Milking Robots Market Size, Share, Trends, Growth and Forecast 2032

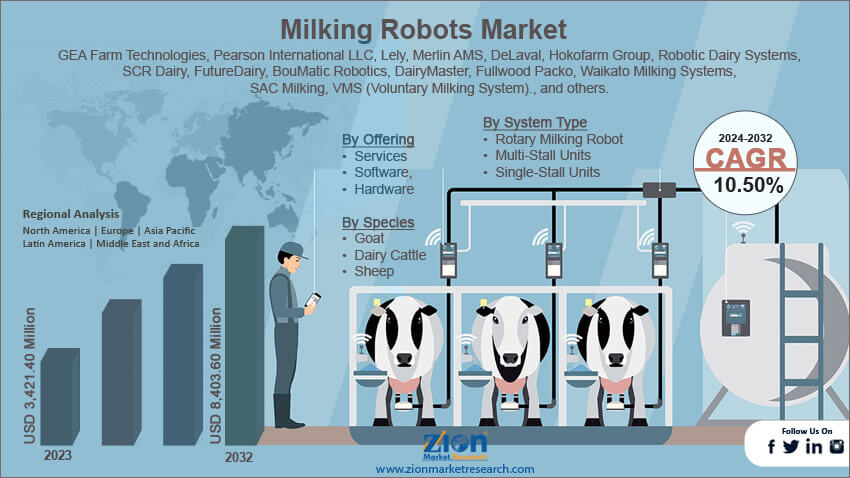

Milking Robots Market By Offering (Services, Software, and Hardware), By Herd Size (Above 1000, Between 100 and 1000, Below 100), By System Type (Rotary Milking Robot, Multi-Stall Units, and Single-Stall Units), By Species (Goat, Dairy Cattle, and Sheep), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

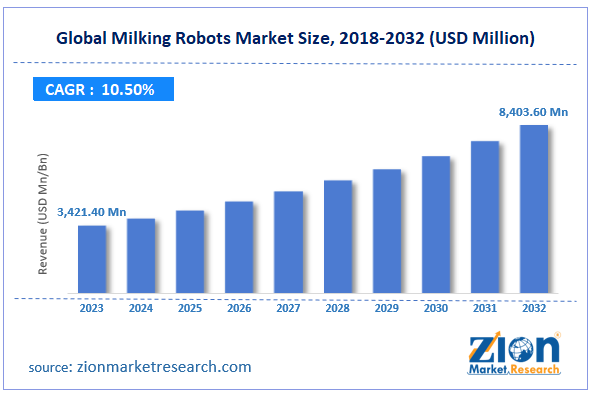

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3,421.40 Million | USD 8,403.60 Million | 10.50% | 2023 |

Milking Robots Industry Prospective:

The global milking robots market size was worth around USD 3,421.40 million in 2023 and is predicted to grow to around USD 8,403.60 million by 2032 with a compound annual growth rate (CAGR) of roughly 10.50% between 2024 and 2032.

Milking Robots Market: Overview

Milking robots are used in the process of automatic milking. These are automated robotic tools used for milking dairy cattle with zero human intervention. Milking robots are also known as voluntary milking systems (VMS) or automatic milking systems (AMS). Milking robots were first developed in the 20th century and since then have become highly commercial in several types of herd settings. Milking robots can be classified as a type of agricultural robot. Traditional methods of milking cattle can be labor intensive. In addition to this, when cattle enter the lactation period, the milking process has to be consistent in terms of milking frequency. For instance, lactating cattle should be ideally milked twice a day with sufficient time between the two milking processes.

Additionally, other dairy farm work must be programmed in accordance with milking time and duration. This means the labor employed to milk cattle has to be consistently present. This translates to extreme reliance on human labor for the milking process. To reduce the pressure on human labor, automated milking robots were developed. These machines are powered using a software program and a hardware device. Modern milking robots offer advanced features that promote product adoption in the commercial market. During the forecast period, the industry for milking robots is expected to garner high revenue as consumer awareness steadily rises.

Key Insights:

- As per the analysis shared by our research analyst, the global milking robots market is estimated to grow annually at a CAGR of around 10.50% over the forecast period (2024-2032).

- In terms of revenue, the global milking robots market size was valued at around USD 3,421.40 million in 2023 and is projected to reach USD 8,403.60 million by 2032.

- The market is projected to grow at a significant rate due to the growing demand in the dairy industry.

- Based on offering segmentation, the hardware segment is projected to swipe the largest market share.

- Based on system segmentation, the rotary milking robot segment is growing at a high rate and is projected to dominate the global market.

- On the basis of region, Europe is expected to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Milking Robots Market: Growth Drivers

Growing demand in the dairy industry to drive market growth rate

The global milking robot market is expected to grow due to the rising demand for dairy products across the globe. In 2023, the dairy industry was valued at over USD 940 billion and is projected to exhibit a CAGR of over 5% during the forecast period. The dairy sector is essentially run by milk produced by cattle and other mammals such as goats and sheep. The growing population rate is a primary driver of end-consumers. In addition to this, the disposable income of the general population is on the rise. The higher access to food products through the launch of new supermarkets, hypermarkets, and other forms of grocery-based retail stores is also promoting the market growth rate. The dairy sector is further influenced by the integration of digital systems and solutions in the food industry. For instance, the launch of food delivery applications in addition to the quick delivery model has managed to revolutionize grocery purchases, especially in urban areas.

In September 2023, Getir, a European quick commerce company, and Uber Eats announced a partnership in the United Kingdom. The tie-up is expected to expand the range of groceries on the Uber Eats application. In November 2023, Netherlands-based Crisp, a grocery application, raised around €35 million which the company is expected to use to expand their business and change the European food system. Meeting such drastically changing demands of end-consumers can be difficult for milk producers and suppliers, especially in case of a lack of sufficient human labor. Milking robots are automated systems that showcase high efficiency in milking activities. They do not require any assistance from human resources and thus can be employed by large food companies that deal with the sale of milk and associated products.

Milking Robots Market: Restraints

High cost of milking robots to restrict the market expansion rate

The global milking robots market is expected to be restricted due to the high cost of milking robots. The hardware and software programs responsible for powering milking robots are expensive and high maintenance. The average cost of a milking robot can range between USD 150,000 to USD 200,000 thus making it unaffordable for smaller players to adopt the product.

In addition to this, milking robots pose the threat of replacing human resources if adopted on a large scale. The robotics and automation industry is already witnessing resistance from human labor due to the risk it poses in replacing humans at work.

Milking Robots Market: Opportunities

Improvements in milking robot technology will generate high-growth opportunities

The global industry for milking robots is expected to come across high growth opportunities due to the growing improvements in product technology and services. Moreover, companies are working toward reducing the overall cost of technology to improve its affordability. In January 2024, DeLaval, a leading player in the milking robots sector launched a new product in the market in the form of VMS™ Batch Milking system. The product not only reduces human labor but also increases milking efficiency.

In July 2021, GEA launched the next generation of the DairyPro and DairyRobot R9500 automatic milking systems. The next generation has showcased multiple optimizations with benefits such as the MilkRack milking unit and the In-Liner Everything milking process. The new tools are backed by novel software package 1.5 that offers a new separation mode thus saving resources and time.

Rising efforts by regional governments to promote digitization in the agriculture sector will create further expansion possibilities

The global milking robot market will be impacted by the growing efforts of the government to digitize the agricultural sector. In September 2023, India’s agri-startup Ninjacart, announced the launch of the Agri Next initiative through which the company wishes to promote digital solutions across the country’s agricultural value chain.

In February 2024, the European Commission launched a new set of calls with a total worth of €176 million through the Digital Europe Programme. Initiatives such as extended subsidies, tax rebates, and additional benefits can help the increased adoption of milking robots.

Additional benefits offered by milking robots to promote greater use of the device

Modern milking robots provide several additional benefits apart from automatic milking. Some of the novel advantages include using digital systems to generate data-backed information on milk factors when external factors such as feedstock quality or quantity are changed. Additionally, these tools can be used to make predictive analyses in case the cattle are at risk of medical danger thus affecting the milking robots industry.

Milking Robots Market: Challenges

Limited bonding time between herd and farmer is a key challenge to overcome

The global milking robot market is a leading cause of limited bonding time between farmers and the herd. In a traditional setup, farmers get to check the health of the animals. However, in automated solutions, this step is eliminated. Additionally, farmers have to rely heavily on companies supplying the essential software and services needed to run the milking robots.

Milking Robots Market: Segmentation

The global milking robots market is segmented based on offering, herd size, system type, species, and region.

Based on offering, the global market divisions are services, software, and hardware. In 2023, the hardware segment was the highest revenue generator. More than 70.01% of the total share was dominated by the hardware segment. The rising investments in automated solutions specially designed for the dairy industry along with the increasing shortage of labor are expected to drive the segmental market demand. Software solutions are provided by the robotic tools suppliers.

Based on herd size, the global milking robots industry segments are above 1000, between 100 and 1000, and below 100.

Based on system type, the global market is divided into rotary milking robots, multi-stall units, and single-staff units. During the forecast period, the rotary milking robot segment is expected to grow at a CAGR of over 20.01%. These tools work as a combination of milking robots and rotary parlors thus offering improved services by milking multiple cattle at once in a streamlined fashion. The modernization of the dairy industry is likely to benefit the segmental demand.

Based on species, the global market divisions are goat, dairy cattle, and sheep.

Milking Robots Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Milking Robots Market |

| Market Size in 2023 | USD 3421.40 Million |

| Market Forecast in 2032 | USD 8,403.60 Million |

| Growth Rate | CAGR of 10.50% |

| Number of Pages | 208 |

| Key Companies Covered | GEA Farm Technologies, Pearson International LLC, Lely, Merlin AMS, DeLaval, Hokofarm Group, Robotic Dairy Systems, SCR Dairy, FutureDairy, BouMatic Robotics, DairyMaster, Fullwood Packo, Waikato Milking Systems, SAC Milking, VMS (Voluntary Milking System)., and others. |

| Segments Covered | By Offering, By Herd Size, By System Type, By Species, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Milking Robots Market: Regional Analysis

Europe to deliver the best results during the forecast period

The global milking robot market will be dominated by Europe during the forecast period. The region held control over 30.01% of the global revenue in 2023. The presence of a large-scale regional dairy industry along with the growing focus of digitizing the region’s agriculture sector will fuel the market growth rate in Europe. The region is witnessing a surging demand rate for dairy products. The rise in the international travel index mainly focusing on the region’s food industry is driving the demand for the regional dairy sector. However, the region is facing labor shortages in farmlands. Milking robots can be helpful in dealing with the product at an effective rate.

In February 2021, Lantmännen, a Sweden-based agriculture cooperative replaced its old rotary with 7 milking cows belonging to the range of DeLaval VMS™ V310 and DeLaval VMS™ V300. The cooperative will use the technologies to improve the output from the milking process. The North American market is growing at a fast pace. The reason for higher regional growth is the presence of a large food & beverage industry. The US food corporations have a global presence. These companies are heavy investors in agriculture technology since the digital systems allow them to keep up with the ever-increasing demand for food & beverages.

Milking Robots Market: Competitive Analysis

The global milking robots market is led by players like:

- GEA Farm Technologies

- Pearson International LLC

- Lely

- Merlin AMS

- DeLaval

- Hokofarm Group

- Robotic Dairy Systems

- SCR Dairy

- FutureDairy

- BouMatic Robotics

- DairyMaster

- Fullwood Packo

- Waikato Milking Systems

- SAC Milking

- VMS (Voluntary Milking System).

The global milking robots market is segmented as follows:

By Offering

- Services

- Software,

- Hardware

By Herd Size

- Above 1000

- Between 100 and 1000

- Below 100

By System Type

- Rotary Milking Robot

- Multi-Stall Units

- Single-Stall Units

By Species

- Goat

- Dairy Cattle

- Sheep

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Milking robots are used in the process of automatic milking.

The global milking robot market is expected to grow due to the rising demand for dairy products across the globe.

According to study, the global milking robots market size was worth around USD 3,421.40 million in 2023 and is predicted to grow to around USD 8,403.60 million by 2032.

The CAGR value of milking robots market is expected to be around 10.50% during 2024-2032.

The global milking robot market will be dominated by Europe during the forecast period.

The global milking robots market is led by players like GEA Farm Technologies, Pearson International LLC, Lely, Merlin AMS, DeLaval, Hokofarm Group, Robotic Dairy Systems, SCR Dairy, FutureDairy, BouMatic Robotics, DairyMaster, Fullwood Packo, Waikato Milking Systems, SAC Milking, and VMS (Voluntary Milking System).

The report explores crucial aspects of the milking robots market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed