Process Analytical Technology Market Size, Share, Analysis, Trends, Growth, Forecast, 2032

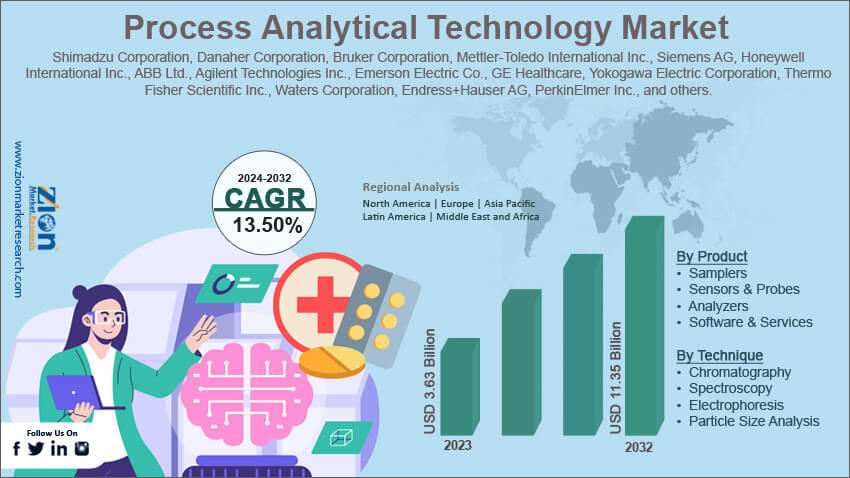

Process Analytical Technology Market By End-User (CMOs and CDMOs, CROs, and Pharmaceutical & Biotechnology Companies), By Product (Samplers, Sensors & Probes, Analyzers, and Software & Services), By Technique (Chromatography, Spectroscopy, Electrophoresis, Particle Size Analysis, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

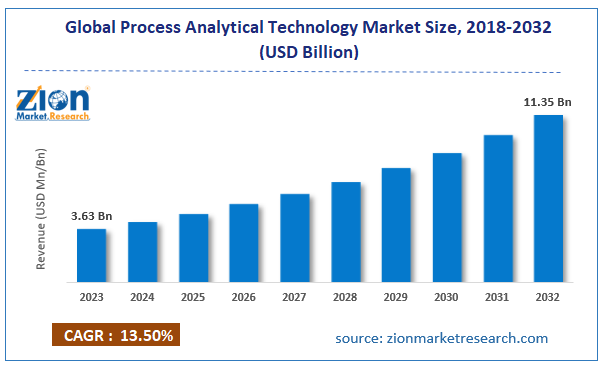

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.63 Billion | USD 11.35 Billion | 13.50% | 2023 |

Process Analytical Technology Industry Prospective:

The global process analytical technology market size was worth around USD 3.63 billion in 2023 and is predicted to grow to around USD 11.35 billion by 2032 with a compound annual growth rate (CAGR) of roughly 13.50% between 2024 and 2032.

Process Analytical Technology Market: Overview

The emergence of process analytical technology (PAT) can be traced to the guidelines published by the United States Food & Drugs Administration (FDA) in 2004. The PAT initiative revolves around focusing on reducing the risks associated with public health during the manufacturing of pharmaceutical drugs. PAT is created for the designing, analyzing, and controlling of pharmaceutical manufacturing processes using the critical process parameters (CPP) measurements that are known to directly affect the critical quality attributes (CQA). Process analytical technology consists of defining CPPs and monitoring them frequently and at predetermined intervals thus making the entire manufacturing process for efficient results. It also helps in curbing the risk of over-processing and minimization of rejections. PAT implementation is carried out through a regulatory framework designed by the US FDA through which the agency plans to encourage drug developers to achieve production efficiency. The basic criteria for the PAT framework start with the drawing of a simple process and end with the evaluation of tools that are necessary for synchronizing the reading of the data.

Key Insights:

- As per the analysis shared by our research analyst, the global process analytical technology market is estimated to grow annually at a CAGR of around 13.50% over the forecast period (2024-2032)

- In terms of revenue, the global process analytical technology market size was valued at around USD 3.63 billion in 2023 and is projected to reach USD 11.35 billion, by 2032.

- The market is projected to grow at a significant rate due to the rising investments in novel drug development procedures

- Based on end-user segmentation, pharmaceutical, and biotechnology companies were predicted to show maximum market share in the year 2023

- Based on technique segmentation, spectroscopy was the leading segment in 2023

- On the basis of region, North America was the leading revenue generator in 2023

Request Free Sample

Request Free Sample

Process Analytical Technology Market: Growth Drivers

Rising investments in novel drug development procedures will boost the market growth rate

The global process analytical technology market is expected to witness a high growth rate due to the increasing investments in the development of novel drugs as the pressure on the global healthcare infrastructure has been rising exponentially. The outburst of the COVID-19 pandemic highlighted the shortcomings in the existing healthcare procedures and the need to modify the ways medicines are developed, manufactured, and distributed. In addition to this, the pandemic has shed light on the need to consistently develop novel drugs as the healthcare needs of the current population continue to evolve.

For instance, Sarepta Therapeutics is currently working on the development of a new drug for the treatment of Duchenne muscular dystrophy (DMD) which is known to affect males in their childhood and can cause the patients to become wheelchair-bound. Sarepta has partnered with Roche and is developing SRP-9001 which the company estimates that the medicine can become curative therapy for a large number of patients in the coming years. In April 2024, Basilea Pharmaceutica Ltd. received approval for its new injection called the Zevtera. It offers treatment for skin and structure infections, bacteremia, and pneumonia. Similarly, the rising number of drug approvals will be crucial in driving the demand for process analytical technology in the coming years.

Growing work toward integrating advanced technologies such as artificial intelligence (AI) into PAT will generate higher revenue

Companies working with process analytical technology are actively seeking ways to integrate AI into the system for improved delivery. Artificial intelligence holds the potential to help the pharmaceutical sector develop new medicines and treatment programs. In December 2023, Merck, a global science and technology company, announced the launch of AIDDISON™ drug discovery software. It will help drug developers shrink the gap between real-world manufacturability and virtual molecule design. Such strides in the integration of AI and drug development will also aid the global process analytical technology market.

Process Analytical Technology Market: Restraints

Lack of trained professionals with experience in PAT development and implementation may restrict the market expansion rate

The global industry for process analytical technology is expected to be restricted due to the lack of trained professionals who have expertise in the development and implementation of process analytical technology. The frameworks designed implementing PAT are complex and dynamic changing from one region to another. It is relatively a new concept hence the lack of availability of skilled professionals. Moreover, in legacy systems, integrating new process analytical technology may become difficult leading to further loss of revenue.

Process Analytical Technology Market: Opportunities

Increasing research & development in cell and gene therapy will generate high-growth opportunities

The global process analytical technology market will generate high growth opportunities due to the increasing investments in the research & development of cell and gene therapy across the globe. For instance, in March 2023, Cell and Gene Therapy Catapult (CGT Catapult) announced the launch of a modern facility in Stevenage. The unit is specially designed for developers working in the cell and gene therapy segment to improve product quality, control and monitor advanced therapy manufacturing processes, and enhance safety by also working on increasing production levels. The PAT facility is equipped with digital and analytical space for cell and gene therapy developers globally. As per market research, cell therapy is used for treating diseases by altering or restoring specific sets of cells while gene therapy deals with introducing, inactivating, or replacing diseased cells with new cells. Researchers claim that this mode of disease treatment can cure the majority of genetic conditions that have not found any cure in the modern healthcare system.

Growing investments in large-scale deployment of Industry 4.0 technologies will generate new expansion possibilities

The global process analytical technology industry will be further positively impacted by the rising development in Industry 4.0 technologies such as the Internet of Things (IoT), 5G communication systems, and cloud-sharing tools. The introduction of new highly advanced PAT-enabling platforms will also boost the market revenue in the coming years.

Process Analytical Technology Market: Challenges

High cost of implementation and issues concerning accurate data interpretation will challenge the market growth rate

The global process analytical technology market will be challenged by the high implementation cost associated with PAT systems since they require advanced tools to support the operation aspect. Additionally, the resistance to change showcased by people comfortable with older protocols and systems may further delay the market adoption rate. Moreover, issues have been raised regarding data interpretation inaccuracy since the technology is new and does not enjoy the perks of a mature market.

Process Analytical Technology Market: Segmentation

The global process analytical technology market is segmented based on end-user, product, technique, and region.

Based on end-users, the global market segments are CMOs and CDMOs, CROs, and pharmaceutical & biotechnology companies. In 2023, nearly 50.01% of the total market share was dominated by the pharmaceutical & biotechnology company segment. Most drug developers have in-house PAT systems as it helps the companies develop and manufacture medicines more efficiently. Contract Manufacturing Organizations (CMOs), Contract Manufacturing Organizations (CDMOs), and Contract Research Organizations (CROs) also use PAT systems to improve performance efficiency.

Based on product, the global process analytical technology industry divisions are samplers, sensors & probes, analyzers, and software & services.

Based on technique, the global market is segmented into chromatography, spectroscopy, electrophoresis, particle size analysis, and others. In 2023, the highest revenue-generating segment was spectroscopy. It accounted for more than 40.0% of the total share. Liquid chromatography/mass spectroscopy (LC/MS) is one of the most common analytical tools used in the drug development processes. It has applications across phases including the final analysis procedures.

Process Analytical Technology Market Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Process Analytical Technology Market |

| Market Size in 2023 | USD 3.63 Billion |

| Market Forecast in 2032 | USD 11.35 Billion |

| Growth Rate | CAGR of 13.50% |

| Number of Pages | 232 |

| Key Companies Covered | Shimadzu Corporation, Danaher Corporation, Bruker Corporation, Mettler-Toledo International Inc., Siemens AG, Honeywell International Inc., ABB Ltd., Agilent Technologies Inc., Emerson Electric Co., GE Healthcare, Yokogawa Electric Corporation, Thermo Fisher Scientific Inc., Waters Corporation, Endress+Hauser AG, PerkinElmer Inc., and others. |

| Segments Covered | By End-User, By Product, By Technique, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Process Analytical Technology Market: Regional Analysis

North America to witness the highest growth rate during the projection period

The global process analytical technology market is expected to witness the highest growth rate in North America. The region held control over 35.05% of the total market share in 2023. The process analytical technology was first introduced by the US FDA. It is the regulatory body in the United States taking care of public health by ensuring the quality of food and drugs sold in the country. Additionally, the frameworks designed by the FDA are valued in the international market as well. PAT belongs to the broader pharmaceutical cGMP for the 21st century – A risk-based approach. Hence, the technology adoption rate in the country is relatively higher. In December 2022, the U.S. Pharmacopeia (USP) announced the launch of the USP Advanced Manufacturing Technology Lab in Virginia as a segment of the company’s research & development analytical solutions. Apart from the other areas of focus, the facility also offers Spectrometric and other process analytical technology applications. The increasing investments in cell and gene therapy and the growing development of new vaccines and medical solutions will further affect the industry's growth rate. In 2023, the total spending on cell and gene therapy reached around USD 6 billion as per market research.

Process Analytical Technology Market: Competitive Analysis

The global process analytical technology market is led by players like:

- Shimadzu Corporation

- Danaher Corporation

- Bruker Corporation

- Mettler-Toledo International Inc.

- Siemens AG

- Honeywell International Inc.

- ABB Ltd.

- Agilent Technologies Inc.

- Emerson Electric Co.

- GE Healthcare

- Yokogawa Electric Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

- Endress+Hauser AG

- PerkinElmer Inc.

The global process analytical technology market is segmented as follows:

By End-User

- CMOs

- CDMOs

- CROs

- Pharmaceutical & Biotechnology Companies

By Product

- Samplers

- Sensors & Probes

- Analyzers

- Software & Services

By Technique

- Chromatography

- Spectroscopy

- Electrophoresis

- Particle Size Analysis

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The emergence of process analytical technology (PAT) can be traced to the guidelines published by the United States Food & Drugs Administration (FDA) in 2004.

The global process analytical technology market is expected to witness a high growth rate due to the increasing investments in the development of novel drugs as the pressure on the global healthcare infrastructure has been rising exponentially.

According to study, the global process analytical technology market size was worth around USD 3.63 billion in 2023 and is predicted to grow to around USD 11.35 billion by 2032.

The CAGR value of process analytical technology market is expected to be around 13.50% during 2024-2032.

The global process analytical technology market is expected to witness the highest growth rate in North America.

The global process analytical technology market is led by players like Shimadzu Corporation, Danaher Corporation, Bruker Corporation, Mettler-Toledo International Inc., Siemens AG, Honeywell International Inc., ABB Ltd., Agilent Technologies Inc., Emerson Electric Co., GE Healthcare, Yokogawa Electric Corporation, Thermo Fisher Scientific Inc., Waters Corporation, Endress+Hauser AG and PerkinElmer Inc.

The report explores crucial aspects of the process analytical technology market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed