Robotic Surgery Market Size, Share, Trends, Growth 2028

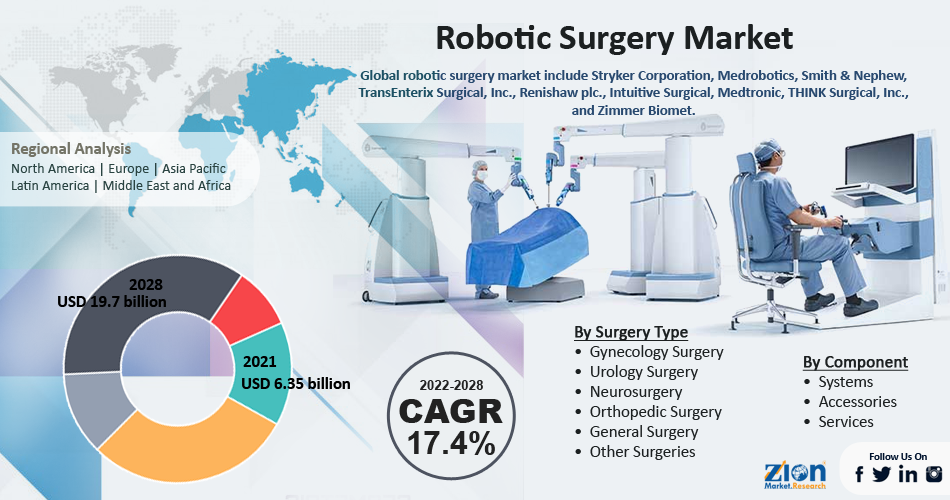

Robotic Surgery Market By Component (Systems, Accessories, and Services),By Surgery Type (Gynecology Surgery, Urology Surgery, Neurosurgery, Orthopedic Surgery, General Surgery, and Other Surgeries), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.35 Billion | USD 19.7 Billion | 17.4% | 2021 |

Robotic Surgery Industry Prospective:

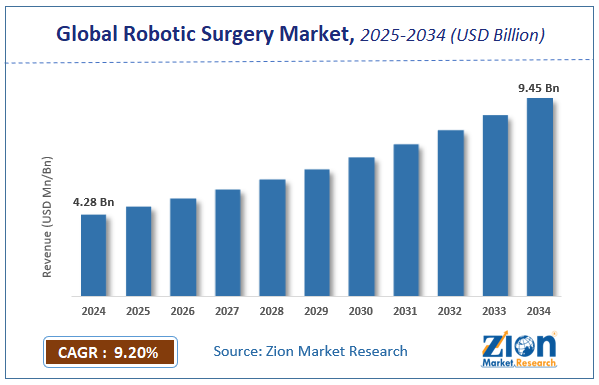

The global robotic surgery market size was worth around USD 6.35 billion in 2021 and is predicted to grow to around USD 19.7 billion by 2028 with a compound annual growth rate (CAGR) of roughly 17.4% between 2022 and 2028.

The report analyzes the global robotic surgery market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the robotic surgery market.

Robotic Surgery Market: Overview

Robotic surgery, also known as robot-assisted surgery, enables medical professionals to carry out a variety of intricate treatments with greater accuracy, adaptability, and control than is feasible with traditional methods. Robotic surgery is frequently related to minimally invasive surgery, which involves operations done through small incisions. It may also be employed sometimes during various types of open surgery. A camera arm and motorized arms with surgical tools attached are part of the most popular clinical robotic surgical system. While sitting at a computer panel next to the operating table, the surgeon manages the arms. A high-definition, enlarged, 3D image of the surgical site is provided to the surgeon through the console. Other members of the team who assist with the procedure are under the surgeon's direction.

COVID-19 Impact:

The COVID-19 outbreak has had a disastrous effect on the population and economy of the whole planet. Healthcare systems are under a lot of stress as a result of the epidemic. In order to reduce the risk of transmission and save money for COVID-19 patients, healthcare organizations and professionals have been directed to halt performing optional surgical operations and medical evaluations during this time. The outbreak has caused a temporary worldwide restriction on elective procedures, which has caused cancellations worldwide and had a detrimental impact on the world.

Robotic Surgery Market: Growth Drivers

The benefits associated with robotic surgeries are likely to propel the market growth during the forecast period.

The advantages connected with robotic surgeries such as lesser incisions, fewer cuts, lower scarring, reduced discomfort, greater safety, quicker recovery times, and significant cost savings, are driving up demand for minimally invasive surgeries (MIS) globally. These benefits are enhanced by robotic minimally invasive surgery, which provides improved precision, repeatability, manageability, and effectiveness. The surgical success rate in the IRDG group was almost 98 percent; this was significantly higher than the CLDG (conventional laparoscopic distal gastrectomy) group, which taken into account for 89.5 percent success rate, as per a recent article on the contrast of surgical results among conventional laparoscopic and integrated robotic surgery for distal gastrectomy. All of these factors are likely to drive the global robotic surgery market.

Robotic Surgery Market: Restraints

Costly robotic surgical systems are the major restrain for the market growth.

Minimally invasive procedures cost less money than robotically assisted procedures. Only unique and complicated clinical situations are recommended for robotic hysterectomy by the American Congress of Obstetricians and Gynecologists. According to the organization, the cost of hysterectomy procedures in the US would increase by an estimated US$ 960 Mn if robotic surgery were to be used for all hysterectomies. The CyberKnife robotic system costs about US$ 4 million per unit, whereas the da Vinci system, one of the most popular robotic systems, prices between USD 1.5 million and US$ 2.5 million. The already high expense of robotic surgery is increased even further by the annual maintenance cost of a robot, which is close to USD 125,000. The typical cost of a robotic surgical operation ranges from US$ 2,500 to US$ 5,000.

Robotic Surgery Market: Opportunities

Increasing adoption of robotic surgery in ambulatory surgical centers is likely to offer better growth opportunities.

Ambulatory surgery centers (ASCs) are independent medical clinics with a focus on outpatient surgical, diagnostic, and preventative treatments. Governments, third-party payers, and patients all benefit greatly from the cost-effectiveness of ASCs. ASCs offer a lower-cost site of care compared to hospital outpatient departments, which according to a study by Healthcare BlueBook (a provider of data for healthcare services) and HealthSmart (a provider of health plans for self-funded employers), reduces the cost of outpatient surgery by USD 38 billion annually. ASCs are getting more and more sophisticated robotics to handle difficult situations, especially in the US. Some of these ASCs include the Health East Ambulatory Surgical Center, Hutchinson Ambulatory Surgery Center, and the Atlanta Minimally Invasive Gynecologic Surgery Center which utilizes the da Vinci Surgical System for surgical procedures.

Robotic Surgery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Robotic Surgery Market |

| Market Size in 2021 | USD 6.35 Billion |

| Market Forecast in 2028 | USD 19.7 Billion |

| Growth Rate | CAGR of 17.4% |

| Number of Pages | 255 |

| Key Companies Covered | Stryker Corporation, Medrobotics, Smith & Nephew, TransEnterix Surgical, Inc, Renishaw plc, Intuitive Surgical, Medtronic, THINK Surgical, Inc, Zimmer Biomet |

| Segments Covered | By Component, By Surgery Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Robotic Surgery Market: Challenges.

Low healthcare budgets in middle-income countries pose a major challenge to market growth.

Most of the countries in Africa, Asia Pacific, and the Middle East still facing a dearth of healthcare budgets which limits the purchase and maintenance of robotic surgical systems. Typically, surgical robots are highly costly. They typically consist of equipment that is placed over the patient and a different control console for the surgeon. This is also impacting the adoption of surgical robots by private healthcare operators.

Robotic Surgery Market: Segmentation

The global market for robotic surgery is categorized into component, surgery type, and region. Based on components, the market is bifurcated into systems, accessories, and services. By surgery type, the market is segmented as orthopedic surgery, gynecology surgery, neurosurgery, general surgery, urology surgery, and other surgeries.

Recent Developments

In January 2021, Stryker bought OrthoSensor and its Verasense intraoperative sensor technology, to improve the Mako robots from the orthopedic company, TransEnterix's Intelligent Surgical Unit, which enhances the Senhance robotic surgical system with AI-based capabilities and makes machine vision possible, has acquired CE Mark clearance.

Robotic Surgery Market: Regional Landscape

North America To Lead The Global Market During The Upcoming Period

North America led the global robotic surgery market with more than 55 percent of the share in 2021. The substantial market share in North America may be ascribed to the region's investment in surgical robot R&D as well as the growing use of these systems for pediatric and general surgeries in Canada and the US respectively. During the forecast period, Asia Pacific region is anticipated to see the highest CAGR of 18.5 percent. The increasing patient population and rising use of sophisticated automated surgical tools are expected to cause the Asia Pacific area to expand at a profitable pace throughout the projection period.

Additionally, it is projected that expanding contemporary healthcare facilities and raising awareness of the benefits of adopting new medical technology would promote market expansion in the area. Moreover, growing government attempts to create cutting-edge healthcare infrastructure draw international investors to participate in the development of automated instruments, which is predicted to drive market expansion in this region over the future years.

Robotic Surgery Market: Competitive Landscape

Major players operating in the global robotic surgery market include

- Stryker Corporation

- Medrobotics

- Smith & Nephew

- TransEnterix Surgical, Inc

- Renishaw plc

- Intuitive Surgical

- Medtronic

- THINK Surgical, Inc

- Zimmer Biomet

Report Scope:

Global robotic surgery market is segmented as follows:

By Component

- Systems

- Accessories

- Services

By Surgery Type

- Gynecology Surgery

- Urology Surgery

- Neurosurgery

- Orthopedic Surgery

- General Surgery

- Other Surgeries

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The advantages connected with robotic surgeries such as lesser incisions, fewer cuts, lower scarring, reduced discomfort, greater safety, quicker recovery times, and significant cost savings, are driving up demand for minimally invasive surgeries (MIS) globally. These benefits are enhanced by robotic minimally invasive surgery, which provides improved precision, repeatability, manageability, and effectiveness. The surgical success rate in the IRDG group was almost 98 percent; this was significantly higher than the CLDG (conventional laparoscopic distal gastrectomy) group

According to the Zion Market Research report, the global robotic surgery market was worth about 6.35 (USD billion) in 2021 and is predicted to grow to around 19.7 (USD billion) by 2028, with a compound annual growth rate (CAGR) of around 17.4 percent.

North America led the global robotic surgery market with more than 55 percent of the share in 2021. The substantial market share in North America may be ascribed to the region's investment in surgical robot R&D as well as the growing use of these systems for pediatric and general surgeries in Canada and the US respectively.

Major players operating in the global robotic surgery market include Stryker Corporation, Medrobotics, Smith & Nephew, TransEnterix Surgical, Inc., Renishaw plc., Intuitive Surgical, Medtronic, THINK Surgical, Inc., and Zimmer Biomet.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed