P2P Lending Market Size, Share, Trends, Growth and Forecast 2032

P2P Lending Market By Loan Type (Personal Loans, Student Loans, Real Estate Loans, and Business Loans), By Platform Type (Web-Based Platform and Mobile-Based Platform), By End-User (Businesses and Individuals), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

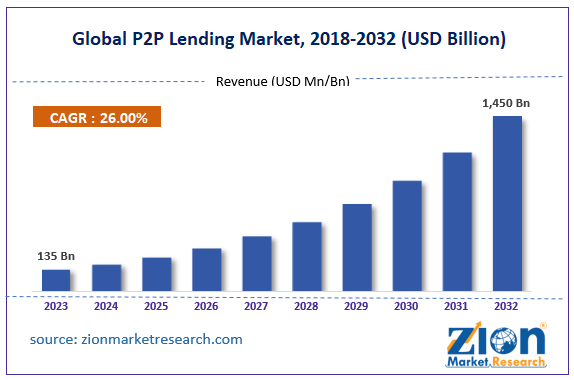

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 135 Billion | USD 1,450 Billion | 26% | 2023 |

P2P Lending Industry Prospective:

The global P2P lending market size was evaluated at $135 billion in 2023 and is slated to hit $1,450 billion by the end of 2032 with a CAGR of nearly 26% between 2024 and 2032.

P2P Lending Market: Overview

P2P lending, also referred to as peer-to-peer lending, is a financial innovation connecting borrowers with lenders. Moreover, it bypasses conventional financial institutes such as banks. Reportedly, it functions on digital platforms, enabling the mapping of persons opting for loans with those who want to lend them money. For the record, the P2P lending process facilitates loans at reduced rates of interest for borrowers, along with ensuring good returns for lenders.

Key Insights

- As per the analysis shared by our research analyst, the global P2P lending market is projected to expand annually at the annual growth rate of around 26% over the forecast timespan (2024-2032)

- In terms of revenue, the global P2P lending market size was evaluated at nearly $135 billion in 2023 and is expected to reach $1,450 billion by 2032.

- The global P2P lending market is anticipated to grow rapidly over the forecast timeline owing to changing consumer tastes and demand for small business lending.

- In terms of loan type, the business loans segment is slated to register the highest CAGR over the forecast period.

- Based on platform type, the web-based platform segment is predicted to contribute majorly towards global market revenue in the ensuing years.

- On the basis of end-user, the individuals segment is likely to maintain segmental domination in the forthcoming years.

- Region-wise, the European P2P lending industry is projected to register the fastest CAGR during the assessment timespan.

P2P Lending Market: Growth Factors

Cost-effectiveness of P2P lending transactions and new digital tool launches to boost the global market trends

Technological breakthroughs such as the launch of digital tools, blockchain systems, and data analytics tools are expected to boost the growth of the global P2P lending market. Furthermore, lower costs of borrowers and supportive laws will steer the global market trends.

In addition, changing consumer tastes and demand for small business lending will contribute majorly towards the global market expansion in the years ahead. Growing tilt towards cashless transactions is likely to propel the growth of the market globally. Usage of AI and advanced fraud detection tools in the P2P lending business and the focus of market players on targeting students and real estate owners are likely to translate into huge growth in the market space across the globe. Quick fund access, a fast approval process, and flexible terms of repayment are some of the factors that are likely to help the global market thrive in the coming years.

P2P Lending Market: Restraints

Lack of fiscal literacy rate & rising default rates can impede the global industry expansion over 2024-2032

Changing regulations and volatile situations witnessed in the lending business and limited credit history of borrowers can halt the growth of the global P2P lending industry. Low financial literacy and risk of investing in P2P lending owing to rising frauds and defaults can restrict the global industry expansion.

P2P Lending Market: Opportunities

Changing consumer tastes and high ROI to create new growth avenues for the global market

A prominent surge in the number of joint ventures between fintech firms and P2P lending platforms and changing customer trends is expected to create new facets of growth for the global P2P lending market. Furthermore, P2P lending offers high returns on investments, which is likely to provide a strong platform for the growth of the P2P lending business globally.

P2P Lending Market: Challenges

Need for swift fiscal transactions at lower operating costs can challenge the global industry growth over 2024-2032

Lack of access to strong technology infrastructure facility and need for seamless financial transactions are some of the few challenges faced by the global P2P lending industry. An increase in the risk of defaulting on loans along with growing operating costs owing to manifold transactions of each borrower has resulted in some of the P2P tools closing their operations. This, in turn, has created a huge hiccup in the growth of the industry across the globe.

P2P Lending Market: Segmentation

The global P2P lending market is divided into loan type, platform type, end-user, and region.

In terms of loan type, the P2P lending market across the globe is segmented into personal loans, student loans, real estate loans, and business loans segments. Apparently, the business loans segment, which garnered nearly 59% of the global market earnings in 2023, is set to record the fastest CAGR in the next couple of years subject to surging demand for business loans by small as well as medium-sized firms.

Based on the platform type, the global P2P lending industry is divided into web-based platform and mobile-based platform segments. Apparently, the web-based platform segment, which led the global industry share in 2023, is expected to contribute lucratively towards the global industry expansion in the ensuing years and this can be subject to ability of web-based tools in providing an extensive number of features, enhanced end-user experience, and compatibility with a slew of equipment.

On the basis of end-user, the global P2P lending market is segregated into businesses and individuals segments. Moreover, the individuals segment, which led the segmental surge in 2023, is likely to retain its segmental dominance even in the near future subject to escalating demand for personal loans for consolidation of debts, education, and household activities such as refurbishment & renovation.

P2P Lending Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | P2P Lending Market |

| Market Size in 2023 | USD 135 Billion |

| Market Forecast in 2032 | USD 1,450 Billion |

| Growth Rate | CAGR of 26% |

| Number of Pages | 221 |

| Key Companies Covered | CRED Mint, Zopa, Mobikwik Xtra, LenDenClub, SoFi, Fello, Upstart, Prosper, Mintos, IndiaP2P, iLend, Faircent, Finzy, and others. |

| Segments Covered | By Loan Type, By Platform Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

P2P Lending Market: Regional Insights

Asia-Pacific is projected to maintain leading status in the global market over the forecast timeline

Asia-Pacific, which accounted for about two-fifths of the global P2P lending market size in 2023, is expected to establish a leading position in the global market during the period from 2024 to 2032. In addition, the regional market expansion in the coming seven years can be due to a rise in the population in countries such as India and China.

Apart from this, an increase in the web penetration in these countries and demand for alternate financing will proliferate the regional market size. Moreover, favorable government schemes and laws will drive the regional market space in the coming years.

The European P2P lending industry is anticipated to register the highest CAGR in the expected timespan. The geometric growth of the industry in Europe can be credited to presence of strong financial system and favorable regulations for P2P lending. Reportedly, customers in Europe are tech-savvy and P2P tools cater to various needs of the borrowers and lenders in countries of Europe. Countries such as the UK, France, Estonia, and Germany are likely to be the key regional revenue growth drivers in the near future.

P2P Lending Market: Competitive Space

The global P2P lending market profiles key players such as:

- CRED Mint

- Zopa

- Mobikwik Xtra

- LenDenClub

- SoFi

- Fello

- Upstart

- Prosper

- Mintos

- IndiaP2P

- iLend

- Faircent

- Finzy

The global P2P lending market is segmented as follows:

By Loan Type

- Personal Loans

- Student Loans

- Real Estate Loans

- Business Loans

By Platform Type

- Web-Based Platform

- Mobile-Based Platform

By End-User

- Businesses

- Individuals

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

P2P lending, also known as peer-to-peer lending, is a financial innovation that connects borrowers with lenders. Moreover, it bypasses conventional financial institutes such as banks.

The global P2P lending market's growth over the forecast period can be attributed to the growing trend towards cashless transactions.

According to a study, the global P2P lending industry size was $135 billion in 2023 and is projected to reach $1,450 billion by the end of 2032.

The global P2P lending market is anticipated to record a CAGR of nearly 26% from 2024 to 2032.

The European P2P lending industry is set to register the fastest CAGR over the forecasting timeframe owing to the presence of a strong financial system and favorable regulations for P2P lending. Reportedly, European customers are tech-savvy, and P2P tools cater to the various needs of borrowers and lenders in European countries. Countries such as the UK, France, Estonia, and Germany are likely to be the key regional revenue growth drivers in the near future.

The global P2P lending market is led by players such as CRED Mint, Zopa, Mobikwik Xtra, LenDenClub, SoFi, Fello, Upstart, Prosper, Mintos, IndiaP2P, iLend, Faircent, and Finzy.

The global P2P lending market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, cash-benefit analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, factor analysis, and value chain analysis. It provides an apt scenario about demand and factor conditions in the country impacting the profitability of the firms in the domestic and international markets.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed