Retail Core Banking Systems Market Size, Share, Trends, Industry Analysis & Growth 2032

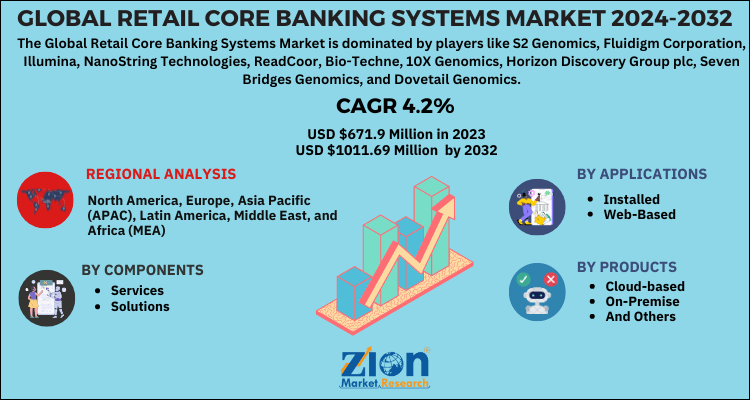

Retail Core Banking Systems Market By components (services and solutions), By products (cloud-based, on-premise, and others), By applications (installed, web-based) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

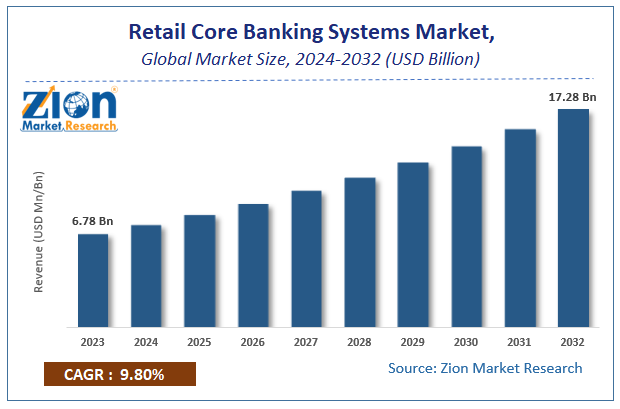

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.78 Billion | USD 17.28 Billion | 9.8% | 2023 |

Description

Retail Core Banking Systems Market Insights

According to the report published by Zion Market Research, the global Retail Core Banking Systems Market size was valued at USD 6.78 Billion in 2023 and is predicted to reach USD 17.28 Billion by the end of 2032. The market is expected to grow with a CAGR of 9.8% during the forecast period. The report analyzes the global Retail Core Banking Systems Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Retail Core Banking Systems industry.

Global Retail Core Banking Systems Market: Overview

The retail core banking system is a personal banking service for customers as an individual. Through such systems, banks facilitate the consumers to manage their finance efficiently, provide access to credit, and safe deposition. The services facilitated in the systems involve a certificate of deposits, credit/debit cards, personal loans, mortgages, savings & checking accounts, and many more. The system aims to stabilize and constitute core deposits. Retail banking improves yield and enhances the bottom line for the system as well as the bank. It helps the consumers to achieve their aspirations through affordable credit.

Global Retail Core Banking Systems Market: Growth Factors

The surging concentration of banks on consumer interactions and engagements to assure customer retention is generating demand for efficient banking solutions that can intelligently deal with critical issues and innovatively simplify them for the banking customers. Core banking solutions help to achieve customer satisfaction and build loyalty. However, the growing importance of CBS due to the high efficacy is increasing the implementation and adoption of such innovative solutions. Thus accelerating the growth of the global retail core banking system market.

The on-going trend of digitalization has increased online banking transactions rapidly coupled with the centralized banking that facilitates real-time services and hence positively shaped the trajectory of the global retail core banking system market. The core banking solutions like application programming interfaces (APIs), P2P payment, video collaborations, the proliferation of digital account opening, cloud computing, and many others are fueling the growth of the global retail core banking system market.

The surging on-cloud deployments enabled banks to conveniently maintain transactions 7 personal details of customers on the network servers and have easy access from a location across the globe has supported the growth of the global retail core banking system market. The banking services are transformed remarkably over a period of time in terms of the offering, services, products, and other operations.

Technological advancements have contributed significantly to the growth of the market globally. Retail banking facilitates low costs for funds, effective management of customer relationships, and achieve a strong customer base. Moreover, with retail banking consumers' loans are presumed at much lower rates as compared with traditional banking services. The growing inclination of people toward net banking has also bolstered the growth of the global retail core banking system market.

The unique feature of customer follow-ups and convenient monitoring of huge stats efficiently has helped the financial sector to proliferate its business operations and thus boost the demand for such systems in the market globally. Moreover, the growing research and development activities in the sectors are expected to boost the market growth significantly during the forecast periods.

Global Retail Core Banking Systems Market: Segmentation

The global retail core banking system market can be segmented into components, products, applications, and regions.

By component, the market can be segmented into services and solutions. The solutions segment accounts for the largest share in the global retail core banking system market

By product, the market can be segmented into cloud-based, on-premise, and others. The on-premise segment holds hegemony over others.

By applications, the market can be segmented into installed, web-based, and others.

Retail Core Banking Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Retail Core Banking Systems Market |

| Market Size in 2023 | USD 6.78 Billion |

| Market Forecast in 2032 | USD 17.28 Billion |

| Growth Rate | CAGR of 9.8% |

| Number of Pages | 210 |

| Key Companies Covered | Infrasoft Tech, Exitos, Intertech, BML Istisharat, Finastra, FIS Global, Fiserv, Tata Consultancy, Oracle, EdgeVerve, Temenos, Fidelity National Information Services, Inc., and Jayam Solutions Private Limit |

| Segments Covered | By Components, By Products, By Applications And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Retail Core Banking Systems Market: Regional analysis

North America accounts for the largest share in the global retail core banking system market due to the growing technological advancements and surging adoption of blockchain technology by financial institutes. The growing B2B services as the solution is driving the growth of the regional market.

Asia Pacific is also expected to witness huge growth during the forecast period due to the high market penetration with unique core banking solutions coupled with the new architects to promote digital banking.

Global Retail Core Banking Systems Market: Competitive Players

Some of the significant players in the global retail core banking system market are:

- Infrasoft Tech

- Exitos

- Intertech

- BML Istisharat

- Finastra,

- FIS Global

- Fiserv

- Tata Consultancy

- Oracle

- EdgeVerve

- Temenos

- Fidelity National Information Services, Inc.

- Jayam Solutions Private Limit.

The Global Retail Core Banking Systems Market is segmented as follows:

By components

- services

- solutions

By products

- cloud-based

- on-premise

- and others

By applications

- installed

- web-based

Global Retail Core Banking Systems Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

Choose License Type

FrequentlyAsked Questions

The surging concentration of banks on consumer interactions and engagements to assure customer retention is generating demand for efficient banking solutions that can intelligently deal with critical issues and innovatively simplify them for the banking customers. Core banking solutions help to achieve customer satisfaction and build loyalty. However, the growing importance of CBS due to the high efficacy is increasing the implementation and adoption of such innovative solutions.

Some of the significant players in the global retail core banking system market are Infrasoft Tech, Exitos, Intertech, BML Istisharat, Finastra, FIS Global, Fiserv, Tata Consultancy, Oracle, EdgeVerve, Temenos, Fidelity National Information Services, Inc., and Jayam Solutions Private Limit.

North America accounts for the largest share in the global retail core banking system market due to the growing technological advancements and surging adoption of blockchain technology by financial institutes. The growing B2B services as the solution is driving the growth of the regional market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed