Pet Care E-Commerce Market Size, Share, Trends, Growth 2030

Pet Care E-Commerce Market By Type (Grooming, Pet Food, Medicines, and Others), By Animal Type (Crawler, Feline, Canine, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

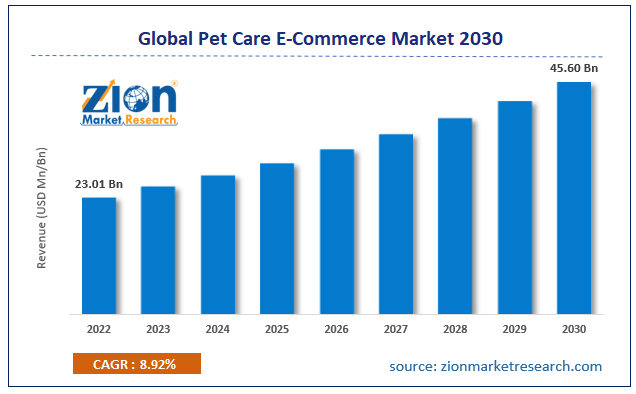

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.01 Billion | USD 45.60 Billion | 8.92% | 2022 |

Pet Care E-Commerce Industry Prospective:

The global pet care e-commerce market size was worth around USD 23.01 billion in 2022 and is predicted to grow to around USD 45.60 billion by 2030 with a compound annual growth rate (CAGR) of roughly 8.92% between 2023 and 2030.

Pet Care E-Commerce Market: Overview

Pet care e-commerce is the online trading of goods and services specifically related to pet care items, food products, clothing, and other accessories. The industry for pet care products and services through the Internet is relatively new and has been a byproduct of the growing popularity of e-commerce-led transactions. These digital platforms intend to provide access to all necessary products used for pet care under one umbrella as pet owners do not have to spend time physically scouting for products and purchasing them. Pet care e-commerce websites function the same as other more traditionally used platforms in terms of browsing and purchasing experience.

However, they may offer certain additional features that align more with pet care including assistance with veterinary care or consultations and pet insurance. Although the market for pet care e-commerce platforms is considered new, it is a fast-growing industry mainly led by the increasing number of pet owners across the globe along with several advantages offered by digital purchase experience. During the forecast period, market players must remain attentive to specific challenges and growth restrictions to continue benefiting from the growing set of consumers.

Key Insights:

- As per the analysis shared by our research analyst, the global pet care e-commerce market is estimated to grow annually at a CAGR of around 8.92% over the forecast period (2023-2030)

- In terms of revenue, the global pet care e-commerce market size was valued at around USD 23.01 billion in 2022 and is projected to reach USD 45.60 billion, by 2030.

- The pet care e-commerce market is projected to grow at a significant rate due to the growing rate of pet adoption

- Based on type segmentation, pet food was predicted to show maximum market share in the year 2022

- Based on animal type segmentation, canine was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Pet Care E-Commerce Market: Growth Drivers

Growing rate of pet adoption to drive market growth

The global pet care e-commerce market is expected to be driven by the increasing number of pet adoptions across the globe. Several reasons have been influential in the growing trend of pet adoption including personal and medical reasons. For instance, some people choose to become pet owners instead of producing biological children. The decision could be either personal or caused by medical reasons. In addition to this, several families globally continue to adopt some form of pet and consider them as integral family members.

A report published by HealthforAnimals reports that there are over 1 billion pets across the globe with regions such as China, the US, and Europe housing more than 0.5 billion pet owners. E-commerce websites dedicated to providing pet care products have proven extremely helpful to urban populations that own pets since these platforms are generally meant to meet the tailored needs of their clients. For instance, several platforms provide subscription-based meal plans for pets based on their nutritional needs and even offer doorstep delivery.

Major e-commerce portals offering special pet care segments to add to market revenue

Since the online sale of pet care products has increased in the last few years, major e-commerce portals including Amazon and others have integrated special segments specially designed for pet products. In October 2023, Amazon was reported to be considering the addition of veterinary telehealth to the long list of its existing services. Such market tactics by mature players that already have a large group of audience will directly impact the market growth rate.

Pet Care E-Commerce Market: Restraints

Questions over product quality and fraud may create growth limitations

The global pet care e-commerce industry is expected to be restricted due to the increasing concerns over the quality of products available on digital platforms. Online transactions are vulnerable to fraud and the trend is more common when purchases are made from questionable websites including social media platforms. The concerns become more serious when pet food is concerned since it can directly impact pet health. Some of the most common e-commerce frauds widely prevalent in the commercial world include refund fraud, stolen credit card, account takeover, and triangulation fraud. As per official data, losses incurred due to fraud related to e-commerce online payments reached USD 41.1 billion in 2022.

Pet Care E-Commerce Market: Opportunities

Growing international collaborations and strategic partnerships to create growth opportunities

The global pet care e-commerce market will come across several new growth avenues due to the increasing rate of international and domestic partnerships between stakeholders operating in the sector. This includes strategic measures such as mergers & acquisitions along with other forms of investment. In August 2023, Kanine, a global pet company providing premium products, entered the Indian market by announcing a partnership with India’s highly popular e-commerce website Myntra and Kanine Pets World India. The company will be selling pet products for cats and dogs including items such as grooming products, apparel, and other accessories. This move is a result of the growing market potential of emerging economies where the economic growth is expected to be steady during the forecast period along with changing lifestyles of the regional population.

In September 2023, witnessing the dramatic shift of pet owners toward online portals for fulfilling pet needs, UK-based Butternut Box, a direct-to-customer (D2C) brand, announced that it had raised over $350 million in its recent round of funding. The company is currently operational in European nations and will continue to focus on international expansions in the coming years.

Rising access to smart devices will impact the use of e-commerce channels for pet care products

One of the indirect ways the industry for pet care products through e-commerce channels is expected to be influenced by is the growing access and use of smart devices such as mobile phones and tablets along with cheaper Internet. These points allow a growth in consumer awareness rate that directly translates to improved sales.

Pet Care E-Commerce Market: Challenges

Competition from traditional pet care sellers and regulatory hurdles to challenge market growth

The global pet care e-commerce industry will face challenges due to the existing competition from traditional means of shopping for pet care products including brick-and-mortar stores specializing in items for pets. They offer in-person suggestions which can be helpful to pet owners. Additionally, the complexities associated with selling pet food in new markets may further add to market restrictions.

Pet Care E-Commerce Market: Segmentation

The global pet care e-commerce market is segmented based on type, animal, and region.

Based on type, the global market is segmented into grooming, pet food, medicines, and others. In 2022, the pet food segment held control over 40.1% of the total share since pet food is one of the primary essentials of pet care. E-commerce websites offer multiple advantages including consultations about the best pet food available for purchase and offer door-step delivery. Additionally, companies that offer pre-planned meals have become popular in recent times as they are helpful for pets with specific medically-induced nutrition requirements.

Based on animal type, the global market is divided into crawler, feline, canine, and others. In 2022, the highest sale was observed in the canine segment which dominated more than 49.5% of the total segmental revenue. The high growth rate is a result of a higher number of canine pet owners globally. In 2022, the dog population in Europe was recorded at 105.4 million. Additionally, the feline segment is also important for overall market growth due to the surge in the number of cat adoptions worldwide.

Pet Care E-Commerce Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pet Care E-Commerce Market |

| Market Size in 2022 | USD 23.01 Billion |

| Market Forecast in 2030 | USD 45.60 Billion |

| Growth Rate | CAGR of 8.92% |

| Number of Pages | 224 |

| Key Companies Covered | BarkShop, Chewy, Walmart Pet Supplies, Amazon Pet Supplies, Zooplus, PetSmart, Pet Circle, Petco, JetPet, PetFlow, Petco Pharmacy, Only Natural Pet, Pet Mountain, Petbarn, FarmVet, Pet Valu, 1800PetMeds, HealthyPets, PetSmart Pharmacy, PetCareRx, Chewy Pharmacy, and others. |

| Segments Covered | By Type, By Animal Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pet Care E-Commerce Market: Regional Analysis

North America to register the highest growth rate during the projection period

The global pet care e-commerce market will be led by North America during the forecast period. As per official data, the US is home to the largest number of dog owners. More than 76 million dogs in the US are currently domesticated. Furthermore, the presence of several pet care e-commerce brands helps the region grow at a rapid pace. For instance, US-based Chewy Inc., a pet products online retailer, caters to over 20.4 million customers. In August 2023, the company announced that it was preparing for a Canada launch in the coming months as the regional market holds extensive potential. Consumer awareness and acceptance of pet-related e-commerce portals is high in North America.

The leading reason is the exceptional quality of services provided by regional service providers and the growing investments in improving the supply chain along with customer service. The US Food and Drugs Administration (FDA) is a major regulator of quality pet food products on digital sales platforms. Asia-Pacific is a lucrative market and holds excellent growth potential. China is one of the largest countries with a high rate of pet adoptions. It also boasts of high consumerism levels directly impacting the regional market growth trend.

Pet Care E-Commerce Market: Competitive Analysis

The global pet care e-commerce market is led by players like:

- BarkShop

- Chewy

- Walmart Pet Supplies

- Amazon Pet Supplies

- Zooplus

- PetSmart

- Pet Circle

- Petco

- JetPet

- PetFlow

- Petco Pharmacy

- Only Natural Pet

- Pet Mountain

- Petbarn

- FarmVet

- Pet Valu

- 1800PetMeds

- HealthyPets

- PetSmart Pharmacy

- PetCareRx

- Chewy Pharmacy

The global pet care e-commerce market is segmented as follows:

By Type

- Grooming

- Pet Food

- Medicines

- Others

By Animal Type

- Crawler

- Feline

- Canine

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pet care e-commerce is the online trading of goods and services specifically related to pet care items, food products, clothing, and other accessories.

The global pet care e-commerce market is expected to be driven by the increasing number of pet adoptions across the globe.

According to study, the global pet care e-commerce market size was worth around USD 23.01 billion in 2022 and is predicted to grow to around USD 45.60 billion by 2030.

The CAGR value of pet care e-commerce market is expected to be around 8.92% during 2023-2030.

The global pet care e-commerce market will be led by North America during the forecast period.

The global pet care e-commerce market is led by players like BarkShop, Chewy, Walmart Pet Supplies, Amazon Pet Supplies, Zooplus, PetSmart, Pet Circle, Petco, JetPet, PetFlow, Petco Pharmacy, Only Natural Pet, Pet Mountain, Petbarn, FarmVet, Pet Valu, 1800PetMeds, HealthyPets, PetSmart Pharmacy, PetCareRx, and Chewy Pharmacy among others.

The report explores crucial aspects of the pet care e-commerce market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed