Liquid Synthetic Rubber Market Size, Share, Trends and Forecast, 2030

Liquid Synthetic Rubber Market By Product (Liquid Isoprene, Liquid Butadiene, Liquid Styrene Butadiene, and Others), By Application (Adhesives, Industrial Rubber Manufacturing, Tire Manufacturing, Polymer Modification, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2030

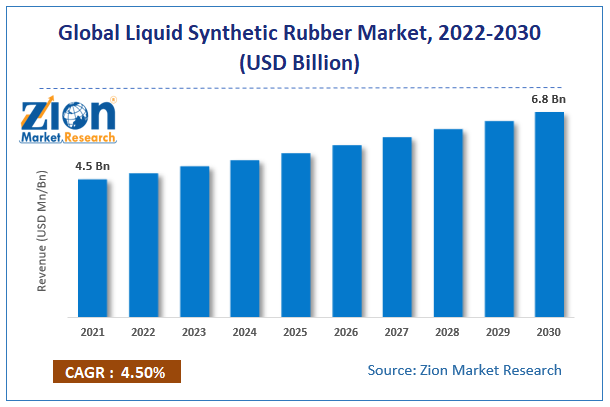

| Market Size in 2021 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.5 Billion | USD 6.8 Billion | 4.5% | 2021 |

Liquid Synthetic Rubber Market Size & Industry Analysis:

The global liquid synthetic rubber market size was worth around USD 4.5 billion in 2021 and is predicted to grow to around USD 6.8 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.5% between 2022 and 2030. The report analyzes the global liquid synthetic rubber market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the liquid synthetic rubber market.

Liquid Synthetic Rubber Market: Overview

Liquid synthetic rubber (LSR) is a liquid polyurethane molding compound that cures a very tough flexible rubber and shows excellent flow properties. In addition to this, they also show exceptional properties for tooling applications and are extremely wear- & abrasion-resistant. Liquid synthetic rubber is usually used on damaged rubber, conveyor belting, moldings, gaskets, rollers, casting, ducting, expansion joints, and much more.

Key Insights

- As per the analysis shared by our research analyst, the global liquid synthetic rubber market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2022-2030).

- In terms of revenue, the global liquid synthetic rubber market size was valued at around USD 4.5 billion in 2021 and is projected to reach USD 6.8 billion, by 2030.

- The increase in the production of vehicles across the globe is expected to drive the growth of the market during the forecast period.

- Based on the product, the liquid styrene butadiene segment accounted for the largest revenue share in 2021.

- Based on the application, the tire manufacturing segment is projected to dominate the market during the forecast period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

To know more about this report, request a sample copy.

Liquid Synthetic Rubber Market: Growth Drivers

The rising demand for automotive tires drives the market growth

One of the key reasons propelling the global liquid synthetic rubber market is the rising global demand for automobile tires for both new and replacement cars. Tire manufacture accounts for more than 70% of all SBR produced globally, which has increased demand for synthetic rubber in the automotive sector.

The market for liquid synthetic rubbers is anticipated to develop quickly as the global demand for OEM tires rises as a result of the expansion of the automobile sector. The demand for replacement tires has expanded as a result of longer vehicle lifespans and a movement in consumer preference toward high-performance tires.

Liquid Synthetic Rubber Market: Restraints

Volatility in the price of raw materials is expected to limit the market growth

The price volatility of raw materials is a factor impeding the growth of the market for liquid synthetic rubber. The price of crude oil has a direct impact on the cost of styrene and butadiene, both of which are significant raw materials in the production of liquid SBR and BR. Furthermore, the production of liquid synthetic rubber necessitates the use of several catalysts and solvents derived from the oil and gas industry, such as hexane, cyclohexane, benzene, and toluene.

Liquid Synthetic Rubber Market: Opportunities

The increasing adoption of synthetic rubber over natural rubber drives the market expansion

Natural rubber (NR) is extracted from the latex of the Hevea brasiliensis tree and takes seven years from plantation to extraction. Although natural rubber has outstanding physical features, it is losing market share to synthetic rubber for a variety of reasons, including high cost, limited abrasion resistance, and resilience to acid, weather, and oil, which is expected to have a favorable impact on market growth.

The macro issues influencing the NR market include restricted availability, which causes price volatility and uncertainty about raw material supply. Because natural rubber plantations are geographically concentrated, there is a strong reliance on places such as Southeast Asia to meet demand.

Liquid Synthetic Rubber Market: Challenges

Environmental concerns are the major challenging factor that hampers the market

The synthetic rubber manufacturing sectors are significantly responsible for air, water, and noise pollution in the environment. Rubber industries serve as a massive backbone for a wide range of sectors that manufacture synthetic and non-synthetic rubber goods. The synthetic rubber production business generates huge volumes of waste in the form of air, noise, and water as by-products in addition to the principal product. In addition, the main components of synthetic rubber pollution are SBR and butadiene.

These substances are not readily biodegradable, therefore when wastewater is dumped into the water, it can decrease the water's oxygen content and raise the number of poisons that can harm marine life. Thus, environmental concerns act as a challenge for market growth during the forecast period.

Liquid Synthetic Rubber Market: Segmentation

The global liquid synthetic rubber market is segmented based on product, application, and region

Based on the product, the global market is bifurcated into liquid isoprene, liquid butadiene, liquid styrene butadiene, and others. The liquid styrene butadiene segment accounted for the largest revenue share in 2021 and is expected to show its dominance during the forecast period.

The growth in the segment is attributed to the growing uses of this compound in tire manufacturing. Moreover, it has remarkable qualities such as low rolling resistance, high tensile strength, robust resilience, and high abrasion resistance. Furthermore, when utilized in tires, building sealants, adhesives, and coatings, L-SBR grades give exceptional flexibility and tensile strength. Because of the numerous possible applications, the construction industry is expected to have a high development potential for liquid styrene butadiene.

Buildings have varying environmental effects on different areas. The use of SBR material as an additive in high-performance concrete has enhanced weather resilience and building quality, paving the way for LSR-SBR in the construction industry. Thus, driving the segmental growth during the forecast period.

Based on the application, the global liquid synthetic rubber market is bifurcated into adhesives, industrial rubber manufacturing, tire manufacturing, polymer modification, and others. The tire manufacturing segment is expected to dominate the market over the forecast period. Liquid synthetic rubber is widely used in tire manufacturing because it improves tire longevity and performance, as well as the implementation of tire labeling regulations. PBR and SBR are the most prevalent synthetic rubbers used in tire manufacture.

Polybutadiene is largely utilized in the production of automotive tires. It is estimated that the tire manufacturing process consumes approximately 70% of the polybutadiene output. It is primarily utilized in tires as a sidewall to reduce fatigue caused by continual flexing throughout the run. Butadiene is also used in a variety of other automotive components. For instance, according to OICA, around 80.14 million vehicles were produced globally in 2021 compared to 77.71 million vehicles produced in 2020, witnessing an increased growth rate of about 3%. Thus, growth in automotive vehicle production is likely to drive the demand for tires during the study period.

Recent Developments:

- In April 2021, Arlanxeo expanded its presence in the Indian subcontinent with the establishment of Arlanxeo India Private Limited. This will allow it to integrate its services to provide a single point of contact for the whole spectrum of its products and applications in the Indian subcontinent market.

- In January 2019, Saudi Aramco, a Saudi Arabia-based oil and chemical giant, purchased $1.67 billion for Arlanxeo from LANXESS AG. The acquisition is expected to aid Saudi Aramco in increasing fuel efficiency through tire performance. Arlanxeo is a synthetic rubber firm established in the Netherlands that specializes in producing synthetic rubbers and elastomer plastics such as polybutadiene/butadiene rubber (BR) for tire manufacturers and automobile parts around the world.

Liquid Synthetic Rubber Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Liquid Synthetic Rubber Market Research Report |

| Market Size in 2021 | USD 4.5 Billion |

| Market Forecast in 2030 | USD 6.8 Billion |

| Compound Annual Growth Rate | CAGR of 4.5% |

| Number of Pages | 199 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Kuraray Co., TER HELL & Co. GmbH, Synthomer plc, Nippon Soda Co., Ltd., Asahi Kasei, Evonik Industries AG, Efremov Synthetic Rubber, Kumho Petrochemical Co., Ltd, Royal Adhesives & Sealants, Puyang Linshi Chemical New Material Co., Ltd. among others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Liquid Synthetic Rubber Market: Regional Analysis

The Asia Pacific is expected to dominate the market during the forecast period

The Asia Pacific region is expected to dominate the global liquid synthetic rubber market during the forecast period. The growth in the region is attributed to the increasing automotive industry, growing demand from industrial rubber manufacturers, adhesives and sealants, coatings, and polymer modification, especially in China and India. For instance, the world's greatest manufacturer and user of automobiles are China.

OICA estimates that China produced approximately 26.08 million vehicles in 2021 compared to 25.25 million vehicles in 2020, a growth rate of nearly 2%. Moreover, in the construction sector, liquid synthetic rubber is also used. The Chinese government approved 26 infrastructure projects in 2019, with an estimated investment of roughly USD 142 billion; these projects are currently under construction and are expected to be finished by 2023, according to the National Development and Reform Commission. Thus, the aforementioned facts supported the market growth of the Asia Pacific region.

On the other hand, the lucrative end-user of liquid synthetic rubber, the expanding European automobile industry, supports market expansion. Significant tire manufacturers including Bridgestone, Michelin, Goodyear, Pirelli, and Apollo are present, and the manufacturers' adoption of cutting-edge manufacturing techniques is anticipated to support market expansion.

In addition, it is projected that the use of the product as a construction sealant would increase demand for it in the region. This is because the construction sector has recently undergone major changes due to the construction of high-rise buildings, better residential neighborhoods, and new town centers. Due to the scarcity of liquid natural rubber, a sizable portion of liquid isoprene rubber usage happens in Europe. The product demand in the region is anticipated to be driven by increasing product penetration as an adhesive sealant in the automotive industry and an increase in vehicle manufacturing in the region.

Liquid Synthetic Rubber Market: Competitive Analysis

The global liquid synthetic rubber market is dominated by players like:

- Kuraray Co.

- TER HELL & Co. GmbH

- Synthomer plc

- Nippon Soda Co., Ltd.

- Asahi Kasei

- Evonik Industries AG

- Efremov Synthetic Rubber

- Kumho Petrochemical Co., Ltd

- Royal Adhesives & Sealants

- Puyang Linshi Chemical New Material Co., Ltd. among others.

The global liquid synthetic rubber market is segmented as follows:

By Product

- Liquid Isoprene

- Liquid Butadiene

- Liquid Styrene Butadiene

- Others

By Application

- Adhesives

- Industrial Rubber Manufacturing

- Tire Manufacturing

- Polymer Modification

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The major factors driving the market growth of the liquid synthetic rubber market are increasing demand in the tire and industrial rubber manufacturing. Furthermore, the increased demand for products with low volatile organic compound concentrations is driving market expansion.

According to the report, the global liquid synthetic rubber market size was worth around USD 4.5 billion in 2021 and is predicted to grow to around USD 6.8 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.5% between 2022 and 2030.

The global liquid synthetic rubber market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market owing to the increasing automotive sector.

The global liquid synthetic rubber market is dominated by players like Kuraray Co., TER HELL & Co. GmbH, Synthomer plc, Nippon Soda Co., Ltd., Asahi Kasei, Evonik Industries AG, Efremov Synthetic Rubber, Kumho Petrochemical Co., Ltd, Royal Adhesives & Sealants, Puyang Linshi Chemical New Material Co., Ltd. among others.

Choose License Type

List of Contents

MarketSize Industry Analysis:OverviewTo know more about this report,request a sample copy.Growth DriversRestraintsOpportunitiesChallengesSegmentationRecent Developments:Market Report Scope:Regional AnalysisCompetitive AnalysisThe global liquid synthetic rubber market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed