Rail Welding Machines Market Growth, Size, Share, Trends, and Forecast 2030

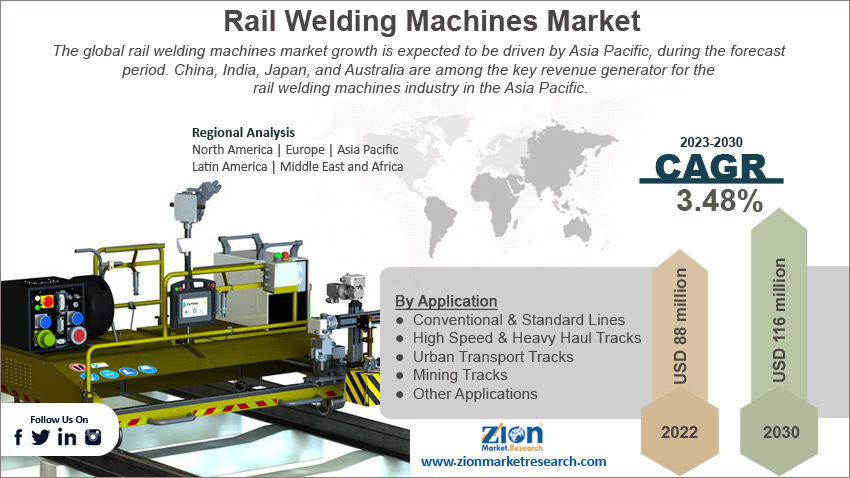

Rail Welding Machines Market By Type (Stationary Welding Machines And Mobile Welding Machines), By Application (Conventional & Standard Lines, High Speed & Heavy Haul Tracks, Urban Transport Tracks, Mining Tracks, And Other Applications), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 88 million | USD 116 million | 3.48% | 2022 |

Rail Welding Machines Industry Perspective:

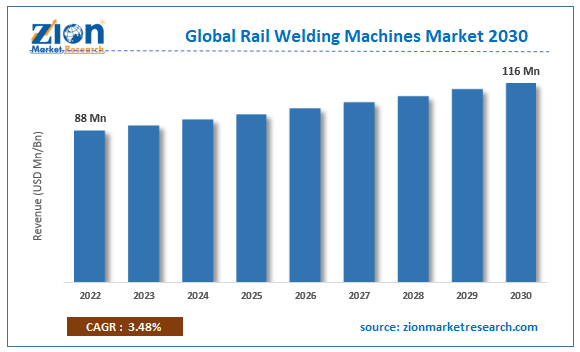

The global rail welding machines market size was worth around USD 88 million in 2022 and is predicted to grow to around USD 116 million by 2030 with a compound annual growth rate (CAGR) of roughly 3.48% between 2023 and 2030.

Rail Welding Machines Market: Overview

Rail welding machines are used to weld rail tracks & turnout joints. These machines are majorly based on flash-butt welding technology. In the flash-butt welding method, electric power is used between the end surfaces of the rails being joined, the free rail is moved forward & backward at low speed, and flash & arc are produced by the resistance & local heating caused by the contact of the rail ends. The contact flash generation process is repeated till a melt layer is formed on the entire joint surface, then after one rail end is pressed to obtain perfect homogenous joints. Flash-butt welding method provides raw characteristics like standalone tracks to the joint surfaces. Flash-butt welding has the highest welding efficiency among all rail welding methods. Other welding methods include gas pressure welding, enclosed arc welding, aluminothermic welding, and others.

Currently, both mobile & stationary welding machines are used by railway infrastructure firms. Stationary machines are widely used for joining short & long rails. Stationary welding machines are mostly used at rail welding plants. Whereas mobile welding systems are self-propelled, generally, truck-based rail vehicles or container systems on which welding machines are fitted. These wagons can be moved from one welding position to another. Continuous welded rail offers a smooth & continuous track length for efficient railway activities. Rising expansion in railway networks, across the globe, is expected to enhance the growth of the rail welding machines industry.

Key Insights

- As per the analysis shared by our research analyst, the global rail welding machines market is estimated to grow annually at a CAGR of around 3.48% over the forecast period (2023-2030).

- In terms of revenue, the global rail welding machines market size was valued at around USD 88 million in 2022 and is projected to reach USD 116 million, by 2030.

- The global rail welding machines market is projected to grow at a significant rate due to the rising investment in the expansion of railway routes, worldwide.

- Based on type segmentation, mobile welding machines were predicted to show maximum market share in the year 2022.

- Based on application segmentation, conventional & standard lines were the leading revenue-generating application in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Rail Welding Machines Market: Growth Drivers

Rising investment in the expansion of railway routes to drive market growth during the forecast period.

The global rail welding machines market is projected to grow owing to the increasing investment in railway routes expansion projects for high-speed railways, urban transport or metro railways, freight transport routes, and others. Globally, railway routes in India & China are expanding at a fast rate, owing to the increased demand for passenger transport, freight transport, raw material transport for various industries, and others. The industrial growth in the country is also fueling the demand for new railway routes for products & goods transportation within the vast territory of the country. According to the Indian Railway, as of December 2022, the length of railway routes in India accounted for over 68 thousand kilometers. The railway length in the country is expected to rise significantly in the coming years, owing to planned urban transport projects, intercity projects, freight corridors, etc. in the country. Further, according to the Indian government, the length of railway lines in the country is expected to reach around 1.2 lakh kilometers by 2025. Such expansion in the country is expected to propel the demand for rail welding machines in the country.

United States railway infrastructure is well-developed, with more than 140,000 miles of track in operating condition. A major portion of the railway lines in the United States are operated by freight rail enterprises. In July 2023, Amtrak planned to invest around USD 75 billion for expansion in the United States. The company proposed service improvements to 25 existing routes as well as planned to build 39 other new routes.

In July 2023, Deutsche Bahn (DB) in collaboration with European rail companies studied on the expansion of the high-speed rail network in the European region. These firms along with local governments are planning to double the volume of European high-speed rail (HSR) by 2030 and triple by 2050. Some of the economies with the longest rail routes are Russia, Germany, France, and others. In Russia, the Trans-Siberian Railway is among the longest railway network, across the globe, with a length of around 9200 kilometers.

Rail Welding Machines Market: Restraints

Construction & expansion of alternate transport routes to restrict market expansion

Railways are, majorly, preferred for transporting passengers & goods within a country. However, alternate routes for transportation such as roadways, inland waterways, and others are also available for short to long routes. Roadways are conventional transport routes for goods in various countries.

According to the National Highway Authority of India, the length of national highways in India accounted for around 140,995 kilometers in FY2022, registering a growth rate of around 3.33% year-on-year. Further, the United States has the largest road network, worldwide, with a length of around 68,03,479 kilometers, as of January 2023. The expansion of road networks across the globe is somehow reducing the requirement for railway routes and its expansion, thereby, hindering the growth of the rail welding machines industry.

Rail Welding Machines Market: Opportunities

Technological advancement of rail welding machines to provide growth opportunities

Manufacturers are investing in the development of more advanced rail welding machines to perform welding tasks more easily and in a comparatively short period of time. Recently, Mirage Ltd has developed an induction welding technology for rail. Some of the key advantages of the mirage rail induction welding system provide automatic shearing, offers error-proof welds, and is deployable from light-weight road rail vehicles (RRV), trucks, or trailers. Insert welding can be done to reduce rail consumption to near zero. In addition, a significant development was made in butt welding technology through the application of modern microprocessor controls and the application of DC & finite control during the welding process. Such developments were made to enhance the efficiency of the current butt-welding machine. Moreover, various R&D in the field of rail welding machines is in the initial stages. In January 2022, Pandrol unveiled a new PLA Evo aluminothermic welding process for rail infrastructure. The process forms improved metallurgical weld joints. Moreover, the product is compatible with the existing preheaters in the market. All such development is expected to act as an opportunity for the rail weld machine industry, in the coming years.

Rail Welding Machines Market: Challenges

High precision factors & loss of metal to challenge market cap growth

During flash-butt welding, rail metallic material is lost during flashing & upsetting. This reduces the overall length of the rail. However, accurate calculations made during the welding process solve the length issues. The excess metal is squeezed outwards during the flash-butt welding and later, this flashing is trimmed off. Moreover, both rail profiles are required to keep straight, which is a hard task during the welding process. However, current technology avoids these challenges through its high-precision characteristics & functions.

Rail Welding Machines Market: Segmentation

The global rail welding machines market is segmented based on type, application, and region.

Based on type, the global market segments are stationary welding machines & mobile welding machines. Currently, the global rail welding machines market is dominated by mobile welding machines, considering their ease of applicability at different locations. Mobile welding machine comprises rail welding equipment fitted on a truck-based rail-road vehicle. These rail welding machines perform tasks at higher rates & good efficiency. Some of the key providers of mobile rail welding machines are Holland, L.P., Plasser & Theurer, Caterpillar (Progress Rail), and others.

Based on application, the global market segments are conventional & standard lines, high-speed & heavy haul tracks, urban transport tracks, mining tracks, and other applications. Currently, the rail welding machines industry is dominated by the conventional & standard lines segment. Conventional & standard lines are the most widely used railway network across the globe. Most of the conventional rail routes are situated in North America, Europe, China, India, Russia, and Japan, as per IEA. However, in the coming years, high-speed & heavy-haul tracks are expected to acquire significant market share, owing to the increasing investments in high-speed train infrastructures.

Rail Welding Machines Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Rail Welding Machines Market Report |

| Market Size in 2022 | USD 88 Million |

| Market Forecast in 2030 | USD 116 Million |

| Growth Rate | CAGR of 3.48% |

| Number of Pages | 218 |

| Key Companies Covered | BAIDIN GMBH, Caterpillar, Chengdu Aigre Technology Co. Ltd., CJSC Pskovelektrosvar, Contrail, CRRC Corporation Limited, Geismar, Holland, L.P., KZESO PrJSC, Mirage Ltd, Pandrol, Plasser & Theurer, Schlatter Industries AG, VAIA CAR S.p.A., VFC Engineering S.A.S., Vossloh, and Welding Alloys. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rail Welding Machines Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

The global rail welding machines market growth is expected to be driven by Asia Pacific, during the forecast period. China, India, Japan, and Australia are among the key revenue generator for the rail welding machines industry in the Asia Pacific.

China planned to construct around 3,000 kilometers of new railway lines in 2023, out of which around 2,500 kilometers of track will be allocated for high-speed railways. These new railway constructions include the Sichuan-Xizang Railway & other 102 railway projects which were planned according to the country’s 14th five-year plan for national economic & social development. China State Railway Group Company, Ltd. announced to make business revenue of around CNY 817.5 billion in 2023, up by 18% over 2022. In 2022, China Railways invested around CNY 710.9 billion in capital investment in railways and expanded by 4,100 kilometers of new operational railway lines. Out of the total expansion in 2022, 2,082 kilometers of railway lines are for high-speed railways in China. Such factors will enhance the growth of the rail welding machines industry in China.

In India, according to the India Brand Equity Foundation (IBEF), Indian railways revenue accounted for around INR 2.40 lakh crore (around USD 29 billion) in FY2022-23, registering a growth rate of around 25% compared to the previous year. The railway system in India is regarded as one of the biggest in the world under a single management. The country is expanding its semi-high-speed rail networks at a significant rate. With around 22,593 operating trains (13,452 passengers and 9,141 freight trains), the country has the fourth-largest railway network, carrying 24 million passengers daily and 203.88 million tons of freight. Considering such factors, the railway routes in the country frequently go for maintenance. In many cases, rail profiles need to be replaced with new ones, which will further require rail welding machines for joining two rail profiles.

Japan is known for both conventional & high-speed train routes. According to the Government of Japan, the length of the total operating passenger railway network in Japan accounted for around 27.50 thousand kilometers. East Japan Railway Company, Tokyu Corporation, and Hokkaido Railway Company are among the key railway operating companies in Japan.

In Australia, Australian Rail Track Corporation (ARTC) manages more than 8,500 kilometers of railway track in Queensland, New South Wales, Victoria, South Australia, and Western Australia. In March 2023, the Australian & Victorian governments signed a deal with the Australasian Railway Association (ARA) to improve the interoperability of the rail network in the country. The agreement is expected to fuel the growth of the railway in the country.

Rail Welding Machines Market: Competitive Analysis

The global rail welding machines market is dominated by players like:

- BAIDIN GMBH

- Caterpillar

- Chengdu Aigre Technology Co. Ltd.

- CJSC Pskovelektrosvar

- Contrail

- CRRC Corporation Limited

- Geismar

- Holland, L.P.

- KZESO PrJSC

- Mirage Ltd

- Pandrol

- Plasser & Theurer

- Schlatter Industries AG

- VAIA CAR S.p.A.

- VFC Engineering S.A.S.

- Vossloh

- Welding Alloys

The global rail welding machines market is segmented as follows:

By Type

- Stationary Welding Machines

- Mobile Welding Machines

By Application

- Conventional & Standard Lines

- High Speed & Heavy Haul Tracks

- Urban Transport Tracks

- Mining Tracks

- Other Applications

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Rail welding machines are used to weld rail tracks & turnout joints. These machines are majorly based on flash-butt welding technology. Other welding methods include gas pressure welding, enclosed arc welding, aluminothermic welding, etc. Mobile & stationary welding machines are used to perform rail welding tasks.

The global rail welding machines market cap may grow owing to the rising demand from the rising investment in the expansion of railway routes. Significant growth opportunities can be expected due to the technological advancement of rail welding machines.

According to study, the global rail welding machines market size was worth around USD 88 million in 2022 and is predicted to grow to around USD 116 million by 2030.

The CAGR value of the rail welding machines market is expected to be around 3.48% during 2023-2030.

The global rail welding machines market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the presence of a huge conventional & high-speed railway network.

The global rail welding machines market is led by players like BAIDIN GMBH, Caterpillar, Chengdu Aigre Technology Co. Ltd., CJSC Pskovelektrosvar, Contrail, CRRC Corporation Limited, Geismar, Holland, L.P., KZESO PrJSC, Mirage Ltd, Pandrol, Plasser & Theurer, Schlatter Industries AG, VAIA CAR S.p.A., VFC Engineering S.A.S., Vossloh, and Welding Alloys.

The report analyzes the global rail welding machines market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the rail welding machines industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed