Plant-based Food & Beverages Market Size, Share, Analysis, Growth, Forecasts, 2032

Plant-based Food & Beverages Market By Type (Dairy Alternatives, Meat Alternatives, Snacking Items, Plant-Based Milk, and Others), By Distribution Channel (Online Stores and Offline Stores), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

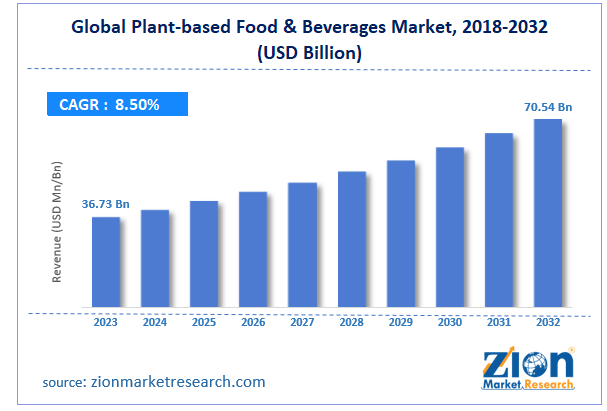

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 36.73 Billion | USD 70.54 Billion | 8.50% | 2023 |

Plant-based Food & Beverages Industry Prospective:

The global plant-based food & beverages market size was worth around USD 36.73 billion in 2023 and is predicted to grow to around USD 70.54 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.50% between 2024 and 2032.

Plant-based Food & Beverages Market: Overview

Plant-based food & beverages (F&B) are an emerging group of consumer goods that aim to deliver animal-free products to consumers. These food & beverages are made using plant-based ingredients and do not contain any form of animal-derived meat.

For instance, plant-based beverages are also known as non-dairy or alternative drinks. Some of the most common plant ingredients used for producing F&B include fruits, beverages, oats, nuts & seeds, whole grains, legumes, and herbs and spices.

During the forecast period, the demand for animal-free alternatives in the food & beverages industry is expected to deliver excellent growth momentum driven by multiple factors. For instance, a growing number of people inclined toward vegan and vegetarian food diets will be influential in driving the market demand rate.

On the other hand, increasing awareness about the environmental and ethical concerns over excessive dependence on animal-based diets will encourage more consumers to opt for plant-based alternatives. Increasing the introduction of vegetable and fruit-based novel food items will generate excellent growth opportunities for the plant-based food & beverages industry players. However, the market may face growth restrictions due to the higher cost of producing plant-based F&B and the volatile supply of raw materials.

Key Insights:

- As per the analysis shared by our research analyst, the global plant-based food & beverages market is estimated to grow annually at a CAGR of around 8.50% over the forecast period (2024-2032)

- In terms of revenue, the global plant-based food & beverages market size was valued at around USD 36.73 billion in 2023 and is projected to reach USD 70.54 billion by 2032.

- The plant-based food & beverages market is projected to grow at a significant rate due to the rising trend of vegan and vegetarian diets.

- Based on the type, the plant-based milk segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the distribution channel, the offline segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Plant-based Food & Beverages Market: Growth Drivers

Rising trend of vegan and vegetarian diets to drive market demand rate during the forecast period

The global plant-based food & beverages market is expected to be driven by the growing number of vegan and vegetarian diet followers across the globe. Vegetarianism is the practice of consuming only plant-based food items. Followers of vegetarian diets do not consume meat in any form, including poultry, fish, and other products.

A vegan diet, on the other hand, is considered an extension of vegetarians since it is more stringent in terms of food & beverages that can be consumed. Vegan diet followers, for instance, do not consume any form of food or drink items obtained using animals including cow or buffalo milk.

According to certain studies, following a plant-based diet is known to have several health benefits. For instance, research indicates that a vegetarian diet can help manage or curb the risk of developing diabetes.

Moreover, it is known to be a heart-friendly diet and assists in increasing lifespan. As the awareness of the positive health implications of a plant-based diet increases, the industry players can expect higher revenue.

Environmental impact of animal-based F&B industry to create more momentum for plant-based alternatives

The industry dealing with animal agriculture is one of the largest environmental polluters. According to the United Nations Food & Agriculture Organization, the meat and dairy industry is known to release around 14.5% of global greenhouse gas emissions.

Furthermore, the alarming rate of increase in waste generated by the livestock farming industry has raised concerns across the globe. According to recent reports, more than 20% of meat produced worldwide is wasted every year. As awareness of the environmental impact of animal agriculture continues to rise, the global plant-based food & beverages market players can expect higher revenue in the coming years.

Plant-based Food & Beverages Market: Restraints

Increased cost of research and production to limit the industry’s final growth rate

The global industry for plant-based food & beverages is expected to be restricted due to the high cost of producing the F&B items. Plant-based food and beverage items depend heavily on ingredients sourced from around the globe. The availability of raw materials significantly impacts the final cost of production.

Furthermore, the plant-based raw materials industry does not enjoy the benefits of a well-established supply chain, unlike animal-based raw materials which further contribute to increased costs. These factors are likely to impede the industry’s final return on investment (ROI) during the forecast period.

Plant-based Food & Beverages Market: Opportunities

Investments in plant-based proteins to generate growth opportunities during the forecast period

The global plant-based food & beverages market is expected to generate growth opportunities due to the increasing demand for plant-based protein.

According to medical professionals worldwide, protein is a crucial component of all diet forms which has ultimately affected the demand for protein-providing food & beverage solutions.

In January 2025, GoodMills Innovation, a leading provider of sustainable ingredients for food items, announced the launch of GoWell® Tasty Protein. It is a novel plant-based protein blend to be used for preparing baked goods. According to official reports, the product delivers a protein content of 60% thus allowing the final product to be more healthy as compared to other alternatives.

Surging demand for plant-based meat products opens new avenues for extensive growth

Plant-based meat alternatives have gained wide popularity in the last few years. These solutions are used for preparing burgers, sausages, and other items that are traditionally prepared using animal meat.

In September 2021, Beyond Meat, a leading provider of plant-based meat, announced the launch of Beyond Chicken® Tenders at select retail stores in the US. The company enjoys the acceptance of its several other plant-based chicken items.

In a recent event, Next Gen Foods announced that it will soon launch its TiNDLE chicken in the UK market after the successful debut of its product in other markets. TiNDLE chicken will be available in 50 locations across London upon its launch.

Plant-based Food & Beverages Market: Challenges

Regulatory and labeling challenges along with technical production difficulties limit market expansion

The global plant-based food & beverages industry is expected to be challenged by the presence of a complex and comprehensive regulatory environment surrounding the production and sale of the goods.

Furthermore, labeling complications for products according to regional frameworks can create additional growth barriers for industry players. Plant-based F&B items are technically more difficult to produce since extensive research is required to deliver the right texture and taste to ensure customer satisfaction.

Plant-based Food & Beverages Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plant-based Food & Beverages Market |

| Market Size in 2023 | USD 36.73 Billion |

| Market Forecast in 2032 | USD 70.54 Billion |

| Growth Rate | CAGR of 8.50% |

| Number of Pages | 223 |

| Key Companies Covered | The Hain Celestial Group Inc., Tofutti Brands Inc., Beyond Meat, Ingredion Incorporated, Impossible Foods, Eden Foods Inc., Danone S.A., SunOpta Inc., Nestlé S.A., Blue Diamond Growers, Daiya Foods Inc., Conagra Brands Inc., VBites Foods Ltd., Kellogg Company, Unilever PLC., and others. |

| Segments Covered | By Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plant-based Food & Beverages Market: Segmentation

The global plant-based food & beverages market is segmented based on type, distributional channel, and region.

Based on the type, the global market segments are dairy alternatives, meat alternatives, snacking items, plant-based milk, and others. In 2023, the highest growth was listed in the plant-based milk segment. The growing number of people with an aversion to animal-derived milk is fueling demand for plant alternatives such as almond and soy milk.

According to market studies, around 2.01 to 6.05% of the world population is allergic to milk protein, requiring them to consume other alternatives. During the forecast period, demand for meat alternatives is expected to deliver improved revenue.

Based on the distribution channel, the plant-based food & beverages industry divisions are online stores and offline stores. In 2023, the highest revenue was generated by offline stores due to the higher popularity of hypermarkets and supermarkets in terms of advertising and selling plant-based food & beverages.

However, during the forecast period, the online stores segment is likely to deliver comprehensive results as a result of increased adoption of grocery and food items delivering applications. In 2024, the global grocery delivery market crossed USD 900 billion according to research.

Plant-based Food & Beverages Market: Regional Analysis

North America to dominate the market growth rate during the forecast period

The global plant-based food & beverages market will be dominated by North America during the forecast period. The US is expected to deliver the highest revenue driven by the growing number of vegan populations across the region.

According to industry-based studies, nearly 2.02% of the US population is currently vegan. The higher rate of food innovation across North America will be critical to the region’s final revenue by the end of the projection duration.

For instance, in October 2024, the country witnessed the launch of three plant-based milk solutions. In November 2024, a Danone North American brand, Silk, announced the launch of plant-based milk for children which is made of peas and oats.

Asia-Pacific is another prominent market for plant-based food & beverage solutions. Several cultures in Asia-Pacific promote animal-free diets. The rising health awareness in the region along with growing disposable income and changing consumer lifestyle will be critical to the region’s final demand for plant-based F&B.

Moreover, environmental concerns over the region’s animal agriculture sector along with a growing focus on animal welfare across major Asian economies will fuel regional market expansion according to industry studies.

Plant-based Food & Beverages Market: Competitive Analysis

The global plant-based food & beverages market is led by players like

- The Hain Celestial Group Inc.

- Tofutti Brands Inc.

- Beyond Meat

- Ingredion Incorporated

- Impossible Foods

- Eden Foods Inc.

- Danone S.A.

- SunOpta Inc.

- Nestlé S.A.

- Blue Diamond Growers

- Daiya Foods Inc.

- Conagra Brands Inc.

- VBites Foods Ltd.

- Kellogg Company

- Unilever PLC.

The global plant-based food & beverages market is segmented as follows:

By Type

- Dairy Alternatives

- Meat-Alternatives

- Snacking Items

- Plant-Based Milk

- Others

By Distribution Channel

- Online Stores

- Offline Stores

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Plant-based food & beverages (F&B) are an emerging group of consumer goods that aim to deliver animal-free products to consumers.

The global plant-based food & beverages market is expected to be driven by the growing number of vegan and vegetarian diet followers across the globe.

According to study, the global plant-based food & beverages market size was worth around USD 36.73 billion in 2023 and is predicted to grow to around USD 70.54 billion by 2032.

The CAGR value of the plant-based food & beverages market is expected to be around 8.50% during 2024-2032.

The global plant-based food & beverages market will be dominated by North America during the forecast period.

The global plant-based food & beverages market is led by players like The Hain Celestial Group, Inc., Tofutti Brands, Inc., Beyond Meat, Ingredion Incorporated, Impossible Foods, Eden Foods Inc., Danone S.A., SunOpta Inc., Nestlé S.A., Blue Diamond Growers, Daiya Foods Inc., Conagra Brands, Inc., VBites Foods Ltd., Kellogg Company, and Unilever PLC.

The report explores crucial aspects of the plant-based food & beverages market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Plant-based Food BeveragesIndustry Prospective:Plant-based Food Beverages OverviewKey Insights:Plant-based Food Beverages Growth DriversPlant-based Food Beverages RestraintsPlant-based Food Beverages OpportunitiesPlant-based Food Beverages ChallengesPlant-based Food Beverages Report ScopePlant-based Food Beverages SegmentationPlant-based Food Beverages Regional AnalysisPlant-based Food Beverages Competitive AnalysisRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed