Software-Defined Wide Area Network (SD-WAN) Market Size, Share, Trends, Growth and Forecast 2034

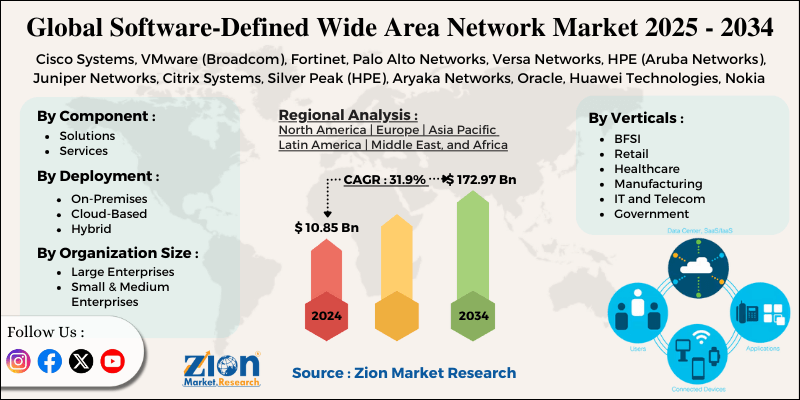

Software-Defined Wide Area Network (SD-WAN) Market By Component (Solutions and Services), By Deployment Model (On-Premises, Cloud-Based, and Hybrid), By Organization Size (Large Enterprises and Small and Medium Enterprises), By Industry Vertical (BFSI, Retail, Healthcare, Manufacturing, IT and Telecommunication, Government, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

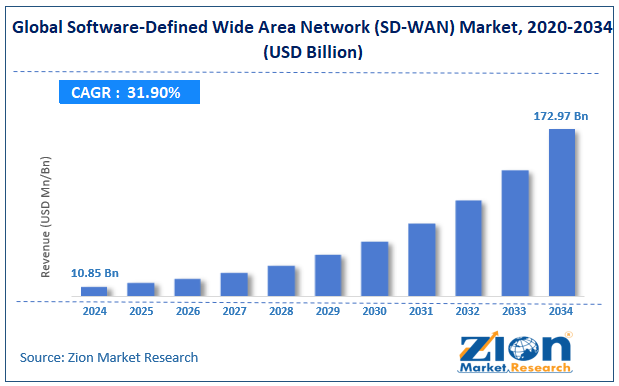

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.85 Billion | USD 172.97 Billion | 31.90% | 2024 |

Software-Defined Wide Area Network (SD-WAN) Industry Prospective:

The global software-defined wide area network (SD-WAN) market was valued at approximately USD 10.85 billion in 2024 and is expected to reach around USD 172.97 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 31.90% between 2025 and 2034.

SD-WAN Market: Overview

Software-Defined Wide Area Network (SD-WAN) is an advanced networking technology that applies software-defined networking principles to WAN connections, enabling organizations to intelligently route traffic across multiple links based on application requirements, network conditions, and business policies.

This evolving market includes virtual overlay networks, application-aware routing technologies, and centralized management platforms that enhance network performance while reducing operational complexity and costs. SD-WAN solutions provide enterprises flexible, secure, and cost-effective alternatives to traditional WAN infrastructures. Digital transformation initiatives, cloud adoption, and the need for branch office connectivity optimization are driving the SD-WAN market.

The accelerating migration to cloud applications, increasing demand for network visibility and control, and growing emphasis on security integration are expected to drive substantial growth in the software-defined wide-area network market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global software-defined wide area network market is estimated to grow annually at a CAGR of around 31.90% over the forecast period (2025-2034)

- In terms of revenue, the global paper-based plasma separation market size was valued at around USD 10.85 billion in 2024 and is projected to reach USD 172.97 billion by 2034.

- The software-defined wide area network market is projected to grow significantly due to widespread cloud adoption, increasing demands for network agility, and expanding enterprise digital transformation initiatives across diverse industry verticals.

- Based on components, solutions lead the segment and will continue to dominate the global market.

- Based on the deployment model, cloud-based deployments are anticipated to command the largest market share.

- Based on organization size, large enterprises are expected to lead the market during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

SD-WAN Market: Growth Drivers

Cloud transformation and distributed application architectures

Enterprise migration to cloud applications drives massive growth in the software-defined wide-area network market. Organizations invest in advanced networking technologies to access Software-as-a-Service (SaaS) applications and cloud infrastructure.

Traditional WAN architectures struggle to handle modern application traffic patterns well, resulting in a poor user experience. This accelerated during the shift to remote work, and organizations prioritized network transformation to support distributed operations.

Multi-cloud deployments are driving demand with a growing preference for intelligent traffic steering and direct internet access at branch locations. Additionally, SD-WAN solutions offer centralized control and enhanced security, enabling IT teams to manage complex, distributed networks across multiple cloud environments efficiently.

Cost optimization and operational efficiency

Financial considerations transform enterprise networking strategies and create momentum for software-defined wide-area network adoption. Transport-agnostic connectivity options, centralized management platforms, and automated deployment resonate with cost-conscious organizations.

SD-WAN delivers significant operational savings compared to traditional MPLS-only architectures. Zero-touch provisioning, template-based configurations, and policy-based management drive adoption in distributed enterprise environments and further grow the SD-WAN market. The ability to scale networks without significant infrastructure investments makes SD-WAN an attractive solution for enterprises looking to optimize performance and budget.

SD-WAN Market: Restraints

Integration challenges with existing infrastructure

The complexity of migrating from legacy WAN architectures creates implementation hesitation and extends adoption timelines throughout enterprise networks. Concerns about disrupting critical business applications and managing hybrid environments during transition phases contribute to cautious deployment strategies.

Industry surveys reveal that many IT leaders express anxiety about maintaining connectivity reliability during infrastructure modernization initiatives. The necessity for specialized networking expertise and updated operational procedures further complicates adoption in organizations with established WAN management practices.

SD-WAN Market: Opportunities

Secure Access Service Edge (SASE) convergence

Integrating network and security functions presents significant opportunities in the global software-defined wide-area network industry. Developing SASE frameworks combining SD-WAN with cloud-delivered security services creates new segments with tremendous growth potential.

For example, vendors with unified platforms that address connectivity and security requirements are seeing faster adoption than point solutions. Zero-trust network access, cloud access security brokers, and firewall-as-a-service resonate with security-conscious enterprises and drive engagement with organizations with distributed workforces.

Identity-based policy enforcement and continuous threat monitoring are also being implemented, and the secure software-defined wide-area network market is growing.

SD-WAN Market: Challenges

Security concerns and threat landscape evolution

SD-WAN providers identify security threats as their primary strategic challenge, as direct internet access at branch locations expands the potential attack surface. Solution developers face pressure to enhance native security capabilities while maintaining interoperability with specialized security tools.

Security analysts report threat actors targeting software-defined wide-area network environments to exploit potential configuration weaknesses. Policy consistency across hybrid environments remains challenging; network administrators report significant time investments in security rule validation.

As application patterns become more complex, security policy refinement requires continuous attention; vendors report substantial development resources allocated to security enhancements. Security information sharing and threat intelligence integration remain inconsistent across providers, with many offering proprietary approaches rather than standardized frameworks in the networking industry.

Software-Defined Wide Area Network (SD-WAN) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Software-Defined Wide Area Network (SD-WAN) Market |

| Market Size in 2024 | USD 10.85 Billion |

| Market Forecast in 2034 | USD 172.97 Billion |

| Growth Rate | CAGR of 31.90% |

| Number of Pages | 213 |

| Key Companies Covered | Cisco Systems, VMware (Broadcom), Fortinet, Palo Alto Networks, Versa Networks, HPE (Aruba Networks), Juniper Networks, Citrix Systems, Silver Peak (HPE), Aryaka Networks, Oracle, Huawei Technologies, Nokia (Nuage Networks), Cato Networks, Cloudflare, Bigleaf Networks, Teldat, FatPipe Networks, Barracuda Networks, Peplink, and others. |

| Segments Covered | By Component, By Deployment Model, By Organization Size, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

SD-WAN Market: Segmentation

The global software-defined wide area network market is segmented into components, deployment model, organization size, industry vertical, and region.

Based on components, the market is segregated into solutions and services. Solutions lead the market by forming the foundational layer of SD-WAN infrastructure, enabling essential functions like centralized control, traffic routing, security, and application optimization, making them the primary focus of enterprise deployment strategies.

Based on the deployment model, the software-defined wide area network industry is divided into on-premises, cloud-based, and hybrid. Cloud-based deployments are expected to lead the market during the forecast period, offering simplified management, scalability, and integration with cloud security services for distributed organizations.

Based on organization size, the software-defined wide area network industry is categorized into large enterprises and small and medium enterprises. Large enterprises are expected to lead the market since they typically operate complex networks across multiple locations and can realize significant benefits from optimized WAN infrastructures.

Based on industry vertical, the market is classified into BFSI, retail, healthcare, manufacturing, IT and telecommunication, government, and others. The IT and telecommunication vertical is expected to lead the market due to its technology-forward approach and critical dependency on reliable, high-performance network infrastructure.

SD-WAN Market: Regional Analysis

North America to lead the market

North America leads the software-defined wide area network (SD-WAN) market due to early adoption, massive cloud migration, and the presence of major vendors. The U.S. is significant in global SD-WAN spending, with enterprises across various industries undergoing network transformation.

The region has a mature IT infrastructure with continuous modernization cycles driven by digital business needs. North American companies have high adoption rates for advanced networking with integrated security, and cloud-delivered network services are becoming standard in enterprise architecture. The competitive business environment drives operational efficiency investments; network agility is a competitive differentiator.

Leading SD-WAN vendors have a significant research and development presence in North America and are driving regional innovation. The presence of major technology companies, digital transformation, and remote work enablement also contributes to growth. Technological advancements like AI for network operations and edge computing further drive infrastructure upgrades.

North America’s strong ecosystem of system integrators, managed service providers, and cloud partners further accelerates SD-WAN deployment across enterprise segments.

Asia Pacific to grow significantly.

Asia Pacific is experiencing growth in the software-defined wide area network industry, driven by digital transformation initiatives, expanding enterprise connectivity requirements, and cloud adoption acceleration.

The Asia Pacific software-defined wide area network market has developed over recent years, with multinational corporations and regional enterprises investing in network modernization. Countries like Japan, South Korea, Singapore, and Australia lead the adoption of networking solutions, while rapidly developing Southeast Asian economies represent emerging growth opportunities.

The region's diverse business landscape demands flexible networking solutions adaptable to varying infrastructure environments. Growing focus on cost-effective international connectivity drives SD-WAN adoption among organizations with regional operations spanning multiple countries. Increasing emphasis on branch connectivity optimization and application performance improvement fuels the expansion of software-defined networking approaches in the Asia Pacific region.

Recent Market Developments:

- In January 2025, Cisco Systems expanded its network infrastructure portfolio by launching an advanced SD-WAN platform featuring artificial intelligence operations, automated threat response, and integrated 5G connectivity for enhanced enterprise networking capabilities.

- In February 2025, VMware (now part of Broadcom) introduced a comprehensive SASE framework built on its SD-WAN foundation, providing organizations with unified security and networking controls, identity-based access policies, and cloud-native security services through a single management console.

- In March 2025, Fortinet launched an enhanced secure SD-WAN solution featuring dedicated security processing units, zero-trust access controls, and seamless multi-cloud connectivity designed for enterprises requiring advanced threat protection within their network infrastructure.

SD-WAN Market: Competitive Analysis

The global software-defined wide area network industry is led by players like:

- Cisco Systems

- VMware (Broadcom)

- Fortinet

- Palo Alto Networks

- Versa Networks

- HPE (Aruba Networks)

- Juniper Networks

- Citrix Systems

- Silver Peak (HPE)

- Aryaka Networks

- Oracle

- Huawei Technologies

- Nokia (Nuage Networks)

- Cato Networks

- Cloudflare

- Bigleaf Networks

- Teldat

- FatPipe Networks

- Barracuda Networks

- Peplink

The global SD-WAN market is segmented as follows:

By Component

- Solutions

- Services

By Deployment Model

- On-Premises

- Cloud-Based

- Hybrid

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By Industry Vertical

- BFSI

- Retail

- Healthcare

- Manufacturing

- IT and Telecom

- Government

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Software-Defined Wide Area Network (SD-WAN) is an advanced networking technology that applies software-defined networking principles to WAN connections, enabling organizations to intelligently route traffic across multiple links based on application requirements, network conditions, and business policies.

The software-defined wide area network market is expected to be driven by increasing cloud adoption, growing demands for network agility, expanding digital transformation initiatives, rising focus on integrated security, and the need for optimized application performance across distributed environments.

According to our study, the global software-defined wide area network market was worth around USD 10.85 billion in 2024 and is predicted to grow to around USD 172.97 billion by 2034.

The CAGR value of the software-defined wide area network market is expected to be around 31.90% during 2025-2034.

The global software-defined wide area network market will register the highest growth in North America during the forecast period.

Key players in the software-defined wide area network market include Cisco Systems, VMware (Broadcom), Fortinet, Palo Alto Networks, Versa Networks, HPE (Aruba Networks), Juniper Networks, Citrix Systems, Silver Peak (HPE), Aryaka Networks, Oracle, Huawei Technologies, Nokia (Nuage Networks), Cato Networks, Cloudflare, Bigleaf Networks, Teldat, FatPipe Networks, Barracuda Networks, and Peplink.

The report comprehensively analyses the software-defined wide area network market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, and the evolving enterprise requirements shaping the network infrastructure ecosystem.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed