Real-Time Payments Market Size, Growth, Share, Demand Analysis 2024-2032

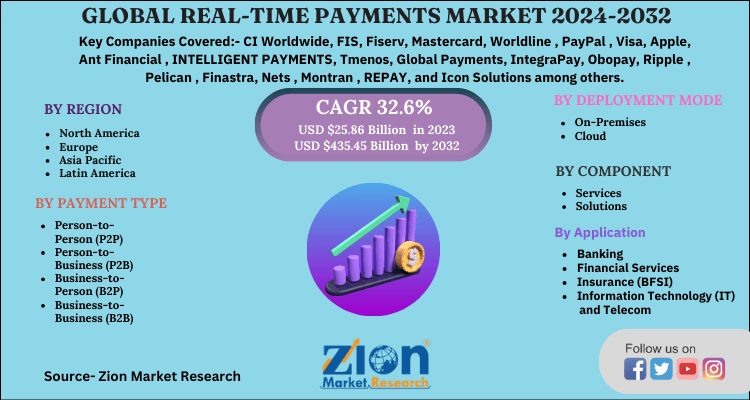

Real-Time Payments Market - By Payment Type (Person-to-Person (P2P), Person-to-Business (P2B), Business-to-Person (B2P), Business-to-Business (B2B), Others) By Deployment Mode (On-Premises and Cloud) By component (Services (Managed Services, Professional Services) and Solutions (Payment Processing Solution, Payment Gateway Solution, Payment Security Solution, Fraud Management Solution)) By Application (Banking, Financial Services, and Insurance (BFSI), Information Technology (IT) and Telecom, Healthcare and Education, Manufacturing and Transportation, Government and Utilities, Construction and Retail, Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

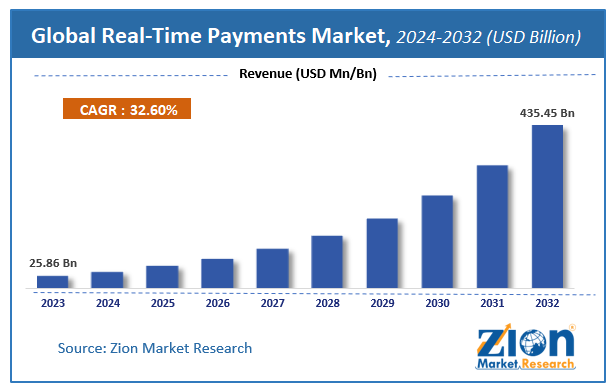

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 25.86 Billion | USD 435.45 Billion | 32.6% | 2023 |

Real-Time Payments Market Insights

According to a report from Zion Market Research, the global Real-Time Payments Market was valued at USD 25.86 Billion in 2023 and is projected to hit USD 435.45 Billion by 2032, with a compound annual growth rate (CAGR) of 32.6% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Real-Time Payments industry over the next decade.

Global Real-Time Payments Market: Overview

Real-time payments refers to the electronic or digital payment technologies that allow the transaction to be approved in real time or immediately and the funds to be credited to the payee 's account and subsequently reported to the payer. Convenience and quicker availability of funds and the reception of money transfer provided by these systems are gaining popularity among end-users as well as service providers. It is an on-going payment service that can be made available at any time and for any period. Real-time payment can be conducted from a wide variety of apps and computers, such as tablets, laptops, mobile applications and digital wallets.

Global Real-Time Payments Market: Growth Factors

Increasing smartphones penetration, along with increasing demand for pay-now facility are among the major factors propelling growth of the real-time payments market. In addition to this, growing need for fast and secure instant payment gateways is another factor expected to fuel growth of the target industry in the near future. Furthermore, real-time payment systems are majorly used in the banking, financial services sectors and growing digitalization among multiple areas are in turn fuelling the global market growth. However, increasing market competition may hamper growth of the global market in the coming years. Nevertheless, technological advancements and improving changes in regulatory framework may create huge growth opportunities in future.

Global Real-Time Payments Market: Segmentation

The real-time payments market is segmented based on payment type, deployment mode, component, application. Based on payment type the market is divided as Person-to-Person (P2P), Person-to-Business (P2B), Business-to-Person (B2P), Business-to-Business (B2B), and Others. By Deployment Mode, the global market is segregated as on-premises and cloud. On the basis of component the global market is divided as services and solutions. Services segment is segmented as managed services, professional services and solutions segment is categorised as payment processing solution, payment gateway solution, payment security solution, fraud management solution. On the basis of application the global industry is divided as banking, financial services, and insurance (BFSI), information technology (IT) and telecom, healthcare and education, manufacturing and transportation, government and utilities, construction and retail, others.

Region-wise, the global market is segregated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Real-Time Payments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Real-Time Payments Market |

| Market Size in 2023 | USD 25.86 Billion |

| Market Forecast in 2032 | USD 435.45 Billion |

| Growth Rate | CAGR of 32.6% |

| Number of Pages | 110 |

| Key Companies Covered | CI Worldwide, FIS, Fiserv, Mastercard, Worldline , PayPal , Visa, Apple, Ant Financial , INTELLIGENT PAYMENTS, Tmenos, Global Payments, IntegraPay, Obopay, Ripple , Pelican , Finastra, Nets , Montran , REPAY, and Icon Solutions among others |

| Segments Covered | By Payment Type, By Deployment Mode, By Component, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Real-Time Payments Market: Regional Analysis

The North America real-time payments market is projected to hold the significant share globally in the future, owing to the presence of major players, and increasing demand from various end use industries in the countries of North America. Further, penetration of smartphones and growing demand for pay-now facility are expected to fuel growth of the market in the Asia Pacific. The Europe real-time payments market is anticipated to grow at a rapid rate in the years ahead. This is due to increasing demand form banking, financial services and increasing digitalization in the countries of the region.

Global Real-Time Payments Market: Competitive Players

Some main participants of the real-time payments market are:

- CI Worldwide

- FIS

- Fiserv

- Mastercard

- Worldline

- PayPal

- Visa

- Apple

- Ant Financial

- INTELLIGENT PAYMENTS

- Tmenos

- Global Payments

- IntegraPay

- Obopay

- Ripple

- Pelican

- Finastra

- Nets

- Montran

- REPAY

- Icon Solutions among others.

The Global Real-Time Payments Market is segmented as follows:

By Payment Type

- Person-to-Person (P2P)

- Person-to-Business (P2B)

- Business-to-Person (B2P)

- Business-to-Business (B2B)

- Others

By Deployment Mode

- On-Premises

- Cloud

By component

- Services

- Managed Services,

- Professional Services

- Solutions

- Payment Processing Solution

- Payment Gateway Solution

- Payment Security Solution

- Fraud Management Solution

By Application

- Banking

- Financial Services

- Insurance (BFSI)

- Information Technology (IT) and Telecom

- Healthcare and Education

- Manufacturing and Transportation

- Government and Utilities

- Construction and Retail, Others

Real-Time Payments Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Growing demand for pay-now facility, coupled with increase in the penetration of smartphones across the globe are some among factors expected to support growth of the target market in the near future. Additionally, real-time payment systems are widely adopted among banking, financial services and insurance (BFSI) sector which is further fuelling growth worldwide.

According to Zion Market Research, global demand for Real-Time Payments market is expected to generate revenue of around USD 55.5 Billion by end of 2026, growing at a CAGR of around 29.8% between 2020 and 2026.

The North America real-time payments market is projected to hold the significant share globally in the future. Presence of key operating players and high awareness real-time payment gateways in the region are expected to propel the demand.

Some main participants of the real-time payments market are CI Worldwide, FIS, Fiserv, Mastercard, Worldline , PayPal , Visa, Apple, Ant Financial , INTELLIGENT PAYMENTS, Tmenos, Global Payments, IntegraPay, Obopay, Ripple , Pelican , Finastra, Nets , Montran , REPAY, and Icon Solutions among others.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed