Global Remicade Biosimilar Market Size, Share, Growth Analysis Report - Forecast 2034

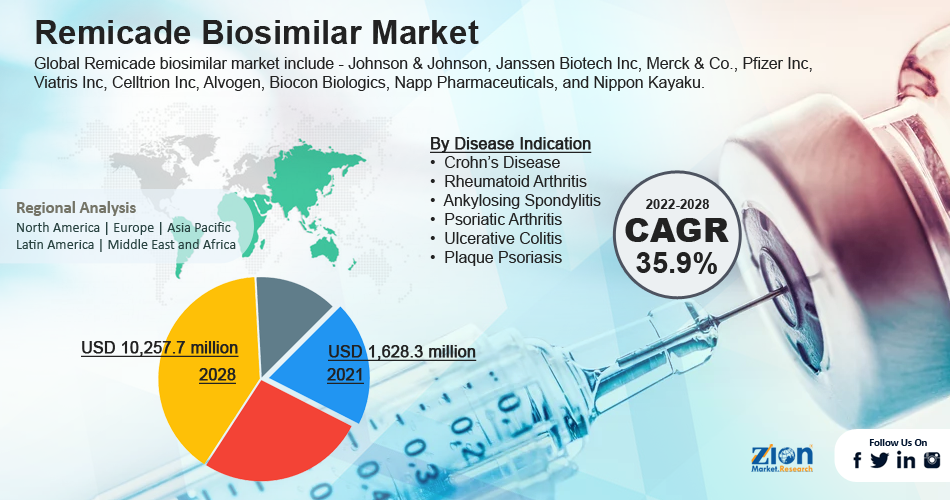

Remicade Biosimilar Market By Indication (Rheumatoid Arthritis, Psoriatic Arthritis, Crohn’s Disease, Ulcerative Colitis, Ankylosing Spondylitis, Plaque Psoriasis), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), Route of Administration (Intravenous, Subcutaneous), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034-

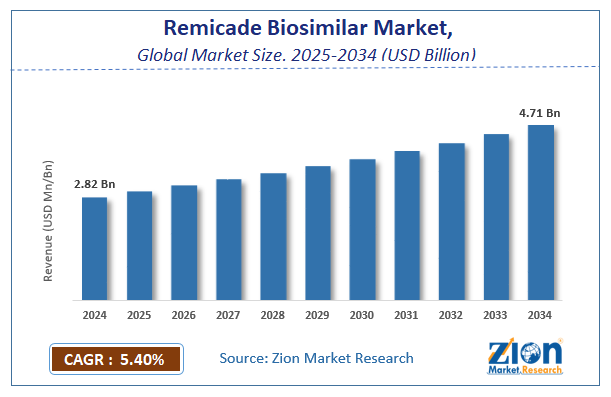

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.82 Billion | USD 4.71 Billion | 5.4% | 2024 |

Remicade Biosimilar Market: Industry Perspective

The global remicade biosimilar market size was worth around USD 2.82 Billion in 2024 and is predicted to grow to around USD 4.71 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.4% between 2025 and 2034.

The report analyzes the global remicade biosimilar market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the remicade biosimilar industry.

Remicade Biosimilar Market: Overview

A biological product classified as a biosimilar also called a reference biological product, is very similar to a drug that has already received FDA approval. The U.S. FDA and the European Medicines Agency (EMA) license biosimilar medications identical to reference products regarding safety, purity, efficacy, and effectiveness.

Large regulatory agencies can only approve these biosimilar medications for the conditions and indications already authorized for the reference product. For the treatment of many different diseases, there is a high demand for biological products. However, there is a growing market demand for biosimilar products to reduce healthcare costs. The rising prevalence of autoimmune diseases, especially rheumatoid arthritis and psoriatic arthritis, early brand-name Remicade patent expiration, discounted prices across the European market, and quicker response times due to intravenous administration are all driving factors for the market growth.

Additionally, introducing biosimilar versions may reduce the financial burden on healthcare system applications and increase patient access to critical medications. Serious drug side effects that necessitate hospital treatment or even be fatal are obstacles to the Remicade biosimilar industry. These include invasive fungal infections, such as histoplasmosis, bacterial sepsis, tuberculosis, etc.

Key Insights

- As per the analysis shared by our research analyst, the global remicade biosimilar market is estimated to grow annually at a CAGR of around 5.4% over the forecast period (2025-2034).

- Regarding revenue, the global remicade biosimilar market size was valued at around USD 2.82 Billion in 2024 and is projected to reach USD 4.71 Billion by 2034.

- The remicade biosimilar market is projected to grow at a significant rate due to increasing prevalence of autoimmune diseases, the desire for cost-effective treatment options compared to the originator biologic, and the expiration of patents on the original Remicade drug.

- Based on Indication, the Rheumatoid Arthritis segment is expected to lead the global market.

- On the basis of Distribution Channel, the Hospital Pharmacies segment is growing at a high rate and will continue to dominate the global market.

- Based on the Route of Administration, the Intravenous segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Remicade Biosimilar Market: Growth Drivers

Growing demand for biosimilar drugs owing to their cost-effectiveness is likely to pave the way for market growth

Increased demand for biosimilars likely promotes corporate growth in the future. The cost of the Remicade biosimilar medications is 20–30% less than their reference medications, per the American Journal of Managed Care (AJMC). Patients benefit from having access to advanced, effective treatments while saving money. Compared to innovator biologics, the development costs of biosimilars are cheaper.

The price of Remicade biosimilars is reduced by lower R&D expenses. Lower-cost biosimilars reduce the cost of reference biologics due to price rivalry among producers. The decreased unit price of a biologic due to its rival medication and the enhanced accessibility of a variety of Remicade biosimilars for the patients are two ways that these drugs' cost-effectiveness improves total healthcare costs.

Constant focus on expanding biosimilar portfolios by prominent drug makers is a key trend bolstering the global Remicade biosimilar market prospects. Thus, it is anticipated that the later entrance biologics' overall competitive costs will support their demand over the forecast period.

Remicade Biosimilar Market: Restraints

High developmental costs and complex manufacturing processes hamper the market growth

Developing Remicade biosimilars is a difficult and expensive process that needs a lot of money, technical know-how, clinical trial experience, scientific criteria, and quality control procedures. Unlike generic drug developers, Remicade biosimilar producers must invest in clinical testing and post-approval monitoring and control measures comparable to those of the original patent businesses.

The ability to manage variability during the production process, where the final products are similar to their biological products, is another important concern in the production of Remicade biosimilars. Manufacturing Remicade biosimilars should adhere to established quality standards for both safety and efficacy.

Regulatory agencies may ask for more preclinical, clinical evidence to prove that the manufacturing process has no bearing on the product's efficacy or safety and that there is no difference between the biosimilar and the biologic medication.

Remicade Biosimilar Market: Opportunity

Major biologics patents expiration and research into new indications bring up market growth opportunities

Most prior biologic drugs lost patent protection in the last century, and many of today's best-selling drugs are expected to lose patent coverage in the coming years. This opens up new avenues for biosimilar drugs. Nearly 20 oncology biologics patents will expire by 2023, potentially paving the way for more Remicade biosimilars in the field. There are currently a variety of diseases and ailments that are treated with Remicade biosimilars. Oncology, autoimmune diseases, diabetes, and hepatitis are the main target treatment areas for which numerous Remicade biosimilars are under development.

Remicade Biosimilar Market: Challenges

Significant drug-related adverse effects continue to be a market challenge

Serious adverse effects of the medicine that may need hospitalization or possibly be lethal are a barrier to the growth of the global Remicade biosimilars market. These include invasive fungal infections, such as histoplasmosis, bacterial sepsis, tuberculosis, etc. Moreover, the market for Remicade biosimilars is significantly challenged by the accessibility of substitute medications. These medications are structurally altered biologic medications that affect the medication's effectiveness and safety. As a result, complicated biologics whose mode of action is unknown can be dangerous.

Remicade Biosimilar Market: Segmentation Analysis

The global remicade biosimilar market is segmented based on Indication, Distribution Channel, Route of Administration, and region.

Based on Indication, the global remicade biosimilar market is divided into Rheumatoid Arthritis, Psoriatic Arthritis, Crohn’s Disease, Ulcerative Colitis, Ankylosing Spondylitis, Plaque Psoriasis.

On the basis of Distribution Channel, the global remicade biosimilar market is bifurcated into Hospital Pharmacies, Retail Pharmacies, Online Pharmacies.

By Route of Administration, the global remicade biosimilar market is split into Intravenous, Subcutaneous.

Remicade Biosimilar Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Remicade Biosimilar Market |

| Market Size in 2024 | USD 2.82 Billion |

| Market Forecast in 2034 | USD 4.71 Billion |

| Growth Rate | CAGR of 5.4% |

| Number of Pages | 236 |

| Key Companies Covered | Johnson & Johnson, Janssen Biotech Inc, Merck & Co., Pfizer Inc, Viatris Inc, Celltrion Inc, Alvogen, Biocon Biologics, Napp Pharmaceuticals, Nippon Kayaku, and others. |

| Segments Covered | By Indication, By Distribution Channel, By Route of Administration, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- September 2021: Sandoz, a Novartis division, announced a commercialization agreement for the biosimilar BAT1706, bevacizumab, with Bio-Thera Solutions. This agreement aided market expansion and added to Sandoz's top oncology off-patent portfolio. The agreement enables the business to perfectly balance patient care and financial efficiency.

- July 2021: Biocon Ltd (Biocon Biologics), in collaboration with Viatris, Inc., received FDA approval for the first exchangeable biosimilar SEMGLEE (insulin glargine injection) to treat diabetes.

Remicade Biosimilar Market: Regional Landscape

North America dominated the Remicade biosimilar market in 2025

Due to the existence of top market players in the region, the rapid entry of biosimilars into the market, and the high adoption rate owing to the biosimilars' low price, Europe dominates the global Remicade biosimilars market. For instance, the European Commission (EC), a division of Novartis, authorized Zessly (infliximab), a Remicade biosimilar, for use in Europe in 2019. This is primarily due to the bio-like version being introduced shortly after the patent on the branded version expired. The European Medical Association's useful regulatory framework, high medical reimbursement rates, and technological advancement further contribute to regional expansion.

Remicade Biosimilar Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the remicade biosimilar market on a global and regional basis.

The global remicade biosimilar market is dominated by players like:

- Johnson & Johnson

- Janssen Biotech Inc

- Merck & Co.

- Pfizer Inc

- Viatris Inc

- Celltrion Inc

- Alvogen

- Biocon Biologics

- Napp Pharmaceuticals

- Nippon Kayaku

The global remicade biosimilar market is segmented as follows;

By Indication

- Rheumatoid Arthritis

- Psoriatic Arthritis

- Crohn’s Disease

- Ulcerative Colitis

- Ankylosing Spondylitis

- Plaque Psoriasis

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Route of Administration

- Intravenous

- Subcutaneous

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Leading players in the global remicade biosimilar market include Johnson & Johnson, Janssen Biotech Inc, Merck & Co., Pfizer Inc, Viatris Inc, Celltrion Inc, Alvogen, Biocon Biologics, Napp Pharmaceuticals, Nippon Kayaku, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed