Self-Monitoring Blood Glucose Devices Market Size, Share, Demand & Trends Analysis Report by 2028

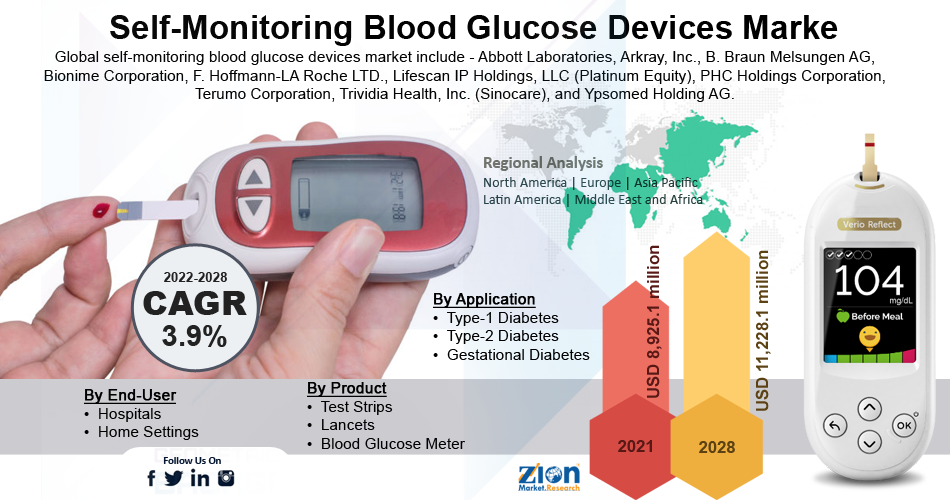

Self-Monitoring Blood Glucose Devices Market By Product (Test Strips, Lancets, Blood Glucose Meters), By Application (Type-1 Diabetes, Type-2 Diabetes, Gestational Diabetes), By End-User (Hospitals, Home Settings), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

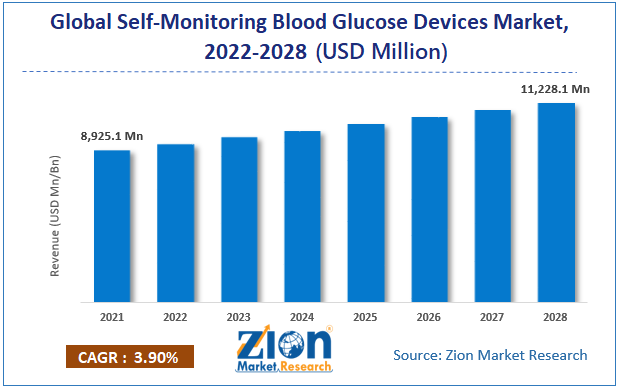

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8,925.1 Million | USD 11,228.1 Million | 3.9% | 2021 |

Industry Prospective:

The Global Self-Monitoring Blood Glucose Devices Market Size was worth around USD 8,925.1 million in 2021 and is estimated to grow to about USD 11,228.1 million by 2028, with a compound annual growth rate (CAGR) of approximately 3.9% over the forecast period. The report analyzes the self-monitoring blood glucose devices market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the self-monitoring blood glucose devices market.

Self-Monitoring Blood Glucose Devices Market: Overview

Blood glucose monitoring helps patients with diabetes make daily management decisions such as insulin dose, food intake, and physical exercise. Self-monitoring blood glucose (SMBG) is an advanced diabetes management procedure. It includes using blood glucose metrics by patients to check their respective glucose levels and provide an appropriate measure of capillary glucose concentration.

Request Free SampleSelf-monitoring blood glucose technology uses lancets, test strips, and blood glucose meters to achieve long-term glycemic control. The growth of self-monitoring blood glucose devices can be attributed to factors such as an increase in risk factors that lead to diabetes and a rise in the incidence rate of diabetes. However, blood glucose monitoring devices have some shortcomings. They do not measure the exact glucose level in the blood and can give inaccurate results, thereby hampering the market growth.

Request Free SampleSelf-monitoring blood glucose technology uses lancets, test strips, and blood glucose meters to achieve long-term glycemic control. The growth of self-monitoring blood glucose devices can be attributed to factors such as an increase in risk factors that lead to diabetes and a rise in the incidence rate of diabetes. However, blood glucose monitoring devices have some shortcomings. They do not measure the exact glucose level in the blood and can give inaccurate results, thereby hampering the market growth.

COVID-19 Impact:

The COVID-19 pandemic has provided new opportunities for self-monitoring blood glucose devices, which have gained more popularity in the diabetic care market. Increasing awareness regarding the advantages of blood glucose monitoring devices increased among the consumers during the pandemic because there had been an increased emphasis on telemedicine and virtual clinics for diabetic management. The self-monitoring blood glucose devices helped healthcare providers and patients improve glycemic control and potentially increase patient self-management.

Key Insights

- As per the analysis shared by our research analyst, the global self-monitoring blood glucose devices market value to grow at a CAGR of 3.9% over the forecast period.

- In terms of revenue, the global self-monitoring blood glucose devices market size was valued at around USD 8,925.1 million in 2021 and is projected to reach USD 11,228.1 million by 2028.

- An increase in the prevalence of diabetes is expected to drive the global self-monitoring blood glucose devices market growth.

- By product, the test strips segment accounted for a major share in 2021

- By end users, the hospital's segment accounted for a major share in 2021

- North America dominated the global self-monitoring blood glucose devices market in 2021.

Self-Monitoring Blood Glucose Devices Market: Growth Drivers

Increasing awareness regarding the use of self-monitoring blood glucose devices to drive the market growth

Self-monitoring blood glucose devices are predicted to showcase a high growth rate. Self-monitoring blood glucose devices are witnessing robust advances along with several launches by major players. Moreover, demand for self-monitoring blood glucose devices increased due to a rise in awareness regarding the usage of self-monitoring blood glucose devices and their benefits. Additionally, the rise in the geriatric population and technological advancements in blood glucose monitoring devices will boost the growth of the global self-monitoring blood glucose devices market.

Self-Monitoring Blood Glucose Devices Market: Restraints

Shortcomings of self-monitoring blood glucose devices hinder the market growth

Self-monitoring blood glucose devices have shortcomings, such as not measuring the exact blood glucose level and can give inaccurate results, which hampers the market growth.

Self-Monitoring Blood Glucose Devices Market: Opportunities

Technological advancements to present market opportunities

Technological advancements in the self-monitoring blood glucose devices owing to an increase in the adoption of these technologies to manage diabetes will provide opportunities for key players in the global self-monitoring blood glucose devices market. At the same time, increasing awareness of diabetes monitoring devices is expected to promote the market's growth.

Self-Monitoring Blood Glucose Devices Market: Challenges

High cost of self-monitoring blood glucose devices

The cost of self-monitoring blood glucose devices is high, and it is still difficult for many target customers to afford them. Hence, the self-monitoring blood glucose devices market is stagnant in countries with lower disposable income and low purchasing power.

Recent Developments

- February 2020: Abbott partnered with Insulet to integrate its Continuous Glucose Monitor technology with Insulet’s automated insulin delivery system.

- January 2020: Tandem Diabetes Care, Inc., an insulin delivery and diabetes technology company, announced the launch of the t:slim X2™ insulin pump with Control-IQ™ technology.

Self-Monitoring Blood Glucose Devices Market: Segmentation

The global self-monitoring blood glucose devices market is segregated based on product, application, and end-user.

Based on product, the market is divided into test strips, lancets, and blood glucose meters. Among these, the test strip segment dominates the market, accounting for a major share of global sales in 2021 due to greater knowledge of self-testing, which enables diabetic patients to frequently track their blood glucose levels without having to visit a clinic or diagnostic laboratory. Furthermore, the global market for self-monitoring blood glucose devices is growing due to the rising prevalence of diabetes and the increased demand for improved screening & monitoring techniques.

Based on application, the market is classified into type-1 diabetes, type-2 diabetes, and gestational diabetes. In 2021, the type-2 diabetes segment developed at fastest rate. An increase in the number of patients with type-2 diabetes is driving the segment's growth. Furthermore, due to a growth in the number of older adults, an increase in the prevalence of obesity, and a sedentary lifestyle, the type 2 diabetes sector is anticipated to develop at the quickest rate during the projection period.

Based on end-user, the market is classified into hospitals and home settings. The hospital's segment dominated the market in 2021, accounting for a major share of global revenue due to the expansion of healthcare infrastructure throughout emerging nations and an overall rise in hospitalizations. However, due to the increased adoption of blood glucose self-monitoring devices and the rise in consumer desire for portable & high-end technological products, the home settings category is anticipated to grow at the quickest rate during the projected period.

Self-Monitoring Blood Glucose Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Self-Monitoring Blood Glucose Devices Market Research Report |

| Market Size in 2021 | USD 8,925.1 Million |

| Market Forecast in 2028 | USD 11,228.1 Million |

| Growth Rate | CAGR of 3.9% |

| Number of Pages | 254 |

| Key Companies Covered | Abbott Laboratories, Arkray, Inc., B. Braun Melsungen AG, Bionime Corporation, F. Hoffmann-LA Roche LTD., Lifescan IP Holdings, LLC (Platinum Equity), PHC Holdings Corporation, Terumo Corporation, Trividia Health, Inc. (Sinocare), and Ypsomed Holding AG. among others. |

| Segments Covered | By Product, By Application, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Self-Monitoring Blood Glucose Devices Market: Regional Landscape

North America dominated the self-monitoring blood glucose devices market in 2021.

North America acquired a major share of the global self-monitoring blood glucose devices market in 2021 due to the region's high incidence rate of diabetes. Moreover, the presence of key players in North America promotes the market's growth. Further, the constantly evolving healthcare industry drives the market growth in this region.

The CDC estimates that 34.2 million Americans will have diabetes in 2020, and one in three people in the country have prediabetes. The patient base is further augmented by obesity, unhealthful eating patterns, and other environmental variables. The industry's expansion will also be fueled by several initiatives launched by national and international organizations to lower the disease burden.

Self-Monitoring Blood Glucose Devices Market: Competitive Landscape

Some of the leading players in the global market include

- Abbott Laboratories

- Arkray Inc.

- B. Braun Melsungen AG

- Bionime Corporation

- F. Hoffmann-LA Roche LTD.

- Lifescan IP Holdings LLC (Platinum Equity)

- PHC Holdings Corporation

- Terumo Corporation

- Trividia Health Inc. (Sinocare)

- Ypsomed Holding AG.

Global Self-Monitoring Blood Glucose Devices Market is segmented as follows:

By Product

- Test Strips

- Lancets

- Blood Glucose Meter

By Application

- Type-1 Diabetes

- Type-2 Diabetes

- Gestational Diabetes

By End-User

- Hospitals

- Home Settings

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Which key factors will influence self-monitoring blood glucose devices market growth over 2022-2028?

The growth of self-monitoring blood glucose devices can be attributed to factors such as an increase in risk factors that lead to diabetes and a rise in the incidence rate of diabetes. Additionally, the rise in the geriatric population and technological advancements in blood glucose monitoring devices will boost the growth of self-monitoring blood glucose devices. However, blood glucose monitoring devices have some shortcomings. They do not measure the exact blood glucose level and can give inaccurate results, hamper the market growth. At the same time, increasing awareness of diabetes monitoring devices is expected to promote the market's growth.

According to the report, the global self-monitoring blood glucose devices market was worth about 8,925.1 million in 2021 and is predicted to grow to around 11,228.1 million by 2028, with a compound annual growth rate (CAGR) of around 3.9 percent.

Which region will contribute notably towards the self-monitoring blood glucose devices market value?

North America acquired a major share of the self-monitoring blood glucose devices market in 2021 due to the region's high incidence rate of diabetes. Moreover, the presence of key players in North America promotes the market's growth. Further, the constantly evolving healthcare industry drives the market growth in this region. The CDC estimates that 34.2 million Americans will have diabetes in 2020, and one in three people in the country have prediabetes. The patient base is further augmented by obesity, unhealthful eating patterns, and other environmental variables. The industry's expansion will also be fueled by several initiatives launched by national and international organizations to lower the disease burden.

Some of the main competitors dominating the global self-monitoring blood glucose devices market include - Abbott Laboratories, Arkray, Inc., B. Braun Melsungen AG, Bionime Corporation, F. Hoffmann-LA Roche LTD., Lifescan IP Holdings, LLC (Platinum Equity), PHC Holdings Corporation, Terumo Corporation, Trividia Health, Inc. (Sinocare), and Ypsomed Holding AG.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed