Session Initiation Protocol (SIP) Trunking Services Market Size, Share, Analysis, 2032

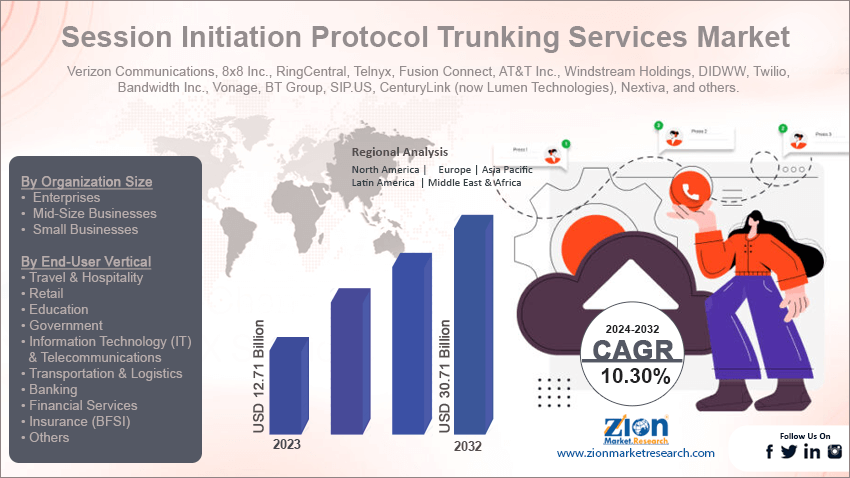

Session Initiation Protocol (SIP) Trunking Services Market By Organization Size (Enterprises, Mid-Size Businesses, and Small Businesses), By End-User Vertical (Travel & Hospitality, Retail, Education, Government, Information Technology (IT) & Telecommunications, Transportation & Logistics, Banking, Financial Services, & Insurance (BFSI), and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

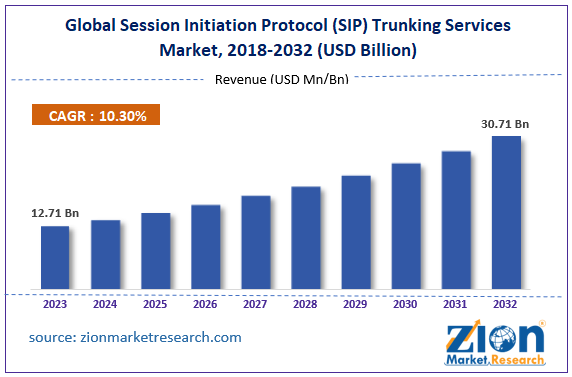

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.71 Billion | USD 30.71 Billion | 10.30% | 2023 |

Session Initiation Protocol (SIP) Trunking Services Industry Prospective:

The global session initiation protocol (SIP) trunking services market size was worth around USD 12.71 billion in 2023 and is predicted to grow to around USD 30.71 billion by 2032, with a compound annual growth rate (CAGR) of roughly 10.30% between 2024 and 2032.

Session Initiation Protocol (SIP) Trunking Services Market: Overview

Session initiation protocol (SIP) trunking services providers allow receiving or making calls digitally or performing other forms of digital communication over the internet.

According to market analysis, the term trunk refers to digital phone lines that can be used to connect with a phone number using the internet. SIP trunking service providers not only facilitate voice calls but also allow multimedia communications that work as a combination of audio, video, and text. In recent times, SIP trunk services have gained wide popularity among small and large enterprises. The technology is actively replacing Integrated Services Digital Networks (ISDN) and analog phone lines across the globe. SIP trunking has several benefits, making it lucrative for a wide range of end-users.

For instance, session initiation protocol trunking services are known to be more cost-effective as compared to traditional phone lines especially if the demand for international phone calls is higher.

Furthermore, it offers scalability, allowing companies to scale their internet connection depending on the final call volume. The main components of SIP trunking services include SIP trunks, SIP channels, SIP protocol, and SIP provider. During the forecast period, the demand for SIP trunking services is expected to continue growing in the backdrop of several favorable factors, such as business globalization and advancements in the end-user industries.

Key Insights:

- As per the analysis shared by our research analyst, the global session initiation protocol (SIP) trunking services market is estimated to grow annually at a CAGR of around 10.30% over the forecast period (2024-2032)

- In terms of revenue, the global session initiation protocol (SIP) trunking services market size was valued at around USD 12.71 billion in 2023 and is projected to reach USD 30.71 billion by 2032.

- The session initiation protocol trunking services providers market is projected to grow at a significant rate due to the rising launch of 5G telecommunications services.

- Based on organization size, the enterprise segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user vertical, the information technology (IT) & telecommunications segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Session Initiation Protocol (SIP) Trunking Services Market: Growth Drivers

Rising launch of 5G telecommunications services to transform the industry’s growth rate

The global session initiation protocol (SIP) trunking services market is expected to grow due to the rising launch of 5G telecommunication infrastructure worldwide. 5G internet connectivity will allow SIP trunking service providers to deliver faster solutions that work at exceptionally high speeds and promote better-quality audio or video calls.

In addition, 5G internet connectivity will aid improvements in the development of more functional and highly advanced unified communication systems. It will open opportunities for end-users to integrate virtual reality (VR) and artificial reality (AR) in business meetings and communications. 5G technology is witnessing rapid expansion across the globe, with every major economy upscaling its investment in building a more robust and supportive 5G infrastructure.

For instance, in October 2024, the European Commission (EC) announced an investment of EUR 865 million toward the Connecting Europe Facility (CEF) Digital initiative.

With the renewed investments, the EC has escalated its support for more secure and faster digital connectivity networks. Some of the major areas of action of the EC will be deploying 5G infrastructures across the region, deployment of operational digital platforms for transport or energy infrastructures, and deployment and significant upgrade of backbone networks.

Cost efficiency offered by SIP trunking services to create market revenue in the long run

The demand for SIP trunking services is expected to be fueled by the cost-efficiency offered by the technology. For instance, traditional phone lines with international call features require extensive installation and maintenance costs.

Since the solutions available in the global session initiation protocol (SIP) trunking services are charged on a per-channel basis, the end-user pays only for the services used. SIP trunk pricing includes basic components that are actual call charges, price per channel that may include a call allowance, monthly rental charge for the broadband line, and a setup fee.

Session Initiation Protocol (SIP) Trunking Services Market: Restraints

High dependence on the quality of internet connectivity limits the industry’s growth rate

The global session initiation protocol (SIP) trunking services industry is projected to be restricted by the high dependence of technology on internet connectivity. In case of the absence of a stable internet connection, the technology fails to deliver the expected results.

Furthermore, the lack of robust internet infrastructure in certain parts of the world, especially war zones or socially and politically affected countries, as well as remote regions of struggling economies, may limit the industry’s overall growth rate in the coming years.

Session Initiation Protocol (SIP) Trunking Services Market: Opportunities

Rising introduction of new solutions in the market to generate growth opportunities for industry players

The global session initiation protocol (SIP) trunking services market is expected to generate growth opportunities due to the rising number of solutions in the industry. In October 2024, Sinch, an emerging developer of novel communication solutions using its Customer Communications Cloud, announced the launch of an Elastic SIP Trunking solution which can be accessed through the Sinch Customer Dashboard. The solution offers applications for all types of businesses. It is equipped with features such as high reliability, scalability, and cost-efficient communication services.

Furthermore, the company has adopted a pay-as-you-go model, thus allowing end-users to optimize their voice communication systems. In July 2024, Vonage, another leading firm with an exceptional presence in cloud communication systems, launched new capabilities for SIP trunking.

The tool offers Artificial Intelligence (AI)-powered voice engagement solutions using low-code/no-code and pre-built code applications. Some of the main characteristics of the tool include easy deployment, Vonage Code Hub, Vonage Voice Application Programming Interface (API), and Vonage AI Studio.

Session Initiation Protocol (SIP) Trunking Services Market: Challenges

Higher cost of initial setup and security concerns to challenge market expansion trends

The global session initiation protocol (SIP) trunking services industry is expected to be challenged by the higher initial cost of setup. The associated expenses may discourage smaller companies from investing in the SIP trunking setup. In addition to this, market research suggests that session initiation protocol trunking is susceptible to malware practices including toll fraud and eavesdropping. Security concerns may further dilute the industry’s overall growth rate in the coming years.

Request Free Sample

Request Free Sample

Session Initiation Protocol (SIP) Trunking Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Session Initiation Protocol (SIP) Trunking Services Market |

| Market Size in 2023 | USD 12.71 Billion |

| Market Forecast in 2032 | USD 30.71 Billion |

| Growth Rate | CAGR of 10.30% |

| Number of Pages | 214 |

| Key Companies Covered | Verizon Communications, 8x8 Inc., RingCentral, Telnyx, Fusion Connect, AT&T Inc., Windstream Holdings, DIDWW, Twilio, Bandwidth Inc., Vonage, BT Group, SIP.US, CenturyLink (now Lumen Technologies), Nextiva, and others. |

| Segments Covered | By Organization Size, By End-User Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Session Initiation Protocol (SIP) Trunking Services Market: Segmentation

The global session initiation protocol (SIP) trunking services market is segmented based on organization size, end-user vertical, and region.

Based on the organization size, the global market segments are enterprises, mid-size businesses, and small businesses. In 2023, the highest growth was listed in the enterprise segment. This is mainly due to the global presence of enterprise companies requiring them to invest in effective yet cost-efficient communication tools. In addition to this, the advantages offered by the latest SIP trunking service providers will further facilitate segmental growth during the forecast period. The average information technology (IT) budget for a company at present times is around 4% of the final revenue.

Based on the end-user vertical, the session initiation protocol trunking services providers industry divisions are travel & hospitality, retail, education, government, information technology (IT) & telecommunications, transportation & logistics, banking, financial services, & insurance (BFSI), and others. In 2023, the highest demand was listed in the information technology (IT) & telecommunications segment due to the high demand the industry has for reliable communication across time zones. Furthermore, the surging development of new IT companies focusing on AI-based developments will generate higher segmental revenue during the forecast period. By the end of 2024, IT spending worldwide will reach over USD 5 trillion, as per official data.

Session Initiation Protocol (SIP) Trunking Services Market: Regional Analysis

North America to lead the market during the forecast period according to an extensive study

The global session initiation protocol (SIP) trunking services market will be dominated by North America during the forecast period. The US is expected to deliver the highest revenue, especially with the presence of several key players providing effective SIP trunking services to regional and global users.

The US, for instance, is home to one of the world’s most sought-after and technologically advanced IT industries. In addition to this, the innovation-oriented government policies further foster growth in the IT sector, fueling demand for SIP trunking services.

In October 2024, SIPTRUNK, a US-based player in the regional market, announced the launch of superTRUNK. The new tool is meant to empower voice-centric businesses. SIPTRUNK is a BCM One company that currently provides SIP trunks using two networks thus offering more flexibility to the company’s customers.

Furthermore, the regional demand for SIP trunks is exceptionally high, especially in the BFSI and retail sectors. The growing investments in 5G infrastructure will facilitate extensive use of SIP trunks in the coming years creating growth opportunities for regional market players.

Session Initiation Protocol (SIP) Trunking Services Market: Competitive Analysis

The global session initiation protocol (SIP) trunking services market is led by players like:

- Verizon Communications

- 8x8 Inc.

- RingCentral

- Telnyx

- Fusion Connect

- AT&T Inc.

- Windstream Holdings

- DIDWW

- Twilio

- Bandwidth Inc.

- Vonage

- BT Group

- SIP.US

- CenturyLink (now Lumen Technologies)

- Nextiva

The global session initiation protocol (SIP) trunking services market is segmented as follows:

By Organization Size

- Enterprises

- Mid-Size Businesses

- Small Businesses

By End-User Vertical

- Travel & Hospitality

- Retail

- Education

- Government

- Information Technology (IT) & Telecommunications

- Transportation & Logistics

- Banking

- Financial Services

- Insurance (BFSI)

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Session initiation protocol (SIP) trunking services providers allow receiving or making calls digitally or performing other forms of digital communication over the internet.

The global session initiation protocol (SIP) trunking services market is expected to grow due to the rising launch of 5G telecommunication infrastructure worldwide.

According to study, the global session initiation protocol (SIP) trunking services market size was worth around USD 12.71 billion in 2023 and is predicted to grow to around USD 30.71 billion by 2032.

The CAGR value of session initiation protocol (SIP) trunking services market is expected to be around 10.30% during 2024-2032.

The global session initiation protocol (SIP) trunking services market will be dominated by North America during the forecast period.

The global session initiation protocol (SIP) trunking services market is led by players like Verizon Communications, 8x8 Inc., RingCentral, Telnyx, Fusion Connect, AT&T Inc., Windstream Holdings, DIDWW, Twilio, Bandwidth Inc., Vonage, BT Group, SIP.US, CenturyLink (now Lumen Technologies), and Nextiva.

The report explores crucial aspects of the session initiation protocol (SIP) trunking services market, including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed