Site Dumper Market Growth, Size, Share, Trends, and Forecast 2030

Site Dumper Market By Application (Construction, Mining, Agriculture, Utility Industry, and Others), By Type (4-Wheeler Site Dumper, 2-Wheeler Site Dumper, and Tracked Power Dumpers), By Sales Channel (Distributor and Direct Sales), By Capacity (Above 5 Tons, 3 to 5 Tons, 2 to 3 Tons, and Under 2 Tons), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3106.80 million | USD 5083.30 million | 6.35% | 2022 |

Site Dumper Industry Prospective:

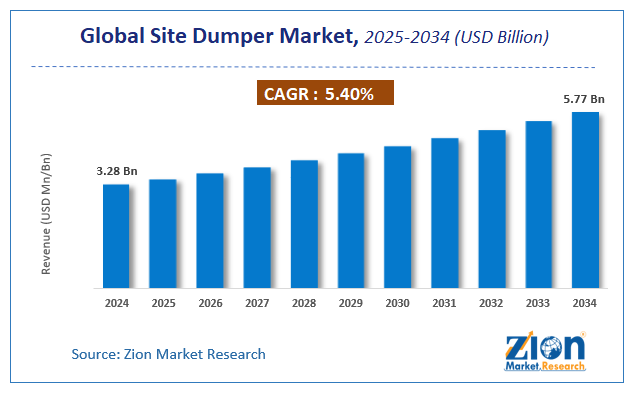

The global site dumper market size was worth around USD 3106.80 million in 2022 and is predicted to grow to around USD 5083.30 million by 2030 with a compound annual growth rate (CAGR) of roughly 6.35% between 2023 and 2030.

Site Dumper Market: Overview

Site dumpers are heavy trailers with modern variants equipped with hydraulic rams used for the transportation of heavy goods from source to end site. They are used for the transportation of materials such as gravel, dirt, or demolition waste and have extensive applications in the growing construction, mining, agriculture, and other industries. A typical site dumper can either tilt on the right or left side or open at the back for offloading purposes and is usually a vehicle with 4 wheels owing to the heavy amount of product carried by the dumpers. Site dumpers are considered the quickest and safest transportation tools that can carry loose material from one place to another without requiring intense labor work. They are mostly used at the start of the construction process for carrying essential goods such as rocks, rubble, or waste. Site dumpers were first introduced in Europe and since then have evolved with time with market players now operating from across the globe. The industry for site dumpers is growing at a steady pace as a result of vehicle engineering innovations and developments.

Key Insights:

- As per the analysis shared by our research analyst, the global site dumper market is estimated to grow annually at a CAGR of around 6.35% over the forecast period (2023-2030)

- In terms of revenue, the global site dumper market size was valued at around USD 3106.80 million in 2022 and is projected to reach USD 5083.30 million, by 2030.

- The site dumper market is projected to grow at a significant rate due to the increasing investments in residential and commercial infrastructure development projects

- Based on application segmentation, construction was predicted to show maximum market share in the year 2022

- Based on sales channel segmentation, distributor was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Site Dumper Market: Growth Drivers

Increasing investments in residential and commercial infrastructure development projects to drive market growth

The global site dumper market is expected to gain higher revenue owing to the increasing investments in residential and commercial infrastructure development projects globally. As the world population continues to grow, the demand for modern housing in the form of standalone buildings or fully equipped apartments is on the rise. Builders operating in the residential sector are increasingly investing in high-end construction projects to provide residential complexes equipped with all modern facilities including swimming pools, gymnasiums, recreational centers, playgrounds, and other facilities. The residential building segment is evolving steadily as consumer expectations continue to change.

In the second quarter of 2023, Europe witnessed the initiation of multiple expensive housing construction projects including the mixed-use complex at Vauxhall Cross Island in London which is expected to be completed by the fourth quarter of 2025. Some of the other projects include the Onest residential complex on a 102,000m2 area in Russia, the Bayerischen Bahnhof project, and the Towarowa 22 Mixed-Use Complex project.

In addition to this, the number of commercial infrastructure projects has increased multifold in the last decade, especially in emerging economies. Globalization is one of the key propellers for increased rates of commercial projects including construction of transportation routes, corporate & industrial offices, and recreational centers. For instance, in the latest development, the Australian government is developing the WestConnex projects. It is considered Australia’s largest road infrastructure project being built with an investment of $1.5 billion and is 33 kilometers long. Site dumpers are used across all these construction projects along with other equipment to carry goods and materials.

Site Dumper Market: Restraints

High cost of the equipment to restrict market growth

Site dumpers are expensive vehicles and this factor could impact the global site dumper industry growth trend The price of site dumpers increases further if advanced features are added to the dumpers including hydraulic arms, global positioning systems (GPS) & route monitoring units, electronic control systems, anti-collision attributes, and advanced safety systems. The average price of site dumpers ranges between USD 15,000 to USD 1,80,000. In addition to this, the construction of the dumpers also demands higher investments since they are built using advanced materials that can carry heavy weights without breaking down. Furthermore, the terrains on which site dumpers function are rough requiring robust tires, four-wheel steering, efficient shock absorbers & suspensions, and terrain management systems. The global economic volatility could lead to supply chain disruptions.

Site Dumper Market: Opportunities

Growing technological advancements in the market to create additional growth opportunities

The global site dumper market will register high growth opportunities as site dumper manufacturers continue to provide upgraded and more efficient vehicles with enhanced power and capabilities. In September 2023, Ausa, a Spanish site dumper manufacturer announced the launch of 2 new site dumpers thus extending its existing range. Each dumper boasts a 2-tonne capacity and the model is called the D201AHG dumper. It is powered by an 18.5 kW Kubota engine and can transport more than 1300 liters of material. For easy access, the dumper is fitted with a backward folding cab. In the same month of the year 2022, the company launched a range of reversible site dumpers along with full seat rotation.

Rising shift toward electric site dumpers holds tremendous growth potential

The changing prices of conventional fuel including diesel and gasoline used for powering sit dumpers have resulted in greater demand and need for alternatives and electric site dumpers are currently leading the race in terms of energy-efficient and sustainable solutions. Moreover, governments across the globe along with domestic and international environmental agencies have emphasized the need to reduce pollution caused by agriculture, mining, and construction industries thus paving a wider path for electric vehicles. In March 2023, India witnessed the launch of its first electric site dumper also called an electric tipper manufactured by Olectra Greentech Limited. It is a 6*4 electric tipper and is announced to comply with all the rules related to Central Motor Vehicle. The company is in talks to supply 20 such vehicles in the coming years.

Site Dumper Market: Challenges

High maintenance requirement of site dumpers to act as crucial barriers along with other challenges

The global site dumper market size is projected to be restrained by the time and other resources invested in maintaining size dumpers. Since these are heavy vehicles working on sophisticated technology, they require frequent care and checks to avoid mishaps while in use. Additionally, the industry for site dumpers is highly regulated since each country has specific laws regulating the type and model of site dumpers that can be used.

Site Dumper Market: Segmentation

The global site dumper market is segmented based on application, type, sales channel, capacity, and region.

Based on application, the global market segments are construction, mining, agriculture, utility industry, and others. In 2022, the highest growth was observed in the construction industry since site dumpers are mostly used in construction and infrastructure projects for carrying materials between two destinations. The rampant growth in the construction industry has resulted in higher segmental growth and will continue the same trend during the forecast period. In 2022, the construction sector accounted for 14.21% of the global gross domestic product (GDP).

Based on type, the site dumpers industry divisions are 4-wheeler site dumper, 2-wheeler site dumper, and tracked power dumpers.

Based on sales channel, the global site dumper market is divided into distributor and direct sales. In 2022, the most revenue-generating segment was distributors since multiple transactions were carried through third-party sellers of heavy vehicles. However, direct sales also grew at a significant rate as more manufacturer-owned distribution units opened up on a large scale. In 2022, the global wholesale and distribution automotive aftermarket was valued at USD 218 billion.

Based on capacity, the site dumper industry divisions are above 5 tons, 3 to 5 tons, 2 to 3 tons, and under 2 tons.

Site Dumper Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Site Dumper Market |

| Market Size in 2022 | USD 3106.80 Million |

| Market Forecast in 2030 | USD 5083.30 Million |

| Growth Rate | CAGR of 6.35% |

| Number of Pages | 221 |

| Key Companies Covered | Volvo Construction Equipment, Caterpillar Inc., Thwaites Limited, Terex Corporation, Cormidi S.r.l., Wacker Neuson, Group, Kubota Corporation, JCB, Multiquip Inc., Doosan Bobcat, Hitachi Construction Machinery Co. Ltd., Liebherr Group, AUSA Center S.A., Komatsu Ltd., Yanmar Holdings Co. Ltd., and others. |

| Segments Covered | By Application, By Type, By Sales Channel, By Capacity, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Site Dumper Market: Regional Analysis

North America to register the highest growth rate during the projected period

The global site dumper market is expected to register the highest growth rate in North America mainly due to the presence of safety regulations in the construction industry requiring the use of effective construction tools. Furthermore, the thriving regional construction sector along with the existence of a large mining industry help the North American market flourish with high revenue. In March 2023, Ausa presented its extensive portfolio at ConExpo held in Las Vegas, USA. The company presented its first zero-emission electric site dumper in North America. The new range has a skip capacity of 626 liters and is equipped with articulated chassis.

Europe is a crucial market for the site dumper industry. It is one of the largest producers of advanced site dumpers with high applications. The country supplies products to other nations such as North America and Asia-Pacific. Europe has a higher demand for energy-efficient site dumpers as the region is focusing on reducing dependence on non-renewable fuel. In January 2023, France-based Mecalac announced the launch of a TA3SH Power Swivel site dumper that can be used in small and confined spaces as well.

Site Dumper Market: Competitive Analysis

The global site dumper market is led by players like:

- Volvo Construction Equipment

- Caterpillar Inc.

- Thwaites Limited

- Terex Corporation

- Cormidi S.r.l.

- Wacker Neuson

- Group

- Kubota Corporation

- JCB

- Multiquip Inc.

- Doosan Bobcat

- Hitachi Construction Machinery Co. Ltd.

- Liebherr Group

- AUSA Center S.A.

- Komatsu Ltd.

- Yanmar Holdings Co. Ltd.

The global site dumper market is segmented as follows:

By Application

- Construction

- Mining

- Agriculture

- Utility Industry

- Others

By Type

- 4-Wheeler Site Dumper

- 2-Wheeler Site Dumper

- Tracked Power Dumpers

By Sales Channel

- Distributor

- Direct Sales

By Capacity

- Above 5 Tons

- 3 to 5 Tons

- 2 to 3 Tons

- Under 2 Tons

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Site dumpers are heavy trailers with modern variants equipped with hydraulic rams used for the transportation of heavy goods from source to end site.

The global site dumper market is expected to gain higher revenue owing to the increasing investments in residential and commercial infrastructure development projects globally.

According to study, the global site dumper market size was worth around USD 3106.80 million in 2022 and is predicted to grow to around USD 5083.30 million by 2030.

The CAGR value of the site dumper market is expected to be around 6.35% during 2023-2030.

The global site dumper market is expected to register the highest growth rate in North America.

The global site dumper market is led by players like Volvo Construction Equipment, Caterpillar Inc., Thwaites Limited, Terex Corporation, Cormidi S.r.l., Wacker Neuson, Group, Kubota Corporation, JCB, Multiquip Inc., Doosan Bobcat, Hitachi Construction Machinery Co., Ltd., Liebherr Group, AUSA Center S.A., Komatsu Ltd., and Yanmar Holdings Co., Ltd.

The report explores crucial aspects of the site dumper market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed