Mobile Payment Transaction Market Size, Share, Trends, Growth 2032

Mobile Payment Transaction Market By Type of Mobile Payment (Mobile Money And Mobile Wallet/Bank Cards), By Mode Of Transaction (NFC, WAP, And SMS), By Application (Energy & Utilities, Hospitality & Transportation, Entertainment, Retail, Healthcare, And Others), And By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

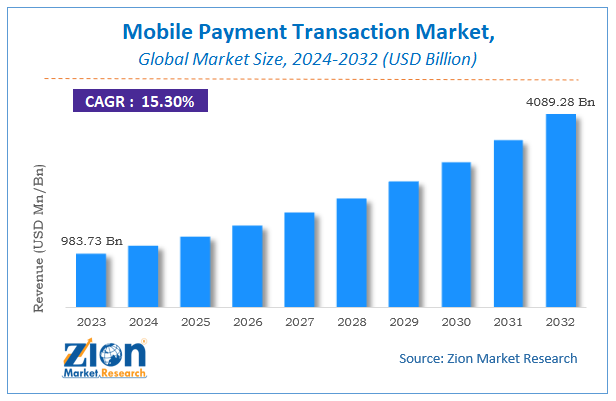

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 983.73 Billion | USD 4089.28 Billion | 15.3% | 2023 |

Mobile Payment Transaction Market Insights

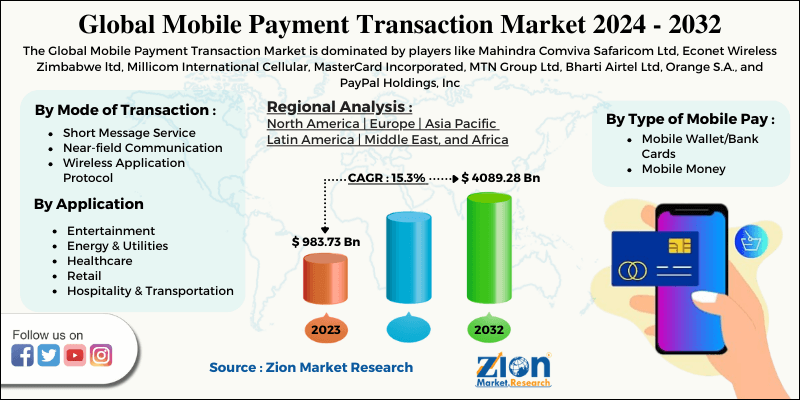

According to Zion Market Research, the global Mobile Payment Transaction Market was worth USD 983.73 Billion in 2023. The market is forecast to reach USD 4089.28 Billion by 2032, growing at a compound annual growth rate (CAGR) of 15.3% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Mobile Payment Transaction Market industry over the next decade.

Mobile Payment Transaction Market Introduction

Mobile payment is a substitute method of conventional payment system where cash, credit cards, and cheque are the mode of payment. Mobile payment offers the customer a method of purchasing goods & services through smartphone, iPhone, and tablets. Apart from this, mobile payment facilitates online cashless transactions and makes use of myriad techniques including direct mobile billing, near field communication, and SMS-based transactional payment. It also enables hassle-free financial deals and enhances transactional security. Thriving e-commerce activities along with surge in the m-commerce sector in developing economies will make notable contributions towards overall mobile payment transaction market revenue over the assessment period.

Furthermore, mobile payments are utilized for myriad operations such as movie ticket ordering, upgrading of games on smartphones, and ordering of food through mobile. All these aspects have garnered high popularity for the mobile payment transactions in the years ahead.

Mobile Payment Transaction Market Growth Drivers

Burgeoning demand for payment deals through mobile or smartphones is predicted to enlarge the scope of mobile payment transaction market over the assessment period. With massive customer demand, mammoth firms are devising new payment methods and this will further steer the expansion of the industry over the forecast timeline. Launching of payment wallets and new cash back offers on mobile payment will translate into humungous market penetration across the globe over the forecast timespan.

With internet penetration witnessed in nook & corner across the globe and rise in the use of smartphones in the developing countries will pave a way for expansion of mobile payment transaction market in the years ahead. The emergence of e-Commerce industry will play a vital role in shaping the growth of mobile payment transaction industry in the ensuing years.

Furthermore, a prominent surge in online retail activities and changing lifestyles is predicted to result in humungous surge in the business growth over the forecast timespan. Governments across the globe are trying to create secured mobile payment infrastructure in the remote & distant locations and also aiding banks to develop such infrastructure to enable cashless transactions. This, in turn, will generate massive demand for mobile payment transactional activities across the globe in the years to come.

Mobile Payment Transaction Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Payment Transaction Market |

| Market Size in 2023 | USD 983.73 Billion |

| Market Forecast in 2032 | USD 4089.28 Billion |

| Growth Rate | CAGR of 15.3% |

| Number of Pages | 110 |

| Key Companies Covered | Mahindra Comviva Safaricom Ltd, Econet Wireless Zimbabwe ltd, Millicom International Cellular, MasterCard Incorporated, MTN Group Ltd, Bharti Airtel Ltd, Orange S.A., and PayPal Holdings, Inc |

| Segments Covered | By Mode of Transaction, By Type of Mobile Pay, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Asia Pacific Market Revenue To Hit Scalable Heights By 2032

The expansion of mobile payment transaction industry in Asia Pacific during 2019-2025 can be credited to presence of strong FinTech infrastructure facility and huge investments by the key players in the region. In addition to this, the introduction of quick payment methods including NFC, mobile point- of-sale, and banking app transactions is prevalent in the countries such as India, China, Japan, Singapore, and Philippines and this will translate into huge regional market expansion over the ensuing years.

Key participants profiled in the report include Mahindra Comviva Safaricom Ltd, Econet Wireless Zimbabwe ltd, Millicom International Cellular, MasterCard Incorporated, MTN Group Ltd, Bharti Airtel Ltd, Orange S.A., and PayPal Holdings, Inc.

The global mobile payment Transaction market is segmented as follows:

By Mode of Transaction

- Short Message Service (SMS)

- Near-field Communication (NFC)

- Wireless Application Protocol (WAP)

By Type of Mobile Pay

- Mobile Wallet/Bank Cards

- Mobile Money

By Application

- Entertainment

- Energy & Utilities

- Healthcare

- Retail

- Hospitality & Transportation

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A mobile payment transaction is the process of paying for products, services, or money via a mobile device—such as a tablet or smartphone. Mobile payments help consumers complete purchases through digital platforms, mobile apps, or contactless systems rather than with conventional payment methods including cash, credit cards, or cheques. Usually quick, safe, and able to be finished with a few taps or scans on a mobile device, these transactions

Mostly driven by technology developments, shifting consumer behavior, and a worldwide move toward digital banking, numerous important elements are influencing the growth of the mobile payment transaction market.

According to Zion Market Research, the global Mobile Payment Transaction Market was worth USD 983.73 Billion in 2023. The market is forecast to reach USD 4089.28 Billion by 2032.

According to Zion Market Research, the global Mobile Payment Transaction Market a compound annual growth rate (CAGR) of 15.3% during the forecast period 2024-2032.

In addition to this, the introduction of quick payment methods including NFC, mobile point- of-sale, and banking app transactions is prevalent in the countries such as India, China, Japan, Singapore, and Philippines and this will translate into huge regional market expansion over the ensuing years.

Key participants profiled in the report include Mahindra Comviva Safaricom Ltd, Econet Wireless Zimbabwe ltd, Millicom International Cellular, MasterCard Incorporated, MTN Group Ltd, Bharti Airtel Ltd, Orange S.A., and PayPal Holdings, Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed