Newborn Screening Instruments Market Size, Share, Trends, Growth and Forecast 2030

Newborn Screening Instruments Market By Test Type (Blood Spot Test, Hearing Test, Critical Congenital Heart Disease (CCHD) Test, and Metabolic Disorder Test), By Product Type (Mass Spectrometers, Pulse Oximeters, Hearing Screening Devices, Assay Kits, and DNA Sequencers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2032

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

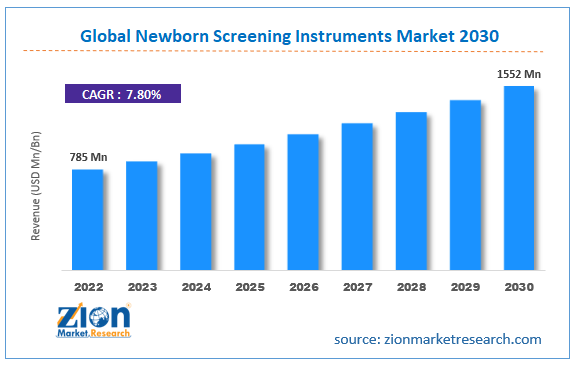

| USD 785 Million | USD 1,552 Million | 7.80% | 2022 |

Newborn Screening Instruments Industry Prospective:

The global Newborn Screening Instruments market size was worth around USD 785 million in 2022 and is predicted to grow to around USD 1,552 million by 2032 with a compound annual growth rate (CAGR) of roughly 7.80% between 2023 and 2032.

Newborn Screening Instruments Market: Overview

Newborn screening instruments are medical devices designed to identify certain genetic, metabolic, and congenital disorders in newborn babies shortly after birth. This early detection enables timely intervention and treatment, potentially preventing serious health complications or even death. These instruments are an integral part of newborn screening programs implemented in many countries to ensure the health and well-being of newborns.

Newborn screening instruments typically involve the collection of a small blood sample from the baby's heel. This sample is then analyzed using various techniques, including mass spectrometry, tandem mass spectrometry (MS/MS), fluorescence, and enzymatic assays. The instruments can detect a range of conditions such as phenylketonuria (PKU), congenital hypothyroidism, sickle cell disease, and metabolic disorders. The process starts with the collection of a few drops of blood on filter paper, which is then dried and sent to a laboratory. The laboratory technicians use specialized equipment, often referred to as newborn screening instruments, to analyze the dried blood spots. These instruments can rapidly and accurately measure the levels of various substances or markers in the blood that indicate the presence of specific disorders.

Key Insights

- As per the analysis shared by our research analyst, the global newborn screening instrument industry is estimated to grow annually at a CAGR of around 7.80% over the forecast period (2023-2032).

- In terms of revenue, the global newborn screening instrument market size was valued at around USD 785 million in 2022 and is projected to reach USD 1552 million, by 2030.

- The global newborn screening instrument market is projected to grow at a significant rate due to the rising incidence of neonatal disorders.

- Based on test type segmentation, the metabolic disorder test was predicted to hold maximum market share in the year 2022.

- Based on product type segmentation, DNA sequencers were the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Newborn Screening Instruments Market: Growth Drivers

Rising incidence of neonatal disorders to drive market growth during the forecast period.

The rising incidence of neonatal disorders globally has emerged as a significant driver propelling the growth of the newborn screening instrument market. Neonatal disorders encompass a range of congenital, genetic, and metabolic conditions that can have long-term detrimental effects on an infant's health and development if not identified and treated early. With increasing awareness about the importance of early detection and intervention, there has been a surge in demand for efficient and comprehensive newborn screening procedures. Statistics pertaining to the prevalence of neonatal disorders reveal a concerning trend. According to global health organizations and studies, the prevalence of congenital disorders and metabolic conditions in newborns varies by region but is estimated to be around 2-5% worldwide. Moreover, the occurrence of these disorders is on the rise due to factors such as changing lifestyles, consanguineous marriages, and genetic predisposition. This escalation in neonatal disorders underscores the urgent need for robust newborn screening programs that can accurately identify these conditions shortly after birth, enabling healthcare professionals to initiate timely interventions that can significantly improve outcomes.

Newborn Screening Instruments Market: Restraints

Cost and infrastructure challenges may hamper the market expansion

Implementing newborn screening programs requires substantial investment in purchasing screening instruments, training healthcare professionals, and establishing the necessary infrastructure. The average cost of newborn screening instruments varies depending on the type of instrument and the number of disorders that it can screen for. However, it is generally in the range of USD 5,000 to USD 10,000 per instrument. The cost of infrastructure for a newborn is typically in the range of USD 100,000 to USD 500,000. The cost of acquiring and maintaining advanced screening technologies can be a deterrent for healthcare facilities, especially in resource-limited settings. Beyond the initial investment, there are ongoing operational costs associated with maintaining and servicing screening instruments, conducting tests, and interpreting results. These costs can strain healthcare budgets, particularly in regions with limited financial resources. Healthcare facilities in certain regions, especially in rural and remote areas, may lack the necessary infrastructure and trained personnel to conduct effective newborn screening. The absence of adequate laboratory facilities, skilled technicians, and transportation logistics can hinder the implementation of screening programs.

Newborn Screening Instruments Market: Opportunities

Advancements in genetic research to provide several growth opportunities

As the understanding of genetics and genomics continues to expand, new insights into the genetic basis of neonatal disorders are emerging. New sequencing technologies are making it possible to sequence the genomes of newborns at an affordable cost. This allows researchers to identify genetic mutations that are associated with neonatal disorders. For example, in 2023, Illumina announced the launch of its NovaSeq 6000 system, which can sequence the genomes of newborns in a few hours. This presents an opportunity to develop more targeted and comprehensive newborn screening tests. By incorporating the latest genetic findings, screening instruments can be designed to identify a broader range of disorders with higher accuracy and sensitivity. Moreover, these advancements enable the identification of specific genetic markers associated with various conditions, allowing for early detection even before clinical symptoms manifest. This not only aids in timely intervention but also lays the foundation for personalized medicine approaches tailored to an individual's genetic makeup. As research breakthroughs continue to unveil the complex genetic underpinnings of neonatal disorders, the newborn screening instrument market can harness this knowledge to offer more sophisticated and effective screening solutions, ultimately improving healthcare outcomes for newborns around the world.

Newborn Screening Instruments Market: Challenges

Standardization of protocols to challenge market cap growth

Standardization of protocols poses a significant challenge for the newborn screening instrument market, impacting the consistency and reliability of screening programs. The lack of uniform guidelines and protocols for screening tests across different regions and healthcare settings can lead to variations in testing procedures, result interpretation, and follow-up actions. This variability hampers the ability to compare results accurately, making it difficult to establish a standardized approach to newborn screening. As a consequence, the quality and accuracy of screening outcomes can be compromised, leading to discrepancies in the identification and diagnosis of neonatal disorders. Moreover, the absence of standardized protocols can create confusion among healthcare professionals and caregivers, potentially resulting in missed diagnoses or unnecessary interventions. It also complicates efforts to collect and analyze data on a broader scale for research and public health purposes. Addressing the challenge of standardization requires collaborative efforts among healthcare authorities, medical societies, and industry stakeholders to develop and promote consistent guidelines and protocols. Only through standardized procedures can the newborn screening instrument market ensure the highest level of accuracy, reliability, and comparability of screening results, thus improving the effectiveness of newborn screening programs and the well-being of newborns worldwide.

Newborn Screening Instruments Market: Segmentation

The global newborn screening instruments market is segmented based on type, application, and region.

Based on test type, the global market segments are blood spot tests, hearing tests, critical congenital heart disease (CCHD) tests, and metabolic disorder tests. At present, the newborn screening instrument industry is dominated by the metabolic disorder test segment. This growth can be attributed to the increasing awareness among healthcare providers and parents about the importance of early detection and intervention for metabolic disorders in newborns. Metabolic disorders, such as phenylketonuria (PKU) and cystic fibrosis, can lead to severe health complications if not identified and managed promptly. Governments and healthcare organizations are focusing on expanding newborn screening programs to include a wider range of metabolic disorders, thereby driving the demand for advanced screening instruments tailored to identify these disorders.

Based on product type, the global newborn screening instruments industry is segmented into mass spectrometers, pulse oximeters, hearing screening devices, assay kits, and DNA sequencers. Out of these, DNA sequencers were the largest shareholding segment in the global market. DNA sequencing technology has advanced significantly in recent years, enabling accurate and comprehensive genetic analysis. DNA sequencing allows for the identification of a wide range of genetic disorders and conditions, making it a valuable tool for newborn screening. Additionally, as the understanding of the genetic basis of diseases improves, healthcare providers and parents are increasingly recognizing the importance of early detection and intervention. DNA sequencers provide detailed insights into an individual's genetic makeup, enabling healthcare professionals to identify potential risks or predispositions to various disorders at an early stage. This proactive approach not only aids in the early diagnosis and treatment of diseases but also empowers families to make informed decisions about their child's health. As awareness about the benefits of genetic screening grows, the demand for DNA sequencers for newborn screening is likely to rise, driving the segment's rapid growth rate.

Newborn Screening Instruments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Newborn Screening Instruments Market |

| Market Size in 2022 | USD 785 Million |

| Market Forecast in 2030 | USD 1552 Million |

| Growth Rate | CAGR of 7.80% |

| Number of Pages | 212 |

| Key Companies Covered | PerkinElmer Inc., Waters Corporation, Bio-Rad Laboratories Inc., Agilent Technologies Inc., Trivitron Healthcare, Natus Medical Incorporated, Zivak Technologies, NEOGEN Corporation, Medtronic, SCIEX (a Danaher Company), and others. |

| Segments Covered | By Test Type, By Product Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Newborn Screening Instruments Market: Regional Analysis

Asia Pacific to lead the global market during the forecast period

In the newborn screening instrument market, the Asia-Pacific region is poised to experience the highest growth rate, with an approximate share of 35% in 2032. This growth can be attributed to several factors. Firstly, the region's large population, particularly in countries like India and China, presents a significant pool of newborns requiring screening. The Asia Pacific region is home to the largest number of newborns in the world. In 2022, there were an estimated 53 million births in the region, accounting for 48% of the global total.

Increased healthcare awareness and improvements in healthcare infrastructure have led to a higher demand for early disease detection, fostering the adoption of newborn screening instruments. The Asia Pacific region is also seeing rapid growth in healthcare developments and investments. In 2021, the region's healthcare industry was valued at USD 1.1 trillion and is expected to grow to USD 2.9 trillion by 2032. Secondly, governments and healthcare organizations in the Asia-Pacific are recognizing the importance of early detection and intervention for congenital disorders and metabolic diseases. As a result, they are implementing newborn screening programs and policies, further boosting the demand for screening instruments.

Newborn Screening Instruments Market: Recent Developments

- In August 2022, Trivitron Healthcare launched Centre of Excellence (CoE) in genomics, newborn screening, metabolomics, and molecular diagnostics. This CoE will focus on creating unparalleled medical discoveries to transform healthcare delivery.

Newborn Screening Instruments Market: Competitive Analysis

The global Newborn Screening Instruments market is dominated by players like:

- PerkinElmer Inc.

- Waters Corporation

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- Trivitron Healthcare

- Natus Medical Incorporated

- Zivak Technologies

- NEOGEN Corporation

- Medtronic

- SCIEX (a Danaher Company)

The global Newborn Screening Instruments market is segmented as follows:

By Test Type

- Blood Spot Test

- Hearing Test

- Critical Congenital Heart Disease (CCHD) Test

- Metabolic Disorder Test

By Product Type

- Mass Spectrometers

- Pulse Oximeters

- Hearing Screening Devices

- Assay Kits

- DNA Sequencers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Newborn screening instruments are medical devices designed to identify certain genetic, metabolic, and congenital disorders in newborn babies shortly after birth. This early detection enables timely intervention and treatment, potentially preventing serious health complications or even death.

The global newborn screening instruments market cap may grow owing to the rising incidence of neonatal disorders, across the globe. Significant growth opportunities can be expected due to advancements in genetic research.

According to study, the global newborn screening instruments market size was worth around USD 785 million in 2022 and is predicted to grow to around USD 1,552 million by 2030.

The CAGR value of the newborn screening instruments market is expected to be around 7.80% during 2023-2030.

The global newborn screening instruments market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the region's large population, particularly in countries like India and China, and significant pool of newborns requiring screening.

The global newborn screening instruments market is led by players like PerkinElmer Inc., Waters Corporation, Bio-Rad Laboratories Inc., Agilent Technologies Inc., Trivitron Healthcare, Natus Medical Incorporated, Zivak Technologies, NEOGEN Corporation, Medtronic, SCIEX (a Danaher Company).

The report analyzes the global newborn screening instruments market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the newborn screening instruments industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed