Logistics Picking Robots Market Size, Share, Analysis, Industry Trends, Growth, 2030

Logistics Picking Robots Market By Type (Full-automatic and Semi-automatic), By Application (Logistics Picking, Logistics Handling, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

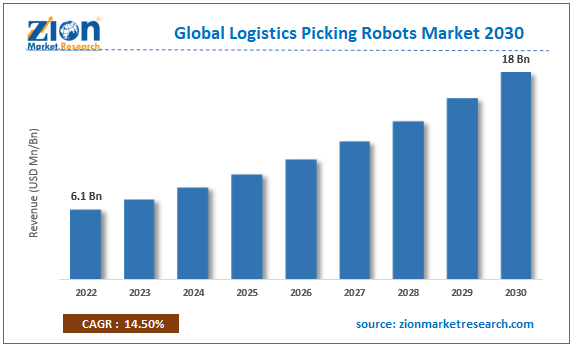

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.1 Billion | USD 18.0 Billion | 14.5% | 2022 |

Logistics Picking Robots Industry Prospective:

The global logistics picking robots market size was worth around USD 6.1 billion in 2022 and is predicted to grow to around USD 18.0 billion by 2030 with a compound annual growth rate (CAGR) of roughly 14.5% between 2023 and 2030.

Logistics Picking Robots Market: Overview

Robots designed to handle orders automatically are called picking robots. These machines come in a variety of shapes and sizes, such as automated warehouse systems and conveyor belts, or industrial robotic arms that handle and arrange goods into orders. Businesses are required to invest in automated picking solutions to lower order picking costs and remove mistakes from the process. Real-time inventory control, very dependable product movements, and round-the-clock operations are made possible by automation and digitalization.

Key Insights

- As per the analysis shared by our research analyst, the global Logistics Picking Robots market is estimated to grow annually at a CAGR of around 14.5% over the forecast period (2023-2030).

- In terms of revenue, the global Logistics Picking Robots market size was valued at around USD 6.1 billion in 2022 and is projected to reach USD 18.0 billion, by 2030.

- The growing e-commerce industry and increasing product launches by the major market players are expected to propel the global logistics picking robots market over the projected timeframe.

- Based on the type, the semi-automatic segment is expected to hold a significant market share over the forecast period.

- Based on application, the logistics picking segment is expected to dominate the market during the forecast period.

- Based on region, the Asia Pacific is expected to capture a significant market share during the forecast period.

Request Free Sample

Request Free Sample

Logistics Picking Robots Market: Growth Drivers

Growth in the e-commerce sector drives market growth

The e-commerce sector contributes significantly to the growing use of logistics picking robots. Because more people are shopping online, wholesalers are being compelled to utilize robotic technologies to automate repetitive tasks to meet delivery deadlines. Furthermore, precise activity information is provided by the efficient integration of digital automation networks. This enables manufacturers, transportation firms, and other industries to quickly evaluate the state of their operations. For the e-commerce industry, which is primarily focused on the timely fulfillment of customer expectations, this function is crucial. This further adds to the logistics picking robots market's expansion.

Logistics Picking Robots Market: Restraints

High initial installation cost hampers market growth

The deployment of mobile logistics robots by end users is restricted by their high initial installation costs and integration requirements. Deploying robotics systems requires a significant initial investment and ongoing maintenance expenditures due to the combination of high-quality hardware and a powerful software control system. Moreover, small and medium-sized businesses employ people to complete repetitive tasks in warehouses and distribution centers because they cannot afford to invest in robotic solutions. This is likely to hamper the logistics picking robots industry growth to a certain extent.

Logistics Picking Robots Market: Opportunities

Growing product launch offers a lucrative opportunity for market growth

The growing product launch is expected to offer a lucrative opportunity for logistics picking robots market growth during the forecast period. For instance, in April 2023, with the introduction of the Robotic Item Picker, a new AI and vision-based solution that can precisely detect and pick things in unstructured situations in warehouses and fulfillment centers, ABB Robotics has expanded its range of logistics automation solutions, which already leads the market. The Item Picker uses artificial intelligence and machine vision to identify the best areas to grab each item before the suction gripper takes it up and deposits it in the appropriate bin.

The system operates without human oversight or knowledge of the physical characteristics of the objects it selects. Up to 1,400 items may be picked every hour at this rate, allowing firms to process more orders without adding employees or time. The Robotic Item Picker may be installed on any of the three ABB robots—the IRB1200, IRB1300, and IRB 2600—and is appropriate for a variety of weights and uses. The item picker has a payload capacity of up to 3 kg and a reach of up to 1.65 m, giving it the versatility needed to complete a wide range of order fulfillment and sorting requirements.

Logistics Picking Robots Market: Challenges

Complex integration poses a major challenge to market growth

It might be difficult to integrate robotics into current warehouse operations. There may be incompatibilities between current software and infrastructure, necessitating careful planning and maybe further expenditures.

Logistics Picking Robots Market: Segmentation

The global Logistics Picking Robot industry is segmented based on the type, application, and region.

Based on the type, the global market is bifurcated into full-automatic and semi-automatic. The semi-automatic segment is expected to hold a significant logistics picking robots market share over the forecast period. Utilizing semi-automatic systems combines automated technology with human labor to strike a balance between flexibility and efficiency. Certain logistics processes use semi-automatic methods, in which robots collaborate with human workers. This cooperative method guarantees that robots take care of monotonous and physically demanding jobs, while human workers handle more intricate decision-making. Furthermore, Semi-automatic systems often have the advantage of being more adaptable to dynamic warehouse environments.

They can handle changes in the layout or inventory more easily than fully automated systems. On the other hand, the full-automatic segment is expected to grow at the highest CAGR during the forecast period. Warehouses and distribution facilities seeking to streamline their order fulfillment procedures are increasingly turning to completely autonomous logistics picking robots. The creation of more complex and proficient entirely autonomous picking robots has been facilitated by ongoing advances in robotics and artificial intelligence (AI). Robust navigation and object recognition are made possible by these robots' sophisticated sensors, computer vision, and machine learning algorithms. Thus, this is expected to drive the market growth.

Based on the application, the global logistics picking robots industry is bifurcated into logistics picking, logistics handling, and others. The logistics picking segment is expected to dominate the market during the forecast period. The market for logistics picking robots has been expanding rapidly due to the growing need for automation in distribution centers and warehouses. The introduction of picking robots has been pushed by the need to manage an increase in e-commerce orders, decrease mistakes, and enhance overall efficiency. For instance, InVia Robotics Inc. claims that over 50% of all operating expenses are incurred by employees during their time spent moving about the warehouse, which makes up over 50% of pick time.

Logistics Picking Robots Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Logistics Picking Robots Market |

| Market Size in 2022 | USD 6.1 Billion |

| Market Forecast in 2030 | USD 18 Billion |

| Growth Rate | CAGR of 14.5% |

| Number of Pages | 222 |

| Key Companies Covered | Yaskawa Electric Corporation, Kuka AG, Fanuc Corporation, Dematic Corporation, KION Group AG, ABB Group, Teradyne Inc., Amazon Robotics LLC, BlueBotics SA, Hi-Tech Robotic Systemz Ltd., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Logistics Picking Robots Market: Regional Analysis

Asia Pacific is expected to capture a significant market share during the forecast period

The Asia Pacific is expected to capture a significant logistics picking robots market share during the forecast period. The growing need for logistics picking robots in emerging countries such as China, Japan, and India is the main reason for the expansion of the market in the region. The rising demand for automation in the logistics industry to boost productivity and reduce costs is expected to fuel the region's need for logistics picking robots. The regional demand for logistics picking robots is also being driven by the growth of e-commerce and the need for faster product delivery. Additionally, it is projected that the availability of low-cost, high-tech logistics robots will aid in the growth of regional markets.

Besides, North America is expected to grow at a rapid pace over the projected timeframe. The logistics industry's increasing use of cutting-edge technology like robots, automation, and artificial intelligence is the main reason for the region's market expansion. The emergence of e-commerce and the need for faster and more efficient product delivery are also driving the growth of the logistics picking robots industry in the region. Furthermore, the presence of significant logistics companies like UPS, FedEx, and Amazon in the region is expected to support the growth of the logistics picking robot industry.

Logistics Picking Robots Market: Competitive Analysis

The global Logistics Picking Robots market is dominated by players like:

- Yaskawa Electric Corporation

- Kuka AG

- Fanuc Corporation

- Dematic Corporation

- KION Group AG

- ABB Group

- Teradyne Inc.

- Amazon Robotics LLC

- BlueBotics SA

- Hi-Tech Robotic Systemz Ltd.

The global Logistics Picking Robots market is segmented as follows:

By Type

- Full-automatic

- Semi-automatic

By Application

- Logistics Picking

- Logistics Handling

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Robots designed to handle orders automatically are called picking robots. These machines come in a variety of shapes and sizes, such as automated warehouse systems and conveyor belts, or industrial robotic arms that handle and arrange goods into orders. Businesses are required to invest in automated picking solutions to lower order picking costs and remove mistakes from the process. Real-time inventory control, very dependable product movements, and round-the-clock operations are made possible by automation and digitalization.

Major drivers driving the logistics picking robots market revenue growth include growing use in the warehouse and e-commerce sectors, an increasing requirement for labor cost reduction and supply chain optimization, and advancements in robot technology.

According to the report, the global logistics picking robots market size was worth around USD 6.1 billion in 2022 and is predicted to grow to around USD 18.0 billion by 2030.

The global Logistics Picking Robot market is expected to grow at a CAGR of 14.5% during the forecast period.

The global Logistics Picking Robot market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the growing e-commerce industry.

The global Logistics Picking Robots market is dominated by players like Yaskawa Electric Corporation, Kuka AG, Fanuc Corporation, Dematic Corporation, KION Group AG, ABB Group, Teradyne Inc., Amazon Robotics LLC, BlueBotics SA, and Hi-Tech Robotic Systemz Ltd. among others.

The Logistics Picking Robots market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed