Mobile Payment Systems Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

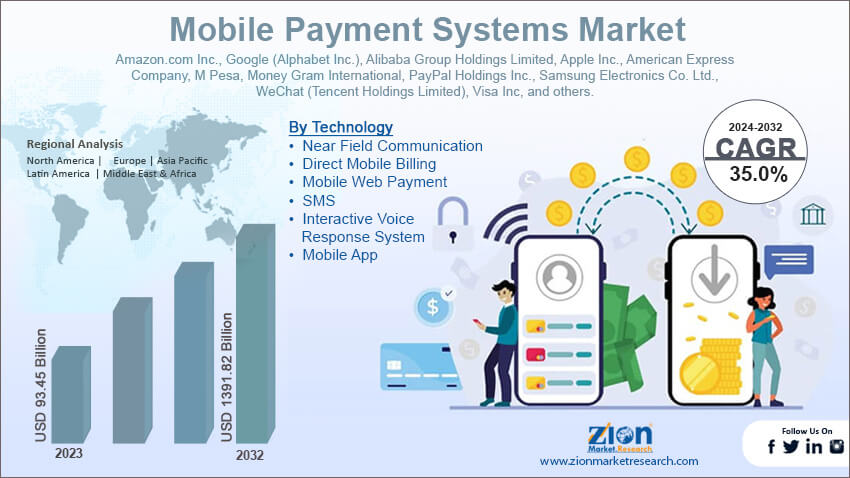

Mobile Payment Systems Market By Technology (Near Field Communication, Direct Mobile Billing, Mobile Web Payment, SMS, Interactive Voice Response System, Mobile App, and Others), By Payment Type (B2B, B2C, B2G, and Others), By Location (Remote Payment and Proximity Payment), By End-use (BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

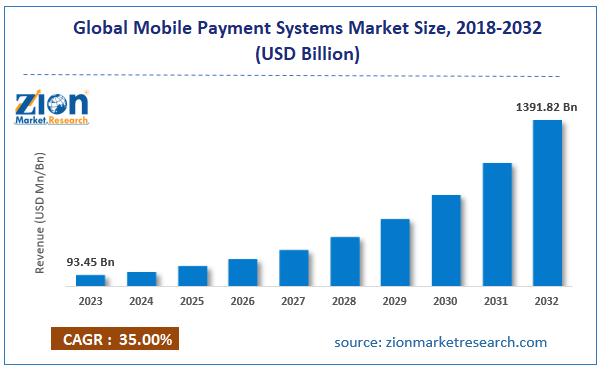

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 93.45 Billion | USD 1391.82 Billion | 35.0% | 2023 |

Mobile Payment Systems Industry Prospective:

The global mobile payment systems market size was worth around USD 93.45 billion in 2023 and is predicted to grow to around USD 1391.82 billion by 2032, with a compound annual growth rate (CAGR) of roughly 35.0% between 2024 and 2032.

Mobile Payment Systems Market: Overview

Using a mobile device to perform and confirm the payment, a mobile payment is the transfer or payment of money, usually to an individual, merchant, or business, for bills, goods, and services. Mobile browsers, SIM toolkits, and mobile menus are some examples of the payment tools that are available.

Among the several mobile financial services (MFS) offered today is mobile payment, which is seen as a starting point for other MFS, including investment products, credit/lending, insurance, and mobile banking. The use of cryptocurrencies by users for trading, savings, investment, and payment has increased recently.

Key Insights

- As per the analysis shared by our research analyst, the global mobile payment systems market is estimated to grow annually at a CAGR of around 35.0% over the forecast period (2024-2032).

- In terms of revenue, the global mobile payment systems market size was valued at around USD 93.45 billion in 2023 and is projected to reach USD 1391.82 billion by 2032.

- The increasing product launch is expected to drive the mobile payment systems industry over the forecast period.

- Based on the technology, the Mobile Web Payment segment is expected to dominate the market over the forecast period.

- Based on the end-use, the BFSI segment is expected to capture the largest market share over the forecast period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Mobile Payment Systems Market: Growth Drivers

Rising adoption of smartphones across the globe drives market growth

The increasing availability and use of smartphones are driving the mobile payment system market's growth. Additionally, the growing accessibility and affordability of smartphones, which has increased their use, is supporting the market's expansion. In addition, a favorable picture of the market's expansion is being created by the incorporation of numerous cutting-edge features like near-field communication (NFC), biometric security, and improved connection options to make smartphones the perfect platform for carrying out mobile payments.

Accordingly, the market is expanding due to the quick development of technology that makes transactions easier and more secure, which in turn encourages customers to use mobile payment methods. Additionally, user-friendly smartphone applications now provide simple navigation, intuitive user interfaces, and a lower entry barrier for new users.

Mobile Payment Systems Market: Restraints

Security concern hinders market growth

Despite the convenience that new payment technologies bring to consumers, the industry is expanding more slowly as a result of worries about security and data breaches. Customers are reluctant to transfer or receive money using their mobile devices because they fear that unregistered mobile service providers may obtain their financial information.

Additionally, the usage of mobile payment services is growing rapidly; however, it is predicted that in the coming years, there will be a higher risk of data breaches and identity theft. This is due to phishing attempts, weak passwords, and public Wi-Fi. These factors raise the risks associated with mobile payments, which limits the mobile payment systems industry growth.

Mobile Payment Systems Market: Opportunities

Rising product launch offers a lucrative opportunity for market growth

The increasing product launch is expected to offer a lucrative opportunity for the growth of the mobile payment systems market over the forecast period. For instance, in January 2023, the introduction of ACI Instant Pay, a new real-time payments system that enables American businesses to instantaneously accept payments online, via mobile devices, and in-store, was announced by ACI Worldwide, a leader in the world of mission-critical, real-time payments software. ACI is now able to offer its real-time payments software solutions to merchants, further solidifying its position as the industry leader in enabling both local and pan-regional real-time schemes that service billions of people globally.

Mobile Payment Systems Market: Challenges

Low trust in mobile payment poses a major challenge to market expansion

One of the main things impeding the mobile payment system industry during the projection period is low trust in mobile payments. As to the YourGov research, approximately 43% of mobile users lack confidence in mobile payments, and 38% have low confidence in security. Similarly, the majority of consumers are hesitant to use mobile payments since contactless payment involves a great deal of unknown danger and fraud, including weaknesses with e-wallets, hacking, and data leaks. Furthermore, fewer people are aware of the advantages of using mobile payments as opposed to cash, credit cards, or debit cards when making online purchases and paying for large-ticket items. During the forecast period, all of these factors will limit the market's expansion.

Mobile Payment Systems Market: Segmentation

The global mobile payment systems industry is segmented based on technology, payment type, location, end-use, and region.

Based on the technology, the global mobile payment systems market is segmented into Near Field Communication, Direct Mobile Billing, Mobile Web Payment, SMS, Interactive Voice Response Systems, Mobile Apps, and Others. The Mobile Web Payment segment is expected to dominate the market over the forecast period. The security and flexibility of mobile web payment solutions are responsible for the rise of the segment. The increasing acceptance of m-commerce is also encouraging for the segment's expansion. Customers can easily revisit or share the website by bookmarking the mobile online payment platforms, which have a URL.

However, the Near Field Communication segment is expected to grow at a rapid rate over the projected period. Customers may instantly redeem their coupons using mobile phones, while merchants can include customer loyalty programs into their payment procedures thanks to NFC technology. The sector is predicted to grow as a result of the expansion of e-commerce platforms and the ongoing use of cutting-edge technology in financial transactions. NFC-based payment usage is anticipated to be fueled by factors including the expanding trend of mobile commerce and the increasing use of wearable payment devices.

Based on the payment type, the global mobile payment systems industry is bifurcated into B2B, B2C, B2G, and Others.

Based on the location, the global mobile payment systems market is bifurcated into remote payment and proximity payment.

Based on the end-use, the global mobile payment systems industry is bifurcated into BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation, and Others. The BFSI segment is expected to capture the largest market share over the forecast period. The industry is expanding as a result of the active efforts made by several banks to implement mobile payments. Companies are also concentrating on implementing a tailored set of all-inclusive payment solutions, which assists in resolving particular difficulties in the loan, insurance, and wealth management industries. Banks can now reach a substantial portion of the unbanked population in emerging nations and provide the customers they currently serve with even more convenience due to mobile banking and payments.

Mobile Payment Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Payment Systems Market |

| Market Size in 2023 | USD 93.45 Billion |

| Market Forecast in 2032 | USD 1,391.82 Billion |

| Growth Rate | CAGR of 35.00% |

| Number of Pages | 212 |

| Key Companies Covered | Amazon.com Inc., Google (Alphabet Inc.), Alibaba Group Holdings Limited, Apple Inc., American Express Company, M Pesa, Money Gram International, PayPal Holdings Inc., Samsung Electronics Co. Ltd., WeChat (Tencent Holdings Limited), Visa Inc, and others. |

| Segments Covered | By Technology, By Payment Type, By Location, By End-use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mobile Payment Systems Market: Regional Analysis

Asia Pacific dominates the market over the projected period

The Asia Pacific is expected to lead the global mobile payment system market growth during the forecast period. The rising smartphone penetration, evolving lifestyles, and the newest developments in online commerce are anticipated to propel regional market expansion. There will likely be growth potential for the regional market as a result of the growing government initiatives in the Asia Pacific area to move toward cashless transactions. The extensive use of mobile technology in developing nations presents banks and fintech companies with a fresh opportunity to provide mobile banking services to underserved and unbanked clients in isolated locations.

Mobile Payment Systems Market: Competitive Analysis

The global mobile payment system market is dominated by players like:

- Amazon.com Inc.

- Google (Alphabet Inc.)

- Alibaba Group Holdings Limited

- Apple Inc.

- American Express Company

- M Pesa

- Money Gram International

- PayPal Holdings Inc.

- Samsung Electronics Co. Ltd.

- WeChat (Tencent Holdings Limited)

- Visa Inc

The global mobile payment systems market is segmented as follows:

By Technology

- Near Field Communication

- Direct Mobile Billing

- Mobile Web Payment

- SMS

- Interactive Voice Response System

- Mobile App

- Others

By Payment Type

- B2B

- B2C

- B2G

- Others

By Location

- Remote Payment

- Proximity Payment

By End-use

- BFSI

- Healthcare

- IT & Telecom

- Media & Entertainment

- Retail & E-commerce

- Transportation

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Using a mobile device to perform and confirm the payment, a mobile payment is the transfer or payment of money, usually to an individual, merchant, or business for bills, goods, and services. Mobile browsers, SIM toolkits, and mobile menus are some examples of the payment tools that are available. Among the several mobile financial services (MFS) offered today is mobile payment, which is seen as a starting point for other MFSs, including investment products, credit/lending, insurance, and mobile banking. The use of cryptocurrencies by users for trading, savings, investment, and payment has increased recently.

The global mobile payment systems market is being driven by several factors including rising cashless transactions, increasing product launches, rising integration with advanced technology, a growing number of startups in the sector, and others.

According to the report, the global mobile payment systems market size was worth around USD 93.45 billion in 2023 and is predicted to grow to around USD 1391.82 billion by 2032.

The global mobile payment systems market is expected to grow at a CAGR of 35.0% during the forecast period.

The global mobile payment systems market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the presence of the major players.

The global mobile payment systems market is dominated by players like Amazon.com Inc., Google (Alphabet Inc.), Alibaba Group Holdings Limited, Apple Inc., American Express Company, M Pesa, Money Gram International, PayPal Holdings Inc., Samsung Electronics Co. Ltd., WeChat (Tencent Holdings Limited), and Visa Inc., among others.

The mobile payment systems market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed