Interactive Video Wall Market Trend, Size, Share, Growth, Forecast 2030

Interactive Video Wall Market By End-User (Government & Defense, BFSI, Media & Entertainment, Educational Institutes, Retail, IT & Telecommunications, Research Organizations, Corporate, and Others), By Layout (Standard Layout and Custom Layout), By Technology (LED Video Wall Technology, LCD Video Wall Technology, Rear Projection Wall Technology, and Blended Projection Wall Technology), By Frame Size (4x4, 3x3, 2x2, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

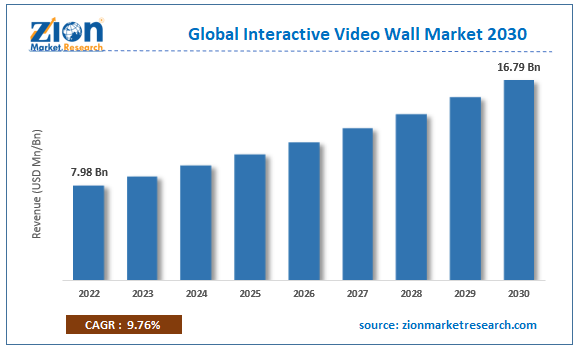

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.98 Billion | USD 16.79 Billion | 9.76% | 2022 |

Interactive Video Wall Industry Prospective:

The global interactive video wall market size was worth around USD 7.98 billion in 2022 and is predicted to grow to around USD 16.79 billion by 2030 with a compound annual growth rate (CAGR) of roughly 9.76% between 2023 and 2030.

Interactive Video Wall Market: Overview

An interactive video wall is one of the most advanced and powerful display systems that displays all forms of information through a highly interactive medium made with a combination of several small displays. The screen of an interactive video wall is sensitive to touch thus displaying engaging content with utmost ease. The traditional counterparts such as a light-emitting diode (LED) display are known to provide a passive viewing experience since the viewers tend to interact with the display only by viewing the content.

However, with interactive video walls or displays, viewers can participate in the interaction by using their tactical senses. They can also be used for a wide range of applications making interactive video walls a highly desirable display setting in various industries. Screens that are specially designed to create an interactive video wall, typically show narrow bezels. This helps to ensure a minimum gap between active display areas since they are built for long-term serviceability. Moreover, they are equipped with hardware that is mandatory for stacking similar screens together and powered by connections to video, daisy chain power, and command signals between the screens.

Key Insights:

- As per the analysis shared by our research analyst, the global interactive video wall market is estimated to grow annually at a CAGR of around 9.76% over the forecast period (2023-2030)

- In terms of revenue, the global interactive video wall market size was valued at around USD 7.98 billion in 2022 and is projected to reach USD 16.79 billion, by 2030.

- The interactive video wall market is projected to grow at a significant rate due to the increasing construction of museums and immersive experience centers

- Based on end-user segmentation, media & entertainment was predicted to show maximum market share in the year 2022

- Based on technology segmentation, LED video wall technology was the leading type in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Interactive Video Wall Market: Growth Drivers

Increasing construction of museums and immersive experience centers to drive market growth

The global interactive video wall market is projected to grow owing to the increasing construction rate of well-curated museums and art galleries that offer immersive experiences to visitors. With increasing world tourism, several governments are investing in creating art-display units to attract more tourists. For instance, the Metropolitan Museum of Art, one of the world’s most popular museums housing all forms of art including contemporary and modern, made a total revenue of USD 213 million in 2022. These centers are an ideal place for leveraging the viewing experience provided by interactive video walls.

Growing number of product offerings to create a higher consumption pattern

The demand for efficient and highly advanced interactive video walls has grown tremendously in the last few years. This has resulted in an increased number of new product launches undertaken by the technology providers. The manufacturers are focusing on improved experience while maintaining the cost of the device and after-sale services along with steady innovation. In July 2022, ViewSonic, an electronic company that specializes in the production of monitors, announced the launch of the ViewBoard 52 series. The range consists of interactive boards that are to be used for education purposes and are available in 3 sizes including 65-inch, 75-inch, and 86-inch. In June 2023, Samsung Electronics America, Inc. launched a new interactive display called the WAC at the 2023 ISTELive conference. The product is a first-of-its-kind by Samsung and works on the Android operating system.

Interactive Video Wall Market: Restraints

High initial cost and repair concerns to restrict market growth

The global interactive video wall market growth is likely to be restricted due to the high cost of these devices as compared to smaller and traditionally used display systems. For instance, the ViewBoard 52 series by ViewSonic starts at a price of USD 48000. Similar pricing patterns are observed for almost all interactive video wall technologies. The price continues to go up as more advanced features are added. In addition to this, maintaining and repairing these interactive systems further adds to the overall cost. Since the technology used for manufacturing such video walls is highly sophisticated including the parts used during the production.

Interactive Video Wall Market: Opportunities

Growing adoption of technology in education institutes to create growth opportunities

The interactive video wall industry growth is expected to come across higher growth opportunities led by the increasing adoption of interactive video walls in education settings. Since the start of COVID-19, several knowledge centers have been propelled to undertake the help of digital systems to cater to the needs of students. The trend has continued and is expected to keep growing in the coming years. Many educational units and centers used advanced mediums such as interactive boards and walls for conducting classes and creating an immersive learning experience for the children.

Rising demand for military-grade engaging video walls to lead to higher revenue

Since interactive video walls are highly beneficial in terms of displaying complex information and content, the demand for military-grade engaging video walls is likely to push for higher revenue. For instance, Legato Security, a Salt Lake-based security service firm, is currently working toward helping local government and Fortune 500 companies upgrade their security systems by using monitors to prevent cybersecurity attacks. The company deals with complete security assessment, incident monitoring and report generation, and final report creation along with providing excellent security strategies. Legato Security uses video wall technology to achieve its vision.

Interactive Video Wall Market: Challenges

Availability of substitutes and alternate solutions may create a challenging environment

The interactive video wall industry faces tough competition from companies providing alternate products and solutions that are more affordable and can perform as per desired expectations. This includes products such as Augmented Reality (AR) smart glasses, Virtual Reality (VR) technology, holographic displays, and projection mapping among many others. These substitutes enjoy the benefits of a mature market with a dedicated consumer base while providers of interactive video walls have to work in creating more demand for the products.

Interactive Video Wall Market: Segmentation

The global interactive video wall market is segmented based on end-user, layout, technology, frame size, and region.

Based on end-user, the global market is segmented into government & defense, BFSI, media & entertainment, education institutes, retail, IT & telecommunications, research organizations, corporate, and others. In 2021, the highest growth was observed in the media & entertainment sector as these display systems are used during live shows and performances. Moreover, they also have applications during broadcasting programs including during news readings and other entertainment programs. Since 2021, the number of live concerts and entertainments has increased with multiple artists announcing world tours. For instance, the recent Eras Tour conducted by popular music artist Taylor Swift has earned over USD 1 billion. As per projections, the tour is likely to generate over USD 5 billion in terms of consumer spending in the US.

Based on layout, the interactive video wall industry is divided into standard layout and customer layout.

Based on technology, the interactive video wall industry segments are LED video wall technology, LCD video wall technology, rear projection wall technology, and blended projection wall technology. In 2022, the highest growth was observed in the LED video wall technology due to the higher performance and energy efficiency shown by LED semiconductors. The majority segment of modern display systems are based on LED technology due to higher production rates and easier access. These systems are highly durable and offer longer performance. Research indicates that the global penetration of LEDs in the lighting industry may reach 76.1% by 2025.

Based on frame size, the global market is segmented into 4x4, 3x3, 2x2, and others.

Interactive Video Wall Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Interactive Video Wall Market |

| Market Size in 2022 | USD 7.98 billion |

| Market Forecast in 2030 | USD 16.79 billion |

| Growth Rate | CAGR of 9.76 |

| Number of Pages | 218 |

| Key Companies Covered | Daktronics, Samsung Electronics, NEC Display Solutions, Sharp Electronics, LG Electronics, Christie Digital Systems, Planar Systems, Userful Corporation, Barco, Matrox Graphics, Sony Electronics, Datapath, EIZO Corporation, Eyevis, Crestron Electronics, and others. |

| Segments Covered | By End-User, By Layout, By Technology, By Frame Size, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Interactive Video Wall Market: Regional Analysis

North America to witness the highest growth rate in the near future

The global interactive video wall market will witness the highest CAGR in North America led by the US during the forecast period. The higher revenue is projected as an outcome of higher penetration of advanced digital systems across end-user verticals including education, corporate, defense, and entertainment. The US is home to some of the world’s popular artists who have invested in running live concerts and shows with extremely high investments. In addition to this, there are several public places in the United States that deploy the use of interactive video walls along with other immersive technologies to provide visitors with exceptional viewing experience.

Some popular sites include Van Gogh: The Immersive Experience which can be visited in several parts of the US. Additionally, the American defense agencies have invested in highly advanced interactive video walls for better control and management of defense-related activities. Europe is projected to grow at a significant rate. The regional growth may be driven by the extensive application of display systems in the growing education regional industry along with greater demand for corporate events.

Interactive Video Wall Market: Competitive Analysis

The global interactive video wall market is led by players like:

- Daktronics

- Samsung Electronics

- NEC Display Solutions

- Sharp Electronics

- LG Electronics

- Christie Digital Systems

- Planar Systems

- Userful Corporation

- Barco

- Matrox Graphics

- Sony Electronics

- Datapath

- EIZO Corporation

- Eyevis

- Crestron Electronics

The global interactive video wall market is segmented as follows:

By End-User

- Government & Defense

- BFSI

- Media & Entertainment

- Educational Institutes

- Retail

- IT & Telecommunications

- Research Organizations

- Corporate

- Others

By Layout

- Standard Layout

- Custom Layout

By Technology

- LED Video Wall Technology

- LCD Video Wall Technology

- Rear Projection Wall Technology

- Blended Projection Wall Technology

By Frame Size

- 4x4

- 3x3

- 2x2

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An interactive video wall is one of the most advanced and powerful display systems that display all forms of information through a highly interactive medium made with a combination of several small displays.

The global interactive video wall market is projected to grow owing to the increasing construction rate of well-curated museums and art galleries that offer immersive experiences to visitors.

According to study, the global interactive video wall market size was worth around USD 7.98 billion in 2022 and is predicted to grow to around USD 16.79 billion by 2030.

The CAGR value of the interactive video wall market is expected to be around 9.76% during 2023-2030.

The global interactive video wall market will witness the highest CAGR in North America led by the US during the forecast period.

The global interactive video wall market is led by players like Daktronics, Samsung Electronics, NEC Display Solutions, Sharp Electronics, LG Electronics, Christie Digital Systems, Planar Systems, Userful Corporation, Barco, Matrox Graphics, Sony Electronics, Datapath, EIZO Corporation, Eyevis, and Crestron Electronics.

The report explores crucial aspects of the interactive video wall market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed