Offsite Construction Market Size, Industry Share, Analysis, Growth Report, 2032

Offsite Construction Market By Application (Commercial, Residential, and Industrial), By Construction Type (Movable and Fixed), By Material (Concrete, Wood, Steel, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

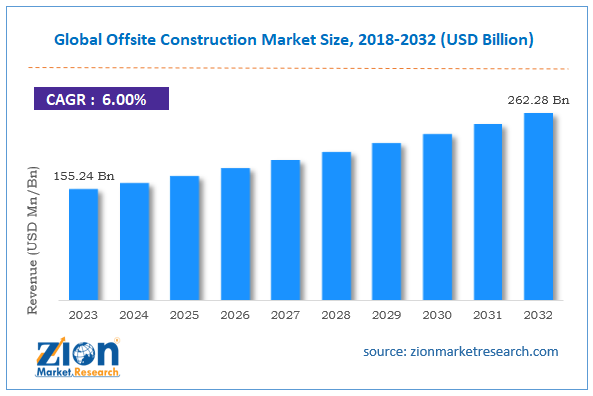

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 155.24 Billion | USD 262.28 Billion | 6.00% | 2023 |

Offsite Construction Industry Prospective:

The global offsite construction market size was worth around USD 155.24 billion in 2023 and is predicted to grow to around USD 262.28 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.00% between 2024 and 2032.

Offsite Construction Market: Overview

Offsite construction is a common practice in the building & construction industry encompassing a broad range of building activities that take place at places away from the final construction site. The practice is also referred to as modular construction or prefabrication. Offsite construction allows companies to construct several components of the final structure in a distant and controlled environment. The finalized components and modules are transported to the actual building site where they are aligned in the desired manner to construct the final structure. Several benefits have been associated with offsite construction as opposed to the traditional means of constructing structure parts and modules at the building site.

In recent times, the adoption rate of offsite construction has increased as engineers, architects, and other associated stakeholders have shown greater interest in incorporating some form of prefabrication in the construction process. A recent survey by the National Institute of Building Sciences (NIBS) Offsite Construction Council concluded offsite construction was implemented by around 93% of all respondents. Additionally, around 50% of the respondents were of the view that cost-efficiency is an important parameter of modular construction. During the forecast period, the demand for the offsite construction industry is likely to grow rapidly.

Key Insights:

- As per the analysis shared by our research analyst, the global offsite construction market is estimated to grow annually at a CAGR of around 6.00% over the forecast period (2024-2032)

- In terms of revenue, the global offsite construction market size was valued at around USD 155.24 billion in 2023 and is projected to reach USD 262.28 billion by 2032.

- The market is projected to grow at a significant rate due to the rising focus on achieving high-quality products

- Based on application segmentation, the residential segment was predicted to show maximum market share in the year 2023

- Based on material segmentation, the concrete segment was the leading segment in 2023

- On the basis of region, Europe is expected to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Offsite Construction Market: Growth Drivers

Rising focus on achieving high-quality products will accelerate the market growth rate

The global offsite construction market is expected to grow during the forecast period since there is a rising focus on developing long-lasting, quality, and sustainable infrastructure or building elements. Consumers globally are more inclined toward spending money on acquiring quality products that can withstand environmental challenges and survive in the long run. Offsite construction typically occurs in a controlled environment and hence it is easier to ensure that the quality of the final good is not compromised. Onsite construction is sometimes prone to lapse in quality checks due to several factors.

However, in modular construction, special processes or protocols are drafted along with the appointment of quality officers to deliver superior-grade elements. In addition to this, another factor of critical importance in the offsite construction procedures is higher sustainability. Prefabrication provides a means to improve waste management systems. Companies offering offsite construction tend to invest in excellent recycling practices, especially at present times when the cost of raw materials is rising sharply. The rise in government initiatives promoting sustainability worldwide will encourage more businesses in the building & construction sector to incorporate offsite construction.

Rising investments in offsite construction solutions will generate high-growth revenue

In the last decade, the total investments and conversations around offsite construction have improved. The continuous rise in delivering innovative solutions offering offsite construction is projected to help the market flourish during the projection period. For instance, in July 2023, Bristing Offsite, a leading firm operating in the construction and manufacturing sector, announced the launch of Horizon in association with Randek AB, a Sweden-based robotic engineering company.

Horizon is a 12,700m2 offsite construction factory building with a total investment of € 52 million as per official reports. Once the factory becomes fully operational, it is estimated to deliver around 4,000 new homes annually. On the other hand, several key players in the global offsite construction market are holding important conversations over ways to navigate through several challenges existing in the sector.

Offsite Construction Market: Restraints

Managing the transportation of large components from the manufacturing point to the final destination is a major limitation

The global offsite construction industry is projected to be restricted in terms of growth due to the logistical limitations that the sector faces when transporting prefabricated structures to the final site of implementation. In some cases, the pre-constructed modules are extremely large and cannot be easily moved from one location to another. They require the use of large cranes or other forms of transportation that may not be easily accessible.

The tools used for transportation are expensive thus causing the players to work on inflated initial budgets. Furthermore, moving the parts through congested routes can be equally tough. Companies operating in the industry must invest in careful planning and resource location to optimize offsite construction processes.

Offsite Construction Market: Opportunities

Growing infrastructure development projects worldwide will generate high-growth opportunities

The global offsite construction market is projected to generate high growth opportunities in the coming years as there has been a rise in several key infrastructure development projects including commercial, residential, and industrial. Countries such as India, China, Germany, the UK, and other nations have invested large sums in future-oriented large-scale projects that are expected to boost the regional economy along with positively impacting the international trade routes.

In February 2024, the European Union (EU) announced that it will be investing €150 billion by 2027 in Africa toward the regional infrastructure improvement projects. Similarly in the same month, Japan authorized an official development assistance (ODA) loan to India to be used for several development initiatives in the country. Offsite construction is expected to become a part of a majority of these projects thus driving market demand.

Increase in demand for reasonably-priced housing units will add more fuel to the growth trajectory

The real-estate prices universally have been rising for the last few years. People are seeking affordable housing with functional amenities. For instance, the average cost of property in London has been around €730,000 in the last 12 months. The rising rate of urbanization along with the growing population rate will contribute to higher demand for less-expensive housing facilities thus impacting the global offsite construction industry demand.

Offsite Construction Market: Challenges

Risk of resistance from the unions poses a significant challenge for the market players

The global offsite construction market faces critical challenges in the form of the risk of unions showing resistance to the implementation of modular construction. The current state of mass layoffs across industries may further generate a sense of job insecurity among the employees leading to resistance toward acceptance of offsite construction. Creating a balance between employee job security and cost efficiency can be difficult for the market players.

Offsite Construction Market: Segmentation

The global offsite construction market is segmented based on application, construction type, material, and region.

Based on application, the global market segments are commercial, residential, and industrial. In 2023, the highest growth was witnessed in the residential segment. The main reason is the steep rise in the demand for housing facilities in urban areas. The growing number of people moving to developed regions for employment and education opportunities along with the increased focus of the regional governments to promote the development of affordable residential units has assisted in higher segmental demand. In 2024, India’s real estate industry is likely to reach USD 0.329 trillion.

Based on construction type, the global offsite construction industry is segmented into movable and fixed.

Based on material, the global market is segmented into concrete, wood, steel, and others. In 2023, the highest demand was observed in the concrete segment since this type of material is used extensively in infrastructure projects and sites. The rise in the number of key architectural projects including commercial and residential buildings has assisted in segmental growth. As per the latest reports, China is home to more than 600 million buildings.

Offsite Construction Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Offsite Construction Market |

| Market Size in 2023 | USD 155.24 Billion |

| Market Forecast in 2032 | USD 262.28 Billion |

| Growth Rate | CAGR of 6.00% |

| Number of Pages | 211 |

| Key Companies Covered | Bouygues Construction, Katerra, Barratt Developments, Skanska, Vinci Construction, Prescient, Laing O'Rourke, Taylor Wimpey, Element5 Co., Lendlease, Champion Homes, Redrow, Modscape, Mace Group, Kier Group., and others. |

| Segments Covered | By Application, By Construction Type, By Material, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Offsite Construction Market: Regional Analysis

Europe will continue to hold its dominance during the forecast period

The global offsite construction market will be dominated by Europe during the forecast period. The primary reason for the higher regional revenue is the presence of a well-adopted and functional ecosystem for offsite construction in European countries such as Sweden and Germany. The growth in the number of construction and manufacturing companies incorporating offsite construction as a means of achieving superior quality, timely, and cost-effective construction solutions has been instrumental in driving the regional market demand. Businesses are working on leveraging 3-dimensional printing technology for implementation in extended industries.

In January 2024, a newly constructed 3D printing building was established as a data center. The structure is reported as the largest 3D-printed structure in Europe. Asia-Pacific is expected to generate higher revenues during the forecast period. Japan, China, and India will be leading the regional market share. The growing number of residential buyers as well as the increase in the number of international-scale infrastructure projects will be beneficial for the regional market players.

Offsite Construction Market: Competitive Analysis

The global offsite construction market is led by players like:

- Bouygues Construction

- Katerra

- Barratt Developments

- Skanska

- Vinci Construction

- Prescient

- Laing O'Rourke

- Taylor Wimpey

- Element5 Co.

- Lendlease

- Champion Homes

- Redrow

- Modscape

- Mace Group

- Kier Group.

The global offsite construction market is segmented as follows:

By Application

- Commercial

- Residential

- Industrial

By Construction Type

- Movable

- Fixed

By Material

- Concrete

- Wood

- Steel

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Offsite construction is a common practice in the building & construction industry encompassing a broad range of building activities that take place at places away from the final construction site.

The global offsite construction market is expected to grow during the forecast period since there is a rising focus on developing long-lasting, quality, and sustainable infrastructure or building elements.

According to study, the global offsite construction market size was worth around USD 155.24 billion in 2023 and is predicted to grow to around USD 262.28 billion by 2032.

The CAGR value of offsite construction market is expected to be around 6.00% during 2024-2032.

The global offsite construction market will be dominated by Europe during the forecast period.

The global offsite construction market is led by players like Bouygues Construction, Katerra, Barratt Developments, Skanska, Vinci Construction, Prescient, Laing O'Rourke, Taylor Wimpey, Element5 Co., Lendlease, Champion Homes, Redrow, Modscape, Mace Group, and Kier Group.

The report explores crucial aspects of the offsite construction market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed