Residential Water Heater Market Size Report, Industry Share, Analysis, Growth, 2030

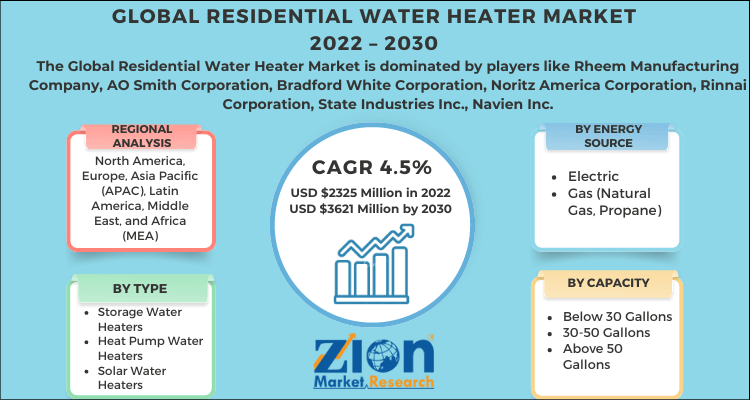

Residential Water Heater Market By Type (Storage Water Heaters, Tankless (On-Demand) Water Heaters, Heat Pump Water Heaters, and Solar Water Heaters), By Energy Source (Electric, and Gas (Natural Gas, Propane)), By Capacity (Below 30 Gallons, 30-50 Gallons, and Above 50 Gallons), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2,325 Million | USD 3,621 Million | 24.5% | 2022 |

Residential Water Heater Industry Prospective:

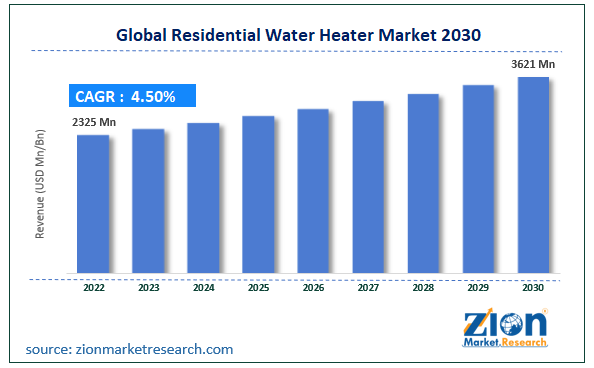

The global residential water heater market size was worth around USD 2,325 million in 2022 and is predicted to grow to around USD 3,621 million by 2030 with a compound annual growth rate (CAGR) of roughly 4.5% between 2023 and 2030.

Residential Water Heater Market: Overview

Residential water heaters play a pivotal role in modern households, providing a consistent supply of hot water for various domestic activities. These essential appliances are designed to heat water for bathing, cooking, cleaning, and other everyday purposes, contributing to the comfort and convenience of residents. These systems can operate on different energy sources, including electricity and gas (such as natural gas or propane), allowing homeowners to select options that align with their energy preferences and regional availability.

Residential water heaters are commonly categorized based on their capacity, with options ranging from compact sizes below 30 gallons to larger tanks of 30–50 gallons and beyond. They are typically distributed through various channels, including online retail platforms, specialty stores, and hypermarkets & supermarkets. As households seek energy-efficient and environmentally conscious solutions, the industry continues to innovate with new technologies to enhance water heating efficiency and reduce ecological footprints. Residential water heaters stand as a cornerstone of modern living, delivering the warmth necessary for daily routines while evolving to meet evolving energy and environmental standards.

Key Insights

- As per the analysis shared by our research analyst, the global residential water heaters industry is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2023-2030).

- In terms of revenue, the global residential water heaters market size was valued at around USD 2,325 million in 2022 and is projected to reach USD 3,621 million, by 2030.

- The global residential water heater market is projected to grow at a significant rate due to the rising residential construction.

- Based on type segmentation, tankless (on-demand) water heaters was predicted to hold maximum market share in the year 2022.

- Based on energy source segmentation, gas (natural gas, propane) was the leading revenue generator in 2022.

- Based on capacity segmentation, above 50 gallons was predicted to hold maximum market share in the year 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Residential Water Heater Market: Growth Drivers

Rising residential construction to drive market growth during the forecast period

The global population is expected to grow to 9.7 billion by 2050, which will create demand for new housing. The world is becoming increasingly urbanized, with more people living in cities. As urbanization continues and populations grow, the demand for housing rises. This led to the construction of new residential buildings, apartments, and housing complexes. Each of these structures requires water heating solutions to provide hot water for various domestic purposes. New construction projects often aim to provide modern amenities to attract potential homeowners and renters. Water heaters are an essential part of these amenities, contributing to the overall comfort and convenience of the living space. In addition to new construction, existing buildings often undergo renovations or retrofits to update infrastructure and improve energy efficiency. This presents an opportunity to replace outdated water heating systems with more energy-efficient and advanced models.

Residential Water Heater Market: Restraints

Maintenance and repairs may hamper the market expansion

Maintenance and repair requirements are a significant restraining factor affecting growth and demand in the residential water heater market. This is due to the frequent servicing needs, high costs, and declining lifespans of traditional water heater units. Most residential water heaters need some type of preventative maintenance or servicing every 1 to 3 years to support optimal performance and longevity. Tasks like draining and flushing the tank to clear mineral buildup and replacing sacrificial anode rods are commonly recommended maintenance procedures for water heaters. If not performed regularly, mineral scale and corrosion can reduce the efficiency and lifespan of the appliance. The labor costs of even basic maintenance procedures often run USD 200 or more when hiring a plumber.

Repair costs for residential water heaters are quite high, averaging approximately USD 240 for minor repairs and up to USD 1,100 or more for full unit replacements. The high repair costs lead many homeowners to delay maintenance or even require fixes due to the financial burden. Putting off maintenance frequently leads to more serious problems and failures down the line, necessitating even costlier repairs. Exacerbating the issue is the fact that the average lifespan of traditional residential water heater designs has decreased over the past couple of decades, declining from over 15 years to around 10–12 years today. This is due to the prevalence of lower-cost units that sacrifice longevity. So, homeowners have to budget for more frequent replacements, sometimes as often as every 8–10 years. Approximately 3 million water heaters are replaced annually; up to 20% of households have water heater leaks or issues annually, and the yearly failure rate is estimated to be as high as 15% for older units.

Residential Water Heater Market: Opportunities

Smart technology integration to provide several growth opportunities

Smart water heaters offer features like remote control, scheduling, and monitoring via smartphone apps. This convenience appeals to modern consumers seeking greater control over their appliances and home systems. Wi-Fi-enabled control allows remote monitoring and adjustment of temperatures through a smartphone app. Brands like Rheem, AO Smith, and Bradford White have water heater lines with Wi-Fi capability. Similarly, voice activation allows for controlling the water heater via voice assistants like Alexa. AO Smith has partnered with Amazon on voice-activated units. Manufacturers that offer smart water heaters can differentiate themselves in a competitive market. The incorporation of innovative technology can attract tech-savvy consumers and position brands as forward-thinking. Smart technology enables manufacturers and service providers to diagnose and troubleshoot issues remotely. This can lead to quicker resolutions, reducing downtime and inconvenience for consumers. Smart water heater owners also save an average of USD 115 per year on energy bills through remote adjustments.

Residential Water Heater Market: Challenges

Lack of awareness to challenge market cap growth

While energy-efficient and technologically advanced water heaters offer substantial benefits, the lack of consumer awareness about these advantages poses a significant barrier. Many consumers might not be fully informed about the energy savings, cost benefits, and environmental impact associated with using energy-efficient water heaters. This lack of awareness could lead potential buyers to prioritize initial purchase costs over long-term savings, thereby impeding the adoption of more efficient options. Moreover, consumers may not be well-versed in the various types of water heaters available, leading them to stick with traditional models without exploring the benefits of newer technologies. Addressing this challenge requires collaborative efforts from manufacturers, industry associations, and government agencies to conduct widespread educational campaigns. Informing consumers about the advantages of energy-efficient water heaters through marketing initiatives, consumer guides, and online resources is crucial.

Residential Water Heater Market: Segmentation

The global residential water heater market is segmented based on type, energy source, capacity, and region.

Based on type, the global market segments are storage water heaters, tankless (on-demand) water heaters, heat pump water heaters, and solar water heaters. Within the type segment of the residential water heater market, the tankless (on-demand) water heater subcategory is projected to experience the highest growth rate. This growth trajectory can be attributed to the convergence of several factors that align with evolving consumer preferences and technological advancements. The surge in demand for tankless water heaters is primarily driven by their energy efficiency and space-saving design. Unlike traditional storage water heaters, which continuously heat and store water, tankless water heaters heat water only when it's needed, minimizing energy waste and reducing utility bills. Consumers are increasingly drawn to the concept of "on-demand" heating as it aligns with sustainability goals and contributes to cost savings over the long term. Also, the compact size of tankless water heaters is particularly attractive in urban and space-constrained environments where maximizing living space is paramount. As residential spaces become smaller and more multifunctional, the streamlined design of tankless water heaters aligns well with modern living arrangements.

Based on energy source, the global residential water heater industry is categorized into electric and gas (natural gas and propane). Out of these, gas (natural gas and propane) was the largest shareholding segment in the global market. Gas-powered water heaters, particularly those utilizing natural gas or propane, offer several advantages that resonate with consumers seeking efficient and cost-effective solutions. These heaters typically exhibit faster heating capabilities, providing hot water on demand without the need for preheating or storage. This rapid heating response aligns with the modern lifestyle, where convenience and time efficiency are paramount. Gas-powered units tend to maintain a more consistent temperature, thereby enhancing user comfort. Secondly, the growing focus on environmental sustainability and energy efficiency is driving the adoption of gas-powered water heaters. Modern gas-powered units are designed to adhere to stringent energy efficiency standards, often incorporating advanced features such as condensing technology that extracts more heat from the combustion process, resulting in reduced energy consumption and greenhouse gas emissions.

Based on capacity, the residential water heater industry segments are below 30 gallons, 30–50 gallons, and above 50 gallons. In the residential water heater market's capacity segment, the category with the potential to exhibit the highest growth rate is the "above 50 gallons" segment. With increasing urbanization and the growing trend towards larger households, the demand for water heaters with higher capacities is on the rise. Larger households often require a greater volume of hot water for various domestic activities such as bathing, dishwashing, and laundry. The "above 50 gallons" water heaters can better cater to the higher water consumption needs of these households, making them a preferred choice among consumers seeking convenience and an uninterrupted hot water supply. The increasing demand for larger capacity water heaters driven by household size and the availability of more efficient and technologically advanced models in this category are expected to contribute to their rapid expansion in the residential water heater market.

Residential Water Heater Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Residential Water Heater Market |

| Market Size in 2022 | USD 2325 Million |

| Market Forecast in 2030 | USD 3621 Million |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 215 |

| Key Companies Covered | Rheem Manufacturing Company, AO Smith Corporation, Bradford White Corporation, Noritz America Corporation, Rinnai Corporation, State Industries Inc., Navien Inc., Whirlpool Corporation, Bosch Thermotechnology, Eemax Inc., and others. |

| Segments Covered | By Type, By Energy Source, By Capacity, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Residential Water Heaters Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

In terms of revenue, Asia Pacific held a dominant share of the global residential water heaters market in 2022. Increasing availability of electricity and gas in rural areas, escalating infrastructure investment, and expanding the construction sector in South Asian and South East Asian economies are all factors driving the demand for water heaters in the Asia Pacific region. Additionally, it is anticipated that the focus on carbon neutrality and energy-efficiency standards would accelerate market growth. Furthermore, growing investment and innovation in the building sector, continuous research and developments, and the implementation of mandatory CO2 emission reduction measures are the primary factors driving the demand for water heaters in China and will continue to do so over the course of the forecast period.

Residential Water Heater Market: Recent Developments

- In 2022, GE Appliances, a Haier company, has opened a new USD 70 million water heater manufacturing plant in Camden, South Carolina. The plant is vertically integrated, meaning that it produces water heaters from coils of steel using metal fabrication and welding equipment, robotic material handling and processing, and enameling systems.

- In 2022, A. O. Smith, a pioneer in the water heating and water treatment industries, introduced the Voltex AL (anti-leak) hybrid electric heat pump water heater to its home product range. The Voltex AL model with its 66-gallon unit has the greatest overall Uniform Energy Factor (UEF) of 4.02 and the 50-gallon unit has the highest UEF of 3.8, making it the most efficient water heater on the market. There is also an 80-gallon variant available.

Residential Water Heater Market: Competitive Analysis

The global residential water heater market is dominated by players like:

- Rheem Manufacturing Company

- AO Smith Corporation

- Bradford White Corporation

- Noritz America Corporation

- Rinnai Corporation

- State Industries, Inc.

- Navien Inc.

- Whirlpool Corporation

- Bosch Thermotechnology

- Eemax Inc.

The global residential water heaters market is segmented as follows:

By Type

- Storage Water Heaters

- Tankless (On-Demand) Water Heaters

- Heat Pump Water Heaters

- Solar Water Heaters

By Energy Source

- Electric

- Gas (Natural Gas, Propane)

By Capacity

- Below 30 Gallons

- 30-50 Gallons

- Above 50 Gallons

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Residential water heaters play a pivotal role in modern households, providing a consistent supply of hot water for various domestic activities. These essential appliances are designed to heat water for bathing, cooking, cleaning, and other everyday purposes, contributing to the comfort and convenience of residents.

The global residential water heaters market cap may grow owing to the rising residential construction, across the globe. Significant growth opportunities can be expected due to the smart technology integration.

According to study, the global residential water heaters market size was worth around USD 2,325 million in 2022 and is predicted to grow to around USD 3,621 million by 2030.

The CAGR value of the residential water heater market is expected to be around 4.5% during 2023-2030.

The global residential water heaters market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the increasing availability of electricity and gas in rural areas, escalating infrastructure investment, and expanding construction sector in South Asian and South East Asian economies.

The global residential water heaters market is led by players like Rheem Manufacturing Company, AO Smith Corporation, Bradford White Corporation, Noritz America Corporation, Rinnai Corporation, State Industries, Inc., Navien Inc., Whirlpool Corporation, Bosch Thermotechnology, Eemax Inc.

The residential water heaters market report analyzes the global residential water heaters market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the residential water heaters industry.

Choose License Type

List of Contents

Residential Water HeaterIndustry Prospective:OverviewKey InsightsGrowth DriversRestraintsOpportunitiesChallengesSegmentationReport ScopeResidential Water Heaters Regional AnalysisRecent DevelopmentsCompetitive AnalysisThe global residential water heaters market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed