Mining Machinery Market Size, Share, Trends, Growth 2030

Mining Machinery Market By Application (Coal Mining, Non-Metal Mining, and Metal Mining), By Machinery (Drills & Breakers, Crushing, Pulverizing & Screening Machinery, Surface Mining Machinery, Underground Mining Machinery, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

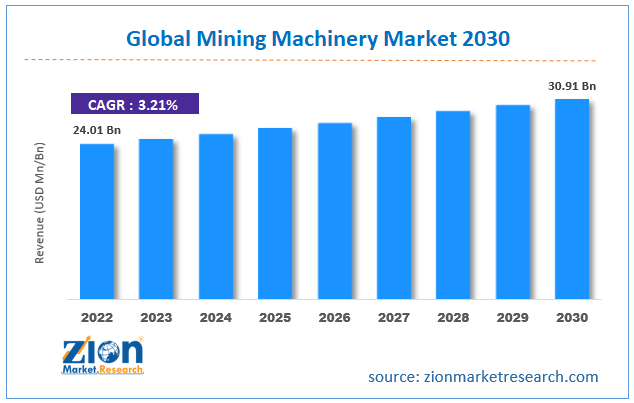

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.01 Billion | USD 30.91 Billion | 3.21% | 2022 |

Mining Machinery Industry Prospective:

The global mining machinery market size was worth around USD 24.01 billion in 2022 and is predicted to grow to around USD 30.91 billion by 2030 with a compound annual growth rate (CAGR) of roughly 3.21% between 2023 and 2030.

Mining Machinery Market: Overview

Mining machines are specially designed equipment and machines used for mining purposes. They are designed and manufactured with the aid of mining machinery engineering. It is a brand of engineering that deals with the key concepts and principles of electrical and mechanical engineering for designing, analyzing, manufacturing, and maintaining mining machinery. Mining is considered one of the most vital industries in the modern world as segments such as coal and minerals mining are responsible for running a large portion of a regional economy. The market is full of several types of mining machines and their use depends on the type of mining procedure.

Some of the most commonly used mining machines include large mining trucks, large dozers, hydraulic mining shovels, motor graders, electric rope shovels, wheel tractor scrapers, large wheel loaders, and underground mining loaders & trucks among others. Since machinery used in mining activities is expected to perform in strenuous and difficult environments, the durability index of these machines must be high. Furthermore, other parameters such as ease of maintenance and environmental considerations play a crucial role in determining if a tool will be successful in the industry for mining machinery.

Key Insights:

- As per the analysis shared by our research analyst, the global mining machinery market is estimated to grow annually at a CAGR of around 3.21% over the forecast period (2023-2030)

- In terms of revenue, the global mining machinery market size was valued at around USD 24.01 billion in 2022 and is projected to reach USD 30.91 billion, by 2030.

- The mining machinery market is projected to grow at a significant rate due to the rising investments in infrastructure development projects

- Based on application segmentation, coal mining was predicted to show maximum market share in the year 2022

- Based on machinery segmentation, surface mining machinery was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Mining Machinery Market: Growth Drivers

Rising investments in infrastructure development projects to drive market growth

The global mining machinery market is expected to be driven by the increasing investments in infrastructure development projects across the globe. The steady rise in the global economy along with rapid globalization has pushed the demand for robust infrastructure systems including energy projects, commercial & residential real estate, transportation routes, and others. This trend is especially evident in emerging economies that are working toward creating an ecosystem that attracts more foreign investments.

In March 2023, Metito Utilities Limited (MUL), a leading operator and investor of wastewater, water, and alternative energy management remedies, along with British International Investment (BII) launched Africa Water Infrastructure Development (AWID), a new company in the African continent. AWID is a novel platform that will aid the development of climate-smart water projects at a large scale and help Africa gain access to water security in the coming years. Mining machines are an integral part of urban development initiatives as they are used for extracting and transporting materials, land reclamation, waste management, tunneling & excavation, and other stages.

Increasing launch of new mining services and transcontinental collaborations may promote a higher growth rate

The global mining machinery industry is expected to gain access to better revenue streams as the number of mining service providers is growing in the commercial world. Along with the emergence of new players, existing companies are actively participating in inter and intra-regional collaborations to undertake high-risk projects as the mining industry continues to evolve with changing times.

In December 2023, Tata Steel announced merger completion with S & T Mining Company Ltd after receiving the necessary sanction from the National Company Law Tribunal (NCLT) Kolkata. On the other hand, in May 2023, a British consortium including Glencore announced an investment of USD 9 billion in the mining and electric vehicle (EV) battery sectors of Indonesia.

Mining Machinery Market: Restraints

High cost of certain mining machinery to restrict market growth

The global mining machinery market growth rate is expected to be restricted due to the high cost of mining machines, especially advanced versions equipped with high technology and systems. For instance, a mining excavator for a 20-ton Class may cost around USD 100,000. In addition to this, the existence of a complex and dynamic regulatory environment for mining machines further restricts market expansion.

Mining Machinery Market: Opportunities

Integration of advanced technology and mining machinery may deliver positive results

The industry for mining machinery will benefit from the growing launch of advanced equipment integrated with superior technologies such as sensors, remote operation, robotics, and artificial intelligence (AI) to name a few. This equipment requires minimal human intervention and work in tandem with the functional skills of the operator thus impacting the overall efficiency of the tool. In March 2023, Tata Hitachi announced the launch of the Mining Excavator ZX670H. It is powered by an EPA Tier II engine, an environmentally friendly alternative thus allowing the excavator to complete the job even at tough mining sites.

In June 2022, ARX Construction and Mining Equipment launched a new set of motor graders along with other mining equipment at the EXCON 2022. Technology integration in the mining industry is not limited to AI and sensor devices. Mining service providers are becoming increasingly accepting of novel solutions such as the incorporation of drone-based surveillance systems for survey and analysis of mining sites.

Deep sea mining projects hold tremendous growth potential

In recent times, global attention has increasingly shifted toward deep sea mining projects as over 90% of the existing water remains explored and researchers predict that these unexplored sites may hold rich mineral and other valuable resources. Countries such as the UK, Mexico, Nauru, and China are at the forefront of such projects.

Mining Machinery Market: Challenges

Concerns over environmental impact of mining projects to challenge market growth

The global mining machinery market will be challenged by the growing concerns and questions over the drastic impact of irresponsible mining activities that have witnessed significant increases in the last few years. As per official reports, around 5% to 7% of total greenhouse emissions are caused by the mining industry. Additionally, a majority of the mining machinery continues to be powered by non-renewable fuel, further causing environmental damage.

Mining Machinery Market: Segmentation

The global mining machinery industry is segmented based on application, machinery, and region.

Based on application, the global market segments are coal mining, non-metal mining, and metal mining. In 2022, the highest growth was observed in the coal mining segment. It dominated around 38% of the total share. Coal mining has become an important part of economic growth since it is essential for several other thriving industries including the energy sector and chemical industry. Moreover, coal mining is one of the largest employers in the mining sector. The growing number of coal mining projects globally will promote a higher growth rate.

Based on machinery, the global market is divided into drills & breakers, crushing, pulverizing & screening machinery, surface mining machinery, underground mining machinery, and others. In 2022, around 39% of the segment was led by surface mining machinery due to their extensive applications in the growing surface mining projects. They deal with the excavation of geological materials and resources from the surface of the Earth and offer exceptional economies of scale.

Mining Machinery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mining Machinery Market |

| Market Size in 2022 | USD 24.01 Billion |

| Market Forecast in 2030 | USD 30.91 Billion |

| Growth Rate | CAGR of 3.21% |

| Number of Pages | 223 |

| Key Companies Covered | Hitachi Construction Machinery Co. Ltd., Caterpillar Inc., Liebherr Group, Komatsu Ltd., Sany Group, Sandvik AB, XCMG Group, Joy Global Inc. (Now part of Komatsu), Terex Corporation, Atlas Copco AB, BEML Limited, Volvo Construction Equipment, Epiroc AB, Doosan Infracore Co. Ltd., Doosan Bobcat, and others. |

| Segments Covered | By Application, By Machinery, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mining Machinery Market: Regional Analysis

Asia-Pacific to continue dominating the market growth trend during the forecast period

The global mining machinery market will be led by Asia-Pacific during the projection period. In 2022, around 35.1% of the global revenue was obtained by players operating from Asian countries such as India, China, Indonesia, and others. One of the primary reasons for higher regional growth is the presence of several key manufacturers or mining machines and the increasing innovation-led strategies adopted by the producers to meet the changing expectations of the consumers. The regional market is further helped by the existence of a robust manufacturing sector and the availability of skilled labor.

In July 2023, Komatsu Limited announced that it would soon launch new versions of its class electric 20-ton excavators powered by Lithium-ion batteries in the European and Japanese markets. Europe is projected to grow at a CAGR of 4.52% during the forecast period led by the growing investments in energy-based infrastructure with a main focus on renewable energy. European countries are expected to become completely self-powering using renewable energy by 2030 and eliminate their dependence on oil & gas during this period.

Mining Machinery Market: Competitive Analysis

The global mining machinery market is led by players like:

- Hitachi Construction Machinery Co. Ltd.

- Caterpillar Inc.

- Liebherr Group

- Komatsu Ltd.

- Sany Group

- Sandvik AB

- XCMG Group

- Joy Global Inc. (Now part of Komatsu)

- Terex Corporation

- Atlas Copco AB

- BEML Limited

- Volvo Construction Equipment

- Epiroc AB

- Doosan Infracore Co. Ltd.

- Doosan Bobcat

The global mining machinery market is segmented as follows:

By Application

- Coal Mining

- Non-Metal Mining

- Metal Mining

By Machinery

- Drills & Breakers

- Crushing

- Pulverizing & Screening Machinery

- Surface Mining Machinery

- Underground Mining Machinery

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Mining machines are specially designed equipment and machines used for mining purposes. They are designed and manufactured with the aid of mining machinery engineering.

The global mining machinery market is expected to be driven by the increasing investments in infrastructure development projects across the globe.

According to study, the global mining machinery market size was worth around USD 24.01 billion in 2022 and is predicted to grow to around USD 30.91 billion by 2030.

The CAGR value of mining machinery market is expected to be around 3.21% during 2023-2030.

The global mining machinery market will be led by Asia-Pacific during the projection period.

The global mining machinery market is led by players like Hitachi Construction Machinery Co., Ltd., Caterpillar Inc., Liebherr Group, Komatsu Ltd., Sany Group, Sandvik AB, XCMG Group, Joy Global Inc. (Now part of Komatsu), Terex Corporation, Atlas Copco AB, BEML Limited, Volvo Construction Equipment, Epiroc AB, Doosan Infracore Co., Ltd., and Doosan Bobcat.

The report explores crucial aspects of the mining machinery market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed