Petrochemicals Market Size, Share, Trends, Growth 2032

Petrochemicals Market By Products (Ethylene, Propylene, Butadiene, Benzene, Toluene, Xylene, Methanol, and Other Products), By End Users (Packaging, Automotive & Transportation, Construction, Electrical & Electronics, Healthcare, and Other End Users), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

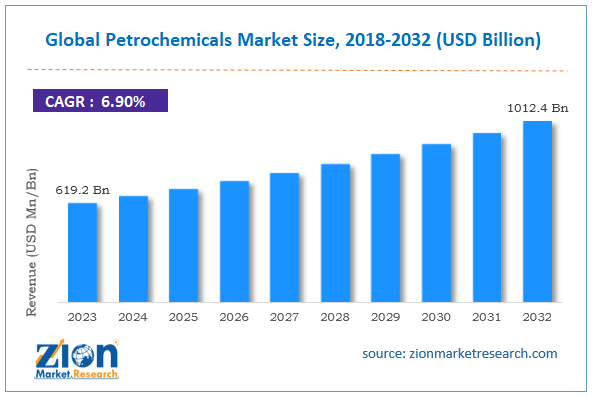

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 619.2 Billion | USD 1012.4 Billion | 6.9% | 2023 |

Petrochemicals Industry Prospective:

The global petrochemicals market size was worth around USD 619.2 billion in 2023 and is predicted to grow to around USD 1012.4 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.9% between 2024 and 2032.

Petrochemicals Market: Overview

Petrochemicals are chemical products derived from crude oil or natural gas. These chemicals serve as the building blocks for various industries, including plastics, textiles, construction materials, and pharmaceuticals. The increasing demand for these end-use products is driving the growth of the petrochemicals market globally.

Key Insights

- As per the analysis shared by our research analyst, the global petrochemicals industry is estimated to grow annually at a CAGR of around 6.9% over the forecast period (2024-2032).

- In terms of revenue, the global petrochemicals market size was valued at around USD 619.2 billion in 2023 and is projected to reach USD 1012.4 billion, by 2032.

- The global petrochemicals is projected to grow at a significant rate due to the growing demand for plastics in packaging, construction, and consumer goods.

- Based on product segmentation, ethylene was predicted to hold maximum market share in the year 2023.

- Based on end users, packaging segment is expected to be the leading revenue generator in 2024.

- On the basis of region, Asia Pacific was the leading revenue generator in 2023.

Petrochemicals Market: Growth Drivers

Growing demand for plastics in packaging, construction, and consumer goods to drive market growth.

The growing demand for plastics in packaging, construction, and consumer goods is a key driver for the global petrochemicals market. Packaging industry is expected to reach around USD 9 billion in 2030 growing at a CAGR of 6%. With the expansion of the packaging industry, demand for petrochemicals required for raw material production is expected to rise. Additionally, the high requirement of petrochemicals for production of synthetic fibers is propelling the industry’s growth. On top of that, petrochemicals are a crucial component in the pharmaceuticals and personal care industry. Rapid expansion of these industries in emerging countries is expected to drive the demand for petrochemicals. Furthermore, rising disposable income in developing economies like China and India has spurred the demand for consumer goods and automobiles, which are major consumers of petrochemicals. Moreover, technological advancements in the petrochemical industry are leading to sustainable production processes. This in turn is improving the overall petrochemical production process.

Petrochemicals Market: Restraints

Fluctuation in oil prices may hamper market growth.

Fluctuations in crude oil prices largely impact the distribution of petrochemicals around the world. This is due to the fact petrochemicals industry is heavily dependent on the price of crude oil. Fluctuations in crude oil prices can significantly impact the profitability of petrochemical companies and hinder market growth. For instance, the average crude oil closing price in the last five years was USD 39.68 (2020), USD 68.17 (2021), USD 94.53 (2022), USD 77.64 (2023), and USD 77.98 (2024). These figures indicate significant fluctuation in the prices which in turn impact the final petrochemical products.

Furthermore, growing environmental concerns may hinder market progress. The production of petrochemicals can have a negative impact on the environment. Due to this many countries around the world have posed stricter environmental regulations.

Petrochemicals Market: Opportunities

Development of bio-based petrochemicals in emerging countries to offer better growth opportunities.

The petrochemical industry is expected to get significant growth opportunities in emerging economies like India, South America, and Africa. This is due to a large and growing consumer base with rising disposable incomes. India is presently one of top economies in the world and it’s growing continuously. The country has expanded its industrial sectors by supporting small and mid-size companies. With the expanding manufacturing industry, demand for petrochemicals is expected to rise in such countries. Moreover, growing investments in Brazil, Africa, and Southeast Asia countries is expected to increase the industrialization rate. Furthermore, emerging countries in the world are focusing to develop bio-based petrochemicals. Growing research activities for the development of bio-based petrochemicals derived from renewable resources offer a sustainable alternative to traditional petrochemicals. This can help the petrochemical industry to address environmental concerns and generate new market opportunities.

Petrochemicals Market: Challenges

Volatile regulatory landscape and geopolitical tensions pose challenges to market growth.

The petrochemical market is largely impacted by a complex and continuously changing regulatory landscape. Stringent regulations on emissions and waste disposal strongly pose challenges for petrochemical companies. For instance, European Union Emissions Trading System (EU ETS) sets a limit on carbon dioxide emissions and necessitates companies to purchase permits for excess emissions. This adds up to significant costs for petrochemical companies operating in Europe. Similarly, Resource Conservation and Recovery Act (RCRA) operating in the United States focuses on the management of hazardous waste. RCRA sets standards for the generation, transportation, treatment, storage, and disposal of hazardous waste generated by petrochemical companies in the region. On the other side, geopolitical tensions and disruptions in the global supply chain can disrupt the supply of crude which can significantly impact the petrochemicals market.

Petrochemicals Market: Segmentation

The global Petrochemicals market is segmented based on Products, End Users, and region.

Based on products, the global market segments are ethylene, propylene, butadiene, benzene, toluene, xylene, methanol, and other products. Presently, ethylene holds the major market share. This is mainly due to the growing demand for ethylene in the personal care, packaging, and chemical industries.

Based on end users, the global market segments are packaging, automotive & transportation, construction, electrical & electronics, healthcare, and other end users. In 2023, the packaging segment held the larger share of the market. Large share of this segment is attributed to the rapidly expanding packaging sector. Petrochemical-based packaging materials like polyethylene and polypropylene are in high demand due to their versatility and durability.

Petrochemicals Market Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Petrochemicals Market |

| Market Size in 2023 | USD 619.2 Billion |

| Market Forecast in 2032 | USD 1,012.4 Billion |

| Growth Rate | CAGR of 6.9% |

| Number of Pages | 206 |

| Key Companies Covered | BASF SE, Chevron Corporation, British Petroleum Plc, Royal Dutch Shell PLC, China National Petroleum Corporation (CNPC), ExxonMobil Corporation, INEOS Group Ltd., China Petrochemical Corporation (SINOPEC), LyondellBasell Industries Inc., SABIC., and others. |

| Segments Covered | By Products, End Users, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Petrochemicals Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is likely to maintain its dominance in the global petrochemical market over the forecast period. Factors such as the presence of a large and growing consumer base, increasing urbanization, and rapid industrialization are driving the petrochemical demand in the region. Developing countries in the region, such as China and India, are the largest manufacturers of plastic products. For instance, China is the world's largest plastics manufacturer, accounting for approximately one-third of worldwide production. China's share of plastic material manufacturing has consistently increased in recent years, growing from 26 percent in 2014 to 32 percent by 2021. The plastics industry, on the other hand, is the largest consumer of petrochemicals. Furthermore, the automobile industry is booming in emerging and developed countries like India, China, South Korea, and Japan, which is expected to increase petrochemical consumption during the future period. In addition, petrochemicals are crucial for other flourishing industries such as synthetic fibers, pharmaceuticals, and personal care products. The expansion of these industries is attributed to a growing consumer base and disposable incomes.

Key Developments

In 2023, Dow announced a USD 8.9 billion investment for a net-zero petrochemical plant project in Alberta's Industrial Heartland, Canada. This plant is expected to yield around 3 million tons of low-emission ethylene and polyethylene derivatives. The actual construction of the facility is scheduled to begin in 2024.

In 2023, SABIC unveiled its newest PCR-based NORYLTM portfolio to minimize carbon footprint by combining bio-based and recycled substances in petrochemical products. Through this SABIC taking a step toward making the chemical business more environmentally friendly.

In 2023, ExxonMobil Corporation announced that it will purchase Denbury Inc. to extend its carbon capture and storage (CCS) technologies and reduce carbon emissions in the petrochemical and energy sectors.

Petrochemicals Market: Competitive Analysis

The global petrochemicals market is dominated by players like:

- BASF SE

- British Petroleum Plc

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- China Petrochemical Corporation

- ExxonMobil Corporation

- INEOS Group Ltd.

- LyondellBasell Industries Inc.

- Royal Dutch Shell PLC

- SABIC

The global petrochemicals market is segmented as follows:

By Products

- Ethylene

- Propylene

- Butadiene

- Benzene

- Toluene

- Xylene

- Methanol

- Other Products

End Users

- Packaging

- Automotive & Transportation

- Construction

- Electrical & Electronics

- Healthcare

- Other End Users

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Petrochemicals are chemical products derived from crude oil or natural gas. These chemicals serve as the building blocks for various industries, including plastics, textiles, construction materials, and pharmaceuticals.

The global petrochemicals market cap may grow owing to the growing demand for plastics in packaging, construction, and consumer goods.

According to study, the global petrochemicals market size was worth around USD 619.2 billion in 2023 and is predicted to grow to around USD 1,012.4 billion by 2032.

The CAGR value of the petrochemicals market is expected to be around 6.9% during 2024-2032.

The global petrochemicals market growth is expected to be driven by Europe. This is due to the established tourist destinations, supportive regulatory environment, and growing popularity of off-beat traveling.

The global petrochemicals market is led by players like BASF SE, Chevron Corporation, British Petroleum Plc, Royal Dutch Shell PLC, China National Petroleum Corporation (CNPC), ExxonMobil Corporation, INEOS Group Ltd., China Petrochemical Corporation (SINOPEC), LyondellBasell Industries Inc., and SABIC.

The report analyzes the global petrochemicals market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the petrochemicals industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed