OTC Agricultural Product Trading Platform Market Size, Share, Trends, Growth and Forecast 2032

OTC Agricultural Product Trading Platform Market By Type (Livestock Products, Crops Products, Fishery Products, Horticultural Products, Forestry Products, and Dairy Products), By Application (Enterprise and Individual), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

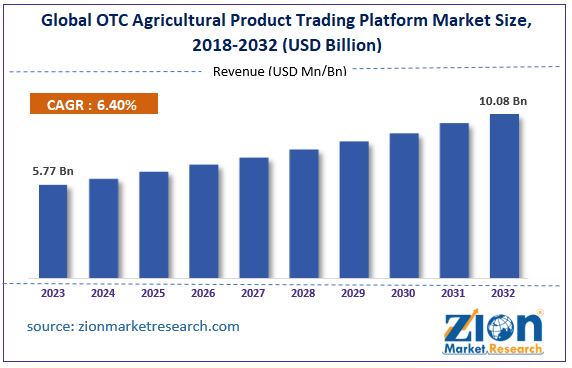

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.77 Billion | USD 10.08 Billion | 6.40% | 2023 |

OTC Agricultural Product Trading Platform Industry Prospective:

The global OTC agricultural product trading platform market size was worth around USD 5.77 billion in 2023 and is predicted to grow to around USD 10.08 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.40% between 2024 and 2032.

OTC Agricultural Product Trading Platform Market: Overview

An agricultural product trading platform that facilitates direct trade between buyers and sellers without requiring a centralized exchange is referred to as an OTC (Over-The-Counter) platform. Sellers post products (such as grains, fruits, vegetables, and livestock) on the market, and buyers search for things that meet their requirements. There may be tools on the platform for matching buyers and vendors according to preferences. With features like blockchain for enhanced security and transparency, mobile accessibility to cater to a wider user base, and artificial intelligence (AI) for better matchmaking, these platforms are evolving in step with technology.

Key Insights

- As per the analysis shared by our research analyst, the global OTC Agricultural Product Trading Platform market is estimated to grow annually at a CAGR of around 6.40% over the forecast period (2024-2032).

- In terms of revenue, the global OTC Agricultural Product Trading Platform market size was valued at around USD 5.77 billion in 2023 and is projected to reach USD 10.08 billion, by 2032.

- The increasing integration of advanced technology such as AI and ML is expected to drive the global OTC agricultural product trading platform market growth over the forecast period.

- Based on the type, the fishery products segment is expected to capture the largest market share over the projected period.

- Based on the application, the enterprise segment is expected to hold a prominent market share over the projected period.

- Based on region, Europe is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

OTC Agricultural Product Trading Platform Market: Growth Drivers

Integration of advanced technology such as AI and ML drives market growth

Advanced analytics, which can process vast amounts of market data in a matter of seconds, is being adopted by OTC agriculture product trading platforms in greater numbers. By recognizing patterns and trends, traders can use a sense of confidence when making decisions, which in turn increases efficiency, in handling risk. This kind of technology provides the predictive ability that helps traders anticipate market movements so that they can adjust their strategies accordingly. This technology functions in the predictive form, and by this forecasting, traders may adapt their strategies to respond to the coming market movements. The use of AI and ML algorithms in OTC (OTC Over-the-Counter) commodity trading systems simplifies rollout strategies and increases market profitability. All of the abovementioned factors will boost the global OTC agricultural product trading platform market growth in the coming years.

OTC Agricultural Product Trading Platform Market: Restraints

Limited market access hindering market growth

Due to the high capital requirements and strict eligibility requirements, the lack of market access on OTC commodity trading platforms prevents many potential participants, including retail investors and smaller businesses, from participating in the trading. This is a major impediment to the growth of the OTC agricultural product trading platform industry. This exclusion has the effect of reducing market participants, which in turn reduces trading activity and market liquidity. Eventually, the barrier to entry becomes pervasive, impeding the OTC agriculture product trading platform's growth and development and limiting its ability to merge with the trading market.

OTC Agricultural Product Trading Platform Market: Opportunities

Growing collaboration offers a lucrative opportunity for market growth

The growing collaboration is expected to offer a lucrative opportunity for OTC agricultural product trading platform market growth over the forecast period. For instance, in October 2023, R.J. O'Brien & Associates (RJO)'s agricultural technology (ag-tech) platform Hrvyst partnered with Greenstone Systems, a Cultura Company, to improve data accessibility through the integration of Hrvyst's physical and hedge management into Greenstone's producer interaction platform, MyGrower. The integrations' execution will be overseen by Hrvyst. Every agricultural enterprise can initiate the relevant bids for the goods related to their establishment. Users of MyGrower can run their businesses from PCs or mobile devices thanks to this integration. Furthermore, merchandisers and originators can now publish cash bids in real-time using the Hrvyst / Greenstone connection. Customers of Hrvyst and Mutual MyGrower can now make use of the Hrvyst cash bids and futures integration.

OTC Agricultural Product Trading Platform Market: Challenges

Regulatory and technology adoption barriers pose a major challenge to market expansion

Regulations about agricultural trading differ greatly between nations and regions, which makes it difficult for platform operators to comply with several legal frameworks. Maintaining adherence to trade, environmental, and food safety rules can be expensive and time-consuming. Furthermore, a lot of farmers and traders might not have the digital literacy needed to use Internet trading platforms efficiently, especially in developing nations. Conventional farming communities may be reluctant to switch from established trade channels to online marketplaces. Thus, posing a major challenge to the market growth.

OTC Agricultural Product Trading Platform Market: Segmentation

The global OTC agricultural product trading platform industry is segmented based on type, application, and region.

Based on the type, the global OTC agricultural product trading platform market is bifurcated into livestock products, crop products, fishery products, horticultural products, forestry products, and dairy products. The fishery products segment is expected to capture the largest market share over the projected period. The market for fisheries goods is one of the many commodities that have been added to OTC (Over-The-Counter) Agricultural Product Trading Platforms. These platforms offer a direct trading environment with flexibility and efficiency for buyers and sellers. The demand for seafood is being driven by an increasing worldwide population and rising health consciousness, which increases the value of efficient trading systems. Furthermore, technological advancements like blockchain for market monitoring and AI for traceability improve the usefulness and allure of over-the-counter (OTC) trading platforms for fisheries products.

Based on the application, the global OTC agricultural product trading platform industry is bifurcated into enterprise and individual. The enterprise segment is expected to hold a prominent market share over the projected period. The market for OTC agricultural product trading platforms presents substantial prospects for businesses by offering specialized, effective, and secure trading solutions. Further adoption and expansion in this industry will be fueled by addressing the unique issues faced by large-scale operations through technical integration, regulatory coordination, and effective security measures. Businesses may successfully manage risks, improve their supply chains, and reach a wider market by utilizing these platforms.

OTC Agricultural Product Trading Platform Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | OTC Agricultural Product Trading Platform Market |

| Market Size in 2023 | USD 5.77 Billion |

| Market Forecast in 2032 | USD 10.08 Billion |

| Growth Rate | CAGR of 6.40% |

| Number of Pages | 212 |

| Key Companies Covered | AxiTrader Limited, GAIN Global Markets Inc., Ibg Holdings L.L.C., LMAX Global, IG Group, CMC Markets, Saxo Bank, City Index, XXZW Investment Group SA, EToro, StoneX, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

OTC Agricultural Product Trading Platform Market: Regional Analysis

Europe is expected to dominate the market during the forecast period

Europe is expected to dominate the global OTC agricultural product trading platform market during the forecast period. The area has a robust legal framework and financial infrastructure, and a wide range of commodities are traded on the market. Moreover, Europe has strong exchanges and trade hubs that improve pricing transparency and liquidity. Furthermore, the presence of significant market players in Europe, including financial institutions, commodity producers, and trading businesses, strengthens the region's dominance in the OTC commodities trading platform industry and solidifies its leading position.

Besides, the North American region also captures a significant market share over the forecast period. Large agricultural businesses that produce a diverse range of crops and livestock are present in both the US and Canada. Because of their diversity, buyers and sellers must be directly connected through effective trading platforms. Additionally, there is an increasing need for agricultural products to have traceability and transparency from both regulatory agencies and consumers. To enable comprehensive tracking of product origins and movements, OTC platforms in North America frequently incorporate blockchain technology.

OTC Agricultural Product Trading Platform Market: Competitive Analysis

The global OTC agricultural product trading platform market is dominated by players like:

- AxiTrader Limited

- GAIN Global Markets Inc.

- Ibg Holdings L.L.C.

- LMAX Global

- IG Group

- CMC Markets

- Saxo Bank

- City Index

- XXZW Investment Group SA

- EToro

- StoneX

The global OTC agricultural product trading platform market is segmented as follows:

By Type

- Livestock Products

- Crops Products

- Fishery Products

- Horticultural Products

- Forestry Products

- Dairy Products

By Application

- Enterprise

- Individual

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An agricultural product trading platform that facilitates direct trade between buyers and sellers without requiring a centralized exchange is referred to as an OTC (Over-The-Counter) platform. Sellers post products (such as grains, fruits, vegetables, and livestock) on the market, and buyers search for things that meet their requirements. There may be tools on the platform for matching buyers and vendors according to preferences. With features like blockchain for enhanced security and transparency, mobile accessibility to cater to a wider user base, and artificial intelligence (AI) for better matchmaking, these platforms are evolving in step with technology.

The OTC agricultural product trading platform market is being driven by several factors including growing demand for agriculture products, rising digital transformation in agriculture, technological advancements, rising government support, and many others.

According to the report, the global OTC agricultural product trading platform market size was worth around USD 5.77 billion in 2023 and is predicted to grow to around USD 10.08 billion by 2032.

The global OTC agricultural product trading platform market is expected to grow at a CAGR of 6.40% during the forecast period.

The global OTC agricultural product trading platform market growth is expected to be driven by Europe. It is currently the world’s highest revenue-generating market due to the supportive regulatory environment.

The global OTC agricultural product trading platform market is dominated by players like AxiTrader Limited, GAIN Global Markets Inc., Ibg Holdings L.L.C., LMAX Global, IG Group, CMC Markets, Saxo Bank, City Index, XXZW Investment Group SA, EToro, and StoneX among others.

The OTC agricultural product trading platform market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed