Lead Smelting and Refining Market Size, Share, Analysis, Forecasts, 2032

Lead Smelting and Refining Market By Furnace (Rotary, Reverberatory, and Blast), By Method (Pyrometallurgical, Solvent Extraction, and Ion Exchange), By Application (Metals & Non-metal Extraction, Ammunition, Batteries, Construction, and Radiation Protection), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

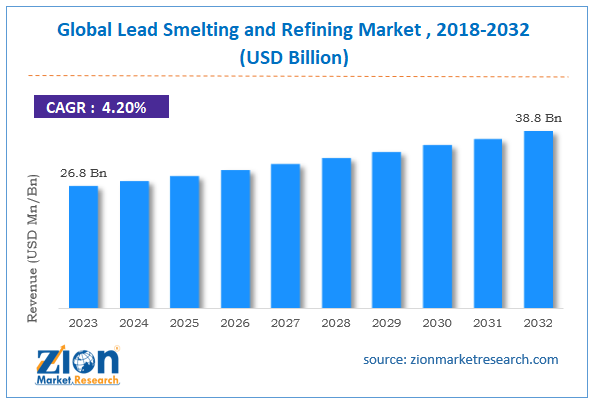

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26.8 Billion | USD 38.8 Billion | 4.2% | 2023 |

Lead Smelting and Refining Industry Prospective:

The global lead smelting and refining market size was worth around USD 26.8 billion in 2023 and is predicted to grow to around USD 38.8 billion by 2032, with a compound annual growth rate (CAGR) of roughly 4.2% between 2024 and 2032.

Lead Smelting and Refining Market: Overview

The industrial process of extracting and purifying lead from its ores or recycled materials is known as lead smelting and refining. There are two primary phases involved, including smelting and refining. Crude lead is extracted by heating lead-containing materials in a furnace, such as lead-acid batteries, PbS, or galena ore.

Usually, carbon-based reducing agents are used for roasting, sintering, and reduction. In addition, crude lead is purified to eliminate impurities, including silver, tin, arsenic, and antimony. High-purity lead for industrial uses can be produced using electrolytic refining techniques or pyrometallurgical processes (such as cupellation and drossing).

Key Insights

- As per the analysis shared by our research analyst, the global lead smelting and refining market is estimated to grow annually at a CAGR of around 4.2% over the forecast period (2024-2032).

- In terms of revenue, the global lead smelting and refining market size was valued at around USD 26.8 billion in 2023 and is projected to reach USD 38.8 billion by 2032.

- The increasing construction industry is expected to drive the lead smelting and refining market over the forecast period.

- Based on the furnace, the rotary segment is expected to hold the largest market share over the forecast period.

- Based on the method, the ion exchange segment is expected to dominate the market expansion over the projected period.

- Based on the application, the construction segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Lead Smelting and Refining Market: Growth Drivers

The implementation of stringent fuel economy and emission norms drives market growth

Air pollution emissions cause respiratory disorders, high medical expenses, and missed workdays, making them the leading environmental cause of early death worldwide. Recent statistics show that just three air pollutants—NO2, PM 2.5, and O3—cause 400,000 premature deaths in the EU each year, with over 70,000 of those fatalities being directly related to nitrogen dioxide (NO2). One of the causes of the violations of air pollution restrictions in many metropolitan areas is urban transportation.

Over the past few decades, the Commission has instructed EU actions to gradually reduce road vehicle emissions of air quality pollutants by improving fuel quality and imposing stricter emission standards on new automobiles. Automakers are progressively adding intelligent start-stop systems to their lineups to lower fuel emissions in tandem with the growing standards. It also propels the rise of EVs. The market for lead smelting and refining is ultimately being driven by all of these factors.

Lead Smelting and Refining Market: Restraints

Stringent environmental regulations hinder market growth

Strict environmental laws have a negative impact on the lead smelting and refining market; they cause operational difficulties, higher expenses, and changes in business methods. Strict restrictions on lead emissions, sulfur dioxide (SO₂), and particulate matter are enforced by governments and environmental organizations to minimize pollution. Operating expenses rise as a result of the need for sophisticated dust control, scrubbers, and air filtration systems for compliance.

Due to stringent worker exposure limitations for lead dust and fumes set by regulatory agencies such as OSHA (U.S.), REACH (Europe), and Chinese environmental legislation, improved safety precautions and recurring health monitoring are required.

Furthermore, a lot of nations, like the US and China, have limited or phased out new primary lead smelting facilities because of the significant dangers of pollution, refocusing attention on secondary lead production (recycling).

Lead Smelting and Refining Market: Opportunities

Rising demand for lead in construction and infrastructure offers a lucrative opportunity for market growth

Lead smelting is also used extensively in the construction industry. It is widely utilized in cables, glass, and roofing. The demand for lead has been rising in recent years due to the rapid development of infrastructure in nations like China and India.

For instance, as China proceeds with its Belt and Road Initiative plans, projects involving building and development require a significant amount of lead. This demand for lead-containing items is also influenced by urbanization and the modernization of older infrastructure in the US and Europe. Therefore, the increasing demand for lead in construction and infrastructure offers a lucrative opportunity for the lead smelting and refining industry over the projected period.

Lead Smelting and Refining Market: Challenges

Health and safety concern poses a major challenge to market expansion

Health and safety issues are significant obstacles in the lead smelting and refining industry, affecting workforce conditions, regulatory compliance, and operating costs. Prolonged exposure to lead dust, fumes, and polluted surfaces can result in brain damage, kidney disease, and cardiovascular problems, especially in personnel who handle raw lead or smelting byproducts.

Governments also establish tight exposure limits and demand personal protective equipment (PPE), regular blood lead level testing, and decontamination methods to reduce danger. Regulations such as OSHA (United States), REACH (Europe), and Chinese environmental legislation establish safety criteria for lead processing industries.

Lead Smelting and Refining Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Lead Smelting and Refining Market |

| Market Size in 2023 | USD 26.8 Billion |

| Market Forecast in 2032 | USD 38.8 Billion |

| Growth Rate | CAGR of 4.2% |

| Number of Pages | 222 |

| Key Companies Covered | Gravita India Pvt. Ltd., Glencore plc, Umicore, Hindustan Zinc Limited (HZL), Yuguang Gold Lead Co. Ltd, Ecobat Technologies, Recylex S.A, Dansuk Industrial Co. Ltd., Asia Recycling Resources Pte Ltd, Doe Run Resources Corporation, Boliden Group, Tasnee, Teck, Nyrstar, Cerro de Pasco Resources (CDPR), and others. |

| Segments Covered | By Furnace, By Method, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lead Smelting and Refining Market: Segmentation

The global lead smelting and refining industry is segmented based on furnace, method, application, and region.

Based on the furnace, the global lead smelting and refining market is bifurcated into rotary, reverberatory, and blast. The rotary segment is expected to hold the largest market share over the forecast period. The shift towards secondary lead production is boosting the adoption of rotary furnaces, which are commonly used for lead battery recycling.

Based on the method, the global lead smelting and refining industry is bifurcated into pyrometallurgical, solvent extraction, and ion exchange. The ion exchange segment is expected to dominate the market expansion over the projected period. Growing demand for eco-friendly refining methods is driving the adoption of ion exchange in hydrometallurgical lead refining.

Based on the application, the global lead smelting and refining market is bifurcated into metals & non-metal extraction, ammunition, batteries, construction, and radiation protection. The construction segment is expected to capture the largest market share over the projected period. Growing global investment in healthcare infrastructure increases demand for lead shielding in radiology rooms and nuclear medicine centers. Thus driving the industry expansion.

Lead Smelting And Refining Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global lead smelting and refining market during the forecast period. The automotive industry, a significant consumer of lead-acid batteries, is one of the most important demand drivers. North America is home to several significant automakers and battery manufacturers, which boosts demand for lead smelting and refining in the region.

In addition to traditional end-use sectors, the growing popularity of renewable energy technologies such as solar power drives increased demand for lead-acid batteries, which are widely utilized in off-grid and backup power systems.

Lead Smelting and Refining Market: Competitive Analysis

The global lead smelting and refining market is dominated by players like:

- Gravita India Pvt. Ltd.

- Glencore plc

- Umicore

- Hindustan Zinc Limited (HZL)

- Yuguang Gold Lead Co. Ltd

- Ecobat Technologies

- Recylex S.A

- Dansuk Industrial Co. Ltd.

- Asia Recycling Resources Pte Ltd

- Doe Run Resources Corporation

- Boliden Group

- Tasnee

- Teck

- Nyrstar

- Cerro de Pasco Resources (CDPR)

The global lead smelting and refining market is segmented as follows:

By Furnace

- Rotary

- Reverberatory

- Blast

By Method

- Pyrometallurgical

- Solvent Extraction

- Ion Exchange

By Application

- Metals & Non-metal Extraction

- Ammunition

- Batteries

- Construction

- Radiation Protection

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The industrial process of extracting and purifying lead from its ores or recycled materials is known as lead smelting and refining.

The lead smelting and refining market is driven by fast urbanization, the increasing construction sector, technological advancements, and many others.

According to the report, the global lead smelting and refining market size was worth around USD 26.8 billion in 2023 and is predicted to grow to around USD 38.8 billion by 2032.

The global lead smelting and refining market is expected to grow at a CAGR of 4.2% during the forecast period.

The global lead smelting and refining market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the growing automotive industry and increasing construction sector.

The global lead smelting and refining market is dominated by players like Gravita India Pvt. Ltd., Glencore plc, Umicore, Hindustan Zinc Limited (HZL), Yuguang Gold Lead Co. Ltd, Ecobat Technologies, Recylex S.A, Dansuk Industrial Co., Ltd., Asia Recycling Resources Pte Ltd, Doe Run Resources Corporation, Boliden Group, Tasnee, Teck, Nyrstar and Cerro de Pasco Resources (CDPR) among others.

The lead smelting and refining market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed