Military Satellite Market Size, Share, Industry Analysis, Trends, Growth, 2032

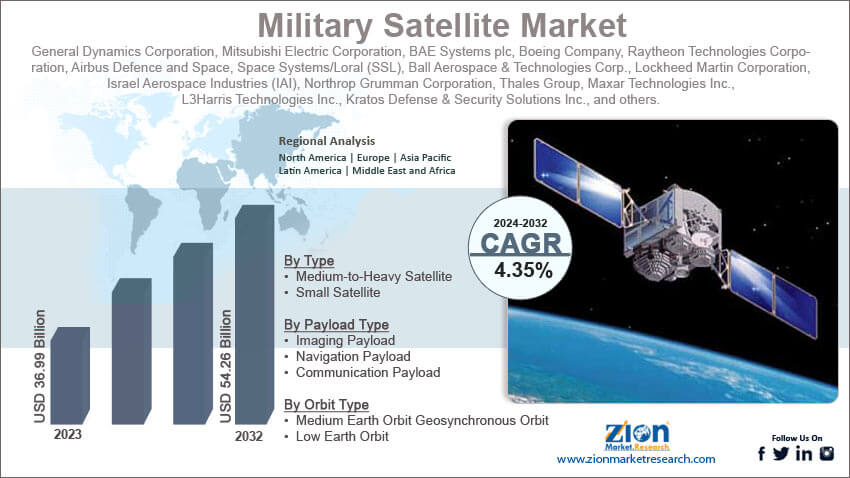

Military Satellite Market By Type (Medium-to-Heavy Satellite and Small Satellite), By Payload Type (Imaging Payload, Navigation Payload, Communication Payload, and Others), By Orbit Type (Medium Earth Orbit Geosynchronous Orbit and Low Earth Orbit), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

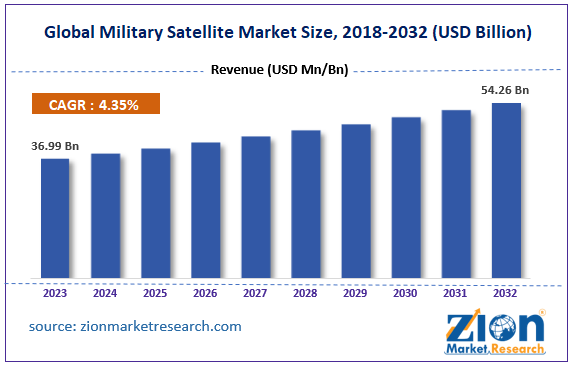

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 36.99 Billion | USD 54.26 Billion | 4.35% | 2023 |

Military Satellite Industry Prospective:

The global military satellite market size was worth around USD 36.99 billion in 2023 and is predicted to grow to around USD 54.26 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.35% between 2024 and 2032.

Military Satellite Market: Overview

Military satellites are artificially-made satellites that serve the specific purpose of military applications. These satellites are primarily used for military communications, navigation, and gathering of intelligence that is further used for improving national security. These highly advanced devices are placed in the Earth’s orbit and were first developed by the US in the 1950s. The pilot military satellite was used for photographic reconnaissance. In the later years, the US tried to develop satellite-based weapons but due to intervention from global welfare agencies, the idea was halted since a consensus was reached to ban the deployment of weapons for mass destruction in the orbit of the planet. Since then, military satellites have been largely used for gathering critical intel or for communication purposes. While the US continues to act as a world leader in terms of deploying military satellites, more countries have followed the path and launched domestically funded and developed satellites. In modern day and age, military satellites have become an integral part of maintaining and guarding national security since these tools are used for communication of important information related to potential threats. Moreover, tactical satellites are also used in ongoing military conflict. The cost of manufacturing and launching military-grade satellites is extremely high. Additionally, military satellites are strictly regulated which adds to the overall complexities in the industry.

Key Insights:

- As per the analysis shared by our research analyst, the global military satellite market is estimated to grow annually at a CAGR of around 4.35% over the forecast period (2024-2032)

- In terms of revenue, the global military satellite market size was valued at around USD 36.99 billion in 2023 and is projected to reach USD 54.26 billion, by 2032.

- The market is projected to grow at a significant rate due to the rising rate of cross-border and internal conflicts

- Based on the type, the small satellite segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the orbit type, the low Earth Orbit segment is anticipated to command the largest market share

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Military Satellite Market: Growth Drivers

Rising rate of cross-border and internal conflicts will drive the market demand

The global military satellite market is expected to grow due to the growing cases of cross-border terrorism and internal conflicts. The textbook definition of terrorism describes it as the act of violence against innocent people or non-combatants with the aim of achieving ideological or political gain. Terrorism has been one of the most pressing concerns for the general population, regional governments, and global welfare organizations to overcome. Around 9% of the global deaths are a result of terrorism-related acts. These activities are harmful to an economy in the long run. It affects peace in a region. Terrorist activities are also known to drastically reduce the extent of economic growth in regions that are constantly exposed to such violent events. Terrorists and their activities are not confined to specific countries. These events occur across the globe. In some countries, the frequency and impact of terrorist-related activities are higher than in others. Nonetheless, terrorists can be located in all countries. Regional militaries are actively seeking new solutions to prevent terrorism-related incidents. Apart from obtaining information related to terrorists, their assets, and other intel, one of the primary focuses of national security teams is on gathering pre-incident intelligence to curb violent activities before they are set into motion. For instance, as per claims made by Israeli officials, around 300 drone missiles were launched by Iran toward Israel. Out of which, the country’s military agencies intercepted 99% of the missiles. This is made possible with the help of military satellites.

Emerging economies will generate significant revenue during the projection period

Emerging economies such as African nations, India, and China are witnessing a surge in investments across industries. Developing nations are actively investing in areas that will help the countries survive in the current state of social and political turmoil. The regional governments across emerging nations are giving utmost importance to national security. In December 2023, Japanese government officials approved the largest defense budget the country has ever seen thus contributing to the global military satellite market. Japan’s recent announcement has allotted nearly 43 trillion yen to the country’s defense team.

Military Satellite Market: Restraints

High cost of developing military-grade satellites may restrict the market expansion

The global industry for military satellites is backed by heavy funding. These devices are state-of-the-art technologies. Designing military satellites, deploying them in outer space, and ensuring the satellites’s connection to the systems located on Earth's surface remains unbroken demands extensive investments which is a primary cause of the restricted growth in the industry. For instance, the recently launched GSAT-7 satellite for the Indian Armed Forces developed by the Indian Space Research Organisation procured a launch cost of INR 480 crore. The satellite itself was built at a cost of INR 185 crore.

Military Satellite Market: Opportunities

Artificial Intelligence (AI) and Machine Learning (ML) to change the industry’s growth outlook in the future

The global military satellite market is projected to generate high growth opportunities in the coming years. Advanced technologies such as AI and ML have the potential to completely change the way military satellites capture and transmit information. Moreover, these technologies can be leveraged to improve the overall performance of military satellites in the coming years. For instance, as per March 2024 reports, India is currently experimenting with AI-powered satellite imagery analysis, vehicle tracking, facial recognition, and natural language processing for its defense teams. In April 2024, technology giant Google announced that the company would provide AI technologies to the National Guard for analyzing disaster areas and draft military response accordingly. In March 2024, BlackSky, a leading supplier of satellite images, announced that it had signed a USD 2 million defense contract from the US national security agencies. Through this partnership, the former is obligated to provide AI models. The company will provide burst images to the US defense teams for training AI technologies to track moving targets.

Communication satellites may have higher demand during the forecast period

While military satellites have several applications, market trends indicate that there is a thriving market for communication-oriented military satellites. National security agencies are seeking satellites that are hack-proof. These communication tools are undergoing major changes to improve their data transmission capabilities by improving aspects such as speed and security. In May 2022, space communication reached a major breakthrough when two military satellites launched in 2021 completed an experiment in which they demonstrated cross-satellite communication using lasers thus paving more growth opportunities for the global military satellite market.

Military Satellite Market: Challenges

Regulatory hurdles surrounding military satellites are a major challenge for the industry players

The global industry for military satellites is challenged by the presence of several regulatory hurdles surrounding the production, launch, and use of military satellites. The industry is heavily regulated by international agencies as well as domestic laws. Moreover, companies wanting to participate in military satellite production must ensure 100% compliance with regional laws. The risk of intellectual property (IP) infringement continues to bother military space agencies globally.

Military Satellite Market: Segmentation

The global military satellite market is segmented based on type, payload type, orbit type, and region.

Based on the type, the global market segments are medium-to-heavy satellites and small satellites. In 2023, the highest demand was observed in the small satellite segment. These variants do not weigh over 2600 lbs. They are of moderate size and mass. The high cost of manufacturing medium-to-heavy satellites may be unaffordable for a large number of military groups. In such cases, small satellites may prove beneficial. These devices are also known as CubeSats. Developed economies with higher funding continue to invest in medium-to-heavy satellites.

Based on payload type, the global military satellite divisions are imaging payload, navigation payload, communication payload, and others.

Based on orbit type, the global market segments are medium Earth Orbit, geosynchronous orbit, and low Earth Orbit. In 2023, the highest growth was observed in the low Earth Orbit segment. These satellites are deployed not more than 2000 kilometers from the Earth’s surface. They are used for surveillance and reconnaissance activities thus leading to higher investments in the developed or low orbit satellites. Medium Earth Orbit satellites can present in the range of 2000 km to 35,786 km from the surface of the Earth.

Military Satellite Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Military Satellite Market |

| Market Size in 2023 | USD 36.99 Billion |

| Market Forecast in 2032 | USD 54.26 Billion |

| Growth Rate | CAGR of 4.35% |

| Number of Pages | 218 |

| Key Companies Covered | General Dynamics Corporation, Mitsubishi Electric Corporation, BAE Systems plc, Boeing Company, Raytheon Technologies Corporation, Airbus Defence and Space, Space Systems/Loral (SSL), Ball Aerospace & Technologies Corp., Lockheed Martin Corporation, Israel Aerospace Industries (IAI), Northrop Grumman Corporation, Thales Group, Maxar Technologies Inc., L3Harris Technologies Inc., Kratos Defense & Security Solutions Inc., and others. |

| Segments Covered | By Type, By Payload Type, By Orbit Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Military Satellite Market: Regional Analysis

Asia-Pacific is expected to witness the highest growth during the forecast period

The global military satellite market is expected to witness high growth in Asia-Pacific during the forecast period. China may lead the regional growth in the coming years. In recent times, the Chinese government has shifted its focus to resource-intensive financial commitment including upgrading its national security teams and defense agencies. In February 2024, official reports indicated that China launched a classified military satellite toward the geostationary belt. The successful launch of the TJS-11 (Tongxin Jishu Shiyan-11 payload was confirmed by the China Aerospace Science and Technology Corp., (CASC). In December 2023, the country launched highly confidential spy satellites which have been used for continuous surveillance of the Indo-Pacific region. The spy satellite is called the Yaogan-41, the largest rocket owned by the country, the Long March 5 launcher, modified to achieve the goal. Similarly, India has been making several investments in deploying military satellites to help the regional defense team become better equipped to handle national security threats. In April 2024, Tata Advanced Systems Ltd (TASL) announced the launch of India's first military geospatial satellite with the help of a SpaceX rocket. This is the first time that a military-grade satellite in India has been 100% built by a private company.

Military Satellite Market: Competitive Analysis

The global military satellite market is led by players like:

- General Dynamics Corporation

- Mitsubishi Electric Corporation

- BAE Systems plc

- Boeing Company

- Raytheon Technologies Corporation

- Airbus Defence and Space

- Space Systems/Loral (SSL)

- Ball Aerospace & Technologies Corp.

- Lockheed Martin Corporation

- Israel Aerospace Industries (IAI)

- Northrop Grumman Corporation

- Thales Group

- Maxar Technologies Inc.

- L3Harris Technologies Inc.

- Kratos Defense & Security Solutions Inc.

The global military satellite market is segmented as follows:

By Type

- Medium-to-Heavy Satellite

- Small Satellite

By Payload Type

- Imaging Payload

- Navigation Payload

- Communication Payload

By Orbit Type

- Medium Earth Orbit Geosynchronous Orbit

- Low Earth Orbit

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Military satellites are artificially-made satellites that serve the specific purpose of military applications.

The global military satellite market is expected to grow due to the growing cases of cross-border terrorism and internal conflicts.

According to study, the global military satellite market size was worth around USD 36.99 billion in 2023 and is predicted to grow to around USD 54.26 billion by 2032

The CAGR value of military satellite market is expected to be around 4.35% during 2024-2032.

The global military satellite market is expected to witness high growth in Asia-Pacific during the forecast period.

The global military satellite market is led by players like General Dynamics Corporation, Mitsubishi Electric Corporation, BAE Systems plc, Boeing Company, Raytheon Technologies Corporation, Airbus Defence and Space, Space Systems/Loral (SSL), Ball Aerospace & Technologies Corp., Lockheed Martin Corporation, Israel Aerospace Industries (IAI), Northrop Grumman Corporation, Thales Group, Maxar Technologies Inc., L3Harris Technologies, Inc. and Kratos Defense & Security Solutions, Inc.

The report explores crucial aspects of the military satellite market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Military SatelliteIndustry Prospective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesCommunication satellites may have higher demand during the forecast periodChallengesSegmentationReport ScopeRegional AnalysisCompetitive AnalysisThe global military satellite market is segmented as follows:By RegionNorth AmericaHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed