Offshore Patrol Vessels (OPVs) Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

Offshore Patrol Vessels (OPVs) Market by Type (War-fighting Vessel, Basic Patrol Vessel) by Applications (Navy, Coast Guard, Police Force): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

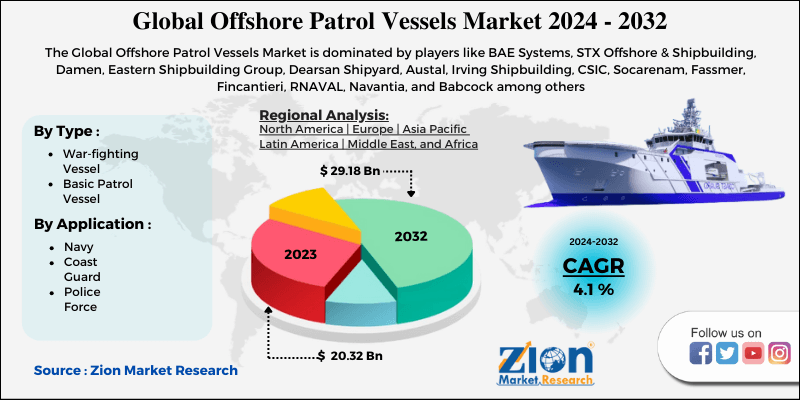

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 20.32 Billion | USD 29.18 Billion | 4.1% | 2023 |

Offshore Patrol Vessels (OPVs) Market Insights

Zion Market Research has published a report on the global Offshore Patrol Vessels (OPVs) Market, estimating its value at USD 20.32 Billion in 2023, with projections indicating that it will reach USD 29.18 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.1% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Offshore Patrol Vessels (OPVs) Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Offshore Patrol Vessels (OPVs) Market: Overview

The offshore patrol vessel is a highly flexible vessel built to perform roles in the management of the Economic Exclusion Zone (EEZ), which also covers maritime protection to coastal areas and successful disaster relief. They are the fastest-rising segment of the naval vessels market. According to statistics, the total number of OPVs on order has expanded by 4% in the last year, whereas the expected number has also increased by 4%.

Offshore Patrol Vessels (OPVs) Market: Growth Factors

The Offshore Patrol Vessels (OPVs) market is experiencing significant growth driven by various factors, primarily the increasing need for maritime security, border control, and protection of offshore assets. With rising geopolitical tensions and security threats, governments around the world are investing in OPVs to ensure the safety of national waters and to secure exclusive economic zones (EEZs). Additionally, the expansion of offshore oil and gas exploration is further boosting demand, as OPVs play a critical role in surveillance and emergency response in these regions. Technological advancements, including enhanced navigation systems, unmanned capabilities, and improved fuel efficiency, are making OPVs more versatile and attractive to navies and coast guards. Furthermore, the demand for cost-effective and adaptable maritime solutions is driving the adoption of modular OPVs, allowing for customization to suit various operational needs. Overall, these factors are contributing to the steady expansion of the OPV market globally.

Global Offshore Patrol Vessels (OPVs) Market: Segmentation

OPVs can be categorized into two groups, high-end war-fighting vessels, and basic patrol vessels. High-end war-fighting vessels are equipped with sophisticated combat systems and C4I (Command, Control, Communications, Computers, & Intelligence) systems, which significantly increase operational flexibility and reduce deployment time. Basic patrol vessels are engineered for continuous low-intensity missions, fitted with basic weapons, and standard navigation sensors, following commercial standards.

The type of OPV, a country chooses depends on its specific naval needs, resulting from the intended role of its naval force, political aspirations, and its geographic location. Most OPV services, however, are of reasonable prices, multi-role type. These are being used in a growing range of functions, including the protection of fisheries, firefighting, pollution control, Search and Rescue (SAR), humanitarian operations, counter-narcotics, and surveillance in the Exclusive Economic Zone (EEZ).

OPVs can help meet the naval demands for ocean surveillance analytics and surface warfare activities in order to avoid invasion and marine transgression of sovereignty. Moreover, they are ideal for the surveillance of underwater communications lanes, the protection of offshore oil installations and other important offshore national assets.

Asia has the largest share (44%) of the current fleet, India and Japan itself owns nearly 50% of Asian vessels, with India accounting for about 26% of the total vessels on order globally.

In the early 1980s, the Indian Navy received the first advanced OPVs, 'the Sukanya class' from South Korea. The ships of this class were later constructed with considerable success in India. Although initially they were developed to protect India's substantial offshore assets, later they proved to be valuable workhorses and therefore were introduced for a range of roles. OPVs have also been the backbone of the Indian Coast Guard, and the procurement activities underway in the Navy and the Coast Guard highlight their usefulness.

Many companies are developing cutting-edge OPVS and have established skills to meet navies' ever-increasing naval requirements. To meet the UK Royal Navy's multiple mission requirements, BAE Systems has built a new class of 90m Offshore Patrol Vessels (OPV).In the last few years, the Indian private sector has seen the development of large, innovative, state-of-the-art shipyards, capable of participating in the country's warship-building program. ABG, Bharti and Larsen, Pipavav, and Toubro are private shipyards that have invested substantial amounts of money to produce capability and cap Request Free Sample

Request Free Sample

Offshore Patrol Vessels (OPVs) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Offshore Patrol Vessels (OPVs) Market |

| Market Size in 2023 | USD 20.32 Billion |

| Market Forecast in 2032 | USD 29.18 Billion |

| Growth Rate | CAGR of 4.1% |

| Number of Pages | 110 |

| Key Companies Covered | BAE Systems, STX Offshore & Shipbuilding, Damen, Eastern Shipbuilding Group, Dearsan Shipyard, Austal, Irving Shipbuilding, CSIC, Socarenam, Fassmer, Fincantieri, RNAVAL, Navantia, and Babcock among others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Offshore Patrol Vessels (OPVs) Market: Competitive Space

The major players in the global OPVs market include

- BAE Systems

- STX Offshore & Shipbuilding

- Damen

- Eastern Shipbuilding Group

- Dearsan Shipyard

- Austal

- Irving Shipbuilding

- CSIC

- Socarenam

- Fassmer

- Fincantieri

- RNAVAL

- Navantia

- Babcock among others.

The report segment of global OPVs market are as follows:

Global OPVs Market: Type Segment Analysis

- War-fighting Vessel

- Basic Patrol Vessel

Global OPVs Market: Applications Segment Analysis

- Navy

- Coast Guard

- Police Force

Global OPVs Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The offshore patrol vessel is a highly flexible vessel built to perform roles in the management of the Economic Exclusion Zone (EEZ), which also covers maritime protection to coastal areas and successful disaster relief. They are the fastest rising segment of the naval vessels market.

According to Zion Market Research, global Offshore Patrol Vessels (OPVs) Market, estimating its value at USD 20.32 Billion in 2023, with projections indicating that it will reach USD 29.18 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.1% over the forecast period 2024-2032.

Asia has the largest share (44%) of the current fleet, India and Japan itself owns nearly 50% of Asian vessels, with India accounting for about 26% of the total vessels on order globally. In the early 1980s, the Indian Navy received the first advanced OPVs, 'the Sukanya class' from South Korea. The ships of this class were later constructed with considerable success in India. Although initially they were developed to protect India's substantial offshore assets, later they proved to be valuable workhorses and therefore were introduced for a range of roles. OPVs have also been the backbone of the Indian Coast Guard, and the procurement activities underway in the navy and the Coast Guard highlight their usefulness.

The major players in the global OPVs market include BAE Systems, STX Offshore & Shipbuilding, Damen, Eastern Shipbuilding Group, Dearsan Shipyard, Austal, Irving Shipbuilding, CSIC, Socarenam, Fassmer, Fincantieri, RNAVAL, Navantia, and Babcock among others.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-market-size.png)