Metal Anodizing Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

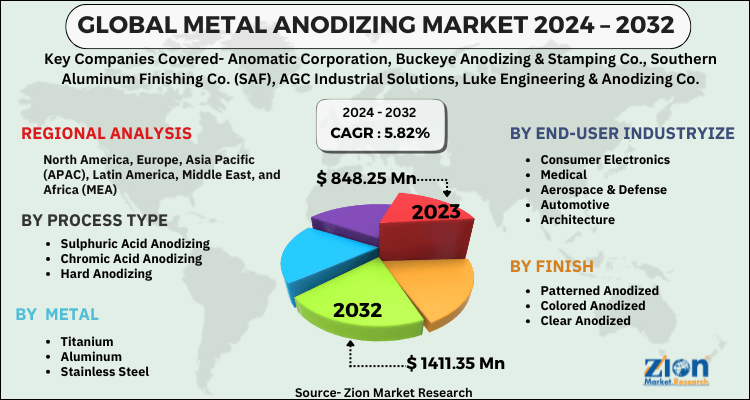

Metal Anodizing Market By Process Type (Sulphuric Acid Anodizing, Chromic Acid Anodizing, and Hard Anodizing), By Metal (Titanium, Aluminum, and Stainless Steel), By End-User Industry (Consumer Electronics, Medical, Aerospace & Defense, Automotive, and Architecture), By Finish (Patterned Anodized, Colored Anodized, and Clear Anodized), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

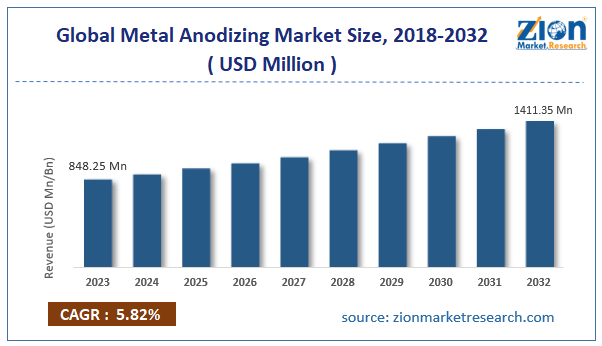

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 848.25 Million | USD 1411.35 Million | 5.82% | 2023 |

Metal Anodizing Industry Prospective:

The global metal anodizing market size was worth around USD 848.25 million in 2023 and is predicted to grow to around USD 1411.35 million by 2032 with a compound annual growth rate (CAGR) of roughly 5.82% between 2024 and 2032.

Metal Anodizing Market: Overview

Metal anodizing refers to the widely popular electrochemical process focusing on converting the metal surface into a highly durable, decorative, and corrosion-resistant variant with anodic oxide finish. According to market experts, aluminum is the best choice for metal anodizing compared to titanium and magnesium.

The process uses electric current to create the desired oxide layer. During metal anodizing, a part of the metal surface is dipped in an acidic electrolyte solution.

The metal surface is the anode, while a cathode is placed externally in the bath. When an electric current passes through the solution, the oxygen atoms released from the electrolyte solution form a combination with the metal atoms on the surface of the dipped material, thus forming a protective oxide-based protective layer. Metal anodizing is witnessing higher demand due to the increased use of end-user materials across industries.

Some of the leading consumers of anodized metals include automotive, marine sector, and building & construction. Increased research and innovation from solutions and technology providers will further facilitate higher growth in the industry during the projection period.

Key Insights:

- As per the analysis shared by our research analyst, the global metal anodizing market is estimated to grow annually at a CAGR of around 5.82% over the forecast period (2024-2032)

- In terms of revenue, the global metal anodizing market size was valued at around USD 848.25 million in 2023 and is projected to reach USD 1411.35 million by 2032.

- The metal anodizing market is projected to grow at a significant rate due to its rising use in the automotive industry.

- Based on type, the chromic acid anodizing segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on end-user industry, the automotive segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Metal Anodizing Market: Growth Drivers

Rising use in the automotive industry to drive market demand rate during the projection period

The global metal anodizing market is projected to grow due to the growing use of the process in the automotive industry. Anodized metals are crucial parts of modern and aesthetically appealing automotives.

According to market research, anodized aluminum is widely used during the production of interior vehicle components as well as exterior parts. They are used in window frames, trim, pedals, handles, and other parts of automobiles that need to be corrosion-resistant while improving the overall appeal of the vehicle.

The global automotive industry is witnessing a steady rise in overall demand from end-consumers. The increase in global investments toward improving the production rate of modern automotives, especially electric vehicles (EVs), is an indication of the growth trend in the automobile industry.

As per official records, EV-based investments in the US have surged beyond expectations in the last few years. In June 2024, Audi, a leading German luxury car maker, announced an investment of USD 1 billion in EV projects in Mexico.

The increased efforts from regional governments to promote local manufacturing of automotives and vehicular parts will further encourage the adoption of metal anodizing in the automobile industry.

Building & construction industry to continue acting as a large investor in the industry

One of the largest contributors to the demand for metal anodizing is the global building & construction sector. Companies operating in infrastructure development activities are seeking durable materials that can be used for architectural projects.

For instance, the demand is higher for materials that offer extreme weather and pollution resistance. The changing weather patterns across the globe, along with intensifying natural calamities, have helped the global metal anodizing market grow.

Moreover, modern commercial or residential buildings must be aesthetically appealing. Companies in the building & construction industry can meet consumer demand with the aid of anodized metals across window frames & doors, structural components, railings, and exterior panels.

Metal Anodizing Market: Restraints

Applications only on limited material is one of the major drawbacks of the process

The global metal anodizing industry is restricted in terms of growth due to the applications of the procedure on limited materials only.

For instance, industry experts suggest that only specific grades of aluminum can be used for metal anodizing. Additionally, the process cannot be used on stainless steel. In the case of applications in small quantities, the solution can be highly expensive leading to limited adoption.

Such technical barriers discourage new entrants in the industry while consumers seek alternate options with higher operational and cost-efficiency.

Metal Anodizing Market: Opportunities

Growth in applications in the aerospace industry will generate new market expansion possibilities

The global metal anodizing market is projected to generate growth opportunities due to the increased applications in the aerospace industry. Anodized metal has registered excellent usage in aircraft wings, skins, and landing gears. The increased investments in the aerospace industry worldwide will promote extensive use of metal anodizing processes.

In November 2024, Boeing, one of the world’s leading producers of aircraft, announced a new partnership with Morocco. Through the agreement, the partners will work toward establishing a highly advanced manufacturing research center in the Mohammed VI Polytechnic University.

In October 2024, GE Aerospace announced an investment of EUR 130 million in the European maintenance, repair, and overhaul (MRO) industry and component repair facilities by 2026. Such investments will create more demand for ancillary processes such as metal anodizing.

Furthermore, metal anodizing has also found users in the space exploration sector. Space missions require vehicles to operate in extreme weather conditions, thus creating application opportunities for anodized metal.

Metal Anodizing Market: Challenges

Challenges associated with wastewater contamination and regulatory complexities to impact overall revenue

The global industry for metal anodizing is projected to be challenged by concerns over extensive wastewater contamination caused by the process. The use of harsh chemicals during metal anodizing can lead to heavy metal wastewater contamination, and companies must ensure compliance with regional laws related to such events.

In addition, metal anodizing is a resource-intensive process that further raises questions about the sustainability of the solution.

Metal Anodizing Market: Segmentation

The global metal anodizing market is segmented based on type, metal, end-user industry, finish, and region.

Based on the type, the global market segments are sulphuric acid anodizing, chromic acid anodizing, and hard anodizing. In 2023, the highest growth was witnessed in the chromic acid anodizing segment due to the extensive use of the end products across major industries, including automotive and aerospace.

Chromic acid anodized materials can last over 2 decades in a mild environment. During the forecast period, sulphuric acid anodizing is anticipated to register a steady rise due to higher corrosion resistance offered by the material.

Based on metal, the metal anodizing industry divisions are titanium, aluminum, and stainless steel.

Based on the end-user industry, the global metal anodizing industry is divided into consumer electronics, medical, aerospace & defense, automotive, and architecture.

In 2023, the highest demand was listed in the automotive segment. Anodized metals are used during the production of durable and appealing crucial automotive components. The emergence of the EV sector has further helped the segment thrive. The global EV market was valued at over USD 600 billion in 2023.

Based on finish, the meindustry tal anodizing divisions are patterned anodized, colored anodized, and clear anodized.

Metal Anodizing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Metal Anodizing Market |

| Market Size in 2023 | USD 848.25 Million |

| Market Forecast in 2032 | USD 1411.35 Million |

| Growth Rate | CAGR of 5.82% |

| Number of Pages | 217 |

| Key Companies Covered | Anomatic Corporation, Buckeye Anodizing & Stamping Co., Southern Aluminum Finishing Co. (SAF), AGC Industrial Solutions, Luke Engineering & Anodizing Co., Valmont Coatings, Master Metal, Tompkins Metal Finishing Inc., O-Flex Metal Finishing Inc., Dajcor Aluminum Ltd., AACOA Inc., KinTec Machining Co. Ltd., International Hardcoat Inc., K&L Anodizing, Teknicote., and others. |

| Segments Covered | By Process Type, By Metal, By End-User Industry, By Finish, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Metal Anodizing Market: Regional Analysis

North America to continue leading the market growth rate during the projection period

The global metal anodizing market will be led by North America during the forecast tenure. In 2023, the US was the leading revenue generator in the region. The presence of a massive aerospace industry, along with heavier investments in space research programs, has fueled regional demand for metal anodizing.

According to official reports, the US has amplified its investments in the EV market. In April 2024, major automotive company Honda Motor Co., Ltd. announced its plans to build a highly comprehensive electric vehicle value chain in the Canadian market.

The company is working with an investment of CAD 15 billion. Similarly, the growing launch of new solutions by regional players is expected to attract new customers across regional and international scales.

In a recent event, US-based Lorin Industries Inc., a leading player in the development of coil anodized aluminum, announced the launch of a new batch, thus solidifying the company’s hold in the market.

Europe is a growing market with significant contributions toward global revenue. In February 2024, Germany-based BASF’s coatings division, Chemetall, announced the launch of its new state-of-the-art facility in Italy. Chemetall is a leading supplier of solutions used in the surface treatment of aluminum substrates.

Metal Anodizing Market: Competitive Analysis

The global metal anodizing market is led by players like:

- Anomatic Corporation

- Buckeye Anodizing & Stamping Co.

- Southern Aluminum Finishing Co. (SAF)

- AGC Industrial Solutions

- Luke Engineering & Anodizing Co.

- Valmont Coatings

- Master Metal

- Tompkins Metal Finishing Inc.

- O-Flex Metal Finishing Inc.

- Dajcor Aluminum Ltd.

- AACOA Inc.

- KinTec Machining Co. Ltd.

- International Hardcoat Inc.

- K&L Anodizing

- Teknicote.

The global metal anodizing market is segmented as follows:

By Process Type

- Sulphuric Acid Anodizing

- Chromic Acid Anodizing

- Hard Anodizing

By Metal

- Titanium

- Aluminum

- Stainless Steel

By End-User Industry

- Consumer Electronics

- Medical

- Aerospace & Defense

- Automotive

- Architecture

By Finish

- Patterned Anodized

- Colored Anodized

- Clear Anodized

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Metal anodizing is a widely popular electrochemical process that converts the metal surface into a highly durable, decorative, and corrosion-resistant variant with an anodic oxide finish.

The global metal anodizing market is projected to grow due to the growing use of the process in the automotive industry.

According to study, the global metal anodizing market size was worth around USD 848.25 million in 2023 and is predicted to grow to around USD 1411.35 million by 2032.

The CAGR value of the metal anodizing market is expected to be around 5.82% during 2024-2032.

The global metal anodizing market will be led by North America during the forecast tenure.

The global metal anodizing market is led by players like Anomatic Corporation, Buckeye Anodizing & Stamping Co., Southern Aluminum Finishing Co. (SAF), AGC Industrial Solutions, Luke Engineering & Anodizing Co., Valmont Coatings, Master Metal, Tompkins Metal Finishing, Inc., O-Flex Metal Finishing, Inc., Dajcor Aluminum Ltd., AACOA, Inc., KinTec Machining Co. Ltd., International Hardcoat, Inc., K&L Anodizing, and Teknicote.

The report explores crucial aspects of the metal anodizing market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed