Robotic Process Automation in BFSI Market Size, Share, Industry Analysis, Trends, Growth, Forecasts, 2032

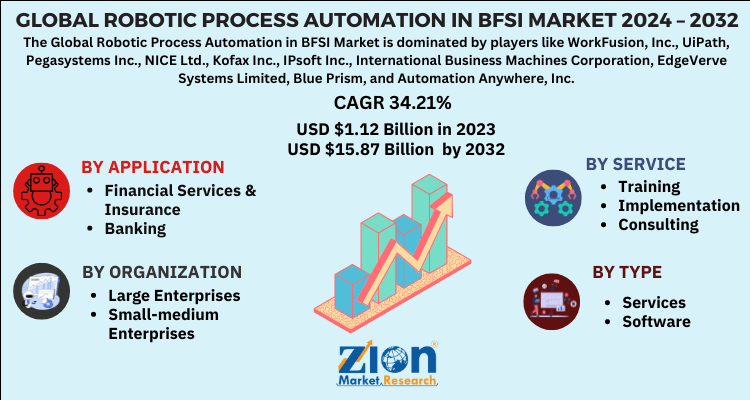

Robotic Process Automation in BFSI Market By application (financial services & insurance and banking), By organization (large enterprises and small-medium enterprises), By service (training, implementation, and consulting), type (services and software) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

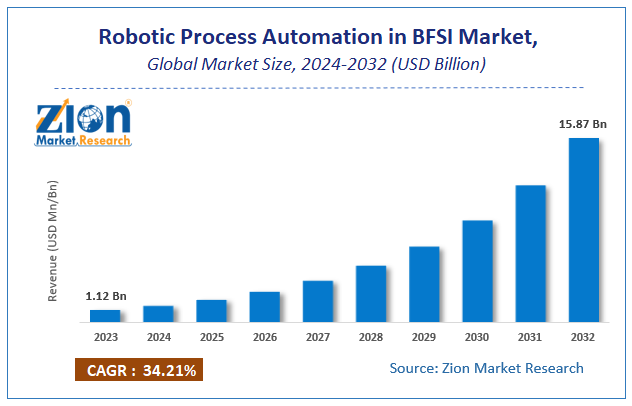

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.12 Billion | USD 15.87 Billion | 34.21% | 2023 |

Description

Robotic Process Automation in BFSI Market Insights

According to the report published by Zion Market Research, the global Robotic Process Automation in BFSI Market size was valued at USD 1.12 Billion in 2023 and is predicted to reach USD 15.87 Billion by the end of 2032. The market is expected to grow with a CAGR of 34.21% during the forecast period. The report analyzes the global Robotic Process Automation in BFSI Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Robotic Process Automation in BFSI industry.

Global Robotic Process Automation in BFSI Market: Overview

Robotic process automation is a technology useful in automating routine business practices with the help of software bots to copy human actions for achieving repetitive tasks across all the organizations. Its utilization ranges from banking to accounting, telecom to retail, healthcare to HR, and several others. It helps organizations in communicating with other digital systems, manipulating data, triggering responses, and processing different transactions. The adoption of robotic process automation offers several benefits like reducing costs, improved internal processes, lower operational risks, better customer experience, and improved efficiency.

Global Robotic Process Automation in BFSI Market: Growth Factors

Banking and several financial institutes are indulged in multidimensional service areas and essentially need the robotic process automation at the front end as well as backend. Different functions in banking & financial services and the insurance sector that require robotic process automation solutions are mortgage processing, opening account & receivables, account closure process, overall customer service, credit card processing, payable accounts, and several others. The surging need for enhancing productivity along with boosting the penetration of advanced technology in the BFSI sector is one of the major factors driving the growth of the global robotic process automation.

The BFSI organizations are increasingly deploying artificial intelligence and robotic process automation to significantly escalate their efficiency in a highly competitive market. Also, a surging need for improving the agility of work and customer experience will further drive market growth. The robotic process automated bots can perform several tasks across different verticals in the organizations to extract information available on digital platforms. For example, bank customers can log in to their account and check balance, set up an automatic bill payment, process KYC verification, and several other functions with the help of internet services. Furthermore, such services lower the manual intervention and improve the customer experience.

Global Robotic Process Automation in BFSI Market: Segmentation

The global robotic process automation can be segmented into application, organization, service, type, and region.

By application, the market can be segmented into financial services & insurance and banking. The banking statement accounts for the largest share in the global robotic process automation owing to the fact that lack of skilled resources and growing personal cost poses a huge requirement to adopt robotic process automation in the banking organizations. The surging market pressure is also inducing banks to find alternative opportunities to maximize efficiency, reduce operational costs, and accelerate productivity gains.

By organization, the market can be segmented into large enterprises and small-medium enterprises. The large enterprise segment holds the largest share in the global robotic process automation due to the growing awareness among the organizations regarding the benefits offered by robotic process automation services and solutions. Large enterprises require a number of tasks to be optimized in order to achieve greater compliance and profit margins.

By services, the market can be segmented into training, implementation, and consulting.

By type, the market can be segmented into services and software. The consulting segment dominates the global market as a large number of organizations are adopting robotic process automation, thereby needing consulting services to understand how to use these solutions to offer enhanced services to customers.

Robotic Process Automation in BFSI Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Robotic Process Automation in BFSI Market |

| Market Size in 2023 | USD 1.12 Billion |

| Market Forecast in 2032 | USD 15.87 Billion |

| Growth Rate | CAGR of 34.21% |

| Number of Pages | 210 |

| Key Companies Covered | WorkFusion, Inc., UiPath, Pegasystems Inc., NICE Ltd., Kofax Inc., IPsoft Inc., International Business Machines Corporation, EdgeVerve Systems Limited, Blue Prism, and Automation Anywhere, Inc |

| Segments Covered | By application, By organization, By service, By type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Robotic Process Automation in BFSI Market: Regional analysis

North America accounts for the largest share in the global market due to the growing adoption of these solutions in the banking sector in the region. Moreover, the surging cost of KYC and other compilations like financial fraud, terrorist financing, money laundering, and several others led to the increase in the adoption of robotic process automation services in the region.

Asia Pacific is expected to witness steady growth in the forthcoming years due to the increasing advancements in the field of robotics.

Global Robotic Process Automation in BFSI Market: Competitive Players

Some of the significant players in the global robotic process automation in the BFSI Market are:

- WorkFusion, Inc.

- UiPath

- Pegasystems Inc.

- NICE Ltd.

- Kofax Inc.

- IPsoft Inc.,

- International Business Machines Corporation

- EdgeVerve Systems Limited

- Blue Prism

- Automation Anywhere, Inc.

The Global Robotic Process Automation in BFSI Market is segmented as follows:

By application

- financial services & insurance

- banking

By organization

- large enterprises

- small-medium enterprises

By service

- training

- implementation

- consulting

By type

- services

- software

Global Robotic Process Automation in BFSI Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

Choose License Type

FrequentlyAsked Questions

Banking and several financial institutes are indulged in multidimensional service areas and essentially need the robotic process automation at the front end as well as backend. Different functions in banking & financial services and the insurance sector that require robotic process automation solutions are mortgage processing, opening account & receivables, account closure process, overall customer service, credit card processing, payable accounts, and several others.

Some of the significant players in the global robotic process automation in the BFSI Market are WorkFusion, Inc., UiPath, Pegasystems Inc., NICE Ltd., Kofax Inc., IPsoft Inc., International Business Machines Corporation, EdgeVerve Systems Limited, Blue Prism, and Automation Anywhere, Inc.

North America accounts for the largest share in the global market due to the growing adoption of these solutions in the banking sector in the region. Moreover, the surging cost of KYC and other compilations like financial fraud, terrorist financing, money laundering, and several others led to the increase in the adoption of robotic process automation services in the region.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed