Mining Chemicals Market Size, Share, Analysis, Trends, Growth, 2032

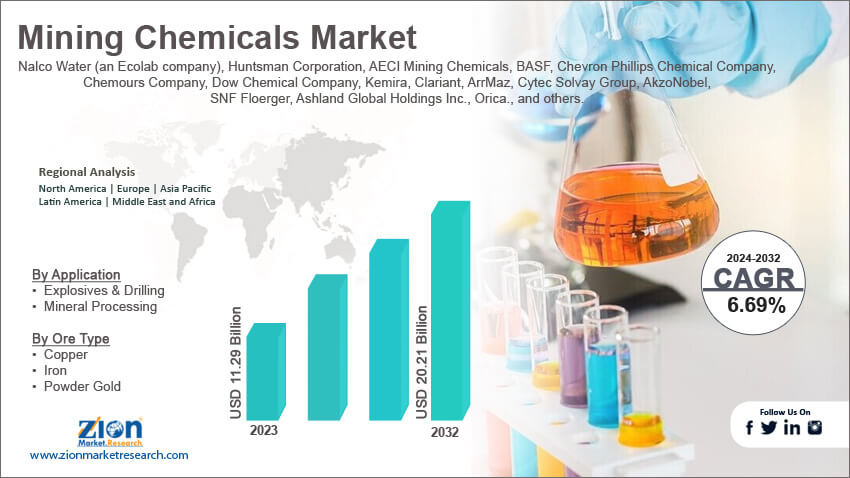

Mining Chemicals Market By Application (Explosives & Drilling and Mineral Processing), By Ore Type (Copper, Iron, Powder Gold, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

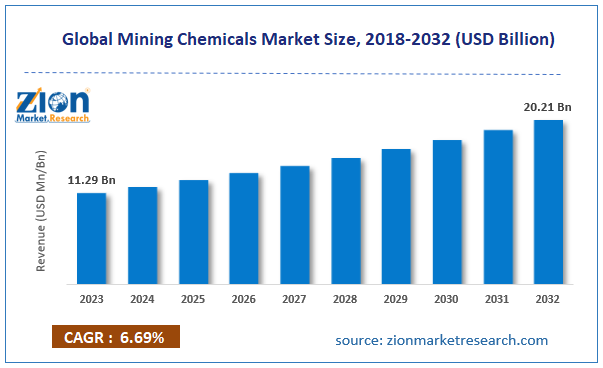

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.29 Billion | USD 20.21 Billion | 6.69% | 2023 |

Mining Chemicals Industry Prospective:

The global mining chemicals market size was worth around USD 11.29 billion in 2023 and is predicted to grow to around USD 20.21 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.69% between 2024 and 2032.

Mining Chemicals Market: Overview

Mining chemicals are materials specially designed to be used during mining procedures. These chemicals assist in ensuring that the mining process can be completed without any hindrances and obstacles. Furthermore, they also assist in improving the overall mining output quality. Mining chemicals have applications across processes such as extraction, mineral processing, refining, separation, and extraction. Mining chemicals are classified into several types: solvent extractants, flotation reagents, leaching chemicals, depressants & dispersants, coagulants & flocculants, corrosion inhibitors, dust control chemicals, and pH modifiers. The demand for mining chemicals has been on the rise due to the growing investments in the mining sector across the globe. However, some of the chemicals used in mining activities are extremely dangerous to the environment and can cause significant environmental damage. This has led to the mining chemicals market players seeking safer alternatives as the mining industry is under constant pressure to reduce the effects of business operations on environmental conditions.

Key Insights:

- As per the analysis shared by our research analyst, the global mining chemicals market is estimated to grow annually at a CAGR of around 6.69% over the forecast period (2024-2032)

- In terms of revenue, the global mining chemicals market size was valued at around USD 11.29 billion in 2023 and is projected to reach USD 20.21 billion, by 2032.

- The mining chemicals market is projected to grow at a significant rate due to the rising coal mining activities globally

- Based on the application, the explosives & drilling segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the ore type, the iron segment is anticipated to command the largest market share

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Mining Chemicals Market: Growth Drivers

Rising coal mining activities globally will drive the demand for associated chemicals

The global mining chemicals market is expected to grow due to the growing rate of coal mining across the globe. Coal is a widely used and valuable source of energy due to its combustible nature. It consists of a high amount of hydrocarbons and carbon. The growing end-user power needs worldwide are driving the consumption of coal. Apart from power-based applications, it is also used in the production of other essential materials such as carbon fibers & foams, cement, synthetic petroleum-based fuels, and medicines. As per the International Energy Agency (IEA), coal demand rose by 1.3% in 2023 becoming the first time coal consumption crossed more than 8.5 million tonnes. Market research suggests that Europe may witness significant investments toward reviving the regional coal mining industry. As Europe has moved to more climate-friendly solutions, the region has witnessed a slump in mining investment. However, this has led to Europe facing difficulties in procuring essential minerals and materials required for running the highly industrialized region especially influenced by the impact of the Russia-Ukraine war. In October 2022, Europe invested € 142 million in funding research for steel and coal projects. Emerging nations are investing heavily in exploring coal reserves to meet the rapidly growing energy demands.

Higher demand for precious minerals worldwide will assist in greater consumption of mining chemicals

Previous minerals such as diamonds, silver, and gold among others have gained popularity across the globe. These minerals have become a staple form of personal jewelry ranging from more affordable options to luxurious items. For instance, diamond jewelry is often some of the most highly-priced accessories owned by men and women across all adult age groups. The global jewelry industry is rapidly expanding to new territories by offering customized solutions to customers. For instance, the popular luxury jewelry brand Bvlgari re-entered the Indian market in 2014 and continues to offer new products. In April 2024, the brand is expected to launch new products for Indian customers. Similarly, domestic jewelry makers offering exquisite and unique designs along with the availability of financial assistance are shaping the precious minerals industry thus ultimately impacting the global mining chemicals market.

Mining Chemicals Market: Restraints

Significant harmful impact of mining chemicals will limit the market’s production rate

The global industry for mining chemicals is expected to be restricted due to the severe environmental impact of harsh chemicals used during mining processes. For instance, one of the most harmful chemicals used for separating gold from the ore is cyanide. The chemical can be fatal if ingested. Extremely small quantities of the chemicals can kill a person. While mining companies use precautionary measures to reduce or eliminate the potency of the chemical, the risk of mishaps persists which can be deadly for the people and the environment. Similarly sulfuric acid can lead to severe burns, deaths, and blindness. These chemicals are not only harmful to the people involved in working with them in proximity but also to the environment.

Mining Chemicals Market: Opportunities

Green mining initiatives will generate higher growth possibilities for the industry players

The global mining chemicals market is expected to generate growth opportunities due to greater investments in green mining. The concept deals with the use of systems and technologies that ultimately target the reduced impact of mining operations on the environment. The concept aims to eliminate environmental impact while the minerals or metals are in the mine. It is an environmentally friendly and sustainable means of extracting, processing, and distributing mined materials. In March 2024, PH7 Technologies, a leading developer of sustainable technologies, launched a proprietary closed-loop process for the mining sector that can effectively reduce the environmental impact. It used advanced chemistry for extracting and refining critical metals which could help the mining sector move to renewable sources with ease. It also allows metal extraction from low-grade resources with utmost efficiency. In October 2023, Peru, the world’s largest producer of gold, announced the launch of the Green Mining project which will create the world’s first mercury-free gold supply chain mined from the Peruvian Amazon. The project is backed by Pure Earth, a non-profit organization, Brilliant Earth, and the Alliance for Responsible Mining. As the green mining segment witnesses more growth, the demand for mining chemicals will surge.

Growing interest in deep-sea mining projects will generate comprehensive revenue for the industry players

Deep-sea mining initiatives deal with exploring minerals and metal reserves from the depths of the sea and ocean. These projects are meant for extracting minerals located on the ocean floor from depths ranging between 200 meters and 6,500 meters with the use of advanced technologies, equipment, and chemicals thus creating opportunities for the global mining chemicals industry. However, deep-sea mining is currently considered financially and environmentally difficult to achieve without bearing heavy financial losses but the prospects of future growth remain active.

Mining Chemicals Market: Challenges

Supply chain disruptions impacting chemical procurement may challenge the market expansion rate

The global industry for mining chemicals is expected to be impacted by the disruptions in the supply chain of chemicals due to the changing global world order, inflating prices of raw materials, and rise in transportation costs. Moreover, the dynamic nature of strict regulations governing the use of toxic chemicals may further limit the industry’s expansion rate.

Mining Chemicals Market: Segmentation

The global mining chemicals market is segmented based on application, ore, and region.

Based on the application, the global market segments are explosives & drilling and mineral processing. In 2023, the highest growth was witnessed in the explosives & drilling segment. It dominated over 35.01% of the total share in 2023 driven by the growing demand for minerals and metals worldwide. Mined commodities are expected to play a crucial role in the development of energy technologies required for a sustainable environment. Minerals such as nickel, silver, steel, neodymium, and lithium will register significant demand during the projection period.

Based on the ore type, the mining chemicals industry segments are copper, iron, powder gold, and others. In 2023, the highest demand was witnessed in the iron segment with control over 18.05% of the final revenue. The growing demand for iron ore metals is expected to promote the regional market demand. Since high-grade iron ore content is on the decline, the froth flotation process is registering higher investments. The method is used for removing iron ore impurities.

Mining Chemicals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mining Chemicals Market |

| Market Size in 2023 | USD 11.29 Billion |

| Market Forecast in 2032 | USD 20.21 Billion |

| Growth Rate | CAGR of 6.69% |

| Number of Pages | 224 |

| Key Companies Covered | Nalco Water (an Ecolab company), Huntsman Corporation, AECI Mining Chemicals, BASF, Chevron Phillips Chemical Company, Chemours Company, Dow Chemical Company, Kemira, Clariant, ArrMaz, Cytec Solvay Group, AkzoNobel, SNF Floerger, Ashland Global Holdings Inc., Orica., and others. |

| Segments Covered | By Application, By Ore Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mining Chemicals Market: Regional Analysis

Asia-Pacific to register significant growth revenue during the projection period

The global mining chemicals market is expected to witness a significant growth rate in Asia-Pacific. In 2023, the region dominated over 35% of the global market share led by the extensive mining activities in specific parts of Asia-Pacific. Australia is the world’s largest economy in terms of mining activities. It is the largest producer of some of the world’s most desired metals and materials such as lithium, iron ore, and bauxite. Moreover, it is also known for producing essential metals such as aluminum, copper, gold, silver, zinc, and nickel. The region’s dominance over the global mining industry is due to the presence of mining-friendly policies in Australia supported by the use of highly advanced and sophisticated mining techniques or technologies, and higher transparency. China, on the other hand, is the world’s most dominant nation in terms of rare earth elements (REE) output. The region controls over 60% of the global REE output and is a significant producer of cement, salt, potash, and nitrogen. The country is regarded as the largest producer of magnesium, gold, cold, and tungsten, among other materials. The state-owned mining companies are investing in international markets to explore mining materials available in other regions.

Mining Chemicals Market: Competitive Analysis

The global mining chemicals market is led by players like:

- Nalco Water (an Ecolab company)

- Huntsman Corporation

- AECI Mining Chemicals

- BASF

- Chevron Phillips Chemical Company

- Chemours Company

- Dow Chemical Company

- Kemira

- Clariant

- ArrMaz

- Cytec Solvay Group

- AkzoNobel

- SNF Floerger

- Ashland Global Holdings Inc.

- Orica.

The global mining chemicals market is segmented as follows:

By Application

- Explosives & Drilling

- Mineral Processing

By Ore Type

- Copper

- Iron

- Powder Gold

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Mining chemicals are materials specially designed to be used during mining procedures.

The global mining chemicals market is expected to grow due to the growing rate of coal mining across the globe.

According to study, the global mining chemicals market size was worth around USD 11.29 billion in 2023 and is predicted to grow to around USD 20.21 billion by 2032

The CAGR value of the mining chemicals market is expected to be around 6.69% during 2024-2032.

The global mining chemicals market is expected to witness a significant growth rate in Asia-Pacific.

The global mining chemicals market is led by players like Nalco Water (an Ecolab company), Huntsman Corporation, AECI Mining Chemicals, BASF, Chevron Phillips Chemical Company, Chemours Company, Dow Chemical Company, Kemira, Clariant, ArrMaz, Cytec Solvay Group, AkzoNobel, SNF Floerger, Ashland Global Holdings Inc. and Orica.

The report explores crucial aspects of the mining chemicals market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed