths in the US. Forklift accidents claim the lives of over 100 people annually, costing the business $135 million. OSHA claims that consistent safety instruction and precautions could have helped to prevent nearly 70% of forklift incidents.

The Australian government has implemented several substantial changes to the forklift manufacturing industry to guarantee safety. For reaching vehicles and counterbalance forklifts, for instance, the speed limit is 5 km/h. The stricter emission tier slabs may cause problems for forklift truck manufacturers since they will have to spend a lot of money on research and development to change the vehicles' emission systems.

Industrial Vehicle Market: Segmentation

The global industrial vehicle industry is segmented based on vehicle type, drive type, application, aerial work platform, and region.

Based on the vehicle type, the global market is bifurcated into forklifts, aisle trucks, tow tractors, and container handlers. The aisle trucks segment is expected to dominate the market during the forecast period. A vehicle called an aisle truck is used to transport and stack products in aisles, which are typically 8 to 9.5 feet wide. It typically has stand-up riders and runs on electric engines. Due to its ability to work in much narrower aisles, it improves productivity by supplying extra storage space. Due to their efficiency, dependability, and low operating costs, aisle trucks are in great demand. Aisle trucks also have several advantages, including better load and lift capacity in narrow areas and comfort and safety. Thus, the aisle truck segment is expected to rise over the forecast period.

Based on the drive type, the global industrial vehicle industry is segmented into ICE, battery-operated, and gas-powered. The battery-operated segment accounted for the largest market share in 2022 and is expected to continue the same pattern during the forecast period. Rechargeable batteries are used to power industrial vehicles that operate on batteries. Recently, battery-powered commercial vehicles have become very common.

Batteries power the motors, which has advantages for the environment. These commercial vehicles are very inexperienced tools for warehouse and company tasks because these engines create lower emissions. Globally, the large majority of logistics service providers are focusing on lowering their carbon impact. Battery-operated engines have received a lot of attention from industrial vehicles looking to cut CO2 emissions and other exhaust pollutants.

Based on the application, the global industrial vehicle market is segmented into manufacturing, warehousing, freight & logistics, and others. The warehousing segment is growing at a rapid rate over the forecast period. The demand for warehouse vehicles to ease the movement of products is influenced by the need for distribution centers and warehouses, which is supported by increasing e-commerce sales.

Based on the aerial work platform, the global industrial vehicle industry is divided into boom lifts and scissor lifts. The boom lifts segment is expected to dominate the market over the forecast period. Construction endeavors involving the building of roads, mines, irrigation systems, urban infrastructure, airports, railways, and ports frequently make use of boom lifts. Due to end users' greater preference for purchasing used boom lifts rather than new ones, which results from the high cost of new equipment, the boom lift market is constrained.

Articulating boom lifts, Telescopic boom lifts, Straight boom lifts, Genie boom lifts, and Towable boom lifts are just a few of the different types available for boom lifts. Boom lifts have features like a 360-degree spinning turntable and a chassis width that enable them to fit through narrow industrial aisleways and crowded workplaces. Boom lifts make it simple to move machines forward and backward from the work platform. Thus, driving segmental growth.

Recent Developments:

- In November 2021, mid-sized 4-wheel internal combustion pneumatic tire forklifts with PF (D) 120N and PF (D) 80N model models were introduced by Mitsubishi Logisnext Americas. All the dealers affiliated with the UniCarriers name can purchase forklifts with these engines.

- In October 2021, the companies that produce and market forklift masts, Lift-Tek Elecar S.p.A. (Italy) and Lift Technologies, Inc. (USA), more commonly known as Lift-Tek, were purchased by Cascade Corporation, a division of Toyota Industries Corporation. The entire stock of Lift-Tek has been purchased by Cascade Corporation.

- In February 2022, in their line of industrial lift trucks, CLARK introduced a new TWLi20 three-wheel electric lift truck powered by lithium-ion batteries.

- In September 2022, FPT Industrial, the Iveco Group's global powertrain brand, reports that it has reached an agreement to invest in a small portion of Blue Energy Commercial Vehicles Private Ltd, an Indian business that develops zero-emission trucks and produces them under the Blue Energy Motors name. The investment further shows FPT Industrial's unwavering commitment to Blue Energy Motors' expansion and its aspirational plan to play a significant part in India's decarbonization transition. The collaboration anticipates the possibility of future technology deployments in the field of electrification even though it is presently concentrated on natural gas fuel applications.

Industrial Vehicle Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Vehicle Market Research Report |

| Market Size in 2022 | USD 41.2 Billion |

| Market Forecast in 2030 | USD 61.3 Billion |

| Compound Annual Growth Rate | CAGR of 5.1% |

| Number of Pages | 201 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Crown Equipment Corporation, Anhui Heli Co. Ltd, Hangcha Forklift, Hyster-Yale Group, Inc., Kion Group AG, Jungheinrich AG, Konecranes, MITSUBISHI HEAVY INDUSTRIES, LTD., Toyota Industries Corporation, C. & J. Clark International, Doosan Corporation, Manitou Group, CARGOTEC CORPORATION, Daifuku Co., Ltd, SSI Schaefer Systems SA (Pty), Hyundai Construction Equipment Europe and Polaris Inc. among others. |

| Segments Covered | By Vehicle Type, By Drive Type, By Application, By Aerial Work Platform, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2022 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Vehicle Market: Regional Analysis

The Asia Pacific is expected to dominate the market during the forecast period

The Asia Pacific region is expected to dominate the global industrial vehicle market during the forecast period. The need for industrial vehicles to transport finished products and raw materials for storage in warehouses is growing as a result of the region's rapid industrialization. Moreover, the growing e-commerce and construction sector in the region is attributed to the growth of the market over the forecast period. For instance, a National E-Commerce Policy was created by the Government of India (GOI) in 2019 to control the higher levels of E-Commerce brought on by India's quick digitization. The strategy emphasizes the protection of customer data, localization of data, intellectual property, and competition.

The GOI permits 100 percent FDI under the automatic route (which needs no previous approval from the RBI or the GOI) under the marketplace model of B2C E-Commerce and 100 percent FDI in B2B E-Commerce. The proposed Personal Data Protection Bill, proposed Non-Personal Data Governance Framework and National Cyber Security Strategy 2020 are all affected by the E-Commerce strategy. Thus, the aforementioned facts supported the market expansion over the forecast period.

Industrial Vehicle Market: Competitive Analysis

The global industrial vehicle market is dominated by players like:

- Crown Equipment Corporation

- Anhui Heli Co. Ltd

- Hangcha Forklift

- Hyster-Yale Group Inc.

- Kion Group AG

- Jungheinrich AG

- Konecranes

- MITSUBISHI HEAVY INDUSTRIES LTD.

- Toyota Industries Corporation

- C. & J. Clark International

- Doosan Corporation

- Manitou Group

- CARGOTEC CORPORATION

- Daifuku Co. Ltd

- SSI Schaefer Systems SA (Pty)

- Hyundai Construction Equipment Europe

- Polaris Inc.

The global industrial vehicle market is segmented as follows:

By Vehicle Type

- Forklifts

- Aisle Trucks

- Tow Tractors

- Container Handlers

By Drive Type

- ICE

- Battery-operated

- Gas-powered

By Application

- Manufacturing

- Warehousing

- Freight & Logistics

- Others

By Aerial Work Platform

- Boom Lifts

- Scissor Lifts

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial vehicles are nothing but motor vehicles that are specially designed for the transportation of goods and logistics purposes between warehouse distribution centers to the stores that contain finished inventory.

Rapid industrialization and an increase in the number of warehouses for better management of manufacturing industries and e-commerce have globally driven the global industrial vehicle market.

According to the report, the global market size was worth around USD 41.2 billion in 2022 and is predicted to grow to around USD 61.3 billion by 2030.

The global industrial vehicle market is expected to grow at a CAGR of 5.1% during the forecast period.

The global industrial vehicle market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market owing to rapid industrialization in the region.

The global industrial vehicle market is dominated by players like Crown Equipment Corporation, Anhui Heli Co. Ltd, Hangcha Forklift, Hyster-Yale Group, Inc., Kion Group AG, Jungheinrich AG, Konecranes, MITSUBISHI HEAVY INDUSTRIES, LTD., Toyota Industries Corporation, C. & J. Clark International, Doosan Corporation, Manitou Group, CARGOTEC CORPORATION, Daifuku Co., Ltd, SSI Schaefer Systems SA (Pty), Hyundai Construction Equipment Europe and Polaris Inc. among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed