Laboratory Water Purifier Market Size, Share, Analysis, Trends, Growth Report, 2032

Laboratory Water Purifier Market By Type (Type 3, Type 2, Type 1, and Others), By Mode of Use (Clinical Analyzers, Point of Use, and Large Central Systems), By Application (Spectrometry, Cell & Tissue Cultures, Chromatography, Clinical Biochemistry Analysis, Microbial Analysis, and Others), By End-User (Biotechnology & Pharmaceutical Industries, Research & Academic Institutes, Hospitals & Diagnostic Laboratories, and Others), By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

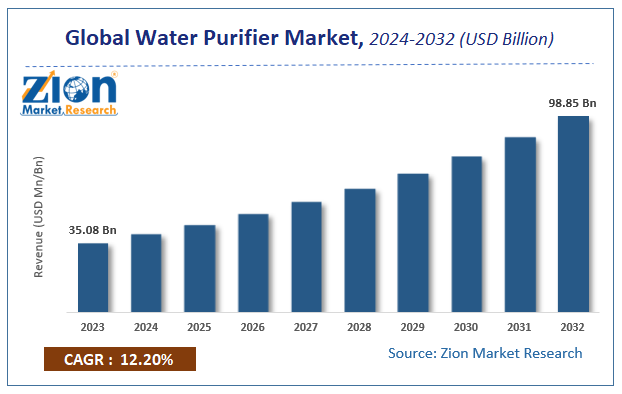

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 35.08 Billion | USD 98.85 Billion | 12.2% | 2023 |

Water Purifier Market Insights

According to a report from Zion Market Research, the global Water Purifier Market was valued at USD 35.08 Billion in 2023 and is projected to hit USD 98.85 Billion by 2032, with a compound annual growth rate (CAGR) of 12.2% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Water Purifier industry over the next decade.

Laboratory Water Purifier Market: Overview

Laboratory water purifiers are water purification devices produced specifically to be used in a laboratory or diagnostic setting. These devices act as the main source of access to clean or pure water for several laboratory experiments, case studies, research, and development. Water is a crucial reagent in any form of lab including clinical, biological, food & beverage, environmental, and all the other laboratory forms. The final result of any research or study depends on the purity level of the water or any other ingredients used. Hence it becomes imperative that laboratories have a constant supply of water that is free of contaminants and impurities to ensure that the results are not compromised. However, tap water generally consists of some form of impure content such as heavy metals, bacteria & microorganisms, chlorine, sediments & particles, and viruses to name a few. Laboratory water purification systems eliminate the presence of these contaminants and help maintain research integrity.

Key Insights:

- As per the analysis shared by our research analyst, the global laboratory water purifier market is estimated to grow annually at a CAGR of around 10.91% over the forecast period (2023-2030)

- In terms of revenue, the global laboratory water purifier market size was valued at around USD 19.01 billion in 2022 and is projected to reach USD 43.50 billion, by 2030.

- The laboratory water purifier market is projected to grow at a significant rate due to the rising pharmaceutical and biopharmaceutical

- Based on type segmentation, type 1 was predicted to show maximum market share in the year 2022

- Based on application segmentation, chromatography was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Laboratory Water Purifier Market: Growth Drivers

Rising pharmaceutical and biopharmaceutical research to drive market growth

The global laboratory water purifier market is projected to grow owing to the increasing rate of research in the pharmaceutical and biopharmaceutical sectors. Surging numbers of patients across the globe suffering from several mild to severe medical conditions and the growing need to ensure that every person has access to quality care are pushing drug and medical therapy developers to produce affordable and effective medicines. Research indicates that changing environmental conditions and rising pollution levels have resulted in an alarming increase in patients with life-threatening medical conditions including cancer, chronic obstructive pulmonary diseases, allergies, and infectious diseases that are air and waterborne.

In addition to this, several other conditions impact the quality of life and do not have any specific cure including diabetes, AIDS, Alzheimer's, and genetic disorders among many others. All of these factors have resulted in increased pressure on drug developers to develop novel medicines and therapies. Research laboratories are regarded as the main development center of pharma companies since these facilities are where the treatments are developed from scratch. All trials, studies, and final testing are conducted in research laboratories. For instance, in January 2023, Pfizer, a leading pharma company, announced that it was exploring more options to develop new drugs for cancer and certain diseases.

Increasing development of new-age water purifiers to deliver higher results

The global laboratory water purifier market growth is projected to be pushed further owing to the increasing launch of more advanced and intelligent laboratory water purifiers. In July 2021, Avidity Science announced the launch of a new range of laboratory water purification systems complementing its existing product portfolio. The i-Series is expected to meet the growing demand for types of laboratory water. The main differentiating factors for this series are the core functionality of the system revolving around integrity, intelligence, and information.

Laboratory Water Purifier Market: Restraints

Lack of standardization to restrict market growth

The laboratory water purifier industry may witness growth limitations owing to the lack of standardization in the sector. Since different types of water purification processes are used depending on regional guidelines and other environmental factors, there are no standard policies that determine which process is more effective. In addition to this, the material used for the purification process also changes depending on the service and product provider. This leads to confusion for the market players and subsequent loss of revenue.

Laboratory Water Purifier Market: Opportunities

Stricter guidelines on the safety of food and beverages to create growth opportunities

In recent times, regional governments and international healthcare bodies have laid out several strict policies and implementation methods to ensure food and beverages (F&B) safety. Players operating in the F&B are subject to stringent guidelines ensuring that the product being sold does not contain harmful products that can lead to serious health concerns in the future. As per reports, Belgium officially recalled over 400 food products. 8 out of 10 products were recalled due to the risk of microbial or chemical contamination. The policies are ensuring that food manufacturers maintain safety measures throughout the research and production process leading to a higher demand for laboratory water purifiers. In April 2021, SGS, a global inspection, testing, and certification firm, launched the Advanced Centre of Testing (ACT) in Chennai, India. The facility is equipped to conduct non-targeted and targeted detection of several contaminants along with conducting procedures such as DNA-based molecular processes and digital sensory analysis.

Laboratory Water Purifier Market: Challenges

High costs of initial investment and maintenance are primary challenges for the industry players

The laboratory water purifier industry growth trend could be subjected to certain growth challenges in the form of increasing costs of laboratory water purification system installation. The rising inflation rate and growing prices of raw materials impact the final cost of the device. In addition to this, lab water purifiers have to be maintained with zero room for negligence since if the device stops functioning, it can lead to severe resource, financial, and collateral damages.

Laboratory Water Purifier Market: Segmentation

The global laboratory water purifier market is segmented based on type, mode of use, application, end-user, and region.

Based on type, the global market segments are type 3, type 2, type 1, and others. In 2022, the highest growth was observed in the type 1 segment and the same trend is expected in the coming years. This water variant does not contain any form of impurities as it is purified to the highest possible level. Type 1 laboratory water has a low concentration of atomic contamination exhibiting a resistivity of 18.2 m-ohm-cm. They also contain less levels of organic content. It is also known as ultrapure water and has extensive applications in the semiconductor industry.

Based on mode of use, the laboratory water purifier industry divisions are clinical analyzers, point of use, and large central systems.

Based on application, the global market is divided into spectrometry, cell & tissue cultures, chromatography, clinical biochemistry analysis, microbial analysis, and others. The most revenue-generating segment in 2022 was chromatography due to its large-scale application of type 1 laboratory water. The method is used for specific identification of components used in a laboratory based on the chemical properties. In 2022, the global preparative and process chromatography market was valued at USD 9.56 billion.

Based on end-user, the laboratory water purifier industry segments are biotechnology & pharmaceutical industries, research & academic institutes, hospitals & diagnostic laboratories, and others.

Water Purifier Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Water Purifier Market |

| Market Size in 2023 | USD 35.08 Billion |

| Market Forecast in 2032 | USD 98.85 Billion |

| Growth Rate | CAGR of 12.2% |

| Number of Pages | 110 |

| Key Companies Covered | GE Water & Process Technologies Inc., Tata Chemicals, Best Brita GmbH, and Aquasana. Other major players influencing the global market are Panasonic, HaloSource Inc., Amway Corporation, Water Technology Group, Eureka Forbes Limited, and Kent RO System Ltd |

| Segments Covered | By Technology, By End-User, By Channel Of Distribution And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Laboratory Water Purifier Market: Regional Analysis

Asia-Pacific to witness the highest growth rate during the forecast period

The global laboratory water purifier market is expected to witness the highest growth in Asia-Pacific during the forecast period. The region is home to some of the largest producers of laboratory water purifier systems with extensive international and domestic demand. Additionally, the expanding application of lab water purification tools in the growing semiconductor industry has allowed Asia-Pacific to maintain its regional dominance. China and Taiwan are two of the largest players in the global semiconductor sector. Facilities manufacturing these devices are growing at a rapid rate since the demand and consumption rate from consumers is surging. India has announced more investments to develop its regional semiconductor sector. Furthermore, increasing research for novel drug development, especially the market for generic medicines is projected to push regional revenue to new heights. Growth in North America is projected to be a result of the crucial role played by US pharma companies in the global drug development market. Additionally, the expanding regional food industry will contribute significantly to North America’s growth.

Laboratory Water Purifier Market: Competitive Analysis

The global laboratory water purifier market is led by players like:

- Sartorius AG

- Merck Millipore

- Pall Corporation

- Avidity Science LLC

- Thermo Fisher Scientific

- Aqua Lab

- ELGA LabWater

- Siemens Water Technologies

- Aqua Solutions Inc.

- SG Water

- Labconco Corporation

- Purite Ltd.

- Labclear

- Buchi Labortechnik AG.

The global laboratory water purifier market is segmented as follows:

By Type

- Type 3

- Type 2

- Type 1

- Others

By Mode of Use

- Clinical Analyzers

- Point of Use

- Large Central Systems

By Application

- Spectrometry

- Cell & Tissue Cultures

- Chromatography

- Clinical Biochemistry Analysis

- Microbial Analysis

- Others

By End-User

- Biotechnology & Pharmaceutical Industries

- Research & Academic Institutes

- Hospitals & Diagnostic Laboratories

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Laboratory water purifiers are water purification devices produced specifically to be used in a laboratory or diagnostic setting.

The global laboratory water purifier market is projected to grow owing to the increasing rate of research in the pharmaceutical and biopharmaceutical sectors.

According to study, the global laboratory water purifier market size was worth around USD 19.01 billion in 2022 and is predicted to grow to around USD 43.50 billion by 2030.

The CAGR value of the laboratory water purifier market is expected to be around 10.91% during 2023-2030.

The global laboratory water purifier market is expected to witness the highest growth in Asia-Pacific during the forecast period.

The global laboratory water purifier market is led by players like Sartorius AG, Merck Millipore, Pall Corporation, Avidity Science LLC, Thermo Fisher Scientific, Aqua Lab, ELGA LabWater, Siemens Water Technologies, Aqua Solutions, Inc., SG Water, Labconco Corporation, Purite Ltd., Labclear, and Buchi Labortechnik AG.

The report explores crucial aspects of the laboratory water purifier market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed