Photovoltaic Glass Market Size, Share, Trends, Growth 2032

Photovoltaic Glass Market By End-Use (Industrial, Residential, and Commercial), By Composition (Thin Film, Mono-Crystalline, and Poly-Crystalline), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

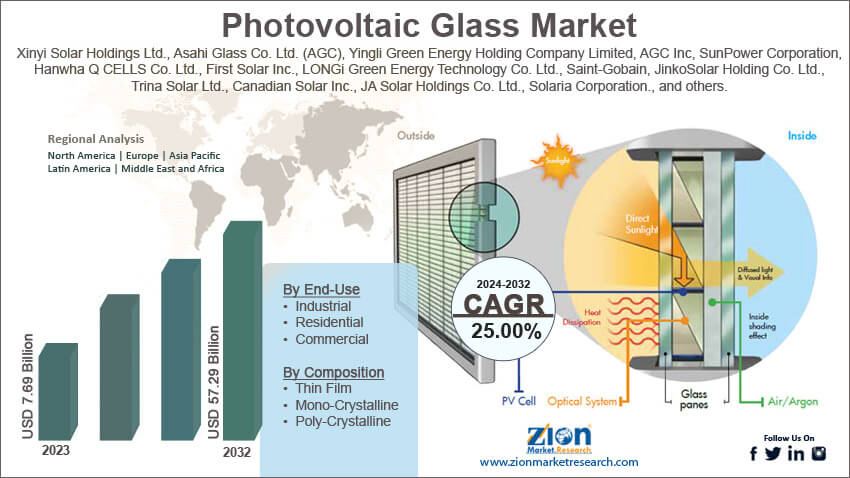

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.69 Billion | USD 57.29 Billion | 25.00% | 2023 |

Photovoltaic Glass Industry Prospective:

The global photovoltaic glass market size was worth around USD 7.69 billion in 2023 and is predicted to grow to around USD 57.29 billion by 2032 with a compound annual growth rate (CAGR) of roughly 25.00% between 2024 and 2032.

Photovoltaic Glass Market: Overview

Photovoltaic glass is also known as solar glass. It is specially designed glass used for capturing solar energy and converting it into electricity thus contributing to improved energy efficient solutions. Solar glass becomes a part of the construction material and hence users do not have to invest in additional solar panels or electricity-generating infrastructure. Photovoltaic glass consists of minute photovoltaic cells that are embedded within the glass structure. Solar glass is also similar to traditional glass since they are also capable of providing similar sound and thermal insulation as conventionally used architectural glass. Moreover, they also allow the passing of natural light thus showcasing excellent filtering power. In addition to this, photovoltaic glass has become highly popular among construction companies. Several regional governments are also showing keen interest in the promotion of photovoltaic glass by offering tax incentives and credits. Several factors are expected to work in favor of the solar glass industry, especially in current times when the rate of energy crisis is on the rise. Additionally, the growing investments in the development of more efficient photovoltaic glass will also help the industry flourish.

Key Insights:

- As per the analysis shared by our research analyst, the global photovoltaic glass market is estimated to grow annually at a CAGR of around 25.00% over the forecast period (2024-2032)

- In terms of revenue, the global photovoltaic glass market size was valued at around USD 7.69 billion in 2023 and is projected to reach USD 57.29 billion, by 2032.

- The market is projected to grow at a significant rate due to the increasing demand for energy-efficient solutions in the construction industry

- Based on end-use segmentation, commercial was predicted to show maximum market share in the year 2023

- Based on composition segmentation, the thin film was the leading segment in 2023

- On the basis of region, Asia-Pacific was the leading revenue generator in 2023

Request Free Sample

Request Free Sample

Photovoltaic Glass Market: Growth Drivers

Increasing demand for energy-efficient solutions in the construction industry will drive the market demand

The global photovoltaic glass market is expected to grow due to the rising demand for energy-efficient solutions in the construction industry. Traditionally, the building & construction sector has been one of the largest consumers of energy. A constant source of energy is essential in the construction sector for the transport and installation of raw materials for creating a final structure. For instance, as per the latest findings, more than 34.9% of India’s energy consumption is attributed to the building sector. Countries across the globe are registering an increasing rate of energy crises and industrial sectors are under pressure to either optimize the consumption of energy or adopt projects that help in generating clean energy. Photovoltaic glass offers solutions to the struggling construction industry to meet their energy demands and contribute to the generation of clean energy. Solar glass panels trap sunlight and convert it into energy that is used to power the building and its several components. For example, India’s Energy Conservation (Amendment) Act, 2022 works toward the transition of the Energy Conservation Building Code to the Energy Conservation and Sustainability Building Code. The latter enlists measures such as net zero emissions, embedded carbon, and deployment of clean energy. In April 2023, the Australian government announced a new set of funding for expanding the regional Nationwide House Energy Rating Scheme (NatHERS) to residential homes in the country. As per official reports, the ratings by NatHERS will be available for the existing homes from mid-2025.

Increasing infrastructure development processes across the globe will help the industry thrive

The demand for photovoltaic glass is expected to be further promoted by the growing construction of modern commercial buildings worldwide. Infrastructure development is a key indicator of overall economic growth. Countries across the globe including emerging nations are actively investing in developing and building exquisite architectural designs and building structures. For instance, Saudi Arabia is currently working on building a sustainable futuristic city spread across multiple hectares. The region will be surrounded by 170 km of glass walls and is expected to emerge as the world’s largest floating facility. Such heavy investments are expected to create more demand in the global photovoltaic glass market.

Photovoltaic Glass Market: Restraints

High cost of the glass may restrict the market expansion rate

The global industry for photovoltaic glass is expected to be restricted due to the high cost of the glass as compared to conventionally used glass structures. The market presence of conventional glass is extremely high. They are comparatively more affordable and modern glass manufacturers are working toward improving the energy-saving capacity of traditional glass. The demand for glass variants with low-emissivity coatings is witnessing high growth which could impact the use of solar glass.

Photovoltaic Glass Market: Opportunities

Rising launch of new solar glass solutions will generate high-growth opportunities

The global photovoltaic glass market is expected to generate high growth opportunities due to the rising launch of new solar glass solutions with advanced technology and efficiency. In 2023, Borosil Renewables, India’s only producer of solar glass, launched multiple types of photovoltaic glass thus strengthening its footprint in the industry. The company launched a new solar glass coated with high transmission anti-reflective (HTAR) coating. The novel technology will aid improvements in light transmission by 0.4% to 0.5% as per company claims. Additionally, the company has also developed small-sized glass to be used directly in solar roof tiles. In February 2024, Solarcycle Inc., a US-based solar recycling company, announced an investment of USD 344 million toward the construction of a new solar glass manufacturing facility. The company will create 600 more jobs in the region through its latest manufacturing facility. In April 2023, Vitro Architectural Glass announced a partnership with First Solar. The former will now be developing advanced thin-film photovoltaic (PV) solar panels for First Solar with an investment of USD 93.6 million as per official reports.

Expansion into new territories may generate higher market revenue

The solar glass industry is relatively new and has only a limited number of players. By expanding into new territories, especially regions seeking solutions to reduce carbon footprint and alternatives to traditional energy sources will be helpful in driving the demand for photovoltaic glass. Emerging nations such as India, Africa, and China are currently investing in sustainable technologies for future growth. Developed countries, on the other hand, enjoy the perks of an already established supporting infrastructure that can be leveraged to develop the global photovoltaic glass market.

Photovoltaic Glass Market: Challenges

Limited raw material suppliers and difficulty in improving product durability could challenge the market expansion rate

The global photovoltaic glass industry is expected to be challenged due to the limited number of suppliers for raw materials needed to produce and design solar glass. Additionally, photovoltaic glass is required to have extreme durability since it must survive extreme weather conditions. Unlike concrete materials used in the construction industry, glass does not typically have high durability, and hence solar glass manufacturing process can be complicated thus limiting the market adoption rate.

Photovoltaic Glass Market: Segmentation

The global photovoltaic glass market is segmented based on end-use, composition, and region.

Based on end-use, the global market segments are industrial, residential, and commercial. In 2023, the highest demand was witnessed in the commercial segment. The growing development of new commercial buildings with advanced features and increasing emphasis on the use of clean energy in commercial facilities is driving the segment demand. In 2023, the global commercial real estate market was valued at over USD 4 trillion and is expected to witness a high growth rate during the projection period.

Based on composition, the global industry segments are thin film, mono-crystalline, and poly-crystalline. In 2023, the demand was the highest in the thin film segment. These variants are more flexible and show higher functionality. Moreover, they are easy to incorporate in glass material and do not lead to a drastic increase in the weight of the overall structure. Smaller panels have a size range of 1 square meter to less than 10 square meters.

Photovoltaic Glass Market Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Photovoltaic Glass Market |

| Market Size in 2023 | USD 7.69 Billion |

| Market Forecast in 2032 | USD 57.29 Billion |

| Growth Rate | CAGR of 25.00% |

| Number of Pages | 233 |

| Key Companies Covered | Xinyi Solar Holdings Ltd., Asahi Glass Co. Ltd. (AGC), Yingli Green Energy Holding Company Limited, AGC Inc, SunPower Corporation, Hanwha Q CELLS Co. Ltd., First Solar Inc., LONGi Green Energy Technology Co. Ltd., Saint-Gobain, JinkoSolar Holding Co. Ltd., Trina Solar Ltd., Canadian Solar Inc., JA Solar Holdings Co. Ltd., Solaria Corporation., and others. |

| Segments Covered | By End-Use, By Composition, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Photovoltaic Glass Market: Regional Analysis

Asia-Pacific holds high growth potential during the forecast period

The global photovoltaic glass market is expected to witness the highest growth in Asia-Pacific. In 2023, the region led over 44.05% of the total market share. Countries such as South Korea, Japan, China, and India will lead the regional demand for solar glass. India is home to one of the biggest producers of photovoltaic glass. These regions have access to a robust glass-making manufacturing infrastructure. Additionally, the availability of skilled labor at reasonable prices is an essential contributor to the growing production of solar glass in Asia-Pacific. China and India are two of the largest economies and are expected to grow at a fast rate during the projection period. The regional construction sector as well as a rapid increase in infrastructure development projects will help the Asia-Pacific region grow further. Europe is projected to emerge as the second-highest revenue-generator during the projection period. The growing investments toward clean energy solutions and the presence of photovoltaic glass producers at an international level will drive the regional growth trends. Countries such as Italy and Germany will lead the growth of the European Union. In 2020, Italy-based FuturaSun announced the launch of a monocrystalline Passivated Emitter Rear Cell (PERC) panel.

Photovoltaic Glass Market: Competitive Analysis

The global photovoltaic glass market is led by players like:

- Xinyi Solar Holdings Ltd.

- Asahi Glass Co. Ltd. (AGC)

- Yingli Green Energy Holding Company Limited

- AGC Inc

- SunPower Corporation

- Hanwha Q CELLS Co. Ltd.

- First Solar Inc.

- LONGi Green Energy Technology Co. Ltd.

- Saint-Gobain

- JinkoSolar Holding Co. Ltd.

- Trina Solar Ltd.

- Canadian Solar Inc.

- JA Solar Holdings Co. Ltd.

- Solaria Corporation.

The global photovoltaic glass market is segmented as follows:

By End-Use

- Industrial

- Residential

- Commercial

By Composition

- Thin Film

- Mono-Crystalline

- Poly-Crystalline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Photovoltaic glass is also known as solar glass.

The global photovoltaic glass market is expected to grow due to the rising demand for energy-efficient solutions in the construction industry.

According to study, the global photovoltaic glass market size was worth around USD 7.69 billion in 2023 and is predicted to grow to around USD 57.29 billion by 2032.

The CAGR value of photovoltaic glass market is expected to be around 25.00% during 2024-2032.

The global photovoltaic glass market is expected to witness the highest growth in Asia-Pacific.

The global photovoltaic glass market is led by players like Xinyi Solar Holdings Ltd., Asahi Glass Co., Ltd. (AGC), Yingli Green Energy Holding Company Limited, AGC Inc, SunPower Corporation, Hanwha Q CELLS Co., Ltd., First Solar, Inc., LONGi Green Energy Technology Co., Ltd., Saint-Gobain, JinkoSolar Holding Co., Ltd., Trina Solar Ltd., Canadian Solar Inc., JA Solar Holdings Co., Ltd., and Solaria Corporation.

The report explores crucial aspects of the photovoltaic glass market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed