Long Steel Products Market Size, Share, Trends, Growth and Forecast 2032

Long Steel Products Market By End-User Industry (Automotive & Aerospace, Building & Construction, Railways & Highways, and Others), By Produce (Wire Rods, Rebars, Tubes, and Sections), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

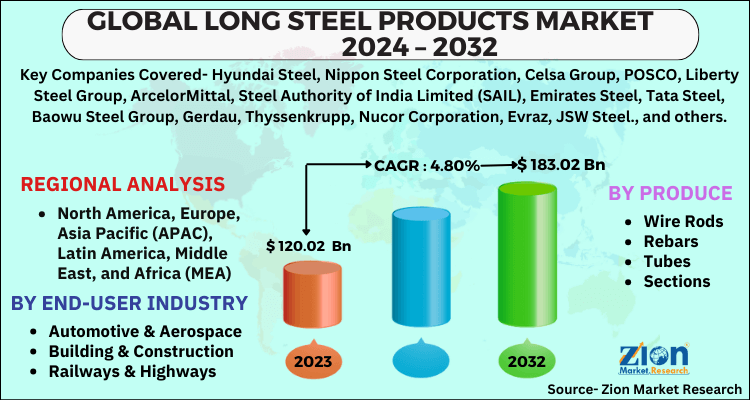

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 120.02 Billion | USD 183.02 Billion | 4.80% | 2023 |

Long Steel Products Industry Prospective:

The global long steel products market size was worth around USD 120.02 billion in 2023 and is predicted to grow to around USD 183.02 billion by 2032, with a compound annual growth rate (CAGR) of roughly 4.80% between 2024 and 2032.

Long Steel Products Market: Overview

Long steel products are special offers of the global steel industry. It includes products such as steel-based rods, wires, bars, and rails. Long steel products are generally used in growing industries such as building & construction, automotive & aerospace, and others. They are physically different from flat steel products, including steel plates and sheets.

Furthermore, applications of long steel products are also significantly different. For instance, reinforcing bars, also known as rebars, are typically used in the construction industry to reinforce concrete strength and provide overall structural integrity.

The demand for long steel products is expected to grow due to increased consumption in the automotive industry especially fueled by rising production of electric vehicles.

In addition, the ongoing use of long steel products in the building & construction industry, especially in infrastructure development projects, may further help the long steel products industry thrive with a higher rate of return.

The price and quantity fluctuations in the global steel industry may impact the demand and supply of long steel products, according to market research.

Key Insights:

- As per the analysis shared by our research analyst, the global long steel products market is estimated to grow annually at a CAGR of around 4.80% over the forecast period (2024-2032)

- In terms of revenue, the global long steel products market size was valued at around USD 120.02 billion in 2023 and is projected to reach USD 183.02 billion by 2032.

- The long steel products market is projected to grow at a significant rate due to the increasing use in the automotive sector.

- Based on end-user industry, the building & construction segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on product, the rebars segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Long Steel Products Market: Growth Drivers

Increasing use in the automotive sector to drive market demand rate

The global long steel products market is expected to grow due to the increasing use of materials in the automotive industry. Long steel products are frequently used for the production of crucial automotive parts such as chassis and axles.

The rising investments in the global automotive sector will fuel the demand for long steel products with higher performance and durability. The changing consumer buying patterns fueled by increased disposable income, along with the availability of multiple options in terms of financial assistance, have helped fuel the demand for affordable and luxury automotives.

For instance, emerging economies such as India and China are registering greater consumption of mid-range vehicles ideal for accommodating nuclear families. In 2023, India recorded an increase of over 8% in car sales compared to 2022. More than 4 million passenger vehicles were sold in 2023.

Similarly, other nations, including developed economies, are focusing on producing fuel-efficient cars. The ongoing innovation related to vehicle technology, such as self-driving cars and electric vehicles, and the surge in consumption of two-wheel vehicles will be crucial to the demand for long steel products. According to market research, the electric vehicles (EV) industry is expected to reach more than USD 2050 billion by 2032

Surging consumption in the building & construction industry to promote an extensive growth rate

Long steel products are highly popular in the building & construction industry. These materials are used during the initial construction phase of residential or commercial buildings. They play the role of enhancing the structure’s overall strength and durability.

The continuous investments in the construction of residential homes, especially fueled by smart city projects worldwide, are expected to create excellent demand in the global long steel products market.

For instance, the UK is currently witnessing the development of the Victory Quay Residential Community. It involves the construction of 11-storey residential blocks extending up to 835 homes. The construction began in the third quarter of 2024 and is expected to be completed by 2029.

In July 2024, Karmod, a Turkish housing company, announced its plans to undertake the construction of state-of-the-art housing projects in three African countries. Additionally, the commercial building segment is witnessing equal investments with demand for sophisticated office or entertainment sites.

Long Steel Products Market: Restraints

Changing steel production and supply rate to limit the industry’s expansion trend

The global industry for long steel products is projected to be restricted by the changing rate of steel production worldwide. According to market findings, steel production in 2023 witnessed a decline of 0.101% compared to 2022.

Additionally, market players witnessed a slow consumption rate for steel in the previous year. Such fluctuations in the production and supply of steel, the raw material essential for derived products, may limit the industry's overall growth rate in the coming years.

Long Steel Products Market: Opportunities

Increased focus on research & development of novel steel to generate growth opportunities

The global long steel products market is expected to generate growth opportunities due to the growing focus on research & development of new steel variants with high-performance value.

For instance, in May 2021, ArcelorMittal Europe announced the launch of Granite® HDXtreme. It is a range of new steel designed specially to meet the requirements of extreme weather.

According to company claims, Granite® HDXtreme is ideal for sea-facing buildings that are subject to harsh weather conditions more frequently.

Furthermore, the new range delivers exceptional protection against ultraviolet (UV) rays due to the application of a special coating on the surface.

In November 2024, ArcelorMittal Nippon Steel India (AM/NS India), a joint venture between Nippon Steel and ArcelorMittal, announced the launch of a steel project in the Indian market.

According to official reports, the project has a capacity of 17.8 million tonnes and will be made with an investment of INR 1.1 lakh crore. The new facility will be located in the Andhra Pradesh region of the country.

The rising focus on the green steel segment will help market players meet the energy and environmental demands of countries worldwide.

Long Steel Products Market: Challenges

Lack of sufficient and efficient recycling practices to challenge the market expansion trends

The global industry for long steel products is expected to be challenged by the lack of effective recycling measures in terms of used long steel products. This leads to higher pressure on the production of new batches of steel-based items, which directly impacts ecological conditions.

Furthermore, the risk of overcapacity may also limit the overall revenue in the industry. Countries such as China are accused of excess steel production, leading to reduced profits.

Long Steel Products Market: Segmentation

The global long steel products market is segmented based on end-user industry, produce, and region.

Based on the end-user industry, the global market segments are automotive & aerospace, building & construction, railways & highways, and others.

In 2023, the highest growth was listed in the building & construction segment. According to market research, the segment dominated over 80% of the total revenue, led by extensive use of long steel products in the construction of residential and commercial spaces.

During the forecast period, the automotive & aerospace industry is likely to deliver exceptional results driven by increased production of fuel-efficient and sustainable vehicles.

Based on produce, the global market segments are rods, rebars, tubes, and sections. In 2023, the highest growth was listed in the rebars segment. It accounted for nearly 39.01% of the final revenue, led by higher use of reinforced bars in the construction business. Increasing the introduction of digital construction & building solutions will promote segmental revenue in the future.

The rods segment is expected to deliver a CAGR of more than 6% during the forecast period. The increased demand across automotive and manufacturing industries will promote a higher segmental growth rate.

Long Steel Products Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Long Steel Products Market |

| Market Size in 2023 | USD 120.02 Billion |

| Market Forecast in 2032 | USD 183.02 Billion |

| Growth Rate | CAGR of 4.80% |

| Number of Pages | 216 |

| Key Companies Covered | Hyundai Steel, Nippon Steel Corporation, Celsa Group, POSCO, Liberty Steel Group, ArcelorMittal, Steel Authority of India Limited (SAIL), Emirates Steel, Tata Steel, Baowu Steel Group, Gerdau, Thyssenkrupp, Nucor Corporation, Evraz, JSW Steel., and others. |

| Segments Covered | By End-User Industry, By Produce, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Long Steel Products Market: Regional Analysis

Asia-Pacific to account for the largest market share during the forecast period

The global long steel products market is expected to witness the highest growth in Asia-Pacific during the forecast period. In 2023, Asia-Pacific held control over 67.05% of the global revenue, led by increased production and consumption in leading regional countries China and India. The thriving construction industry across major Asian countries is helping fuel the regional demand rate.

In addition, China is the world’s largest producer and exporter of steel and derived products. In 2023, China was reported to produce more than 1.35 billion tons of steel.

In addition, the presence of a world-renowned manufacturing industry in Asia-Pacific further helps promote the consumption of long steel products.

The growing investments in automotive and infrastructure development projects across Asia-Pacific will help the region maintain its global dominance.

In 2023, North America accounted for nearly 12% of the global share. The US and Canada were the leading revenue generators. Increased demand for highly durable long steel products in the regional aerospace industry, along with favorable government policies, helped North America’s growth rate. Additionally, increased investments in sustainable building solutions will promote regional growth during the forecast period.

Long Steel Products Market: Competitive Analysis

The global long steel products market is led by players like:

- Hyundai Steel

- Nippon Steel Corporation

- Celsa Group

- POSCO

- Liberty Steel Group

- ArcelorMittal

- Steel Authority of India Limited (SAIL)

- Emirates Steel

- Tata Steel

- Baowu Steel Group

- Gerdau

- Thyssenkrupp

- Nucor Corporation

- Evraz

- JSW Steel.

The global long steel products market is segmented as follows:

By End-User Industry

- Automotive & Aerospace

- Building & Construction

- Railways & Highways

- Others

By Produce

- Wire Rods

- Rebars

- Tubes

- Sections

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Long steel products are special offers of the global steel industry. It includes products such as steel-based rods, wires, bars, and rails.

The global long steel products market is expected to grow due to the increasing use of the material in the automotive industry.

According to study, the global long steel products market size was worth around USD 120.02 billion in 2023 and is predicted to grow to around USD 183.02 billion by 2032.

The CAGR value of the long steel products market is expected to be around 4.80% during 2024-2032.

The global long steel products market is expected to witness the highest growth in Asia-Pacific during the forecast period.

The global long steel products market is led by players like Hyundai Steel, Nippon Steel Corporation, Celsa Group, POSCO, Liberty Steel Group, ArcelorMittal, Steel Authority of India Limited (SAIL), Emirates Steel, Tata Steel, Baowu Steel Group, Gerdau, Thyssenkrupp, Nucor Corporation, Evraz and JSW Steel.

The report explores crucial aspects of the long steel products market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed