Luxury Packaging Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

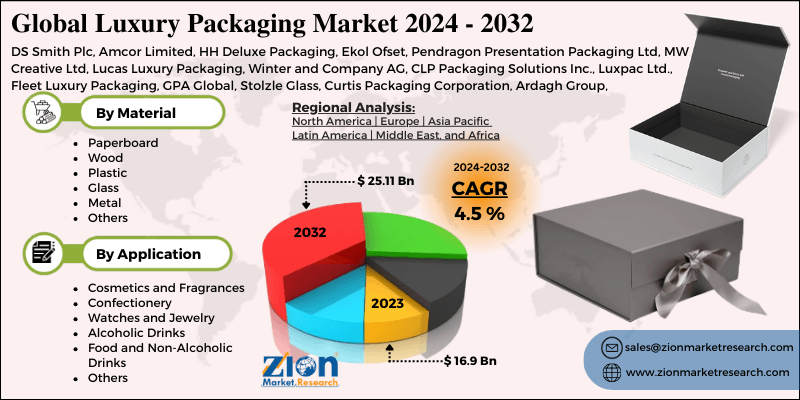

Luxury Packaging Market By Material (Paperboard, Wood, Plastic, Glass, Metal, and Others), By Application (Cosmetics & Fragrances, Confectionery, Watches & Jewelry, Alcoholic Drinks, Food & Non-Alcoholic Drinks, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

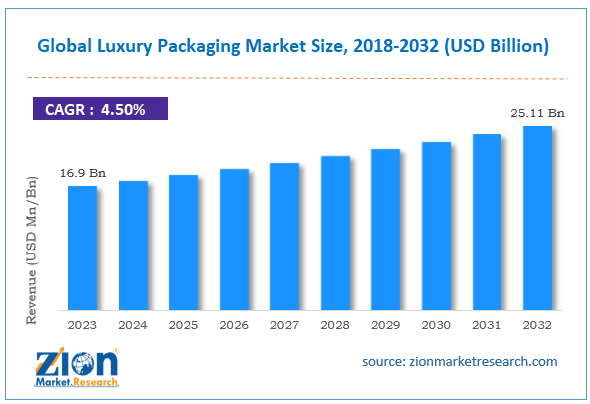

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.9 Billion | USD 25.11 Billion | 4.5% | 2023 |

Luxury Packaging Industry Prospective:

The global luxury packaging market size was worth around USD 16.9 billion in 2023 and is predicted to grow to around USD 25.11 billion by 2032, with a compound annual growth rate (CAGR) of roughly 4.5% between 2024 and 2032.

Luxury Packaging Market: Overview

Luxury packaging is high-end packaging materials and designs aimed to enhance the tactile feel, visual appeal, and perceived worth of luxury goods. Usually found in luxury items, including cosmetics, jewels, fine wines, gourmet food, fashion, and technology, luxury packaging strives to communicate quality, elegance, and distinctiveness.

A major component of brand strategy, luxury packaging improves the complete consumer experience and distinguishes goods on shelves.

Several factors drive the luxury packaging market, including rising demand for premium consumer goods, growing focus on sustainability, expanding e-commerce sector, demand from the cosmetics & personal care industry, development of premium alcohols & beverages sector, and many more. The high product cost is a main impediment to industry growth over the projection period.

Key Insights

- As per the analysis shared by our research analyst, the global luxury packaging market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2024-2032).

- In terms of revenue, the global luxury packaging market size was valued at around USD 16.9 billion in 2023 and is projected to reach USD 25.11 billion by 2032.

- The growing personal care and cosmetic sector is expected to drive the luxury packaging market over the forecast period.

- Based on material, the paperboard segment is expected to capture the largest market share over the projected period.

- Based on application, the cosmetics and fragrances segment dominates the market.

- Based on region, Europe is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Luxury Packaging Market: Growth Drivers

Increasing demand for biodegradable packaging drives market growth

Luxury goods, among other environmentally friendly products, are in demand personally as awareness of them rises. By offering an environmentally favorable alternative to non-degradable packing materials derived from fossil-based products which in turn help to contribute to environmental damage, biodegradable packaging tackles these problems.

Luxury companies are also differentiating themselves on the market by including biodegradable packaging. Using environmentally friendly methods helps companies project a more social responsibility. The biodegradable packaging solutions are supposed to propel the direction of luxury packaging since premium firms are adopting sustainable practices.

Luxury Packaging Market: Restraints

High production cost hinders market growth

The high production cost of luxury packaging might be a major restraining factor for the luxury packaging industry during the forecast period. More costly than conventional packing materials, luxury packaging usually consists of glass, metal, leather, and specialist polymers.

For instance, complex metal detailing on cosmetic packaging or hefty glass bottles for liquor add significant expenses. Because of their limited supply and extra processing needs, sustainable materials—such as recycled glass or biodegradable plastics—increase demand and thereby drive more expenses.

To achieve a unique, high-end look, luxury packaging also frequently combines specialist techniques, including embossing, debossing, metallic foiling, UV coating, and custom finishes. Both complex machinery and expert people needed for these operations increase production costs. Custom shapes, complex patterns, and detailed artwork call for accuracy and lengthier manufacturing periods, therefore adding to labor and machine utilization expenses.

Luxury Packaging Market: Opportunities

Technological advancement offers a lucrative opportunity for market growth

Innovations in printing, like digital printing, enable designs and logos to be detailed, deep in color, and well-defined on premium packaging materials, thus improving the aesthetic value and customizing options available to brands, enabling them to produce unique and eye-catching packaging solutions.

Moreover, the personalization and customization of luxury packaging are improved with digital technology. Using digital printing and data analytics, companies build luxury packaging designs catered to particular demands or tastes.

Apart from this, clever elements included in the packaging, such as NFC tags, RFID chips, and nanotechnology, improve people's involvement by offering interactive content and product information, thus increasing the revenue of the luxury packaging market.

For instance, the global leader in designing and manufacturing sustainable packaging solutions, Amcor, signed a contract with Nfinite Nanotechnology Inc. to test the application of Nfinite's nanocoating technology and thereby enhance recyclable and compostable packaging.

Luxury Packaging Market: Challenges

Environmental concerns and regulation pose a major challenge to market expansion

Consumers expect companies to show a dedication to sustainability since they are growingly conscious of environmental problems. Luxury brands that increasingly are expected to employ recyclable, biodegradable, or reusable materials without compromising the quality or aesthetic appeal of the packaging are impacted by this requirement.

Finding sustainable substitutes for conventional luxury materials like plastics and some metals, which frequently need creativity and investment to keep the same degree of uniqueness and durability, presents a difficulty for luxury companies. Governments all around are also enforcing stronger rules on packaging waste, including prohibitions on single-use plastics and requirements on recycled materials.

For instance, the European Union mandates brands to boost the recyclable content of packaging materials and targets for reduction of packaging waste. Thus, environmental concerns and stringent regulation by the government posed a major challenge for the luxury packaging industry over the analysis period.

Luxury Packaging Market: Segmentation

The global luxury packaging industry is segmented based on material, application, and region.

Based on material, the global luxury packaging market is segmented into paperboard, wood, plastic, glass, metal, and others. The paperboard segment is expected to capture the largest market share over the projected period. High-end consumer electronics, jewelry, cosmetics, and other delicate products are protected by the strong feel of paperboard.

Furthermore, because paperboard is so adaptable, it allows companies to create packaging solutions that complement their brand identity and product positioning.

Furthermore, certain companies and people place a strong focus on sustainability. As paperboard is recyclable or biodegradable and made from renewable resources, its negative environmental effects are mitigated, which supports the expansion of the luxury packaging sector.

Based on application, the global luxury packaging industry is bifurcated into cosmetics & fragrances, confectionery, watches & jewelry, alcoholic drinks, food & non-alcoholic drinks, and others. The cosmetics and fragrances segment dominates the market.

Luxury fragrances and cosmetics need packaging that reflects the high-end quality of the products and radiates exclusivity and elegance. To improve its visual appeal and feel, there is a need for sophisticated materials, patterns, and finishing techniques, including foiling, embossing, debossing, and unique shapes.

The idea of luxury appeal is further enhanced by the opulent appearance of cosmetics and fragrances outside packaging and containers. Overall, the most sophisticated luxury packaging is found in the cosmetics and perfumes industry due to sustainability, people engagement tactics, and aesthetic criteria.

Luxury Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Luxury Packaging Market |

| Market Size in 2023 | USD 16.9 Billion |

| Market Forecast in 2032 | USD 25.11 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 221 |

| Key Companies Covered | DS Smith Plc, Amcor Limited, HH Deluxe Packaging, Ekol Ofset, Pendragon Presentation Packaging Ltd, MW Creative Ltd, Lucas Luxury Packaging, Winter and Company AG, CLP Packaging Solutions Inc., Luxpac Ltd., Fleet Luxury Packaging, GPA Global, Stolzle Glass, Curtis Packaging Corporation, Ardagh Group, Crown Holdings Inc., Cosfibel Group, McLaren Packaging, WestRock Company, Essentra Packaging, and others. |

| Segments Covered | By Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Luxury Packaging Market: Regional Analysis

Europe dominates the market over the projected period

Europe is expected to dominate the luxury packaging market during the forecast period. Many of the well-known luxury brands worldwide in fashion, cosmetics, jewelry, and wines are headquartered in Europe, which fuels the great demand for premium packaging solutions that capture the legacy of elegance and sophistication of the area.

Furthermore, highly valued by Europeans are inclined to sustainability, design, and quality, which influence firms to spend on luxury packaging that improves product attractiveness and conforms with environmental criteria. Moreover, by changing the way luxury businesses approach packaging techniques, the increasing e-commerce income in the UK is boosting market development.

Packaging is becoming more and more important as more people, especially for luxury goods, are turning to online buying as a main point of contact in the customer experience. An article appearing on the International Trade Administration (ITA) website in 2023 indicates that by 2025, the e-commerce sales in the UK are predicted to have an annual average increase rate of 12.6%.

Luxury Packaging Market: Competitive Analysis

The global luxury packaging market is dominated by players like:

- DS Smith Plc

- Amcor Limited

- HH Deluxe Packaging

- Ekol Ofset

- Pendragon Presentation Packaging Ltd

- MW Creative Ltd

- Lucas Luxury Packaging

- Winter and Company AG

- CLP Packaging Solutions Inc.

- Luxpac Ltd.

- Fleet Luxury Packaging

- GPA Global

- Stolzle Glass

- Curtis Packaging Corporation

- Ardagh Group

- Crown Holdings Inc.

- Cosfibel Group

- McLaren Packaging

- WestRock Company

- Essentra Packaging

The global luxury packaging market is segmented as follows:

By Material

- Paperboard

- Wood

- Plastic

- Glass

- Metal

- Others

By Application

- Cosmetics and Fragrances

- Confectionery

- Watches and Jewelry

- Alcoholic Drinks

- Food and Non-Alcoholic Drinks

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Luxury packaging is high-end packaging materials and designs aimed to enhance the tactile feel, visual appeal, and perceived worth of luxury goods. Usually found in luxury items including cosmetics, jewels, fine wines, gourmet food, fashion, and technology, luxury packaging strives to communicate quality, elegance, and distinctiveness. A major component of brand strategy, luxury packaging improves the complete consumer experience and distinguishes goods on shelves.

Several factors drive the luxury packaging market, including rising demand for premium consumer goods, growing focus on sustainability, expanding e-commerce sector, demand from the cosmetics and personal care industry, development of premium alcohols and beverages sector, and many more.

According to the report, the global luxury packaging market size was worth around USD 16.9 billion in 2023 and is predicted to grow to around USD 25.11 billion by 2032.

The global luxury packaging market is expected to grow at a CAGR of 4.5% during the forecast period.

The global luxury packaging market growth is expected to be driven by Europe. It is currently the world’s highest revenue-generating market due to the increasing emphasis on sustainability.

The global luxury packaging market is dominated by players like DS Smith Plc, Amcor Limited, HH Deluxe Packaging, Ekol Ofset, Pendragon Presentation Packaging Ltd, MW Creative Ltd, Lucas Luxury Packaging, Winter and Company AG, CLP Packaging Solutions Inc., Luxpac Ltd., Fleet Luxury Packaging, GPA Global, Stolzle Glass, Curtis Packaging Corporation, Ardagh Group, Crown Holdings Inc., Cosfibel Group, McLaren Packaging, WestRock Company and Essentra Packaging among others.

The luxury packaging market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed