Middle East Drilling Services Market Size, Share, Trends, Growth 2032

Middle East Drilling Services Market By Application (Gas Exploration, Oil Exploration, Well Development, Resource Assessment, Groundwater Monitoring, Reservoir Evaluation, Site Preparation for Construction, and Others), By Deployment (Offshore and Onshore), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 30.25 Billion | USD 49.47 Billion | 6.34% | 2022 |

Middle East Drilling Services Industry Prospective:

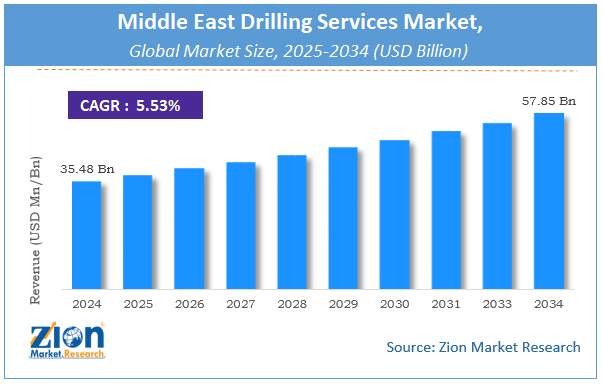

The Middle East drilling services market size was worth around USD 30.25 billion in 2022 and is predicted to grow to around USD 49.47 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.34% between 2023 and 2030.

Middle East Drilling Services Market: Overview

The Middle East drilling services deal with companies and businesses operating in the Middle Eastern region and provide services related to drilling activities for all industrial sectors. Drilling is a process in which a concrete surface is dug using large mechanical tools for various purposes. For instance, some of the most common applications of drilling projects include geothermal drilling, oil & gas exploration drilling, directional drilling, water well drilling, managed pressure drilling, and many others.

The Middle East drilling services industry is one of the highest-revenue generating industries across the globe as a result of greater application of these services across sectors such as energy, mining, environmental science, and building & construction. Each end-user industry has specific requirements thus drilling services providers must customize their solutions depending on client requirements. During the forecast period, the demand for drilling services in the Middle East is expected to grow rapidly as a result of increasing regional investments.

Key Insights:

- As per the analysis shared by our research analyst, the Middle East drilling services market is estimated to grow annually at a CAGR of around 6.34% over the forecast period (2023-2030)

- In terms of revenue, the Middle East drilling services market size was valued at around USD 30.25 billion in 2022 and is projected to reach USD 49.47 billion, by 2030.

- The market is projected to grow at a significant rate due to the presence of the world’s most dominant oil & gas industry

- Based on application segmentation, oil exploration was predicted to show maximum market share in the year 2022

- Based on deployment segmentation, onshore was the leading segment in 2022

- On the basis of region, Qatar was the leading revenue generator in 2022

Middle East Drilling Services Market: Growth Drivers

Presence of the world’s most dominant oil & gas industry will drive the market growth rate

The Middle East drilling services market is projected to grow owing to the presence of the world’s highest revenue-generating oil & gas industry in several Middle Eastern countries. They are considered the backbone of global oil production since they meet oil & gas demand for several major economies. In 2022, Saudi Arabia supplied approximately 456,000 barrels of crude oil per day to the United States. Drilling services are critical aspects of the regional oil & gas industry since drilling equipment is required for all aspects of the oil exploration activities. They are an essential part of these projects from the start until the end of the process.

Drilling services companies not only provide drilling equipment but also participate in other aspects of drilling. For instance, developing critical reports, ensuring drilling accuracy, and preventing avoidable impacts on the environment. The Middle Eastern governments have increased their oil exploration investments since the global demand for oil has increased. The rising investments are further fueled by the ongoing Russia-Ukraine war. Since Russia is currently witnessing a rise in the number of global sanctions against oil trade, more countries are focusing on oil generated from the Gulf nations.

In October 2023, the oil ministry of Kuwait announced its plan to expand its oil production capacity by developing supporting infrastructure at the Durra gas field. As per projections, the Kuwait Petroleum Corporation (KPC) is expected to increase its production capacity to 4 million barrels a day by 2035.

Increasing launch of new drilling equipment and technologies may result in higher revenue

The demand for regional drilling services may witness a positive impact due to the increasing technological developments in drilling equipment and solutions. Service providers are working on developing advanced technologies that offer higher performance and accuracy. Furthermore, the growing focus on leveraging artificial intelligence (AI) to improve drilling project results will allow higher revenue during the forecast period.

Middle East Drilling Services Market: Restraints

High cost of equipment and services to restrict market growth

The Middle East drilling services market is expected to be restricted due to the high cost of equipment. Drilling machines are large pieces of equipment. These heavy pieces of machinery have to be designed carefully with the right raw materials.

Furthermore, any error in the manufacturing of drilling equipment can lead to error in the drilling process thus jeopardizing the results of the complete process. The resource-intensive characteristics of drilling equipment lead to a restricted number of players operating in the regional market.

Middle East Drilling Services Market: Opportunities

Increasing investments in construction projects including the real-estate sector may generate high-growth opportunities

The Middle East drilling services market is expected to come across multiple growth opportunities due to the increasing investments in regional construction projects. In the last few years, Middle Eastern countries have been working on expanding their offerings. They are trying to develop novel means of growth opportunities by diversifying across sectors including real-estate and sports or entertainment sectors. For instance, the United Arab Emirates (UAE) has become a financial center point among leading business houses. Additionally, the country is eyeing the tourism industry by developing world-class infrastructure.

For instance, Dubai is expected to witness the completion of the Wasl Tower in 2024. Upon completion, the sky-high complex will become one of the world’s most sustainable towers in the region. The design of the complex will exhibit a controlled acoustical environment thus preventing a noise-free space. In January 2024, the crown prince of Dubai approved the additional plans to transform the Hatta region into one of the country’s most fascinating tourist spots.

Middle East Drilling Services Market: Challenges

Rising entry of international players in the regional market could challenge the growth rate

The Middle East drilling services market will be challenged by the presence of an extensive international market that is steadily entering the regional economy. Companies from other regions such as Europe and the US have witnessed an increase in partnerships thus leading to higher competition for the domestic players.

Middle East Drilling Services Market: Segmentation

The Middle East drilling services market is segmented based on application, deployment, and region.

Based on application, the market is divided into gas exploration, oil exploration, well development, resources assessment, groundwater monitoring, reservoir evaluation, site preparation for construction, and others. In 2022, the highest growth was witnessed in the oil exploration activities. The Middle East countries are the world’s leading suppliers of oil & gas. These countries have increased their spending on advancing oil exploration projects. As per official data, the regional countries hold over 48% of the world’s total oil reserves.

Based on deployment, the market segments are offshore and onshore. In 2022, the offshore segment registered the highest growth rate due to a higher number of activities conducted onshore including oil exploration projects and construction activities. The offshore segment is projected to become the leading revenue generator during the forecast period due to the increased offshore construction projects in the Middle East. Dubai is projected to invest USD 11 billion in the coming years toward the expansion of clean energy projects in the region.

Middle East Drilling Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Middle East Drilling Services Market |

| Market Size in 2022 | USD 30.25 Billion |

| Market Forecast in 2030 | USD 49.47 Billion |

| Growth Rate | CAGR of 6.34% |

| Number of Pages | 208 |

| Key Companies Covered | National Oilwell Varco (NOV), Schlumberger, Baker Hughes, Halliburton, Abraj Energy Services, Weatherford International, Nabors Industries, Eastern Drilling Company (EDC), Saipem, Precision Drilling, Kuwait Drilling Company, Archer Limited, Arabian Drilling Company, Parker Drilling, Dalma Energy, and others. |

| Segments Covered | By Application, By Deployment, and By Region |

| Countries Covered | Middle East, Saudi Arabia, UAE, Egypt, and Kuwait |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Middle East Drilling Services Market: Regional Analysis

Qatar to register the highest growth rate during the projection period

The Middle East drilling services market will be led by Qatar during the projection period. It is currently the wealthiest country in the Gulf region. Some of the main buyers of Qatar oil are China, Japan, Thailand, Singapore, and South Korea. These nations are registering high economic growth fueling the demand for oil supply thus promoting higher growth in the Qatar region. Additionally, the growing investments by the regional heads toward the infrastructure development of Qatar may aid its control over regional revenue. Saudi Arabia is one of the fastest-growing nations in the Middle East. The massive supply of oil from Saudi Arabia to key economies globally has been helpful in promoting the regional growth rate. The Saudi government has shown interest in the exploration of hydrocarbons which could be beneficial for the market players during the projection period.

The Middle East drilling services industry is expected to generate higher growth due to the rising investments in water-well drilling projects. As per official reports, the Middle East is expected to witness high demand for water-well drilling initiatives to ensure economic growth during the forecast period. As the region's needs and demands continue to evolve with the growing number of population and rising rate of international companies operating from Middle Eastern regions, the regional market players can expect higher demand.

Middle East Drilling Services Market: Competitive Analysis

The Middle East drilling services market is led by players like:

- National Oilwell Varco (NOV)

- Schlumberger

- Baker Hughes

- Halliburton

- Abraj Energy Services

- Weatherford International

- Nabors Industries

- Eastern Drilling Company (EDC)

- Saipem

- Precision Drilling

- Kuwait Drilling Company

- Archer Limited

- Arabian Drilling Company

- Parker Drilling

- Dalma Energy

The Middle East drilling services market is segmented as follows:

By Application

- Gas Exploration

- Oil Exploration

- Well Development

- Resource Assessment

- Groundwater Monitoring

- Reservoir Evaluation

- Site Preparation for Construction

- Others

By Deployment

- Offshore

- Onshore

By Region

- The Middle East

- Saudi Arabia

- UAE

- Egypt

- Kuwait

Table Of Content

Methodology

FrequentlyAsked Questions

The Middle East drilling services deal with companies and businesses operating in the Middle Eastern region and provide services related to drilling activities for all industrial sectors.

The Middle East drilling services market is projected to grow owing to the presence of the world’s highest revenue-generating oil & gas industry in several Middle Eastern countries.

According to study, the Middle East drilling services market size was worth around USD 30.25 billion in 2022 and is predicted to grow to around USD 49.47 billion by 2030.

The CAGR value of the Middle East drilling services market is expected to be around 6.34% during 2023-2030.

The Middle East drilling services market will be led by Qatar during the projection period.

The Middle East drilling services market is led by players like National Oilwell Varco (NOV), Schlumberger, Baker Hughes, Halliburton, Abraj Energy Services, Weatherford International, Nabors Industries, Eastern Drilling Company (EDC), Saipem, Precision Drilling, Kuwait Drilling Company, Archer Limited, Arabian Drilling Company, Parker Drilling, and Dalma Energy.

The report explores crucial aspects of the Middle East drilling services market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed