Global Single-Use Bioreactors Market Size, Share, Growth Analysis Report - Forecast 2034

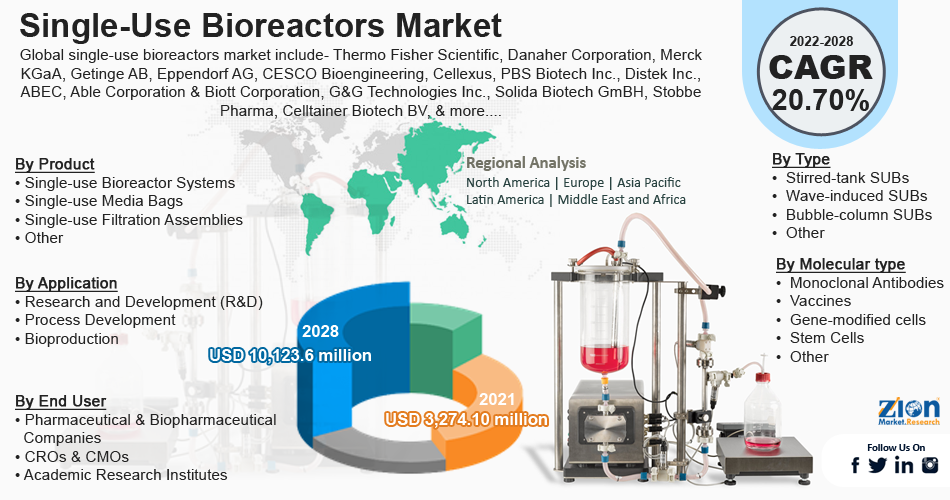

Single-Use Bioreactors Market By Product (Single-use Bioreactor Systems, Single-use Media Bags, Single-use Filtration Assemblies, and Other Products (Single-use vessels, tubing and connectors, samplers, and probes/sensor, and others)), By Type (Stirred-tank SUBs, Wave-induced SUBs, Bubble-column SUBs, and Other SUBs (Hybrid bioreactors and SUBs with vertically perforated discs)), Type of Cell (Mammalian Cells, Bacterial Cells, Yeast Cells, and Other Cells (Insect and plant cells), Molecule Type (Monoclonal Antibodies, Vaccines, Gene-modified cells, Stem Cells, and Other Molecules (Recombinant proteins including growth factors & interferons, antisense, RNA interference and others)), Application (Research and Development (R&D), Process Development, and Bioproduction), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

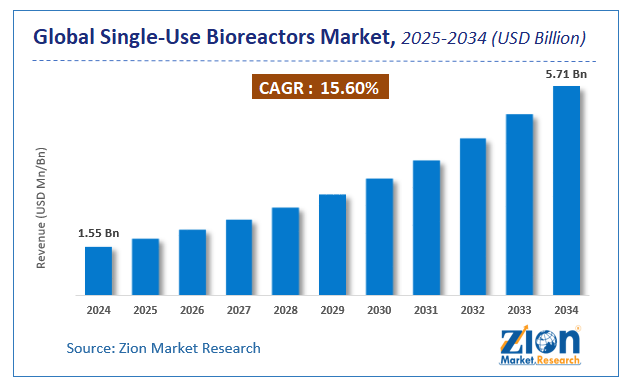

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.55 Billion | USD 5.71 Billion | 15.6% | 2024 |

Single-Use Bioreactors Market: Industry Perspective

The global single-use bioreactors market size was worth around USD 1.55 Billion in 2024 and is predicted to grow to around USD 5.71 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 15.6% between 2025 and 2034.

The report analyzes the global single-use bioreactors market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the single-use bioreactors industry.

Single-Use Bioreactor Market: Overview

Single-use bioreactors (SUBs), also known as disposable bioreactors, use disposable bags instead of stainless steel or glass culture vessels. It is flexible, easy to install, and requires fewer utility requirements such as steam and water. It also reduces labor costs, minimizes the risk of cross-contamination, and eliminates cleaning process and verification issues. As a result, a wide range of applications can be found in contract research organizations (CROs) and contract manufacturing organizations (CMOs) around the world. Overall, disposable bioreactors are suitable for the production of bio pharmacy due to their high operational efficiency.

Recently, the endless efforts of companies to promote their products have proved to be very progressive. You can see working on the instant sensor system, design, agitation mechanism & film technology of disposable bioreactors. Increased acceptance of SUBs among small and medium-sized enterprises and start-ups, reduced automation complexity, ease of cultivating marine organisms, reduced energy & water consumption, growth of the biopharmaceutical market, technological advances in SUBs, and increased R & D in biopharmaceuticals are factors driving drive growth market.

Key Insights

- As per the analysis shared by our research analyst, the global single-use bioreactors market is estimated to grow annually at a CAGR of around 15.6% over the forecast period (2025-2034).

- Regarding revenue, the global single-use bioreactors market size was valued at around USD 1.55 Billion in 2024 and is projected to reach USD 5.71 Billion by 2034.

- The single-use bioreactors market is projected to grow at a significant rate due to increasing adoption of flexible and cost-effective biomanufacturing solutions, the growing demand for biologics, and the need for reduced contamination risks and faster process development.

- Based on Product, the Single-use Bioreactor Systems segment is expected to lead the global market.

- On the basis of Type, the Stirred-tank SUBs segment is growing at a high rate and will continue to dominate the global market.

- Based on the Type of Cell, the Mammalian Cells segment is projected to swipe the largest market share.

- By Molecule Type, the Monoclonal Antibodies segment is expected to dominate the global market.

- In terms of Application, the Research and Development (R&D) segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Single-Use Bioreactors Market: Growth Drivers

Increasing biopharmaceutical R&D help drive the market growth

The susceptibility of the elderly population group to various diseases along with the growing elderly population is driving the demand for bio pharmacies worldwide. In anticipation of this demand, global companies are focusing on biopharmaceutical R & D and manufacturing to develop products and scale production. The pharmacy industry invests an average of six times more R & D in sales than other manufacturing industries. In 2018, bio pharmacy companies invested (estimated) US $ 102 billion in R & D (Source: PhRMA). Disposable technology is an integral part of the bio pharmacy manufacturing process. They account for the majority of small and medium-sized bio pharmacy production, especially in clinical trials and R & D. Due to the advantages of disposable systems over traditional bio-manufacturing techniques, their adoption in biopharmaceutical research and development is increasing. Therefore, increased R & D spending is seen as a positive indicator of global single-use bioreactors market growth.

Single-Use Bioreactors Market: Restraints

Need for improved single-use sensors to hamper the market expansion

Reliable, accurate, and cost-effective sensor availability that meets SUB needs is one of the key challenges in the market. The sensors used in the SUB must be compatible with the existing SUB platform and manage the system without compromising the sterility of the material. Traditionally, the sensor was installed in the SUB system, but this method reduced the quality of the final product. Ideally, the sensor and SUB are shipped as a unit, and the sensor is pre-installed on the SUB to ensure sterilization of the container and sensor. However, due to leaching and extractability issues, the quality of available sensors does not meet GMP standards. This creates challenges when using SUBs, but there is room for improvement in this market segment. But with the development of more accurate and individual process sensors for various parameters (pH value, temperature, flow measurement, product quality), it can then be incorporated into a bioprocess workflow.

Single-Use Bioreactors Market: Opportunities

Emerging markets show opportunities for the global single-use bioreactors market growth

Emerging markets such as China, India, and Indonesia offer significant growth opportunities due to the high growth of their respective pharmaceutical and biopharmacy sectors due to less stringent regulatory guidelines, cheaper labor, and more skilled labor. Due to their cost advantage and skilled workforce, these countries have become hubs for bioprocess outsourcing. Developing countries show that disposable systems are growing fast. For example, many of China's new bioprocessing plants are expected to be built to meet both domestic demand and the desire to become a biopharmacy exporter. Chinese biopharmacy companies have also found that Chinese CMOs are more likely to accept the adoption of disposable technology than domestic biopharmaceutical developers/manufacturers. In 2018, Wuxi Biologics partnered with ABEC to install a 4,000L custom single-run disposable bioreactor at a new commercial production facility in Wuxi, China.

Single-Use Bioreactors Market: Segmentation Analysis

The global single-use bioreactors market is segmented based on Product, Type, Type of Cell, Molecule Type, Application, and region.

Based on Product, the global single-use bioreactors market is divided into Single-use Bioreactor Systems, Single-use Media Bags, Single-use Filtration Assemblies, and Other Products (Single-use vessels, tubing and connectors, samplers, and probes/sensor, and others).

On the basis of Type, the global single-use bioreactors market is bifurcated into Stirred-tank SUBs, Wave-induced SUBs, Bubble-column SUBs, and Other SUBs (Hybrid bioreactors and SUBs with vertically perforated discs).

By Type of Cell, the global single-use bioreactors market is split into Mammalian Cells, Bacterial Cells, Yeast Cells, and Other Cells (Insect and plant cells.

In terms of Molecule Type, the global single-use bioreactors market is categorized into Monoclonal Antibodies, Vaccines, Gene-modified cells, Stem Cells, and Other Molecules (Recombinant proteins including growth factors & interferons, antisense, RNA interference and others).

By Application, the global Single-Use Bioreactors market is divided into Research and Development (R&D), Process Development, and Bioproduction.

Single-Use Bioreactors Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Single-Use Bioreactors Market |

| Market Size in 2021 | USD 1.55 Billion |

| Market Forecast in 2028 | USD 5.71 Billion |

| Growth Rate | CAGR of 15.6% |

| Number of Pages | 209 |

| Key Companies Covered | Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, Getinge AB, Eppendorf AG, CESCO Bioengineering, Cellexus, PBS Biotech Inc, Distek Inc, ABEC, Able Corporation & Biott Corporation, G&G Technologies Inc, Solida Biotech GmBH, Stobbe Pharma, Celltainer Biotech BV, Meissner Filtration Products Inc., bbi-biotech GmBH, ENDEL ENGIE (France), OmniBRx biotechnologies, New Horizon Biotechnology Inc, Satake Chemical Equipment Mfg., Ltd, Sartorius Stedim Biotech, GPC Bio, Cell culture company, Aptus bioreactors |

| Segments Covered | By product, By type, By type of cell, By molecule type, By application, By end user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 - 2024 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In July 2021, BioCentriq and Pall Corporation collaborated in the clinical production of Zolgensma. This is an FDA-approved gene therapy using the iCELLis fixed-bed bioreactor.

- In February 2021, Wuxi Biologics launched a 36,000 liter bio production line with nine 4,000 liter disposable bioreactors.

Single-Use Bioreactors Market: Regional Landscape

The development of the manufacturing industry will help to grow North America region

During the forecast period, North America is likely to dominate the global single-use bioreactors market. The expansion of the region's manufacturing capacity is complementing the market's growth. For example, in September 2021, Thermo Fisher Scientific announced plans to build a new manufacturing facility for disposable bioprocessing products. The addition of the Nashville facility has expanded the global network of SUT manufacturing facilities. The presence of an established bio pharmacy industry and the presence of key players operating in the North American market.

Single-Use Bioreactors Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the single-use bioreactors market on a global and regional basis.

The global single-use bioreactors market is dominated by players like:

- Thermo Fisher Scientific

- Danaher Corporation

- Merck KGaA

- Getinge AB

- Eppendorf AG

- CESCO Bioengineering

- Cellexus

- PBS Biotech Inc

- Distek Inc

- ABEC

- Able Corporation & Biott Corporation

- G&G Technologies Inc

- Solida Biotech GmBH

- Stobbe Pharma

- Celltainer Biotech BV

- Meissner Filtration Products Inc.

- bbi-biotech GmBH

- ENDEL ENGIE (France)

- OmniBRx biotechnologies

- New Horizon Biotechnology Inc

- Satake Chemical Equipment Mfg.

- Ltd Sartorius Stedim Biotech

- GPC Bio

- Cell culture company

- Aptus bioreactors

The global single-use bioreactors market is segmented as follows;

By Product

- Single-use Bioreactor Systems

- Single-use Media Bags

- Single-use Filtration Assemblies

- and Other Products (Single-use vessels

- tubing and connectors

- samplers

- and probes/sensor

- and others)

By Type

- Stirred-tank SUBs

- Wave-induced SUBs

- Bubble-column SUBs

- and Other SUBs (Hybrid bioreactors and SUBs with vertically perforated discs)

By Type of Cell

- Mammalian Cells

- Bacterial Cells

- Yeast Cells

- and Other Cells (Insect and plant cells

By Molecule Type

- Monoclonal Antibodies

- Vaccines

- Gene-modified cells

- Stem Cells

- and Other Molecules (Recombinant proteins including growth factors & interferons

- antisense

- RNA interference and others)

By Application

- Research and Development (R&D)

- Process Development

- and Bioproduction

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global single-use bioreactors market is expected to grow due to growing adoption of cost-effective and flexible bioprocessing solutions, increasing demand for biopharmaceuticals, advancements in disposable technologies, and rising biopharmaceutical R&D investments.

According to a study, the global single-use bioreactors market size was worth around USD 1.55 Billion in 2024 and is expected to reach USD 5.71 Billion by 2034.

The global single-use bioreactors market is expected to grow at a CAGR of 15.6% during the forecast period.

North America is expected to dominate the single-use bioreactors market over the forecast period.

Leading players in the global single-use bioreactors market include Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, Getinge AB, Eppendorf AG, CESCO Bioengineering, Cellexus, PBS Biotech Inc, Distek Inc, ABEC, Able Corporation & Biott Corporation, G&G Technologies Inc, Solida Biotech GmBH, Stobbe Pharma, Celltainer Biotech BV, Meissner Filtration Products Inc., bbi-biotech GmBH, ENDEL ENGIE (France), OmniBRx biotechnologies, New Horizon Biotechnology Inc, Satake Chemical Equipment Mfg., Ltd, Sartorius Stedim Biotech, GPC Bio, Cell culture company, Aptus bioreactors, among others.

The report explores crucial aspects of the single-use bioreactors market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed