Powder Filling Machines Market Size, Industry Share, Analysis, Growth, Forecast 2023-2030

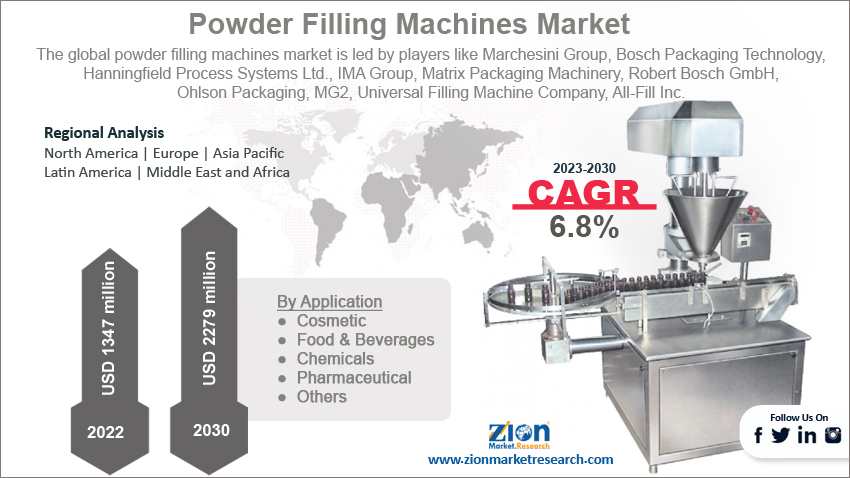

Powder Filling Machines Market By Application (Cosmetic, Food & Beverages, Chemicals, Pharmaceutical, and Others), By Type (Gravity Fillers, Vertical Auger Fillers, Vacuum Fillers, and Cup Fillers), By Mode of Operation (Fully Automatic and Semi-Automatic), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

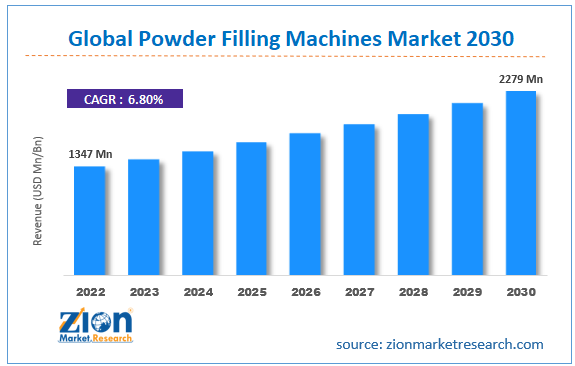

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1347 Million | USD 2279 Million | 6.8% | 2022 |

Powder Filling Machines Industry Prospective:

The global powder filling machines market size was worth around USD 1347 million in 2022 and is predicted to grow to around USD 2279 million by 2030 with a compound annual growth rate (CAGR) of roughly 6.8% between 2023 and 2030.

The report delves deeper into several crucial aspects of the global powder filling machines market. It includes a detailed discussion of existing growth factors and restraints. Future growth opportunities and challenges that impact the powder filling machines industry are comprehensively addressed in the report.

Powder Filling Machines Market: Overview

A powder filling machine is an example of automation in the packaging segment across industries. They are used to fill powder in a container using pieces of machinery. One of the main advantages of using powder filling machines instead of relying on human labor is in terms of performance precision. These machines can fill a container with required powder in precise volumes without getting impacted by the number of times the step is repeated.

They typically use a check weigher or weigh cell for measuring the quantity of powder in a container. Additionally, powder filling machines can handle a wide range of powders across weights and sizes. The market for powder filling machines has grown over the years mainly due to the ease of packaging these devices provide along with being extremely easy to clean or maintain. For commercial purposes, there are multiple types of machines that are available in the market with each product offering specific characteristics.

Key Insights:

- As per the analysis shared by our research analyst, the global powder filling machines market is estimated to grow annually at a CAGR of around 6.8% over the forecast period (2023-2030)

- In terms of revenue, the global powder filling machines market size was valued at around USD 1347 million in 2022 and is predicted to grow to around USD 2279 million, by 2030.

- The powder filling machines market is projected to grow at a significant rate due to the growing application in the food & beverages industry

- Based on application segmentation, pharmaceutical was predicted to show maximum market share in the year 2022

- Based on mode of operation segmentation, fully automatic was the leading mode in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Powder Filling Machines Market: Growth Drivers

Growing application in the food & beverages industry to drive market growth

The global powder filling machines market is projected to grow due to the increasing application of these machines in the food & beverages industry. For instance, powdered products such as spices and sugar along with other items sold on a large scale are filled in containers with an accuracy level which may be difficult to achieve with the help of human labor. Since powder filling machines automate the entire packaging line in food processing activities, they are used for steps starting from the preparation of the container until the final labeling and sealing process.

With the use of these machines, companies in the food industry can not only save more time but achieve a higher level of efficiency along with ensuring the same quality of performance for all packaged products. With the rise in population along with factors such as growing disposable income, rising number of players in the food market, and extensive product innovation, the food & beverages (F&B) sector will continue to grow which in turn is projected to impact the demand for powder filling machines with specific functions. For instance, as per research, nearly 59.1 million metric tons of salt were consumed in the US in 2022.

Powder Filling Machines Market: Restraints

High cost of the machines to restrict market expansion

The global powder filling machines market is projected to register certain growth restrictions led by the high cost of powder filling machines. These machines, including Auger-type filling machines, are excellent examples of automated systems working with complete efficiency and minimum human intervention.

The complexity of these machines is what causes the high cost associated with the machines. For instance, the average cost of a dry powder filling machine may start from 0.5 million to 1 million or above. The final cost depends on the exact specifications of the machine. This could make product adoption a difficult choice for smaller players across end-user verticals. In May 2023, VTOPS launched Desktop Powder Auger Filling Machine offering compact size and higher versatility at a price of USD 1999 for a limited period.

Powder Filling Machines Market: Opportunities

Rising number of players and product innovation to provide growth opportunities

The global sales volume of the powder filling machines industry may reach a higher status due to the increasing number of players in the market that have adopted product innovation as their strategy to reach a broader audience. This can be seen in the number of new launches registered in the past few years.

In December 2022, Nichrome India undertook the demonstration and launch of a new filling machine, the Maxima servi auger filler, at the Pach Mach Asia 2022 exhibition. The product can pack over 200 pouches in one minute. Similarly in October 2021, GEA, a leading technology group, launched a new line of packaging machines for the dairy and food granules or powder segment. The product is called SmartFil M1 and offers a wide range of configurations to meet the specific and diverse needs of players in the F&B market.

Powder Filling Machines Market: Challenges

Strict regulations surrounding the approval, import, and export of the machines to challenge the market expansion

One of the key challenges faced by the global powder filling machines market players is in terms of the existence of a strict regulatory environment that controls the approval of power filling machines across the globe. Every region has its set of policies to regulate these products.

Additionally, the changing economic policies of countries worldwide in the backdrop of the Russia-Ukraine war has impacted the export and import rate which further adds to the challenges faced by the manufacturers and suppliers. In April 2022, the European Union added more products to the list of items that were prohibited to be exported to Russia. The list now contains 672 items.

Powder Filling Machines Market: Segmentation

The global powder filling machines market is segmented based on application, type, mode of operation, and region.

Based on application, the global market is segmented into cosmetic, food & beverages, chemicals, pharmaceutical, and others. The highest CAGR was observed in the pharmaceutical segment in 2022. The drug-developing industry is the largest consumer of the most advanced forms of powder filling machines.

Factors such as growing emphasis on managing hygiene and serious risk of product contamination have encouraged pharma companies to adopt automated systems. Additionally, the availability of powder filling machines meeting the needs of the pharmaceutical industry adds to the growing revenue. In September 2022, MG2 announced its intention to launch EXTRUDOR dosing unit capable of reaching a speed of 70,000 capsules per hour.

Based on type, the powder filling machines industry segments are gravity fillers, vertical auger fillers, vacuum fillers, and cup fillers. The vertical auger fillers segment was the leading revenue generator in 2022. It is one of the most widely used powder filling machines in the pharma industry and is used to fill a variety of medicinal products. Some of the reasons for segmental growth are the precision, quality, consistency, and versatility offered by vertical auger fillers. As the pharma industry continues to invest in better product delivery, product consumption will continue to grow. In 2022, the global pharma packaging market was around USD 100 billion.

Based on mode of operation, the global powder filling machines market segments are fully automatic and semi-automatic. Currently, there is high demand for fully automatic powder filling machines. End-user verticals including cosmetic, pharma, and F&B industries are spending heavily on product packaging as consumer expectations have increased which is further impacted by the announcement of stringent rules related to product safety and hygiene.

Companies are leaving no room for error and hence are adopting the fully automatic versions; however, the semi-automatic machine may have more adopters in small & medium size enterprise segments. In March 2018, Uniaote completed the installation of a fully automatic powder filling machine for an Australian health supplement manufacturing client.

Powder Filling Machines Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Powder Filling Machines Market Research Report |

| Market Size in 2022 | USD 1347 Million |

| Market Forecast in 2030 | USD 2279 Million |

| Growth Rate | CAGR of 6.8% |

| Number of Pages | 221 |

| Key Companies Covered | Marchesini Group, Bosch Packaging Technology, Hanningfield Process Systems Ltd., IMA Group, Matrix Packaging Machinery, Robert Bosch GmbH, Ohlson Packaging, MG2, Universal Filling Machine Company, All-Fill Inc., Karmelle Liquid Filling & Capping Solutions Ltd., Spee-Dee Packaging Machinery, AMS Filling Systems Inc., PASE Group, Oden Machinery Inc., Cozzoli Machine Company, Accutek Packaging Equipment Companies Inc., C.E.King Limited, Pack Leader USA, and Adelphi Group Ltd.. |

| Segments Covered | By Application, By Type, By Mode of Operation, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Powder Filling Machines Market: Regional Analysis

Asia-Pacific to deliver the highest revenue rate in the coming period

The global powder filling machines market is expected to be led by Asia-Pacific during the forecast period as the region is witnessing higher domestic demand across sectors. The pharmaceutical industry along with the cosmetics and F&B sectors of Asia-Pacific has shown tremendous growth in the last decade. From April to December 2022, India’s farm product exports rate was 7.91% higher than April-December 2021.

The region also has higher domestic demand as the current population of the country is 1.4 billion. Additionally, India and China are delivering exceptional products in terms of heavy machinery including power filling machines.

As per recent research, India was the leading exporter of powder filling machines supplying up to 516 shipments from the top 3 exports of the country. Vietnam was third on the list with 240 shipments. Moreover, increasing strategic partnerships with domestic and international companies, adopted by Asian players may assist in further expansion in addition to the growing emphasis of regional governments to promote the export rate of these products.

Powder Filling Machines Market: Competitive Analysis

The global powder filling machines market is led by players like:

- Marchesini Group

- Bosch Packaging Technology

- Hanningfield Process Systems Ltd.

- IMA Group

- Matrix Packaging Machinery

- Robert Bosch GmbH

- Ohlson Packaging

- MG2

- Universal Filling Machine Company

- All-Fill Inc.

- Karmelle Liquid Filling & Capping Solutions Ltd.

- Spee-Dee Packaging Machinery

- AMS Filling Systems Inc.

- PASE Group

- Oden Machinery Inc.

- Cozzoli Machine Company

- Accutek Packaging Equipment Companies Inc.

- C.E.King Limited

- Pack Leader USA

- Adelphi Group Ltd.

The global powder filling machines market is segmented as follows:

By Application

- Cosmetic

- Food & Beverages

- Chemicals

- Pharmaceutical

- Others

By Type

- Gravity Fillers

- Vertical Auger Fillers

- Vacuum Fillers

- Cup Fillers

By Mode of Operation

- Fully Automatic

- Semi-Automatic

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A powder filling machine is an example of automation in the packaging segment across industries.

The global powder filling machines market is projected to grow due to the increasing application of these machines in the food & beverages industry.

According to study, the global powder filling machines market size was worth around USD 1347 million in 2022 and is predicted to grow to around USD 2279 million by 2030.

The CAGR value of powder filling machines market is expected to be around 6.8% during 2023-2030.

The global powder filling machines market is expected to be led by Asia-Pacific during the forecast period as the region is witnessing higher domestic demand across sectors.

The global powder filling machines market is led by players like Marchesini Group, Bosch Packaging Technology, Hanningfield Process Systems Ltd., IMA Group, Matrix Packaging Machinery, Robert Bosch GmbH, Ohlson Packaging, MG2, Universal Filling Machine Company, All-Fill Inc., Karmelle Liquid Filling & Capping Solutions Ltd., Spee-Dee Packaging Machinery, AMS Filling Systems, Inc., PASE Group, Oden Machinery Inc., Cozzoli Machine Company, Accutek Packaging Equipment Companies, Inc., C.E.King Limited, Pack Leader USA, and Adelphi Group Ltd.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed