Scrubber and Purifier Market Trend, Share, Growth, Size Analysis and Forecast 2030

Scrubber and Purifier Market By Type (Scrubber And Purifier), By Method (Wet And Dry), By Orientation (Horizontal And Vertical), By Application (Particulate Matters And Chemicals/Gases), By End-user Industry (Commercial/Institutional Buildings, Residential Buildings, Oil & Gas, Power Generation, Marine, Chemical, Metallurgical, Pharmaceuticals, And Other End-user Industries), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

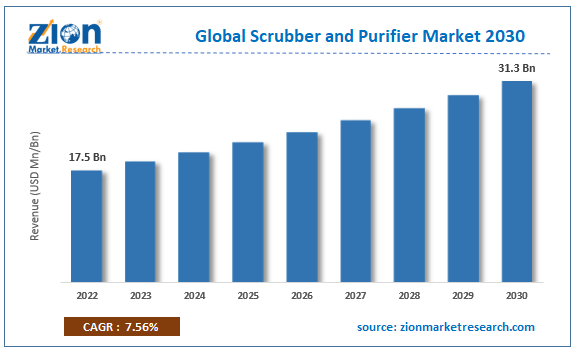

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.5 Billion | USD 31.3 Billion | 7.56% | 2022 |

Scrubber and Purifier Industry Prospective:

The global scrubber and purifier market size was worth around USD 17.5 billion in 2022 and is predicted to grow to around USD 31.3 billion by 2030 with a compound annual growth rate (CAGR) of roughly 7.56% between 2023 and 2030.

Scrubber and Purifier Market: Overview

Scrubbers & purifiers are used to capture particulate matter, chemicals, & gaseous pollutants. Specifically, scrubbers are filtration devices that are generally used in industrial & large commercial environments. Whereas purifiers are frequently used in both residential & industrial sectors depending on their sizes & functionality. Scrubbers are gas/liquid/solid removal devices that offer large interfacial surface areas & a high degree of turbulence between the corresponding phases for efficient removal of chemicals, gases, and particulate matter. Gaseous pollutants can be captured by packed beds, spray towers, and plate-type scrubbers. Whereas venturi & cyclonic scrubbers can be used to capture particulate matter. These scrubbers are used in various end-user industries such as oil & gas, metal industry, chemical, and others. This equipment is based on both wet & dry-cleaning technology. Rising government policies & stringent regulations regarding air pollutants are driving the scrubbers & purifiers market growth.

Key Insights

- As per the analysis shared by our research analyst, the global scrubber and purifier market is estimated to grow annually at a CAGR of around 7.56% over the forecast period (2023-2030).

- In terms of revenue, the global scrubber and purifier market size was valued at around USD 17.5 billion in 2022 and is projected to reach USD 31.3 billion, by 2030.

- The global scrubber and purifier market is projected to grow at a significant rate due to stringent laws & regulations for air pollution, globally.

- Based on type segmentation, the scrubber was predicted to show maximum market share in the year 2022.

- Based on method segmentation, wet scrubber & purifier was the leading revenue generator in 2022.

- Based on orientation segmentation, horizontal was predicted to show maximum market share in the year 2022.

- Based on application segmentation, particulate matter was the leading revenue-generating application in 2022.

- Based on end-user industry segmentation, commercial/institutional buildings were the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Scrubber and Purifier Market: Growth Drivers

Stringent laws & regulations for air pollution to drive market growth during the forecast period.

The global scrubber and purifier market is projected to grow owing to the stringent laws & regulations for air pollution. Various global nations have imposed air pollution standards to curb the harmful environmental effects. The World Health Organization (WHO) provides guidelines to protect populations from adverse effects of air pollution. The present guidelines are applicable to both outdoor & indoor environments, across the globe.

The U.S. Environmental Protection Agency (EPA) sets limits on certain air pollutants anywhere in the United States, under the Clean Air Act (CAA). The Clean Air Act also provides the EPA the authority to limit emissions of air pollutants generated from industries such as chemical, power generation, and steel sectors. As per EPA, around 66 million tons of pollutants were released into the environment of the United States in 2022. These emissions are the key reasons for the formation of ozone & particles, the deposition of acids, and visibility impairment.

The European Union's (EU) clean air strategy seeks to reduce air pollution and enhance ambient air quality in order to safeguard the environment and public health. According to the European Commission, currently, around 300,000 annual premature deaths are caused by fine particulate matter. EU has a plan to reduce these premature deaths by 55% by 2030. These targets encourage the industry to use scrubbers & purifiers at their sites.

All the above-mentioned factors are expected to increase the demand for the scrubber and purifier industry.

Scrubber and Purifier Market: Restraints

High costs associated with the wet scrubber & strict government policies related to wet waste disposal to restrict market expansion

Wet scrubbers are, generally, costlier than dry scrubbers, as liquid/chemicals are more corrosive compared to dry dust. In order to achieve resistance to corrosive fluids, wet scrubbers are made up of stainless steel. However, a baghouse, cartridge collector, & dust cyclone can be manufactured using cheaper carbon steel. Due to the requirement for a higher differential pressure, particularly when using venturi scrubbers, a wet system has higher energy expenditures than a dry system. High-horsepower fans must be used to apply sufficient motive force in order to mix the exhaust gas with the water.

Furthermore, when impurities are collected by a wet scrubber, the water becomes dirty and needs to be changed. This wet waste can’t be disposed of in the nearby water sources, owing to the standards set by the local water authority. Thereby, the extra cost is added for disposal of these wet wastes to landfills or other allowed places. Hence, high costs associated with wet scrubbers & strict government policies related to wet waste disposal are expected to hinder the usage of wet scrubbers.

Scrubber and Purifier Market: Opportunities

Technological development for the scrubber & purifier in the marine industry to provide growth opportunities

Various innovations in the scrubber and purifier industry are expected to create opportunities in the coming years. In March 2023, Wärtsilä got its first carbon capture & storage (CCS) ready scrubber system order from the maritime sector. The delivery is expected to happen in 2023. The CCS-Ready 35MW scrubber from Wärtsilä will be installed on four 8,200 twenty-foot equivalent units (TEU) container vessels that are being built in an open loop configuration. The CCS system from Wärtsilä is currently being tested at a 70% capture rate, and a pilot installation is expected to take place within the next twelve months.

Considering the emission of sulfur oxide from fossil fuel-based ships, the sulfur content has been limited to 0.1% in Europe in emission control areas (ECAs). The stricter international regulations to reduce sulfur emissions in shipping are expected to act as an opportunity for the exhaust gas scrubber systems industry. According to the International Maritime Organization (IMO), scrubbers are expected to be installed on 24% of the global fleet by 2023.

In February 2022, Valmet tested a scrubber & wet electrostatic precipitator combination & decreased exhaust gas emissions in a marine diesel engine by around 99%. The pilot testing & configuration of the product were carried out together with VTT Technical Research Centre of Finland Ltd. Specifically, SOx scrubbers are used to capture particulate matter (PM) & carbon emissions with limited efficiency, however, a wet scrubber with a wet electrostatic precipitator is likely to capture particulate matter (PM) & carbon emissions completely from a ship’s exhaust stream.

All the above-mentioned factors are expected to act as an opportunity for the growth of the scrubber and purifier industry.

Scrubber and Purifier Market: Challenges

Various operational problems associated with wet scrubber to challenge market cap growth

Wet scrubbers are vulnerable to various operating problems. The most frequent of these include clogged nozzles, beds, or mist eliminators, as well as inadequate liquid flow, liquid re-entrainment, poor gas-liquid interaction, and corrosion. Apart from these, a wet scrubber's ability to perform can be hampered by the accumulation of biological growth. Further, poor air distribution or rectangular vertical housings can lead to channeling & reduced efficiency from the wet scrubber system. However, some of these problems can be mitigated through proper operation.

Scrubber and Purifier Market: Segmentation

The global scrubber and purifier market is segmented based on type, method, orientation, application, end-user industry, and region.

Based on type, the global market segments are scrubber & purifier. Currently, the global market is dominated by scrubbers. Scrubbers are air pollution control equipment that are used to remove particulate matter (PM) or gases from an industrial flue gas or exhaust stream.

Based on the method, the scrubber and purifier industry is segmented into wet & dry. The wet segment dominated the market share in 2022. Some of the key manufacturers of wet scrubber systems are GEA Group Aktiengesellschaft, Ergil, Nederman Holding AB, and others.

Based on orientation, the global scrubber and purifier market segments are horizontal & vertical. Currently, the global market is dominated by horizontal. The horizontal fixed-bed scrubber is a washing tower through which a saturated air flow passes horizontally, whereas scrubbing liquid flows vertically downwards. Most of the air purifiers can be placed both vertically or horizontally.

Based on application, the scrubber and purifier industry is segmented into particulate matter and chemicals/gases. The particulate matter segment dominated the market share in 2022. Particulate matter (PM) contains microscopic solids or liquid pollutants which cause health problems. PM 10 is particulate matter less than 10 micrometers in diameter. PM 2.5 is particulate matter smaller than 2.5 micrometers in diameter. Further, PM 1.0 is particulate matter smaller than 1.0 micrometers in diameter.

Based on the end-user industry, the global market segments are commercial/institutional buildings, residential buildings, oil & gas, power generation, marine, chemical, metallurgical, pharmaceuticals, and other end-user industries. Currently, the scrubber and purifier industry is dominated by the commercial/institutional buildings segment. Air scrubbers are employed to remove mold, dust, bacteria, and other pollutants from the air in the office or other commercial facility.

Scrubber and Purifier Market: Report Scope

,

| Report Attributes | Report Details |

|---|---|

| Report Name | Scrubber and Purifier Market |

| Market Size in 2022 | USD 17.5 Billion |

| Market Forecast in 2030 | USD 31.3 Billion |

| Growth Rate | CAGR of 7.56% |

| Number of Pages | 217 |

| Key Companies Covered | ALFA LAVAL, ANDRITZ, Babcock & Wilcox Enterprises Inc., CECO ENVIRONMENTAL, DAIKIN INDUSTRIES Ltd., DUCON, Dyson, Enoch’s Industries Pvt. Ltd., Ergil, Estanc AS, Fuji Electric Co. Ltd., GEA Group Aktiengesellschaft, IQAir, LG Electronics, Nederman Holding AB, SHARP CORPORATION, Thermax Limited, Tri-Mer Corporation, Valmet, Wärtsilä, Whirlpool., and others. |

| Segments Covered | By Type, By Method, By Orientation, By Application, By End-user Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Scrubber and Purifier Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

The global scrubber and purifier market growth is expected to be driven by Asia Pacific, during the forecast period. In Asia Pacific, the majority of demand for scrubbers and purifiers is coming from the commercial sector, residential, and industrial sectors such as oil & gas, metallurgical industry, marine, chemical, and others. China, India, and Japan are among the key procurers of scrubbers and purifiers for their domestic purposes.

According to the National Bureau of Statistics of China, the real estate development investment in China accounted for CNY 13,289.5 billion, registering a decline rate of around 10% compared to the previous year. Out of which, the residential investment accounted for CNY 10,064.6 billion during the same period, down 9.5% over the previous year. In 2022, the sales area of commercial housing in China accounted for 1,358.37 million square meters, witnessing a decline rate of 24.3% over the previous year.

In March 2023, Saudi Aramco & its Chinese partners announced to start of full production at a refinery & petrochemical project in Liaoning, northeast China by 2026 through their Joint venture Huajin Aramco Petrochemical Company (HAPCO) with a refining capacity of around 300,000 barrels per day (BPD) oil. Aramco announced to supply of around 210,000 BPD of crude oil as feedstock for the refinery.

Chinese domestic oil industry is dominated by firms such as China National Offshore Oil Corp., and others. As per the Energy Institute, oil production in China accounted for around 4,111 thousand barrels per day in 2022, compared to 3,994 thousand barrels per day in 2021.

Scrubbers and purifiers are used in the steel industry to capture particulate pollutants. Further, as per the National Bureau of Statistics of China, crude steel production in 2022 declined by 2.1% to 1.01 billion tons, compared to the previous year.

According to the United Nations Conference on Trade and Development (UNCTAD), the total number of merchant fleets in China accounted for around 55,026 units at the start of year 2023, compared to 54,115 units at the start of the previous year.

North America is among the key demand regions for the scrubber and purifier industry. In North America, the majority of demand is coming from the United States, considering the well-established presence of sectors such as oil & gas, chemicals, pharmaceuticals, and others.

According to the Energy Information Administration (EIA), United States crude oil production increased by 5.6% to around 11.9 million barrels per day (b/d) in 2022 compared with 2021.

Moreover, according to the U.S. Census Bureau, the value of commercial construction put in place accounted for USD 114.79 billion in 2022, compared to USD 94.55 billion in the previous year. All such factors will favor the growth of the scrubber and purifier industry.

Scrubber and Purifier Market: Competitive Analysis

The global scrubber and purifier market is dominated by players like:

- ALFA LAVAL

- ANDRITZ

- Babcock & Wilcox Enterprises, Inc.

- CECO ENVIRONMENTAL

- DAIKIN INDUSTRIES, Ltd.

- DUCON

- Dyson

- Enoch’s Industries Pvt. Ltd.

- Ergil

- Estanc AS

- Fuji Electric Co., Ltd.

- GEA Group Aktiengesellschaft

- IQAir

- LG Electronics

- Nederman Holding AB

- SHARP CORPORATION

- Thermax Limited

- Tri-Mer Corporation

- Valmet

- Wärtsilä

- Whirlpool

The global scrubber and purifier market is segmented as follows:

By Type

- Scrubber

- Purifier

By Method

- Wet

- Dry

By Orientation

- Horizontal

- Vertical

By Application

- Particulate Matters

- Chemicals/Gases

By End-user Industry

- Commercial/Institutional Buildings

- Residential Buildings

- Oil & Gas

- Power Generation

- Marine

- Chemical

- Metallurgical

- Pharmaceuticals

- Other End-user Industries

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Scrubbers & purifiers are used to capture particulate matter, chemicals, & gaseous pollutants. Specifically, scrubbers are filtration devices that are generally used in industrial & large commercial environments. Whereas purifiers are frequently used in both residential & industrial sectors depending on their sizes & functionality.

The global scrubber and purifier market cap may grow owing to the stringent laws & regulations for air pollution. Significant growth opportunities can be expected due to the technological development of the scrubber & purifier in the marine industry.

According to study, the global scrubber and purifier market size was worth around USD 17.5 billion in 2022 and is predicted to grow to around USD 31.3 billion by 2030.

The CAGR value of the scrubber and purifier market is expected to be around 7.56% during 2023-2030.

The global scrubber and purifier market growth is expected to be driven by Asia Pacific. Currently, Asia Pacific is the highest revenue-generating market, across the globe, owing to the well-established end-user sectors such as commercial building, oil & gas, marine, chemical, etc. in regional countries such as China, India, Japan, and others.

The global scrubber and purifier market is led by players like ALFA LAVAL, ANDRITZ, Babcock & Wilcox Enterprises, Inc., CECO ENVIRONMENTAL, DAIKIN INDUSTRIES, Ltd., DUCON, Dyson, Enoch’s Industries Pvt. Ltd., Ergil, Estanc AS, Fuji Electric Co., Ltd., GEA Group Aktiengesellschaft, IQAir, LG Electronics, Nederman Holding AB, SHARP CORPORATION, Thermax Limited, Tri-Mer Corporation, Valmet, Wärtsilä, and Whirlpool.

The report incorporates demand & in-depth market insights on the global scrubber & purifier industry and analyzes the market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the scrubber & purifier industry. Moreover, the study covers the competitive landscape, as well as related geopolitical insights, for scrubber & purifier industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed