Mobile Money Market Size, Share, Growth & Forecast 2032

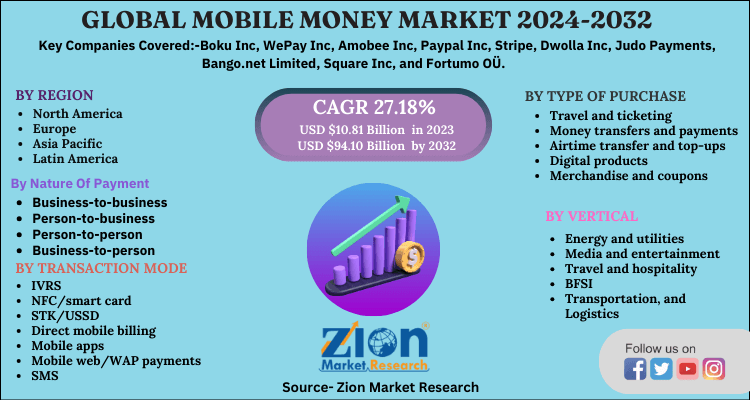

Mobile Money Market: Nature of Payment (Business-To-Business, Person-To-Business, Person-To-Person, and Business-To-Person), Transaction Mode (IVRS, NFC/Smart Card, STK/USSD, Direct Mobile Billing, Mobile Apps, Mobile Web/WAP Payments, SMS, and Others), Type of Purchase (Travel and Ticketing, Money Transfers and Payments, Airtime Transfer and Top-Ups, Digital Products, and Merchandise and Coupons), Vertical (Utilities, Media and Entertainment, Travel and Hospitality, BFSI, Transportation and Logistics, Healthcare, Retail, Telecom and IT, and Others), And By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

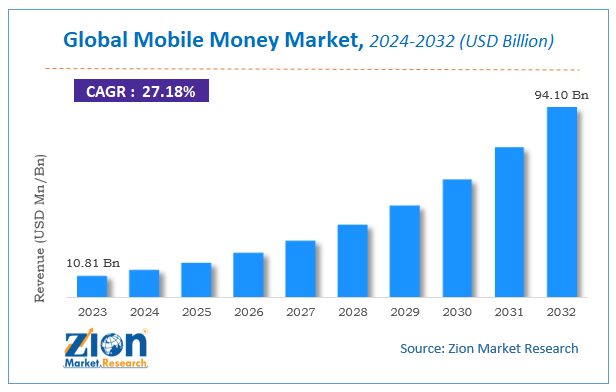

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.81 Billion | USD 94.10 Billion | 27.18% | 2023 |

Mobile Money Market Insights

According to Zion Market Research, the global Mobile Money Market was worth USD 10.81 Billion in 2023. The market is forecast to reach USD 94.10 Billion by 2032, growing at a compound annual growth rate (CAGR) of 27.18% during the forecast period 2024-2032.The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Mobile Money industry over the next decade.

In Global Mobile Money Market Report, Mobile money is a convenient and efficient method of making payments, transferring money, and other transactions through a mobile phone. It provides a better option along with a complete integrated system for transferring money in a very convenient way. Companies focus on strategies to adopt innovative mobile-centric payment systems in order to fasten the process.

These services are initiated through a mobile wallet by using a mobile phone. Mobile money is accompanied by the broader area of electronic commerce where mobile devices are used to purchase items, physically or electronically. The mobile money market is continuously evolving and enables the development of new technologies. Mobile money offers the advantage of the availability of different sources for money transactions from one place to another. This mode does money transactions quickly and within less time and with no effort.

Request Free Sample

Request Free Sample

Global Mobile Money Market: Growth Factors

Constantly developing technology comprised of new product lines are the major drivers for the global mobile money market. Mobile money has become a crucial component of the advanced e-commerce industries. In the last few years, the mobile money market has experienced a rapid upsurge in increasing automation, integrating the entire value chain, and technological advancements in the e-commerce industries. This is anticipated to foster the global mobile money market growth in the next few years. Growth in e-commerce activities and increasing awareness of consumer awareness about the internet may fuel global market growth in the coming years. Increasing double income and rising urbanization is expected to propel the global mobile money market growth. However, huge initial investment needs for the development of mobile money may hinder global market growth.

Mobile Money Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Money Market |

| Market Size in 2023 | USD 10.81 Billion |

| Market Forecast in 2032 | USD 94.10 Billion |

| Growth Rate | CAGR of 27.18% |

| Number of Pages | 110 |

| Key Companies Covered | Boku Inc, WePay Inc, Amobee Inc, Paypal Inc, Stripe, Dwolla Inc, Judo Payments, Bango.net Limited, Square Inc, and Fortumo OÜ |

| Segments Covered | By Nature Of Payment, By Transaction Mode, By Type Of Purchase, By Vertical, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Mobile Money Market: Segmentation

The global mobile money market is divided based on nature of payment, transaction mode, type of purchase, vertical, and region. All the segments of mobile money market have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

The global mobile money market is classified based on the nature of payment as business-to-business, person-to-business, person-to-person, and business-to-person.

On the basis of transaction mode, the global market is bifurcated as IVRS, NFC/smart card, STK/USSD, direct mobile billing, mobile apps, mobile web/WAP payments, SMS, and others.

Moreover, on the basis of the type of purchase, the global market is divided into travel and ticketing, money transfers and payments, airtime transfers and top-ups, digital products, and merchandise and coupons.

Furthermore, based on vertical, the global mobile money market is fragmented into energy and utilities, media and entertainment, travel and hospitality, BFSI, transportation and logistics, healthcare, retail, telecom, IT, and others.

Region-wise, the global market is segregated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Global Mobile Money Market: Regional Analysis

North America accounted for the largest market share in the global mobile money market where consumers are adopting mobile money to a large extent. Emerging countries such as China, India, Malaysia, and Vietnam are contributing to significant growth in the global mobile money market. However, South Africa, Kenya, and Latin America are growing at the fastest rate to grab the largest market share in the global market, which may enhance the global mobile money market in the future.

Global Mobile Money Market: Competitive Players

Major players dominating the global mobile money market are:

- Boku, Inc.

- WePay, Inc.

- Amobee, Inc.

- Paypal, Inc.

- Stripe

- Dwolla, Inc.

- Judo Payments

- Bango.net Limited

- Square, Inc.

- Fortumo OÜ.

Segmentation

Based on the Nature of Payment

- Business-to-business

- Person-to-business

- Person-to-person

- Business-to-person

Based On the TransactionMode

- IVRS

- NFC/smart card

- STK/USSD

- Direct mobile billing

- Mobile apps

- Mobile web/WAP payments

- SMS

- others

Based on the Type of Purchase

- Travel and ticketing

- Money transfers and payments

- Airtime transfer and top-ups

- Digital products

- Merchandise and coupons

Based on Vertical

- Energy and utilities

- Media and entertainment

- Travel and hospitality

- BFSI

- Transportation, and Logistics

- Healthcare

- Retail

- Telecom and IT

Mobile Money Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Constantly developing technology comprised of new product lines are the major drivers for the global mobile money market. Mobile money has become a crucial component of the advanced e-commerce industries. In the last few years, the mobile money market has experienced a rapid upsurge in increasing automation, integrating the entire value chain, and technological advancements of the e-commerce industries.

global Mobile Money Market was worth USD 10.81 Billion in 2023. The market is forecast to reach USD 94.10 Billion by 2032, growing at a compound annual growth rate (CAGR) of 27.18% during the forecast period 2024-2032

North America accounted for the largest market share in the global mobile money market where consumers are adopting mobile money to a large extent. Emerging countries such as China, India, Malaysia, and Vietnam are contributing to significant growth in the global mobile money market.

Some main participants of the Mobile Money market are Boku, Inc., WePay, Inc., Amobee, Inc., Paypal, Inc., Stripe, Dwolla, Inc., Judo Payments, Bango.net Limited, Square, Inc., and Fortumo OÜ.

Key Segment Growing in the Mobile Money Market as Follows

Based on the Nature of Payment

- Business-to-business

- Person-to-business

- Person-to-person

- Business-to-person

Based On the TransactionMode

- IVRS

- NFC/smart card

- STK/USSD

- Direct mobile billing

- Mobile apps

- Mobile web/WAP payments

- SMS

- others

Based on the Type of Purchase

- Travel and ticketing

- Money transfers and payments

- Airtime transfer and top-ups

- Digital products

- Merchandise and coupons

Based on Vertical

- Energy and utilities

- Media and entertainment

- Travel and hospitality

- BFSI

- Transportation, and Logistics

- Healthcare

- Retail

- Telecom and IT

North America accounted for the largest market share in the global mobile money market where consumers are adopting mobile money to a large extent. Emerging countries such as China, India, Malaysia, and Vietnam are contributing to significant growth in the global mobile money market.

However, South Africa, Kenya, and Latin America are growing at the fastest rate to grab the largest market share in the global market, which may enhance the global mobile money market in the future.

Utilities, Media And Entertainment, Travel And Hospitality, BFSI, Transportation And Logistics, Healthcare, Retail, Telecom, IT, And Others are the applications of the Mobile Money Market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed