Medical Foam Market Size, Share, Analysis, Trends, Growth, 2034

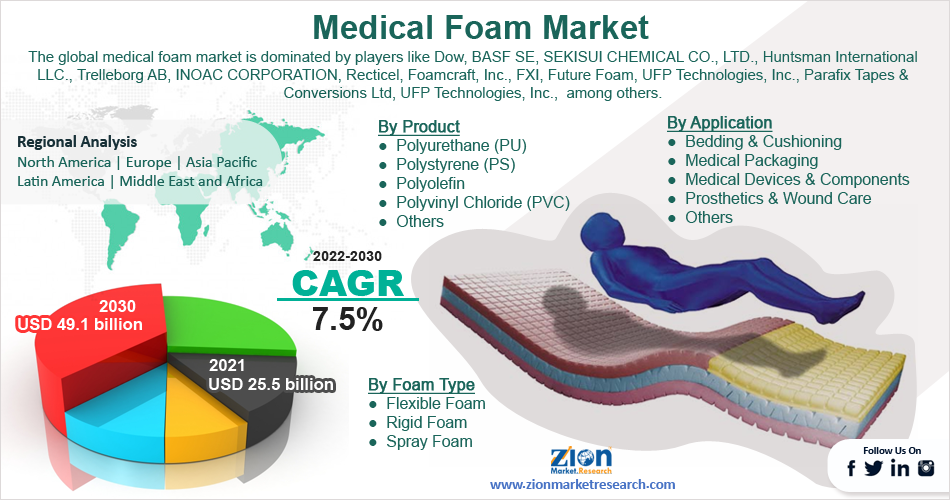

Global Medical Foam Market By Foam Type (Flexible Foam, Rigid Foam, and Spray Foam), By Product (Polyurethane (PU), Polystyrene (PS), Polyolefin, Polyvinyl Chloride (PVC) and Others), By Application (Bedding & Cushioning, Medical Packaging, Medical Devices & Components, Prosthetics & Wound Care and Others), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

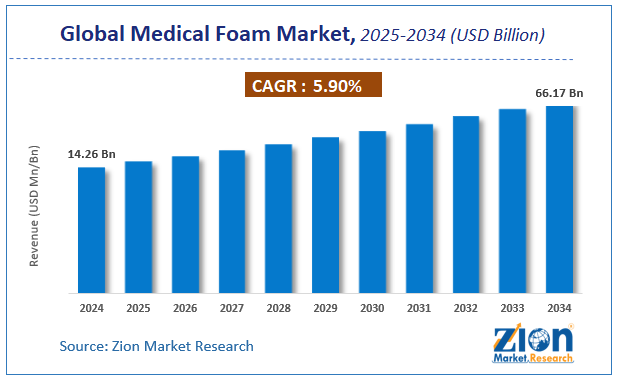

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 37.82 Billion | USD 66.17 Billion | 5.9% | 2024 |

Medical Foam Industry Prospective:

The global medical foam market size was worth around USD 37.82 Billion in 2024 and is predicted to grow to around USD 66.17 Billion by 2034 with a compound annual growth rate 5.9% between 2025 and 2034. The report analyzes the global medical foam market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the medical foam market.

Medical Foam Market: Overview

Medical foam is an antimicrobial product that is used in a variety of medical equipment, components, and support materials in the healthcare industry, such as surgical drapes, wound dressing, and bedding materials. It is made from cell polyurethane, polymers, and metals. Medical foam is also commonly used in prosthetic padding, bespoke orthotics, ostomy device sealing, and body underfoot pressure relief equipment. It has a variety of qualities, including water, strain, and fungal resistance, softness, durability, sterility, and adaptability, making it ideal for protective packing. Medical foams provide compression relief by adapting to the patient's body form and assisting in delivering comfort, relaxation, and pressure-release areas. It is currently available in rigid, flexible, and molded product forms.

Key Insights

- As per the analysis shared by our research analyst, the global medical foam market is estimated to grow annually at a CAGR of around 5.9% over the forecast period (2025-2034).

- Regarding revenue, the global medical foam market size was valued at around USD 37.82 Billion in 2024 and is projected to reach USD 66.17 Billion by 2034.

- The medical foam market is projected to grow at a significant rate due to rising demand for advanced wound care, medical devices, and comfort-enhancing materials in healthcare.

- Based on Foam Type, the Flexible Foam segment is expected to lead the global market.

- On the basis of Product, the Polyurethane (PU) segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Bedding & Cushioning segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

To know more about this report, request a sample copy.

Medical Foam Market: Growth Drivers

Medical Foam is becoming more popular in spinal implants to drive the market growth

The growing use of medical foam in spinal implants is propelling the medical foam industry forward. The global medical foam market is growing because of its broad qualities such as exceptional strength-to-weight ratio, good biocompatibility, outstanding performance, and cost-effectiveness. For instance, Xenco Medical Announces the Nationwide Launch of CancelleX Bio-inspired Spinal Implants, the First Injection-Molded Titanium Foam Spinal Implants Pre-Attached to Disposable Instruments, in June 2020. The Xenco Medical CancelleX lumbar intrabodies, which are designed after cancellous bone and feature interconnected porosity throughout each implant, are the first to use injection molding in the creation of titanium spinal implants. Such product launches directly boost the expansion of the medical foam market, consequently propelling the medical foam industry over the forecast period.

Medical Foam Market: Restraints

Stringent rules and regulations

Market expansion is anticipated to be constrained during the forecast period by the implementation of strict laws to guarantee the highest standards of packaging and labeling services in the healthcare sector. To maintain compliance with policies and guidelines used throughout the pharmaceutical business, all forms of medical packaging go through testing and integrity-related activities. Medical gadgets and packaging must survive harsh disinfectants as well as diverse sterilization processes.

Medical Foam Market: Opportunities

Bolstering Growth of the Bedding & Cushioning Sector

Medical foam is frequently used in bedding and cushioning because of its excellent function and low cost. The need for hospital beds, seat padding, and bed accessories including pillows, head, neck, and shoulder supports is expected to increase, which will fuel the expansion of the global medical foam market. Additionally, the need for bedding and padding has grown due to the expansion of the healthcare industry, the construction of new healthcare facilities in rural areas, and the ongoing corona pandemic, which is projected to fuel product demand in this category. For instance, according to American Hospital Association, the number of beds in US community hospitals increased from 7323 in 2020 to 7887 in 2022.

According to NITI Aayog, the Delhi government increased the number of hospital beds from 10,055 in 2019-20 to 13,844 by December 2021. The demand for medical foam is likely to increase with the increase in medical and healthcare projects around the world because they are less expensive and frequently utilized in healthcare, which is expected to drive the medical foam industry during the forecast period.

Medical Foam Market: Challenges

Fluctuation in the raw material prices

Fluctuations in the price of raw materials such as polyurethane, polyvinyl chloride, and others act as a major challenge for the market expansion over the forecast period. For instance, according to the INDEXBOX, the cost of polyurethanes per ton in August 2022 was $6,278, an increase of 3.7% from the previous month. It climbed at an average monthly rate of +1.8% from January 2022 to August 2022. The month of April 2022 saw the highest growth rate, with a month-over-month increase of 7.7%. The average export prices peaked throughout the period under study in August 2022.

Medical Foam Market: Segmentation

The global medical foam market is segmented based on foam type, product, application and region

Based on the foam type, the global market is bifurcated into flexible foam, rigid foam, and spray foam. The flexible foam segment accounted for the largest revenue share in 2021 and is expected to dominate the market during the forecast period. The segmental growth is attributed to the expanding use of flexible foam in medical packaging, bedding, wound dressings, and cushioning for patients and medical equipment. Moreover, the increased demand for flexible foam is a result of its improved thermal insulation, durability, vibration absorption, high impact, mechanical, and moisture-resistant qualities. Another factor driving up the use of flexible foam in medical packaging and equipment is its lower cost when compared to spray and rigid foam.

Based on application, global medical foam is categorized into bedding & cushioning, medical packaging, medical devices & components, prosthetics & wound care, and others. The bedding & cushioning segment is expected to dominate over the forecast period. The growing geriatric population and rising non-communicable disease prevalence are predicted to increase demand for bedding and cushioning, which in turn is boosting the use of medical foam in a variety of applications.

The necessity for the production of high-quality bedding and cushioning is growing as a result of rising government spending on healthcare facilities designed to improve patient comfort and safety. The continuous COVID-19 dilemma is significantly contributing to the rising demand for bedding and cushioning in hospitals in developed and developing nations. Future market expansion is also anticipated to be aided by polymer foam bedding and cushioning's long-lasting, flexible, and durable qualities as well as its widespread use in hospitals, nursing homes, and medical facilities.

Recent Developments:

- In December 2021, UFP Technologies, Inc., a unique designer and specialized manufacturer of parts, products, and packaging, primarily for the medical industry, recently announced the acquisition of DAS Medical, Inc. DAS is a medical device contract manufacturer with its headquarters in Atlanta, Georgia, and manufacturing in the Dominican Republic. It was established in 2010 and focuses on the design, development, and production of fluid control pouches, robotic draping systems, and single-use surgical equipment covers.

- In July 2021, Creative Foam Corporation announced that it has acquired the assets of RAM Technologies. RAM is a converter and fabricator of formed foam, plastic, and other nonwoven material solutions, primarily serving customers in the medical end-markets. The Seattle metro-based company offers extensive product design and engineering and manufacturing capabilities including thermoforming, compression molding, RF welding, laminating, and encapsulating. The acquisition of RAM Technologies not only expands the Healthcare division’s customer base and combined capabilities but enhances its ability to serve customers coast-to-coast.

Medical Foam Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Foam Market |

| Market Size in 2024 | USD 37.82 Billion |

| Market Forecast in 2034 | USD 66.17 Billion |

| Growth Rate | CAGR of 5.9% |

| Number of Pages | 272 |

| Key Companies Covered | Dow, BASF SE, SEKISUI CHEMICAL CO., LTD., Huntsman International LLC., Trelleborg AB, INOAC CORPORATION, Recticel, Foamcraft Inc., FXI, Future Foam, UFP Technologies Inc., Parafix Tapes & Conversions Ltd, UFP Technologies Inc., Rynel, Alpha Foam Ltd., Joy, and others. |

| Segments Covered | By Foam Type, By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Foam Market: Regional Analysis

The Asia Pacific is expected to hold the largest market share during the forecast period

The Asia Pacific region held the largest share in the global medical foam market of over 40% in 2021 and is expected to continue this pattern during the forecast period. The growth in the region is attributed to the increasing healthcare sector in the region. The region's healthcare sector is being driven by increased infrastructure development, greater per capita income, higher domestic demand, and the availability of low-cost labor. According to the International Trade Administration, the APAC medical equipment industry increased considerably between 2019 and 2020, growing from $82.9 billion to $86.6 billion.

Similarly, the pharmaceutical sector in India is estimated to reach US$65 billion by 2024 and US$120 billion by 2030, according to Invest India. The average index of industrial production of medicines, medical chemicals, and botanical products in FY 2021-22 is 221.6, up 1.3 percent over the previous year. With the steady growth of the medical and healthcare industries in Asia-Pacific, the demand for medical foam for use in medical packaging, medical devices, and other medical and healthcare applications will rise. As a result of the rapid rise of medical foam in medical applications, the medical foam industry is expected to thrive during the projected period.

Besides, the North American region is growing at a significant rate over the forecast period. With increased per capita healthcare spending in the United States, demand for medical equipment is likely to rise dramatically in the future years. This is expected to increase the demand for medical foam in the region. Furthermore, rising per capita healthcare spending in the form of health insurance in the United States has been one of the primary factors influencing the North American industry.

Medical Foam Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the medical foam market on a global and regional basis.

The global medical foam market is dominated by players like:

- Dow

- BASF SE

- SEKISUI CHEMICAL CO. LTD.

- Huntsman International LLC.

- Trelleborg AB

- INOAC CORPORATION

- Recticel

- Foamcraft Inc.

- FXI

- Future Foam

- UFP Technologies Inc.

- Parafix Tapes & Conversions Ltd

- UFP Technologies Inc.

- Rynel

- Alpha Foam Ltd.

- Joyce Foam Products.

- Global Medical Foam Inc.

The global medical foam market is segmented as follows:

By Foam Type

- Flexible Foam

- Rigid Foam

- Spray Foam

By Product

- Polyurethane (PU)

- Polystyrene (PS)

- Polyolefin

- Polyvinyl Chloride (PVC)

- Others

By Application

- Bedding & Cushioning

- Medical Packaging

- Medical Devices & Components

- Prosthetics & Wound Care

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Medical foam is an antimicrobial product that is used in a variety of medical equipment, components, and support materials in the healthcare industry, such as surgical drapes, wound dressing, and bedding materials. It is made from cell polyurethane, polymers, and metals.

The global medical foam market is expected to grow due to rising demand for advanced wound care solutions, increasing applications in orthopedic support, and growth in the healthcare sector drive expansion.

According to a study, the global medical foam market size was worth around USD 37.82 Billion in 2024 and is expected to reach USD 66.17 Billion by 2034.

The global medical foam market is expected to grow at a CAGR of 5.9% during the forecast period.

North America is expected to dominate the medical foam market over the forecast period.

Leading players in the global medical foam market include Dow, BASF SE, SEKISUI CHEMICAL CO., LTD., Huntsman International LLC., Trelleborg AB, INOAC CORPORATION, Recticel, Foamcraft Inc., FXI, Future Foam, UFP Technologies Inc., Parafix Tapes & Conversions Ltd, UFP Technologies Inc., Rynel, Alpha Foam Ltd., Joy, among others.

The report explores crucial aspects of the medical foam market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Medical Foam Industry Prospective:Medical Foam OverviewKey InsightsMedical Foam Growth DriversMedical Foam RestraintsMedical Foam OpportunitiesMedical Foam ChallengesMedical Foam SegmentationRecent Developments:Medical Foam Report Scope Medical Foam Regional AnalysisMedical Foam Competitive AnalysisThe global medical foam market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed