Global Injection Molded Automotive Parts Market Size, Share, Analysis, Trends, Growth, 2032

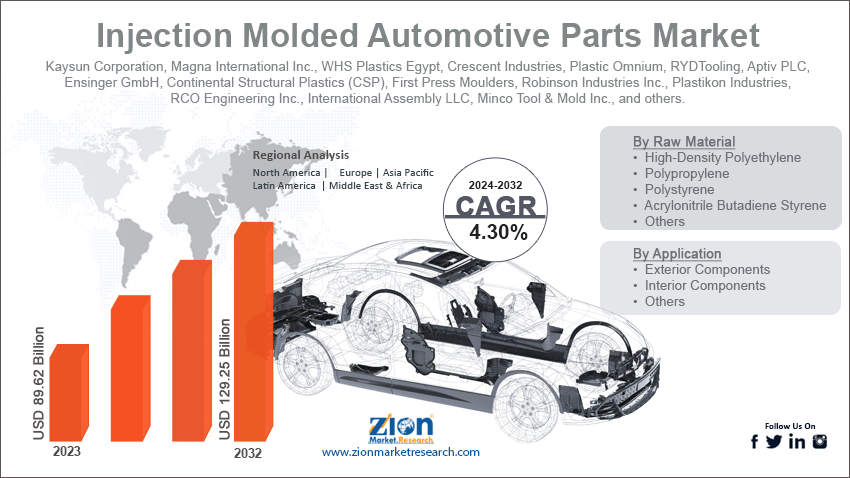

Injection Molded Automotive Parts Market By Raw Material (High-Density Polyethylene (HDPE), Polypropylene, Polystyrene, Acrylonitrile Butadiene Styrene (ABS), and Others), By Application (Exterior Components, Interior Components, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

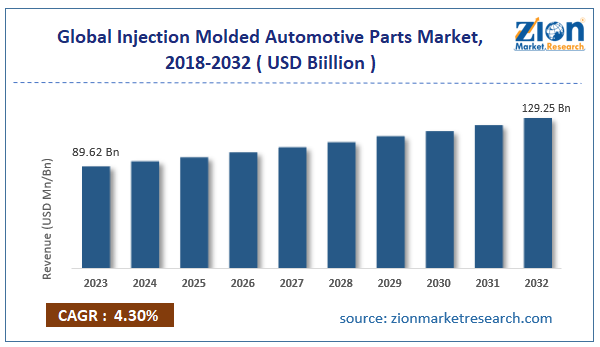

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 89.62 Billion | USD 129.25 Billion | 4.30% | 2023 |

Injection Molded Automotive Parts Industry Prospective:

The global injection molded automotive parts market size was worth around USD 89.62 billion in 2023 and is predicted to grow to around USD 129.25 billion by 2032, with a compound annual growth rate (CAGR) of roughly 4.30% between 2024 and 2032.

Injection Molded Automotive Parts Market: Overview

Injection-molded automotive parts allow vehicle manufacturers to use plastic materials to produce several parts for all types of vehicles. According to market research, the automotive injection molding process has shown applications in electric vehicles (EVs), hybrid vehicles, trucks, buses, motorcycles, and vehicles running on internal combustion engines (ICE). Generally, injection-molded automotive parts are associated with high-volume production.

However, research indicates that production technology can also be leveraged to lower production volumes and rapid prototyping. Furthermore, certain companies operating in the injection molded automotive parts industry are currently experimenting with novel materials such as thermoplastic elastomers (TPEs) and silicone high-consistency rubber (HCR) to deliver more exceptional products. Injection-molded car parts are used in the exterior as well as interior segments of vehicles.

For instance, commonly produced exterior components using injection molding include center console, door handles, and plastic parts offering decorative finish. On the other hand, interior components include bumpers, grills, splash guards, and side mirrors. The growing advancements in injection molding technology will further contribute to the region’s overall revenue in the coming years. However, the industry is likely to face growth inhibitions due to the high range of involved costs as well as the growing popularity of alternate technologies for producing automotive parts.

Key Insights:

- As per the analysis shared by our research analyst, the global injection molded automotive parts market is estimated to grow annually at a CAGR of around 4.30% over the forecast period (2024-2032)

- In terms of revenue, the global injection molded automotive parts market size was valued at around USD 89.62 billion in 2023 and is projected to reach USD 129.25 billion by 2032.

- The injection molded automotive parts market is projected to grow at a significant rate due to the increasing demand for lightweight automobiles.

- Based on raw material, the polypropylene segment is growing at a high rate and will continue to dominate the global market, as per industry projections.

- Based on application, the interior components segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Injection Molded Automotive Parts Market: Growth Drivers

Increasing demand for lightweight automotive to fuel market expansion rate

The global injection molded automotive parts market is expected to be driven by the increasing demand for lightweight vehicles. According to experts in the automotive sector, lightweight vehicles offer significant advantages compared to extremely heavyweight counterparts. For instance, lighter vehicles are known to promote fuel economy. According to market research, fuel economy can be increased by 6% to 8% by reducing vehicle weight by 10%.

Furthermore, lighter vehicles are considered safer to drive. The Environmental Protection Agency (EPA) estimates that nearly 450 lives per billion miles can be saved from fatal accidents by reducing vehicle weight. The growing demand for sustainable use of fuel, especially in the automotive sector, is expected to create more demand for lightweight vehicles.

In August 2024, Tata Motors, India’s largest commercial vehicle manufacturer, announced the launch of a sub-600 kg small commercial vehicle (SCV) especially targeting the last-mile delivery market. The company has emphasized the need to produce lightweight vehicles for last-mile deliveries. Furthermore, the ongoing advancements in material technology with the introduction of new materials that allow automotive companies to produce lightweight cars will encourage higher adoption of injection-molded automotive parts.

Increasing advancements in injection molding technology to create higher industry revenue

Injection molding technology is undergoing several new advancements, which is expected to fuel the demand for novel automotive parts made using the new solutions. For instance, company leaders are working with plant-based materials in the injection molding process to produce more environmentally-friendly plastics.

Such novel initiatives are likely to propel the global injection molded automotive parts market to higher growth momentum in the coming years. In September 2023, PulPac, a leading packaging company, announced the launch of the world’s first injection molding machine designed for fiber-based products.

In October 2024, Milacron, another leading injection molding solution provider, launched an electric counterpart under the name eQ180. The technology is equipped to deliver the production of multi-layer parts using post-consumer recyclable (PCR) materials.

Injection Molded Automotive Parts Market: Restraints

Cost constraints with injection molding technology limit the industry's growth rate

The global industry for injection molded automotive parts is projected to be restricted due to the high cost of setting up the production infrastructure. The upfront cost of constructing and developing a functional production set using injection molding technology can be considerably high, especially for emerging players and small-sized firms. Generally, injection molding is considered more cost-effective for producing automotive parts in large volumes.

Injection Molded Automotive Parts Market: Opportunities

Increasing demand for electric and hybrid vehicles to create new expansion possibilities

The global injection molded automotive parts market is projected to generate growth opportunities due to the rising demand for electric vehicles (EVs). In addition to this, hybrid vehicles that are powered by ICEs, as well as battery packs, have become more common due to the advantages offered by the vehicles over other counterparts. EVs have gained momentum in the last few years due to the urgent need to reduce dependence on nonrenewable fuel sources.

Furthermore, the growing impact of burning fuel such as petrol and diesel on the environment has reached drastic levels, impacting the overall quality of the ecosystem. The regional governments have become supportive of the launch of favorable initiatives to promote the production of affordable electric vehicles.

In July 2024, U.S. The Department of Energy (DOE) announced an investment of USD 1.7 billion to convert 11 at-risk auto manufacturing facilities into EV-producing units. In March 2024, the U.S. General Services Administration (GSA) announced a grant of USD 25 million to support the development of electrical vehicle supply equipment (EVSE) at federal buildings across the country. The injection molding process is commonly used to produce intrinsic parts of EVs. Moreover, the technology is also used to manufacture electric and battery system components in electric vehicles.

Injection Molded Automotive Parts Market: Challenges

Competition from alternate technologies and process complexity challenge market expansion

The global injection molded automotive parts industry is projected to be challenged by the presence of more popular and high-performance alternate technologies such as 3D printing solutions. In addition to this, the complexity of the injection molding process will further discourage the adoption rate of the technology. According to industry analysis, material choices for injection molding to produce automotive parts are highly restricted, leading to further revenue dilution.

Request Free Sample

Request Free Sample

Injection Molded Automotive Parts Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Injection Molded Automotive Parts Market |

| Market Size in 2023 | USD 89.62 Billion |

| Market Forecast in 2032 | USD 129.25 Billion |

| Growth Rate | CAGR of 4.30% |

| Number of Pages | 226 |

| Key Companies Covered | Kaysun Corporation, Magna International Inc., WHS Plastics Egypt, Crescent Industries, Plastic Omnium, RYDTooling, Aptiv PLC, Ensinger GmbH, Continental Structural Plastics (CSP), First Press Moulders, Robinson Industries Inc., Plastikon Industries, RCO Engineering Inc., International Assembly LLC, Minco Tool & Mold Inc., and others. |

| Segments Covered | By Raw Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Injection Molded Automotive Parts Market: Segmentation

The global injection molded automotive parts market is segmented based on raw material, application, and region.

Based on the raw material, the global market segments are high-density polyethylene (HDPE), polypropylene, polystyrene, acrylonitrile butadiene styrene (ABS), and others. In 2023, the highest demand was listed in the polypropylene segment. The material is highly cost-effective and offers superior performance compared to the other materials. Some of the most desirable properties of polypropylene include lightweight structure, high flexibility & impact strength, and excellent chemical resistance. The average cost of small-size injection molding machines can reach up to USD 50,000.

Based on the application, the injection molded automotive parts industry divisions are exterior components, interior components, and others. In 2023, the highest demand was listed in the interior components segment. The high production volume of essential interior parts of vehicles is driving the segmental revenue. Furthermore, growing demand for aesthetically appealing vehicle interiors, as well as greater investments in customized solutions, will further promote revenue in the interior components segment. A conventional passenger car has more than 200 diverse interior parts, according to official statistics.

Injection Molded Automotive Parts Market: Regional Analysis

Asia-Pacific to emerge as the highest revenue generator during the forecast period

The global injection molded automotive parts market will be dominated by Asia-Pacific during the forecast period. Countries such as India, China, Japan, and South Korea will lead the regional market growth rate. Asia-Pacific is the manufacturing hub for automotive parts.

In addition to this, it is also home to some of the leading automotive producers globally. China, for instance, is currently the world’s largest EV producer. The presence of large-scale automotive parts manufacturing facilities across major Asian countries will aid regional market expansion in the coming years.

For instance, in October 2024, Honda, one of Asia’s leading automobile companies, announced the launch of a new EV production plant in China. Honda has launched a new unit with a production capacity of 120,000 units per year in collaboration with Dongfeng Motor Corporation.

In December 2024, Pricol, India’s leading dashboard instruments and driver information systems producer, announced the acquisition of the injection molded plastic components wing of Sundaram Auto Components Ltd (SACL) for INR 215 crore contributing to the region’s growing market. The move is expected to strengthen the foothold of Pricol in automotive parts manufacturing sector of India.

Injection Molded Automotive Parts Market: Competitive Analysis

The global injection molded automotive parts market is led by players like:

- Kaysun Corporation

- Magna International Inc.

- WHS Plastics Egypt

- Crescent Industries

- Plastic Omnium

- RYDTooling

- Aptiv PLC

- Ensinger GmbH

- Continental Structural Plastics (CSP)

- First Press Moulders

- Robinson Industries Inc.

- Plastikon Industries

- RCO Engineering Inc.

- International Assembly LLC

- Minco Tool & Mold Inc.

The global injection molded automotive parts market is segmented as follows:

By Raw Material

- High-Density Polyethylene (HDPE)

- Polypropylene

- Polystyrene

- Acrylonitrile Butadiene Styrene (ABS)

- Others

By Application

- Exterior Components

- Interior Components

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Injection-molded automotive parts allow vehicle manufacturers to use plastic materials to produce several parts for all types of vehicles.

The global injection molded automotive parts market is expected to be driven by the increasing demand for lightweight vehicles.

According to study, the global injection molded automotive parts market size was worth around USD 89.62 billion in 2023 and is predicted to grow to around USD 129.25 billion by 2032.

The CAGR value of the injection molded automotive parts market is expected to be around 4.30% during 2024-2032.

The global injection molded automotive parts market will be dominated by Asia-Pacific during the forecast period.

The global injection molded automotive parts market is led by players like Kaysun Corporation, Magna International Inc., WHS Plastics Egypt, Crescent Industries, Plastic Omnium, RYDTooling, Aptiv PLC, Ensinger GmbH, Continental Structural Plastics (CSP), First Press Moulders, Robinson Industries Inc., Plastikon Industries, RCO Engineering Inc., International Assembly LLC and Minco Tool & Mold Inc.

The report explores crucial aspects of the injection-molded automotive parts market, including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed