Medical Equipment Financing Market Size, Share, Trends, Growth 2030

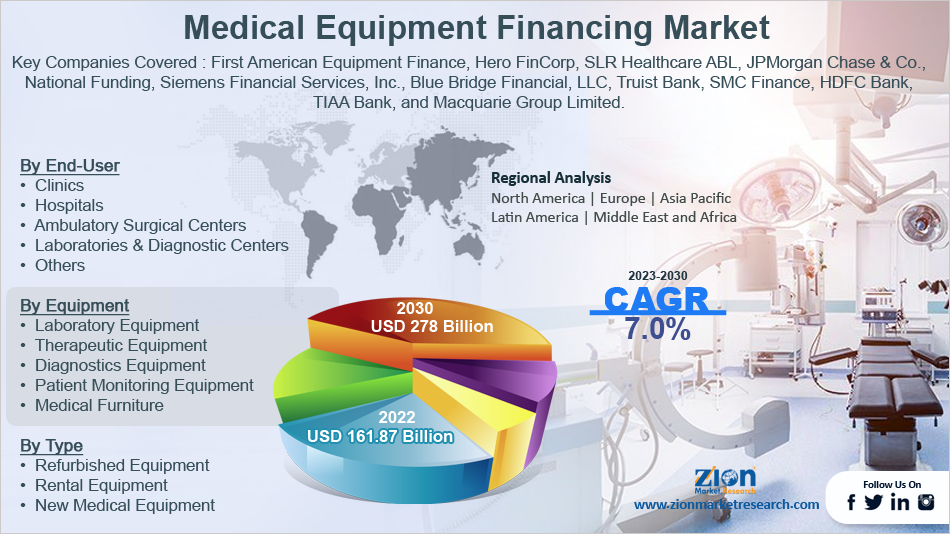

Medical Equipment Financing Market By End-User (Clinics, Hospitals, Ambulatory Surgical Centers, Laboratories & Diagnostic Centers, and Others), By Equipment (Laboratory Equipment, Therapeutic Equipment, Diagnostics Equipment, Patient Monitoring Equipment, and Medical Furniture), By Type (Refurbished Equipment, Rental Equipment, and New Medical Equipment), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

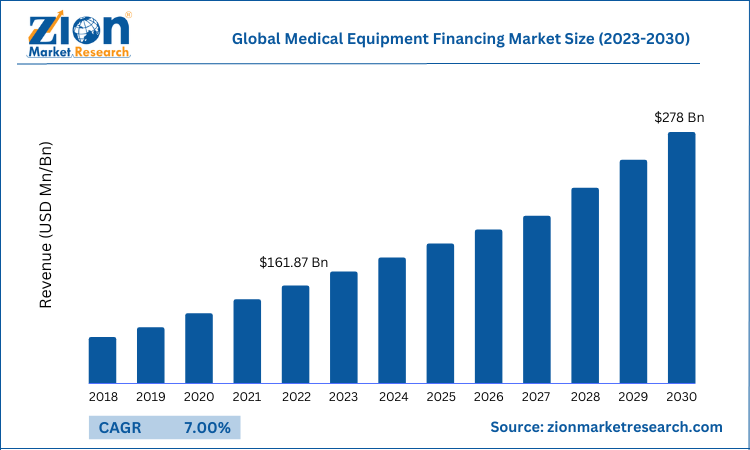

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 161.87 Billion | USD 278 Billion | 7% | 2022 |

Medical Equipment Financing Industry Prospective:

The global medical equipment financing market size was worth around USD 161.87 Billion in 2022 and is predicted to grow to around USD 278 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 7% between 2023 and 2030.

The report analyzes the global medical equipment financing market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the medical equipment financing market.

To know more about this report, Request a sample copy

Medical Equipment Financing Market: Overview

With the growth in medical technology along with the growing population and the subsequent rise in the number of medical conditions being treated, the requirement for state-of-the-art and highly advanced medical equipment is at an all-time high. Owing such pieces of equipment no longer stands as a luxury but a dire need for the medical community. However, these pieces of machinery or supportive equipment are extremely expensive in which some are costlier than others.

The financial outlay to purchase and maintain such medical equipment is significant and may end up blocking a large section of the working capital invested in operating a medical center or treatment facility. Medical equipment financing can be considered a business loan especially created for the medical community.

The loaned amount completely depends on several factors including the credit history and the loan repaying capacity of the borrower and the expected rate of return on the piece of equipment that is being loaned. All categories of medical professionals including dentists, doctors, healthcare facilities, and small hospitals can apply for loans.

Key Insights

- As per the analysis shared by our research analyst, the global medical equipment financing market is estimated to grow annually at a CAGR of around 7% over the forecast period (2023-2030)

- In terms of revenue, the global medical equipment financing market size was valued at around USD 161.87 billion in 2022 and is projected to reach USD 278 billion, by 2030.

- The medical equipment financing industry is projected to grow at a significant rate due to the changing economic conditions across the world

- Based on end-user segmentation, hospitals and clinics were predicted to show maximum market share in the year 2022

- Based on type segmentation, refurbished equipment was the leading type in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Medical Equipment Financing Market: Growth Drivers

Changing economic conditions across the world to propel market demand

The global medical equipment financing market is projected to grow owing to the impact of the changing economic conditions across the world. For instance, the onset of Covid-19 had put the healthcare industry under immense pressure which included operational and economical stress wing to the sudden outburst in demand for additional beds, ventilators, and other medical accessories in general. Some of the healthcare units were not sufficiently equipped monetarily to manage such high demand.In addition to this, the ongoing Russia-Ukraine which has severely impacted oil & gas prices across the globe along with the impending period of the high recession could lead to added duress on the healthcare sector further leading them into financial limitations.

Furthermore, the global industry is witnessing a surge of advancements for different associated technologies that are used extensively to treat various medical conditions ranging from severe to mild. The new machinery comes at a high cost and small or mid-sized medical firms may not be able to afford them. For instance, a 16-slice Computed Tomography (CT) Scan may cost between USD 80,000 to more than USD 110,000.

Medical Equipment Financing Market: Restraints

Lack of awareness to restrict market expansion

The global sales volume may witness certain growth restrictions owing to the lack of awareness about the presence of such an idea where medical equipment can be bought on loan. The concept may not be fairly new but has received major attention in the past few years and remains a relatively fresh idea amongst the medical equipment financing industry players. Although financing companies have amped up efforts to spread mass awareness to benefit from the tide of financial insecurity in the medical community, a huge segment is still untouched.

Medical Equipment Financing Market: Opportunities

Growing technological advancements to provide expansion opportunities

The global medical equipment financing market is projected to register higher growth opportunities driven by the increasing spending on the adoption of new and advanced technologies and breakthrough inventions in the sector. Such automation and mechanization open doors for enhanced medical care, improved patient experience, and the ability to diagnose or treat conditions that previously remained outside the bounds of human capacity. The growing use of machine learning, the Internet of Things (IoT), and artificial intelligence (AI) is expected to attract more buyers in the coming years.

Medical Equipment Financing Market: Challenges

Less number of players to challenge market growth

The medical equipment financing industry could face certain expansion challenges due to the less number of players operating in the segment limiting the true potential of the market. Since the quality of service providers is relatively less than anticipated, they can only reach a restricted segment of buyers. Nonetheless, the global market is registering a growing influx of new players consistently which is a good sign of growth.

Medical Equipment Financing Market: Segmentation

The global medical equipment financing market is segmented based on end-user, equipment, type, and region

Based on end-user, the global market is divided into clinics, hospitals, ambulatory surgical centers, hospitals, and others

- In 2021, the hospitals and clinics segments were the leading consumers in the global market

- The dominance could be attributed to the increasing investments in the hospital sector propelled by a higher need for medical care due to the high patient influx

- Furthermore, these segments have witnessed a high rate of infrastructure investment in the last few years

- The global market can expect high revenue from the laboratories & diagnostic centers during the forecast period as well due to the growing expenses surrounding medical equipment

- As per estimates, the US hospitals, in 2018, spent more than USD 200 billion on the supply of medical devices

Based on equipment, the medical equipment financing industry divisions are laboratory equipment, therapeutic equipment, diagnostic equipment, patient monitoring equipment, and medical furniture.

Based on type, the global market is segmented into refurbished equipment, rental equipment, and new equipment

- In 2021, the global market dominance was seen in the refurbished equipment segment 2021 with a revenue of USD 16.7 billion

- Refurbished equipment undergo necessary quality check before they put to use in the live market

- Several companies offer remodeling services at a nominal cost of refurbished medical devices

- During these processes, the piece of equipment undergoes restoration activities along with disinfection and other necessary changes so that it can provide the best performance

Recent Developments:

- In November 2022, Santander Bank, a wholly owned subsidiary of the Spanish Santander Group, announced that the company is expanding its Commercial Equipment and Vehicle Finance business. This move will allow the company to finance the purchase of commercial equipment by healthcare organizations. It is a nationwide offering and included financing of state-of-the-art medical equipment and technology

- In August 2022, Poonawalla Fincorp announced the remodeling of its product offerings and suite and is expected to go ahead with a retail-based approach. The company’s portfolio, with the recent changes, includes loans for businesses, medical equipment, personal use, financing supply chain, and machine loans. This is expected to help the company see new terms of growth

Povidone Iodine Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Equipment Financing Market Research Report |

| Market Size in 2022 | USD 161.87 Billion |

| Market Forecast in 2030 | USD 278 Billion |

| Compound Annual Growth Rate | CAGR of 7.0% |

| Number of Pages | 209 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | First American Equipment Finance, Hero FinCorp, SLR Healthcare ABL, JPMorgan Chase & Co., National Funding, Siemens Financial Services, Inc., Blue Bridge Financial, LLC, Truist Bank, SMC Finance, HDFC Bank, TIAA Bank, and Macquarie Group Limited. |

| Segments Covered | By End-User, By Equipment, By Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Equipment Financing Market: Regional Analysis

North America to witness the highest growth during the forecast period

The global medical equipment financing market is projected to register the highest growth in North America. The region generated more than USD 46 billion in 2021 and the major reason for the regional growth is the high financing rate witnessed in the countries of the US and Canada. Furthermore, the ongoing research on technological advancements in the medical sector could lead to higher growth revenue during the forecast period. The region boasts of the presence of certain key players that have assisted in driving the concept of financing medical equipment including new products and refurbished medical equipments.

Several associated companies that currently act as support groups in terms of delivering services have helped the market players contribute higher in the previous years. The increasing investments in the healthcare infrastructure of the US could act as an expansion propeller during the forecast period.

Medical Equipment Financing Market: Competitive Analysis

The global medical equipment financing market is led by players like:

- First American Equipment Finance

- Hero FinCorp

- SLR Healthcare ABL

- JPMorgan Chase & Co.

- National Funding

- Siemens Financial Services Inc.

- Blue Bridge Financial LLC

- Truist Bank

- SMC Finance

- HDFC Bank

- TIAA Bank

- Macquarie Group Limited.

The global medical equipment financing market is segmented as follows:

By End-User

- Clinics

- Hospitals

- Ambulatory Surgical Centers

- Laboratories & Diagnostic Centers

- Others

By Equipment

- Laboratory Equipment

- Therapeutic Equipment

- Diagnostics Equipment

- Patient Monitoring Equipment

- Medical Furniture

By Type

- Refurbished Equipment

- Rental Equipment

- New Medical Equipment

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Medical equipment financing can be considered a business loan especially created for the medical community.

The global medical equipment financing market is projected to grow owing to the impact of the changing economic conditions across the world.

According to study, the global medical equipment financing market size was worth around USD 161.87 billion in 2022 and is predicted to grow to around USD 278 billion by 2030.

The CAGR value of the medical equipment financing market is expected to be around 7% during 2023-2030.

The global medical equipment financing market is projected to register the highest growth in North America. The region generated more than USD 46 billion in 2021 and the major reason for the regional growth is the high financing rate witnessed in the countries of the US and Canada.

The global medical equipment financing market is led by players like First American Equipment Finance, Hero FinCorp, SLR Healthcare ABL, JPMorgan Chase & Co., National Funding, Siemens Financial Services, Inc., Blue Bridge Financial, LLC, Truist Bank, SMC Finance, HDFC Bank, TIAA Bank, and Macquarie Group Limited.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed